Recently did a deep dive on 37 different #DTC and #SaaS products and realized:

We have no idea what our customers actually value.

To help, here's a framework and data, to understand what you should include in your product, what should be add-ons, etc.

Let's rock.

We have no idea what our customers actually value.

To help, here's a framework and data, to understand what you should include in your product, what should be add-ons, etc.

Let's rock.

Your positioning/packaging are crucial.

If you're @jjeremycai running @italic or @jessicameher rocking @hiwonderment you need to know which products to offer, which features to build, and which aspects of brand appeal to customers.

Here's the framework for determining that 2/

If you're @jjeremycai running @italic or @jessicameher rocking @hiwonderment you need to know which products to offer, which features to build, and which aspects of brand appeal to customers.

Here's the framework for determining that 2/

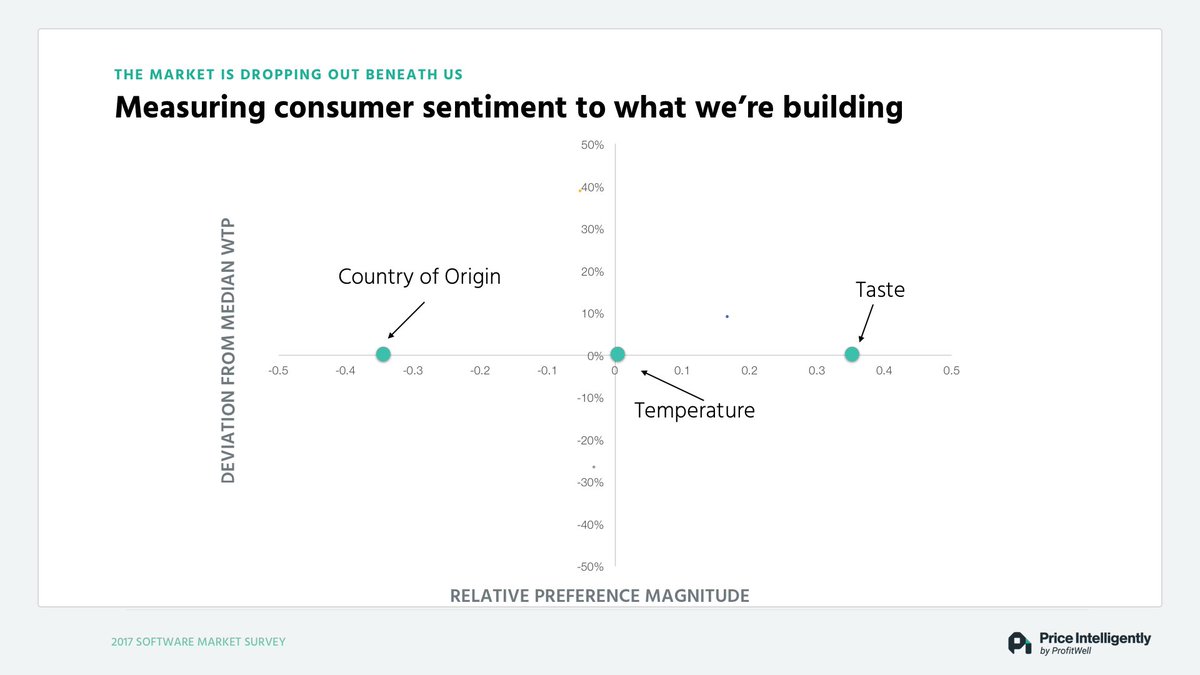

No matter the product, you have two axes of value that you can measure for a customer segment:

1. The relative value of the features or attributes of that product

2. The willingness to pay for that product 3/

1. The relative value of the features or attributes of that product

2. The willingness to pay for that product 3/

Using some easy statistics (which you can make more complicated) I can plot these on a nice 2x2.

Along the X axis I can find that "Taste" is the most important attribute relative to the others and "country of origin" is the least.

Does this mean no one cares about origin? 4/

Along the X axis I can find that "Taste" is the most important attribute relative to the others and "country of origin" is the least.

Does this mean no one cares about origin? 4/

No. It means *for the group I'm targeting* it's least important relative to other features.

If I changed my target segment to the hipsters following me on twitter, I'd likely find country of origin would end up being of higher importance. 5/

If I changed my target segment to the hipsters following me on twitter, I'd likely find country of origin would end up being of higher importance. 5/

I can then overlay willingness to pay data to find that those who care about taste as their number one feature are willing to pay 30% more and those who care about country of origin as #1 are willing to pay 35% more.

How is this useful though? 6/

How is this useful though? 6/

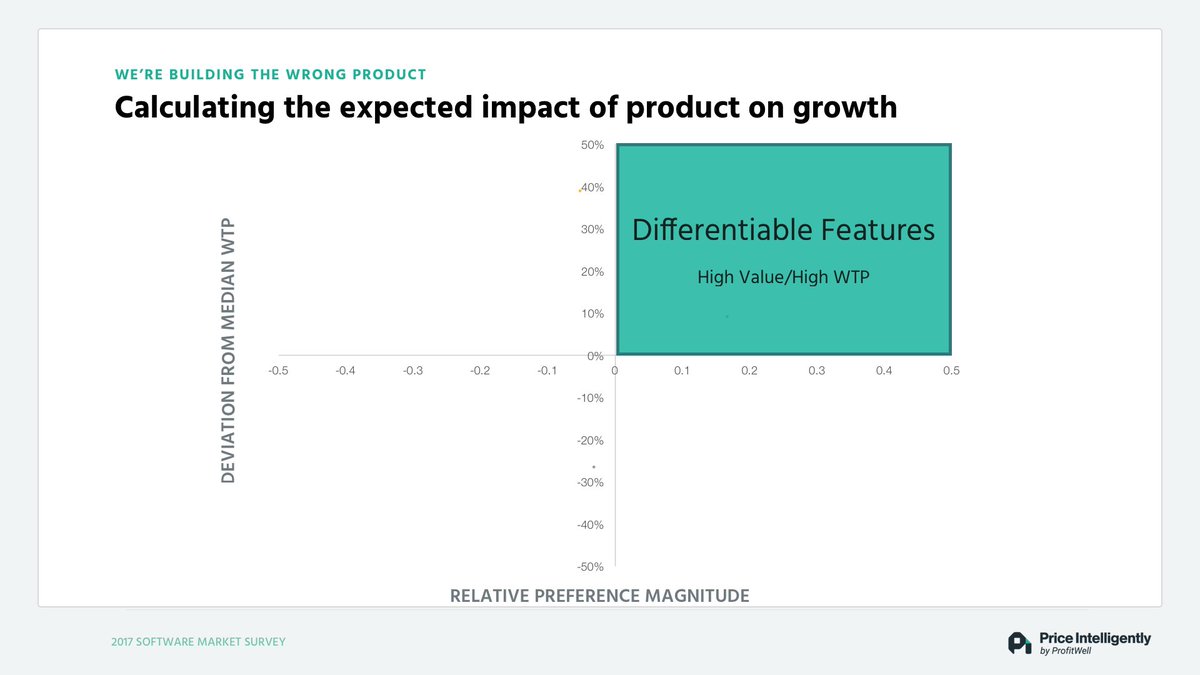

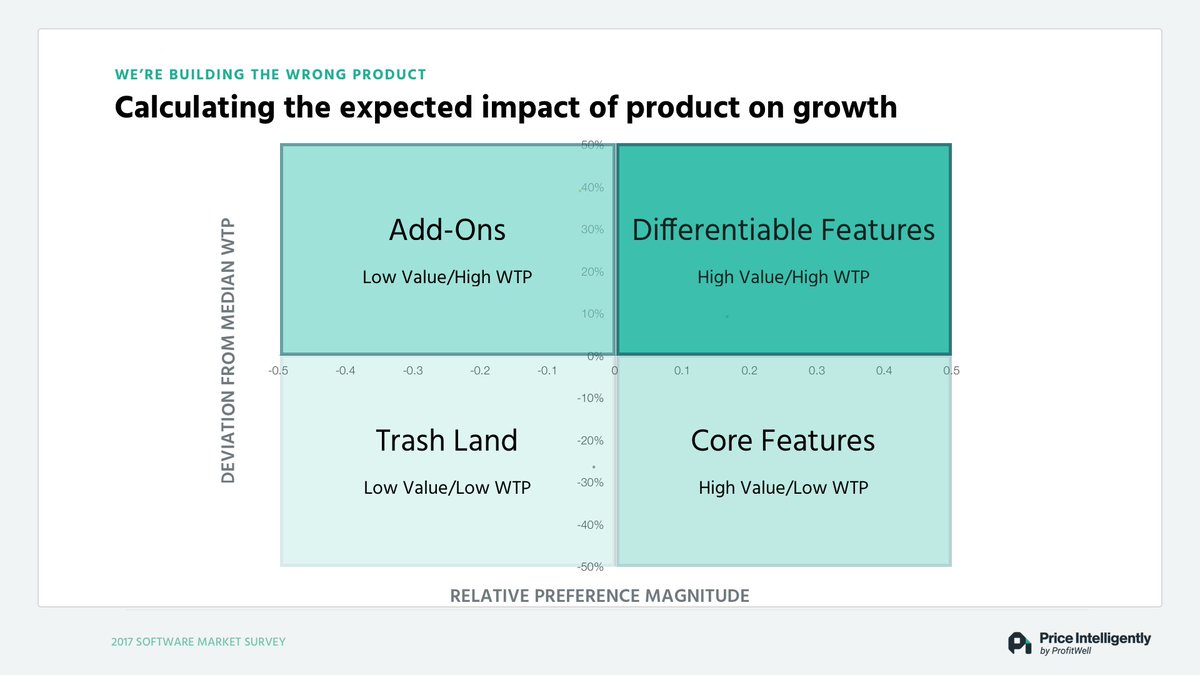

Well, if I find a feature that's of high importance relative to other features amongst the group AND those who care about it as their #1 feature are willing to pay more, I have a differentiable feature or product.

This is something that will drive more premium purchases. 7/

This is something that will drive more premium purchases. 7/

If a feature is of low importance relative to the other features, but those who care about it as their number one are willing to pay more, then I have an add-on (products that should be up-sells).

Features of hight relative importance, but low WTP are core. 8/

Features of hight relative importance, but low WTP are core. 8/

And then low and low is trash.

Note: You'll have to build trash.

A mobile app for fleet management products will show up as trash. Also note that if you ask different segments of your customer base, those segments will be different.

That's the point. 9/

Note: You'll have to build trash.

A mobile app for fleet management products will show up as trash. Also note that if you ask different segments of your customer base, those segments will be different.

That's the point. 9/

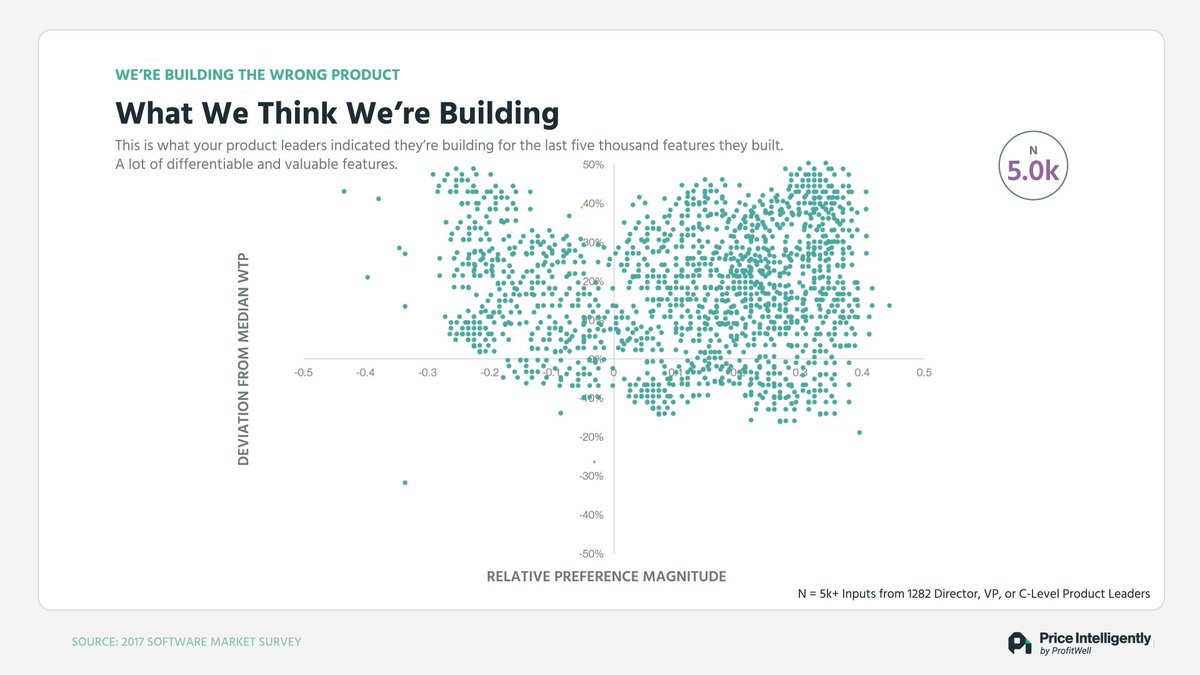

So why is this important?

Well we're bad at understanding the value our customers seek. When the market was less dense we were better, but now we're not great.

Don't believe me? Well, look at this data. 10/

Well we're bad at understanding the value our customers seek. When the market was less dense we were better, but now we're not great.

Don't believe me? Well, look at this data. 10/

After making sure 1,281 product leaders understood this framework, we asked them to plot their features and roadmap on the matrix. Here's what they said.

Yes, it's rare you meet a product leader with a lack of confidence :)

We then talked to their customers though.... 11/

Yes, it's rare you meet a product leader with a lack of confidence :)

We then talked to their customers though.... 11/

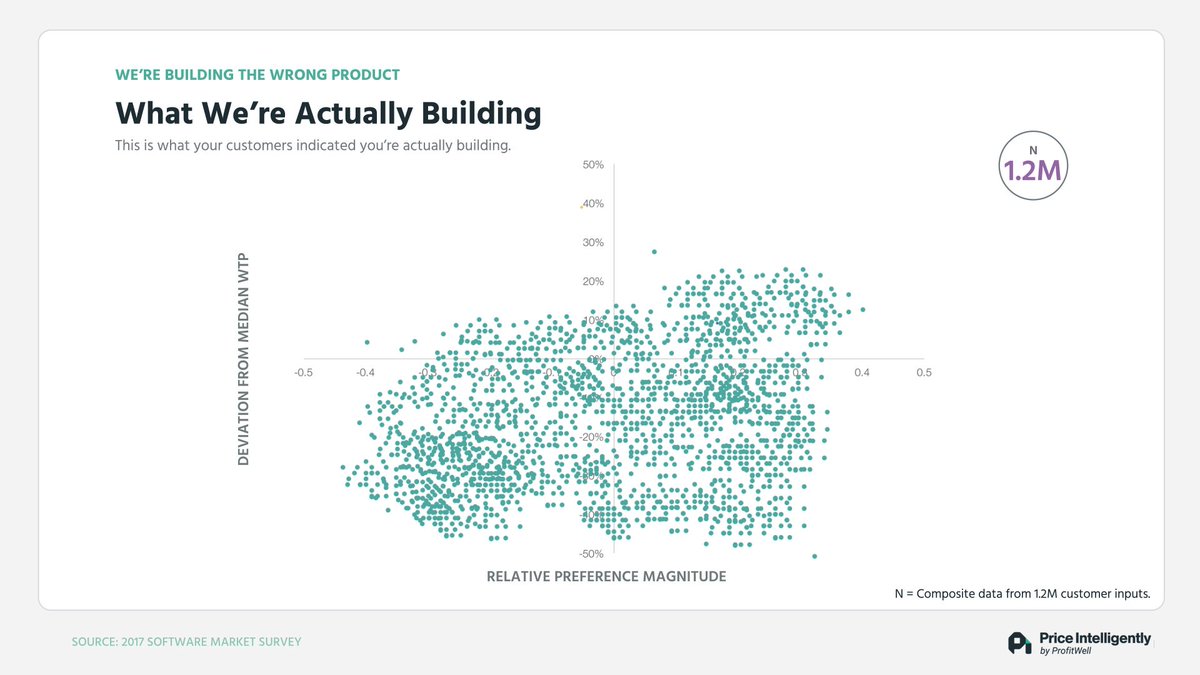

Using @ProfitWell's Price Intelligently software we then measured feature value and willingness to pay for 1.2M customers of these products and here's what they said.

The difference exists because markets are getting denser, and feature value is changing quickly 12/

The difference exists because markets are getting denser, and feature value is changing quickly 12/

This is why @dcancel, @dharmesh, and @hiten talk so much about whoever gets closest to the customer, wins.

You don't need to always listen to your customers, but you need to understand them.

13/

You don't need to always listen to your customers, but you need to understand them.

13/

Ok back to my analyst cave.

If you thought this was worth at least $1 or if you want me to do a thread on how to collect willingness to pay data, please retweet the first tweet in the thread.

Want to get this knowledge in the hands of as many people as possible.

/fin

If you thought this was worth at least $1 or if you want me to do a thread on how to collect willingness to pay data, please retweet the first tweet in the thread.

Want to get this knowledge in the hands of as many people as possible.

/fin

Read on Twitter

Read on Twitter