Wix was founded way back in 2006, and at the time, it seemed like yet another Build Your Own Website startup

But they grew, and evolved, and never quit

Today, they are at $1B+ in ARR and a $15B market cap!!

5 Interesting Learnings:

But they grew, and evolved, and never quit

Today, they are at $1B+ in ARR and a $15B market cap!!

5 Interesting Learnings:

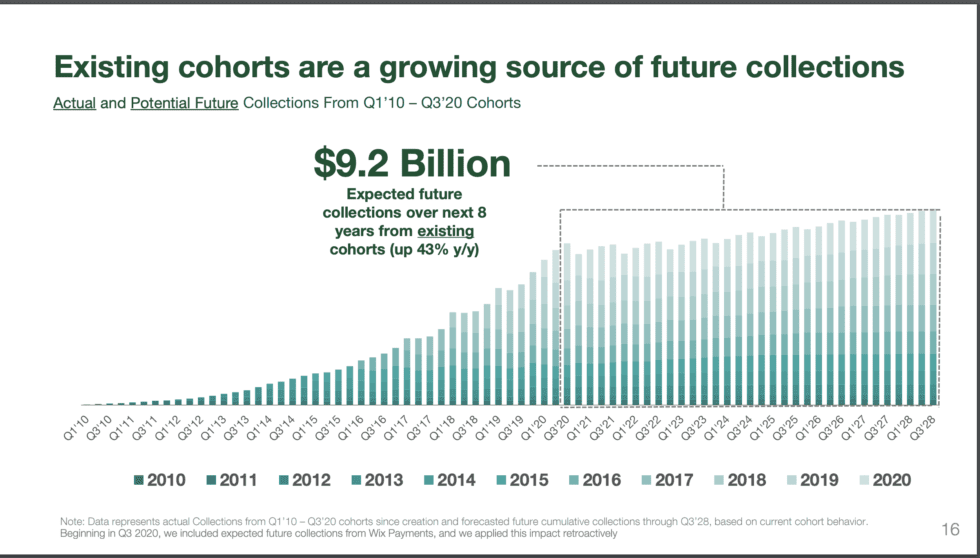

#1. Existing Customers Worth $9.2B Over Next 8 Years

While Wix’s actual churn is a bit unclear, this is a super interesting presentation of CLTV. Wix sees its existing $1B of ARR generating $9.2B over the next 8 years! That’s the power of recurring revenue:

While Wix’s actual churn is a bit unclear, this is a super interesting presentation of CLTV. Wix sees its existing $1B of ARR generating $9.2B over the next 8 years! That’s the power of recurring revenue:

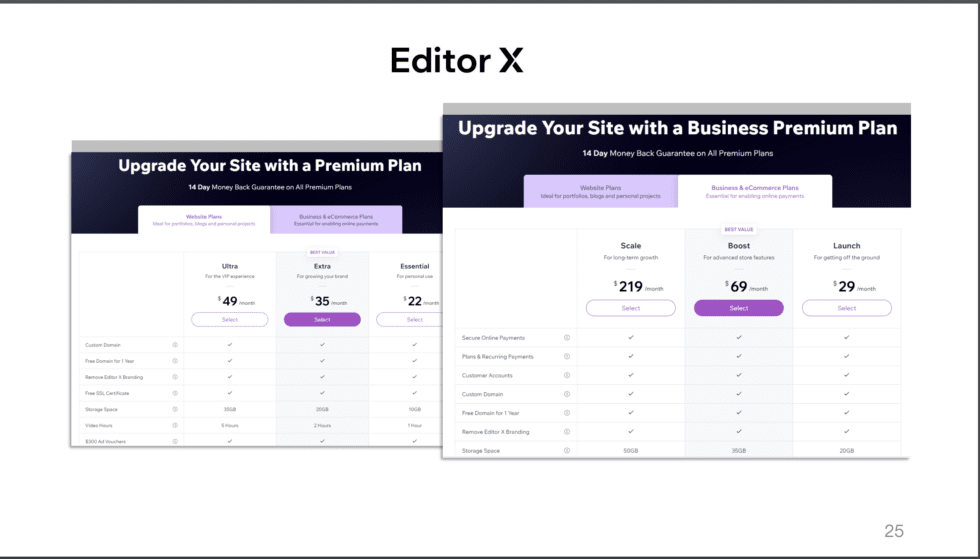

#2. eCommerce and Business Tools Are Key Drivers to Accelerating Growth

Wix has benefitted from eCommerce explosion since Covid.

While their core web site “Creative Subscriptions” are growing at 23% YoY ... their eCommerce+ Business Solutions segment is growing 60% YoY!

Wix has benefitted from eCommerce explosion since Covid.

While their core web site “Creative Subscriptions” are growing at 23% YoY ... their eCommerce+ Business Solutions segment is growing 60% YoY!

To repeat  … Wix’s ecommerce+ products, its business segment, is growing 60% at $200m ARR!!

… Wix’s ecommerce+ products, its business segment, is growing 60% at $200m ARR!!

… Wix’s ecommerce+ products, its business segment, is growing 60% at $200m ARR!!

… Wix’s ecommerce+ products, its business segment, is growing 60% at $200m ARR!!

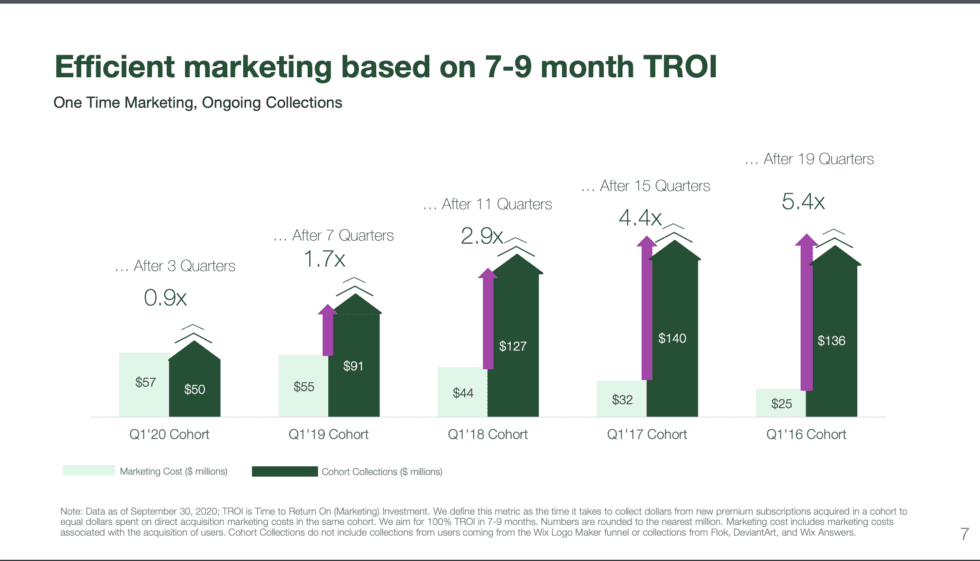

#3. Efficient at SMB marketing — an ~8 month CAC.

We saw in this series other SMB leaders like GoDaddy and Xero need to get well into Year 2 to go profitable on a new customer ... but Wix gets there in just 7-9 months.

Impressive SMB marketing efficiency.

We saw in this series other SMB leaders like GoDaddy and Xero need to get well into Year 2 to go profitable on a new customer ... but Wix gets there in just 7-9 months.

Impressive SMB marketing efficiency.

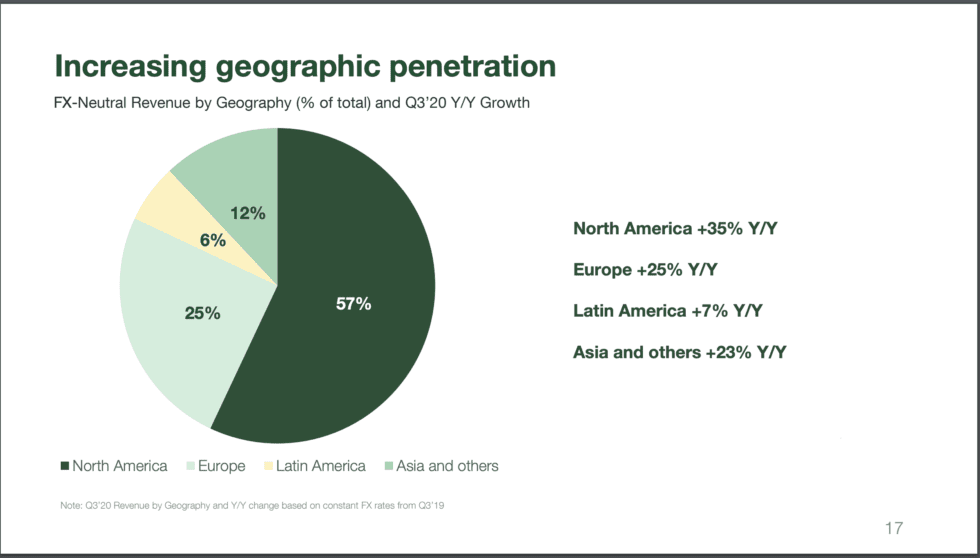

#4. 43% of Revenue Outside North America.

This may be in part due to Wix’s Israeli roots, but it's a reminder to really lean in when you find yourself being pulled outside of your core market.

Go where your customers are.

This may be in part due to Wix’s Israeli roots, but it's a reminder to really lean in when you find yourself being pulled outside of your core market.

Go where your customers are.

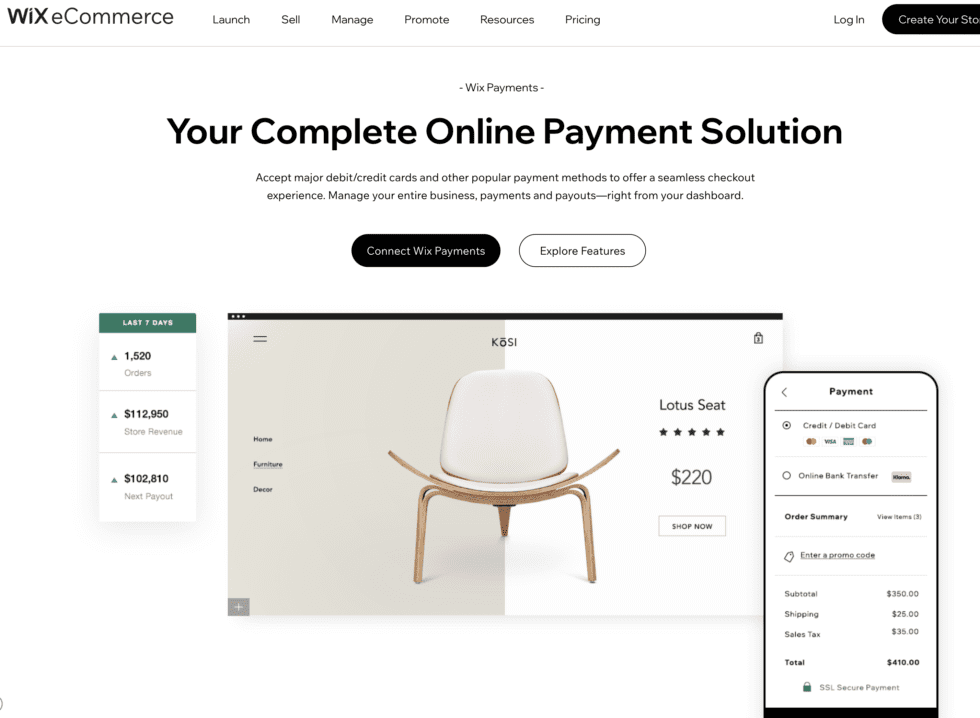

#5. 70% Gross Margins. But much lower in Payments.

Wix’s website business costs are low, but its fast-growing Business Solutions segment has only 29% gross margins, due in large part to Wix Payments costs.

Wix’s website business costs are low, but its fast-growing Business Solutions segment has only 29% gross margins, due in large part to Wix Payments costs.

Wix can get away with lower margins in this segment for now given the 80% margins in websites.

Blended together, margins are still 70%.

But they’ll need to be careful to keep margins at the 60%+ level expected of software companies as Business Solutions revenue grows.

Blended together, margins are still 70%.

But they’ll need to be careful to keep margins at the 60%+ level expected of software companies as Business Solutions revenue grows.

An incredible engine and story, and another impressive story of expanding the product footprint with eCommerce and Payments.

A deeper dive here: https://www.saastr.com/5-interesting-learnings-from-wix-at-1-billion-in-arr/

A deeper dive here: https://www.saastr.com/5-interesting-learnings-from-wix-at-1-billion-in-arr/

Read on Twitter

Read on Twitter