A small thread on a great 2021-22 Budget (full speech available at https://www.indiabudget.gov.in/doc/Budget_Speech.pdf) and some of its effects on stock markets: (1/n)

On the lines of the last few years, one of the major pillars of this budget was to achieve an Atmanirbhar Bharat. This was visible in concessions for MSMEs and increase in customs duties in products produced by MSMEs in India. It has some really bold steps. (2/n)

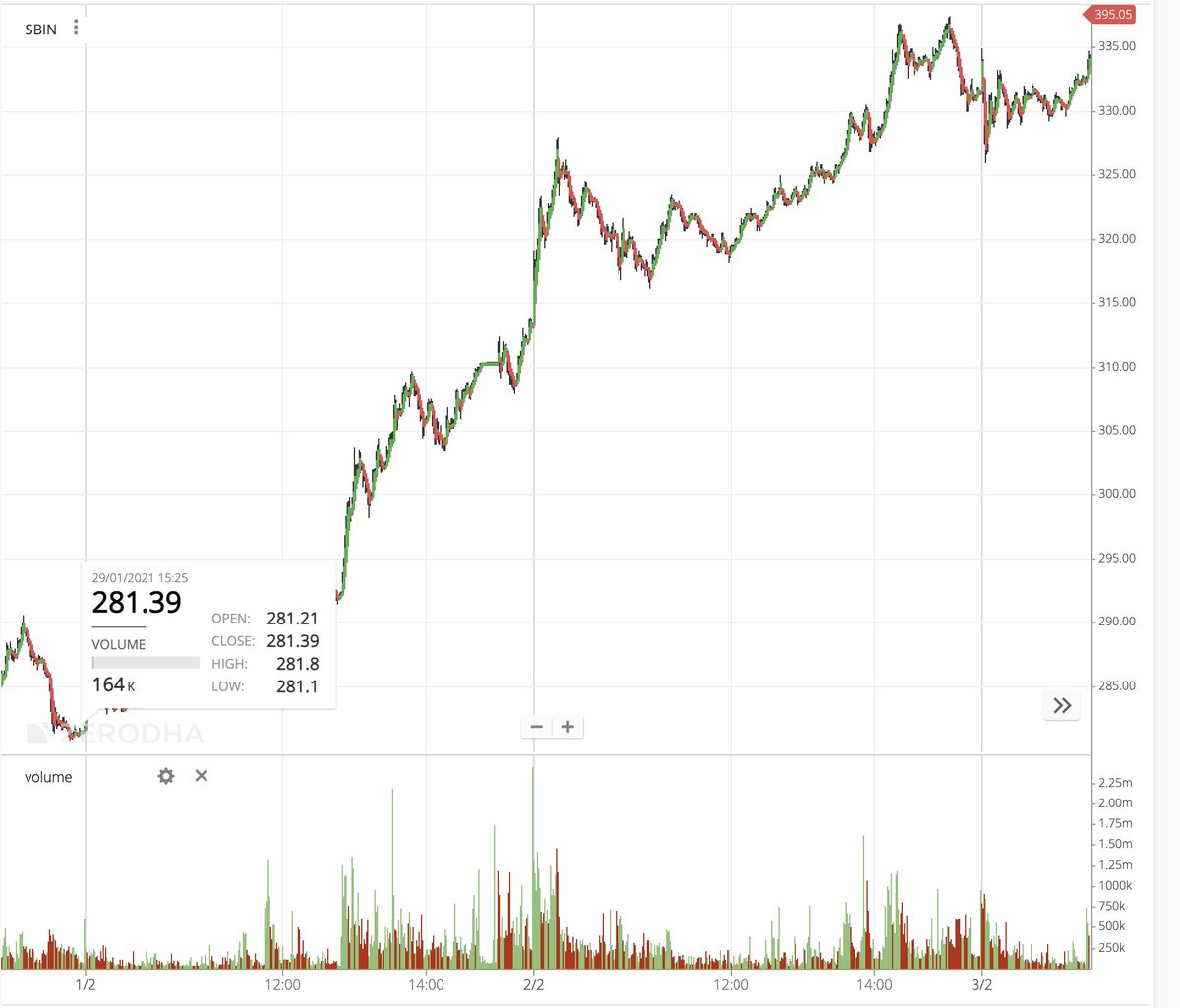

A recapitalization PSU Banks was announced, which led to a terrific rise in prices of SBI and peers. (3/n)

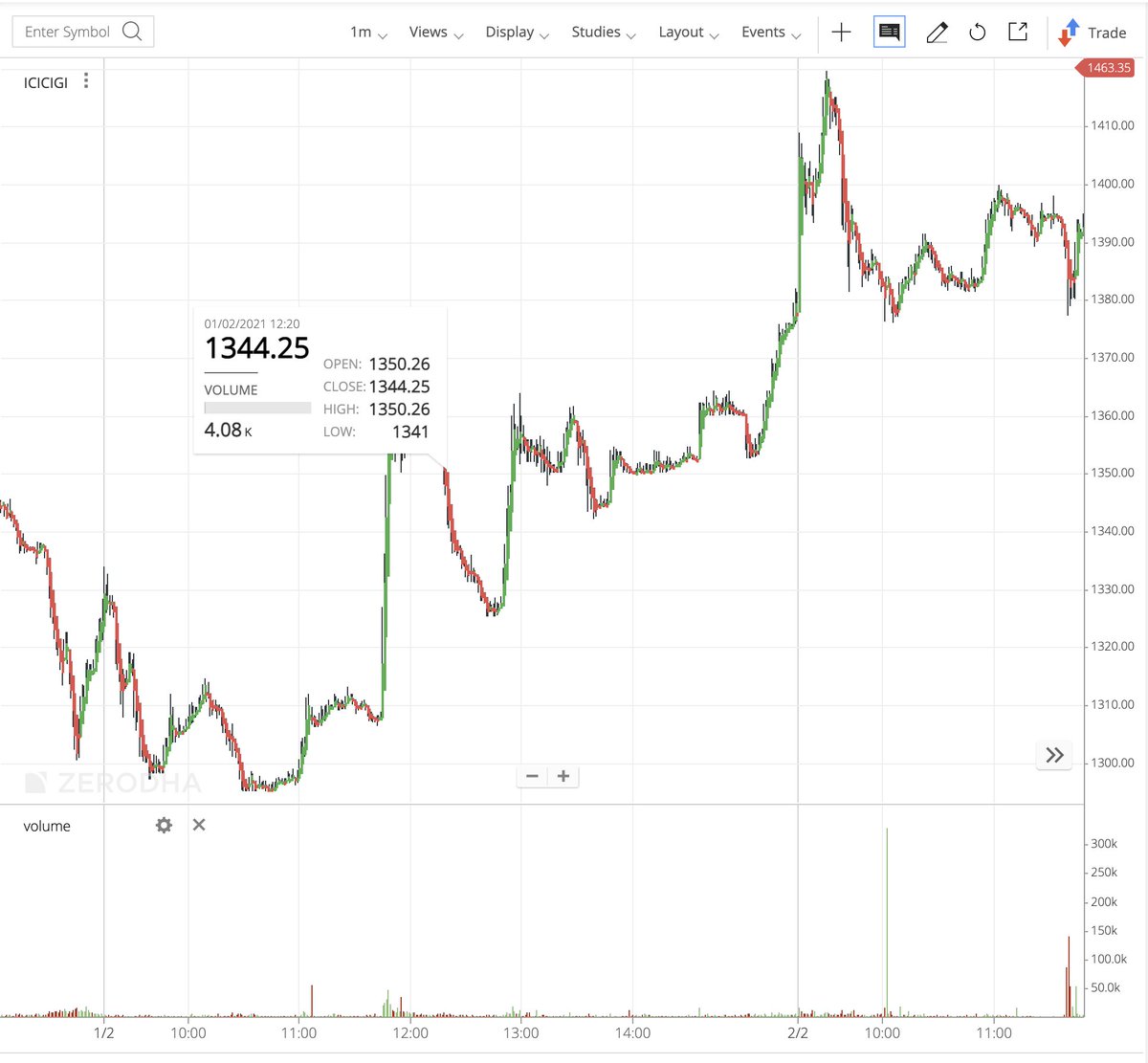

The insurance sector was opened for FDI in India. This led to a sudden increase in the prices of almost all insurance companies. Check out the graph of ICICI Lombard below: (4/n)

Many concessions were announced for the MSME segment like making the turnover requirement for small companies increasing to 2 crores from 50 Lakhs, giving them compliance and charge reliefs and high credit lines. Indirect beneficiary Indiamart in the graph after the budget. (5/n)

Another expected part of the budget(to calm the protests) was a huge increase in credit lines to farmers. This led to a great increase in prices of farmers OEMs like Escorts and M&M (Tractor Manufacturers). (6/n)

India became the first nation globally to introduce social security benefits to gig workers, Though at a minimal level, this was a great and bold step and showed the Government's commitment to change as per the #FutureOfWork. (7/n)

It was a bold budget and hope to see some more reforms in near future to bring the Indian economy at the forefront in the world.

Read on Twitter

Read on Twitter