So Datadog has been the developer's darling for 5+ years

It just makes life running and managing software >easier<

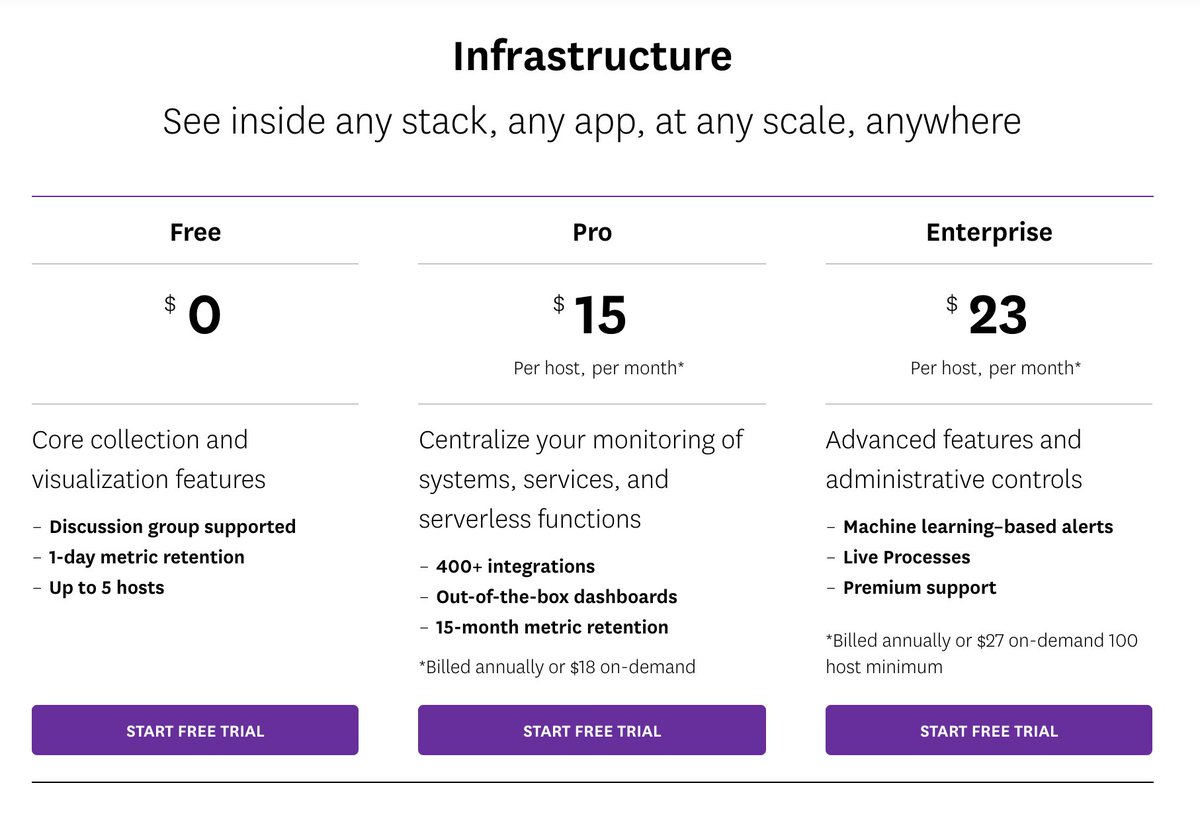

That's enabled it to grow to 50+ $1m customers, 1,000+ $100k customers, and 13,000+ total ... while still offering Free editions

5 Interesting Learnings:

It just makes life running and managing software >easier<

That's enabled it to grow to 50+ $1m customers, 1,000+ $100k customers, and 13,000+ total ... while still offering Free editions

5 Interesting Learnings:

#1. $100k+ customers generate 75% of revenue, even though just 7% of customers.

Even with Free & Cheap editions, 75% of customers grow into $100k+ deals.

Datadog has 1,107 $100k+ customers out of 13,100 total customers. That means 7% of customers generate 75% of revenue

Even with Free & Cheap editions, 75% of customers grow into $100k+ deals.

Datadog has 1,107 $100k+ customers out of 13,100 total customers. That means 7% of customers generate 75% of revenue

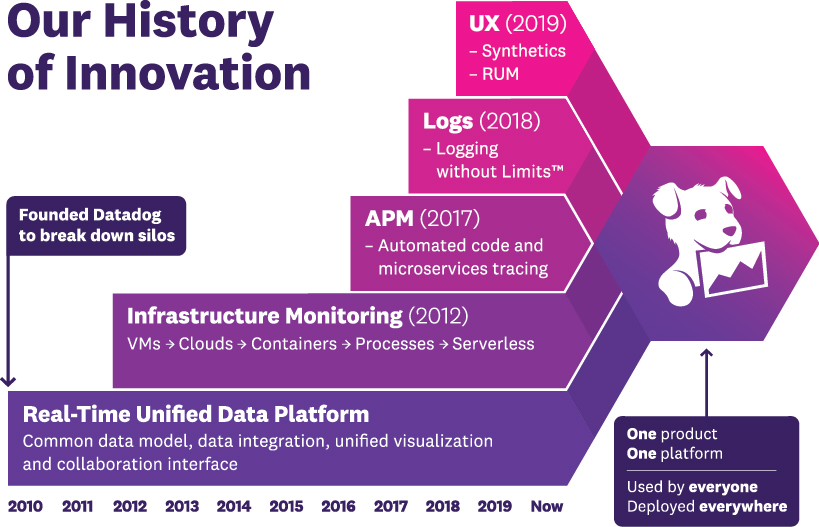

#2. 20%+ of customers now use 4 or more customers, and 70% use 2 or more products -- up from 50% last year.

This is a theme we've seen on this series. At Box, at Salesforce, and more, customers that use more products, buy more, pay more, and have higher NRR.

This is a theme we've seen on this series. At Box, at Salesforce, and more, customers that use more products, buy more, pay more, and have higher NRR.

3. 60% of revenue growth comes from existing customers, and NRR > 130% for 13 consecutive quarters.

This is similar to so many other Cloud leaders. At Salesforce, it's 70%.

This is similar to so many other Cloud leaders. At Salesforce, it's 70%.

4. "Chunking up" payments on some annual deals.

Some larger customers now want semi-annual and monthly billing, and Datadog let them move there where it worked for them.

Annual has its place. But don't over-push annual deals.

Some larger customers now want semi-annual and monthly billing, and Datadog let them move there where it worked for them.

Annual has its place. But don't over-push annual deals.

#5. At IPO, Datadog already had 40+ $1M customers.

Datadog shows customers can pay $1M+ at the same time as 10,000+ pay little or even Free.

Datadog has several customers that have grown to $1M ARR in their first year using the products.

Datadog shows customers can pay $1M+ at the same time as 10,000+ pay little or even Free.

Datadog has several customers that have grown to $1M ARR in their first year using the products.

And a note, like most other SaaS and Cloud leaders, the Covid impact is over for Datadog.

Retention, churn, etc. are all, as a group, back to where they were before Covid hit.

Retention, churn, etc. are all, as a group, back to where they were before Covid hit.

A deeper dive here: https://www.saastr.com/5-interesting-learnings-from-datadog-at-700000000-arr/

And catch up on the series here: https://www.saastr.com/category/company-stage/scale/5-interesting-things/

Read on Twitter

Read on Twitter