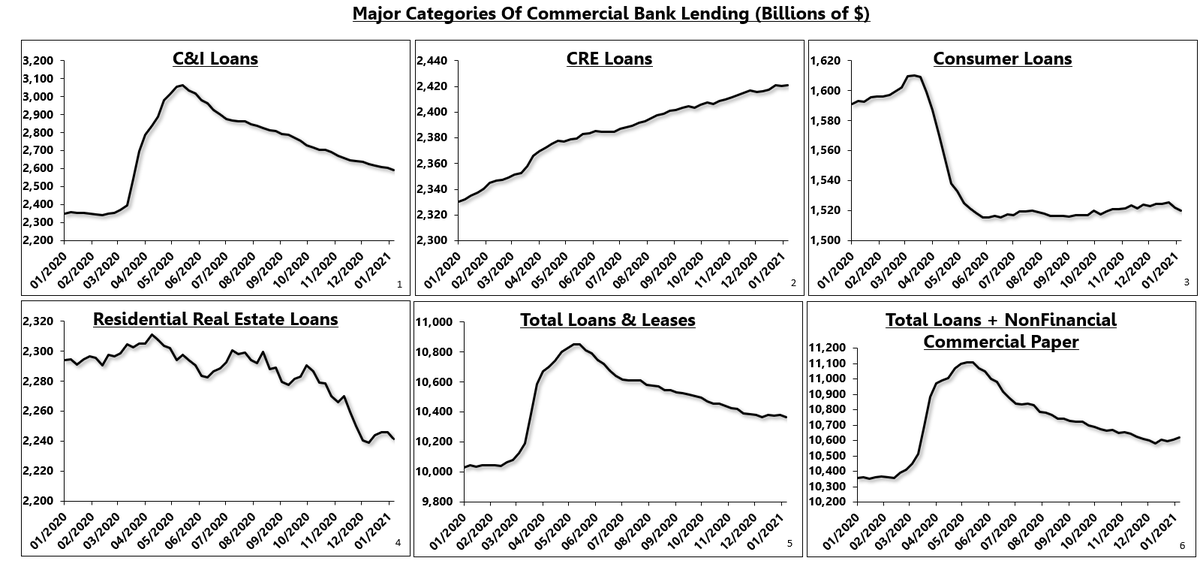

An update on bank lending from commercial banks: an open question in 2021...

Signs of stability can be seen in various key segments.

While total loan growth is declining in nominal dollars, markets care about growth rates and the directional rate of change.

1/

Signs of stability can be seen in various key segments.

While total loan growth is declining in nominal dollars, markets care about growth rates and the directional rate of change.

1/

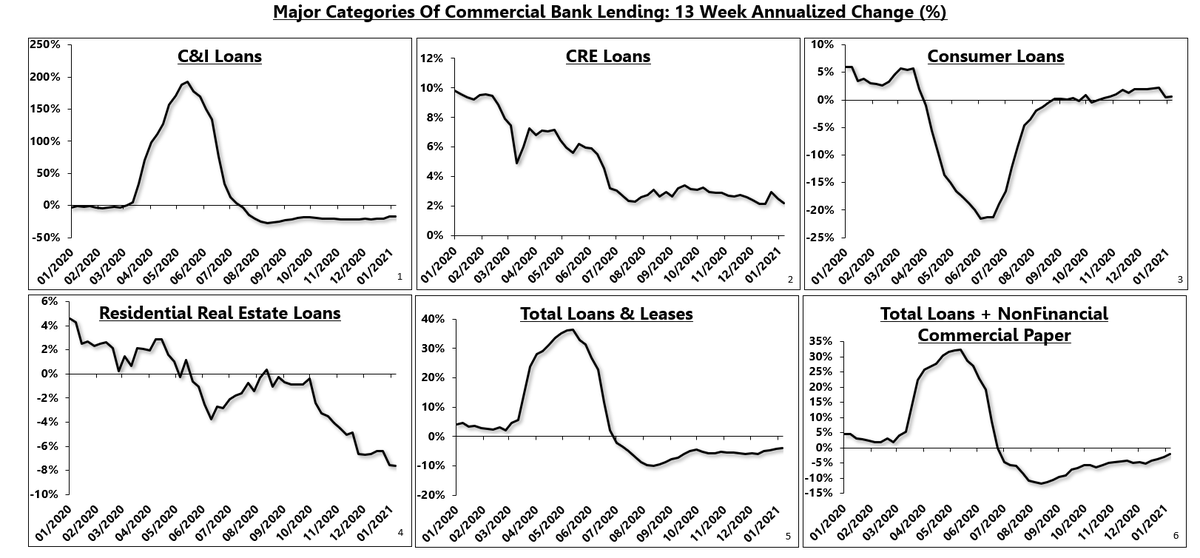

On a 13-week annualized change basis, stability can start to be found in total loans.

C&I loan growth has flattened after a sharp spike and then decline while CRE lending growth continues to cool.

Consumer loan growth crashed and then recovered to the flat-line.

2/

C&I loan growth has flattened after a sharp spike and then decline while CRE lending growth continues to cool.

Consumer loan growth crashed and then recovered to the flat-line.

2/

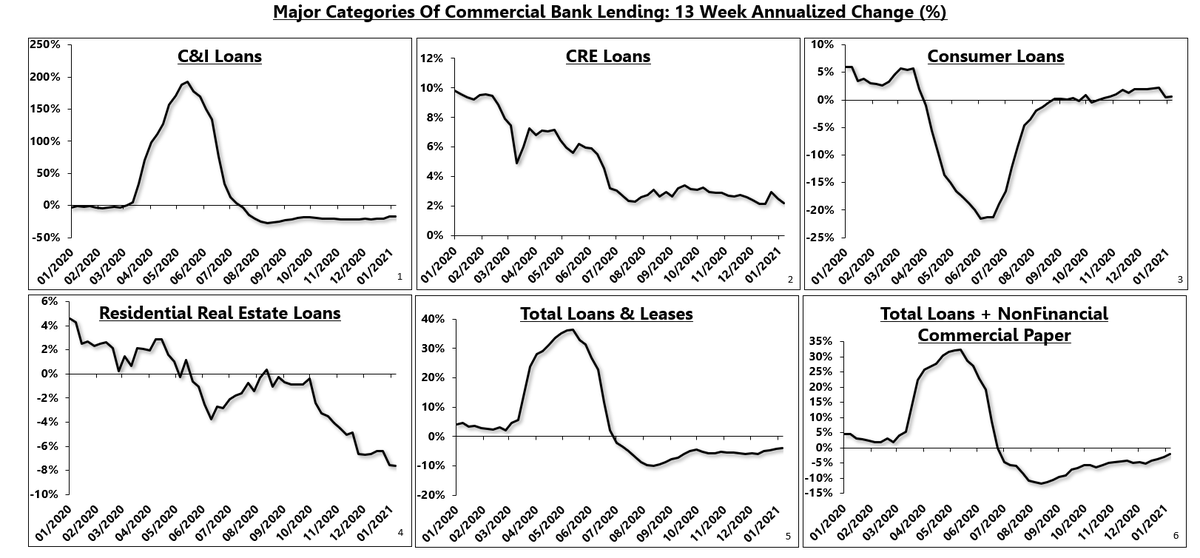

Total loan growth (+ nonfinancial CP) is improving in rate of change terms but is still contracting

Declining loan volume will limit the inflationary impulse coming from the real economy

There is transitory inflation pressure in manufactured goods, however (unrelated)

3/

Declining loan volume will limit the inflationary impulse coming from the real economy

There is transitory inflation pressure in manufactured goods, however (unrelated)

3/

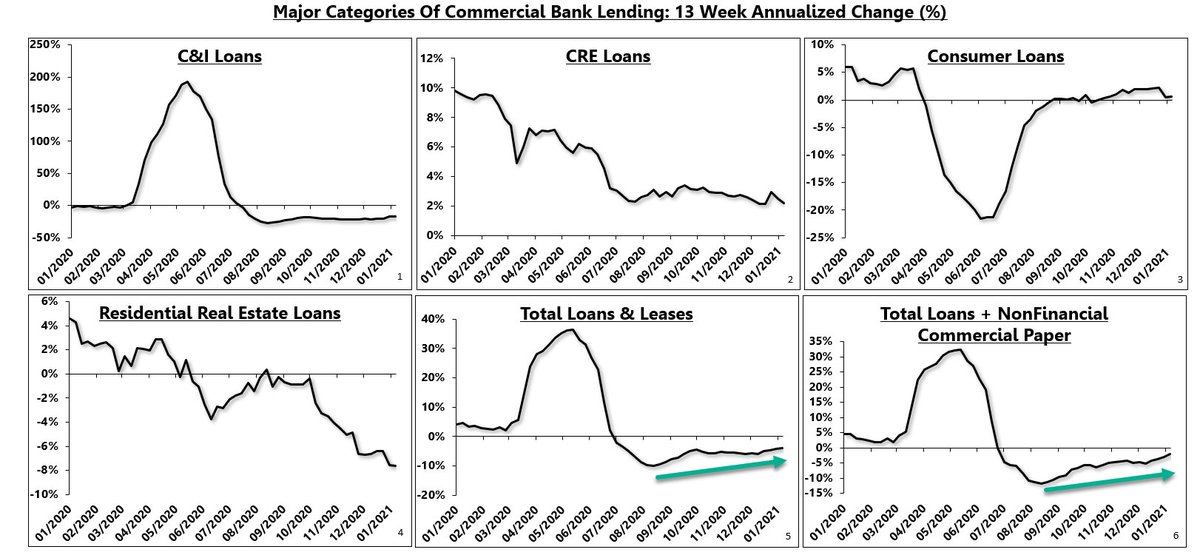

As economic growth continues to improve, led by the industrial sector, monitoring this loan growth dashboard will be critical.

If total loan growth continues to rise in RoC terms, we'll see a stronger inflationary impulse from the real economy.

4/

If total loan growth continues to rise in RoC terms, we'll see a stronger inflationary impulse from the real economy.

4/

My view is that high levels of public and private debt will eventually lead to below-average commercial bank loan growth as we saw from 2010-2020 vs. 2002-2007, with room for a transitory increase like we may be starting to see.

5/

5/

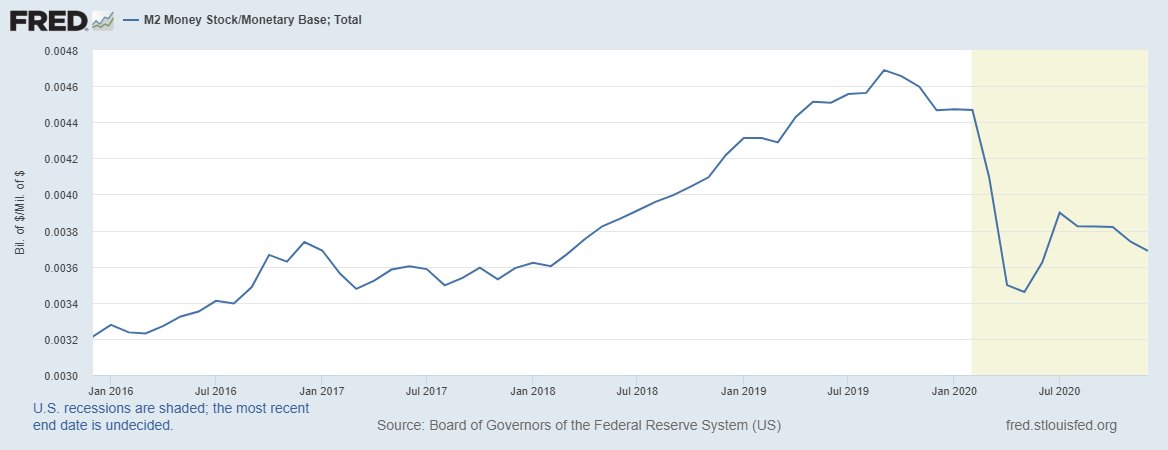

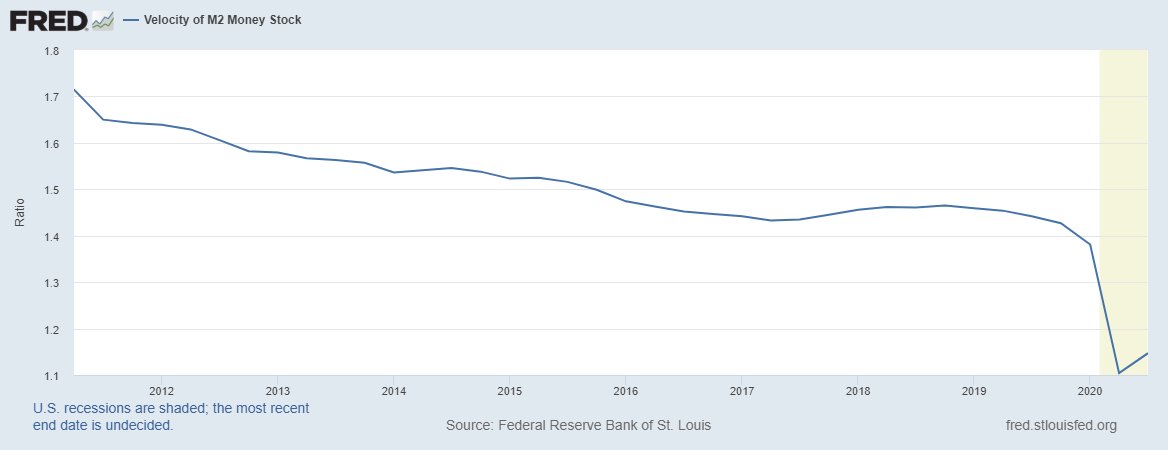

Many analysts comment that loan growth has moved away from commercial banks and this is a fair point.

We should, then, be able to see credit growth coming through the money multiplier and the velocity of money, two hated yet critically important variables.

6/

We should, then, be able to see credit growth coming through the money multiplier and the velocity of money, two hated yet critically important variables.

6/

Given the increase in leading indicators of nGDP growth, I am open to an acceleration in loan volume.

Currently, there is a flattening or an arrest of the decline in growth rate terms.

A full upturn in bank lending growth, however, remains an open question in 2021.

7/7

Currently, there is a flattening or an arrest of the decline in growth rate terms.

A full upturn in bank lending growth, however, remains an open question in 2021.

7/7

Read on Twitter

Read on Twitter