Qualtrics is a favorite SaaS co. at SaaStr

Co-founded by father-son team, run by brothers, bootstrapped most of way in Utah ... they did it their way

Just before IPO, SAP bought 'em for $8B

Now they get a rare >second< chance to IPO

5 Interesting Learnings at ~$800m in ARR:

Co-founded by father-son team, run by brothers, bootstrapped most of way in Utah ... they did it their way

Just before IPO, SAP bought 'em for $8B

Now they get a rare >second< chance to IPO

5 Interesting Learnings at ~$800m in ARR:

#1. Only annual contracts -- and plenty of professional services (25% of revenue)

Qualtrics does have a long tail of 12,000+ customers, but many of its motions are enterprise. 99% of its customers are on annual contracts, and 25% of its revenue is from prof services.

Qualtrics does have a long tail of 12,000+ customers, but many of its motions are enterprise. 99% of its customers are on annual contracts, and 25% of its revenue is from prof services.

25% of revenue from professional services may sound high, but it’s a fairly standard ratio in true enterprise software.

Importantly, Qualtrics’ margins remain high so it’s not losing money on its services. Gross margins on services are about 35%.

Importantly, Qualtrics’ margins remain high so it’s not losing money on its services. Gross margins on services are about 35%.

#2. Spending more on R&D at scale, not less.

Qualtrics as a stand-alone company was spending about 16% of revenue on engineering (i.e., R&D) and that ballooned to as much as 44% under SAP (re-investing in product) ... and now has come down to 31% as the company IPO's (again)

Qualtrics as a stand-alone company was spending about 16% of revenue on engineering (i.e., R&D) and that ballooned to as much as 44% under SAP (re-investing in product) ... and now has come down to 31% as the company IPO's (again)

There are a lot of mini-lessons here on the ability to invest when you don’t have to worry about being public, etc., but the biggest reminder and take-away is you have to invest heavily in your product forever.

Qualtrics like Atlassian invests big $$$ in product at scale

Qualtrics like Atlassian invests big $$$ in product at scale

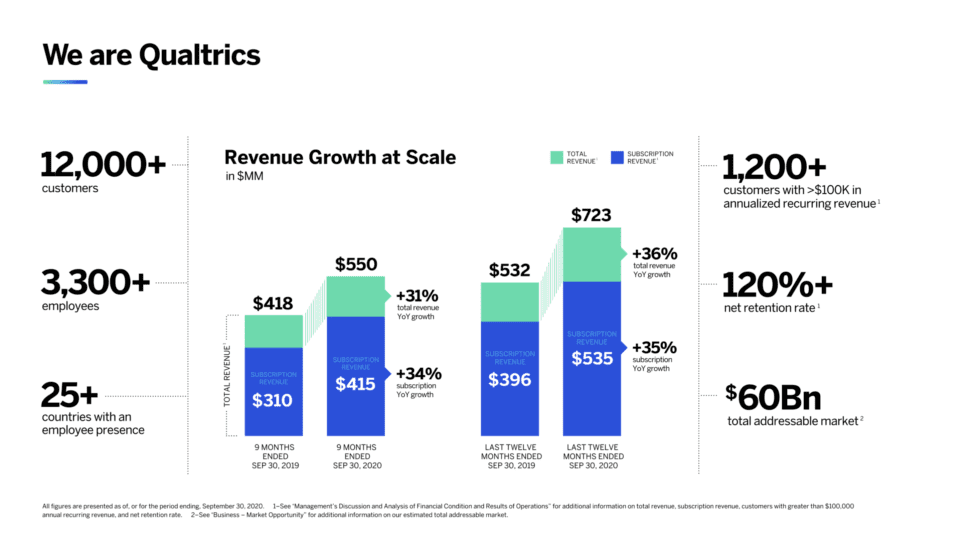

#3. From $35m in revenue in 2012 to $800m in 2021, leveraging 120% NRR.

Just think about that for a minute. Let the power of 120% NRR and strong growth compounding over 8 or so years sink in

Just think about that for a minute. Let the power of 120% NRR and strong growth compounding over 8 or so years sink in

#4. About $250,000 revenue per employee.

With 3,370 employees and $800m in revenue, Qualtrics does about $250,000 in revenue per employee.

This is pretty consistent with other Cloud leaders at scale.

With 3,370 employees and $800m in revenue, Qualtrics does about $250,000 in revenue per employee.

This is pretty consistent with other Cloud leaders at scale.

#5. 64 $1M+ Customers, and 1,200 $100k+ Customers (a 1:20 ratio)

This is how a lot of us end up looking at scale

Qualtrics grew from 27 $1m customers in 2018 to 64 $1m customers today. Assuming they add up to say $100m ARR total, ~15% of their revenue comes from $1m+ deals

This is how a lot of us end up looking at scale

Qualtrics grew from 27 $1m customers in 2018 to 64 $1m customers today. Assuming they add up to say $100m ARR total, ~15% of their revenue comes from $1m+ deals

And for every $1m ACV customer, they have 20 $100k customers.

That 1:20 ratio is pretty interesting and roughly what many vendors that sell to enterprises of different sizes, and in silos, see.

That 1:20 ratio is pretty interesting and roughly what many vendors that sell to enterprises of different sizes, and in silos, see.

A few bonus learnings:

#6. NRR consistent at ~120% for years

We’ve seen some SaaS leaders NRR stay world-class, but decline a bit around $1B in ARR. Not Qualtrics. NRR is basically the same 120%+- for past 3+ years. Much longer really.

#6. NRR consistent at ~120% for years

We’ve seen some SaaS leaders NRR stay world-class, but decline a bit around $1B in ARR. Not Qualtrics. NRR is basically the same 120%+- for past 3+ years. Much longer really.

Read on Twitter

Read on Twitter