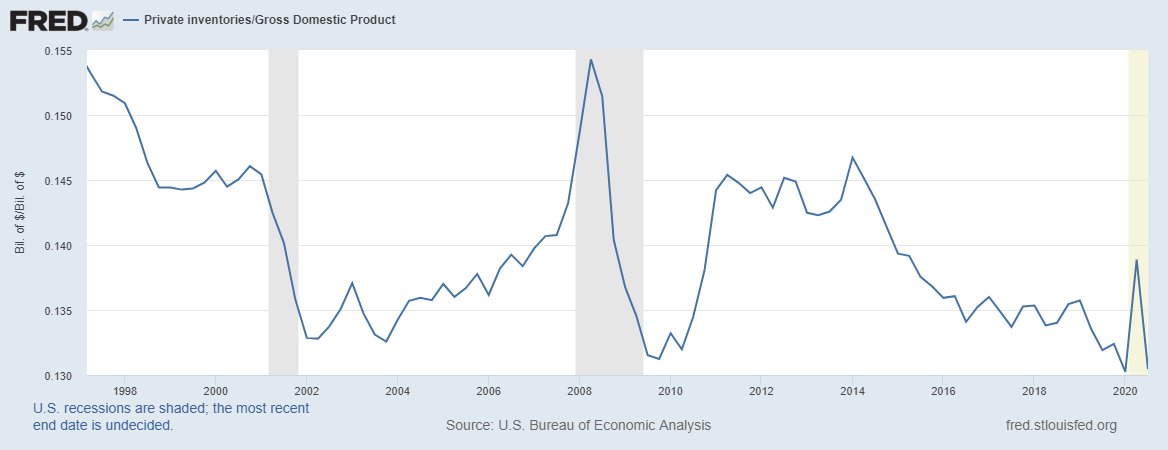

Private inventories to GDP are rock bottom

This is because of a sudden & forced shift to at home goods consumption that caught everyone offsides

The restocking upturn is set to continue

Once the industrial upturn runs it's course, we'll be back to the same old trends

1/

This is because of a sudden & forced shift to at home goods consumption that caught everyone offsides

The restocking upturn is set to continue

Once the industrial upturn runs it's course, we'll be back to the same old trends

1/

That trend shifted suddenly but is unlikely to last for years after the economy re-opens. This shift is likely temporary and a result of forced lockdowns, fear of consumer-facing businesses, etc.

3/

3/

As a result, all the inflation we are seeing is from the goods sector which has similar long-term and short-term trends.

4/

4/

We're unlikely to see a sustained trend of goods inflation rising faster than total inflation once lockdowns end, supply chains are freed and the rush to restock inventories (using industrial commodities) ends

5/

5/

It won't end tomorrow so we have to keep watching the leading indicators.

I believe the inflation picture is coming from this vector while the inflation coming from QE is more centered around financial assets.

6/6

I believe the inflation picture is coming from this vector while the inflation coming from QE is more centered around financial assets.

6/6

CC: @biancoresearch

Read on Twitter

Read on Twitter