Have spent more time recently thinking about portfolio construction, risk adjusted returns, and how that translates to the capital stack and deal structure. Seems that lots of twitter is curious how to think about investing as a LP. Fortunate to wear both hats being a gp myself,

ability to invest and underwrite other LP’s both in our fund and on a personal level.

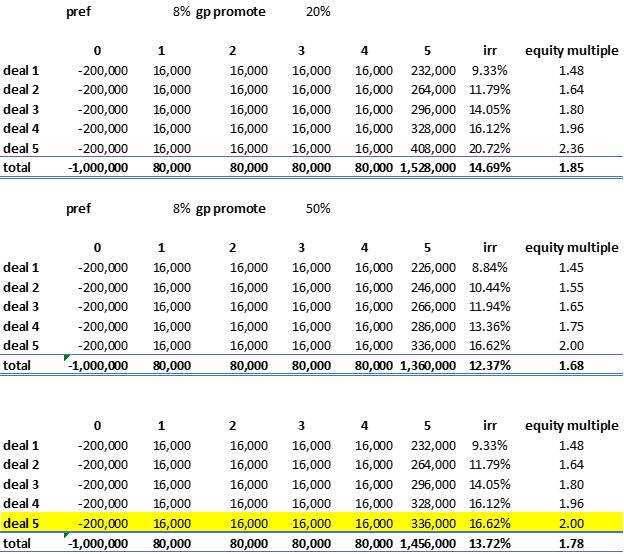

Take the below hypothetical example, HNW investor looking to allocate $1mm over 5 assets with different deal structures. The first example is an 8% pref with a 20% gp split, second is 8% pref

Take the below hypothetical example, HNW investor looking to allocate $1mm over 5 assets with different deal structures. The first example is an 8% pref with a 20% gp split, second is 8% pref

50% gp split, and third is a blend of the two with the first 4 deals (lower performers) being 20% to the gp and the large winner being 50% to the gp (highlighted).

As you can see in the first example, blended portfolio IRR of 14.69%, a solid outcome for a value-add investor.

As you can see in the first example, blended portfolio IRR of 14.69%, a solid outcome for a value-add investor.

The third example with the highlighted deal shows the effect of a larger gp split on your top performer, essentially 100 bps on the IRR lowering your return to 13.72.

@EllliotttB refers to this well as chopping off the right tail of the distribution. The better you are as an

@EllliotttB refers to this well as chopping off the right tail of the distribution. The better you are as an

investor, the more this will matter.

I wanted to put some simple math behind the point to illustrate and contend that if you’re chopping off the right tail of outcomes it may be better to evaluate other parts of the capital stack (pref equity or mezz) as they provide more

I wanted to put some simple math behind the point to illustrate and contend that if you’re chopping off the right tail of outcomes it may be better to evaluate other parts of the capital stack (pref equity or mezz) as they provide more

security by having a preference of payment for giving up some of the right tail. A solid debt/mezz fund will likely do low double digits to teen IRR’s from the middle of the capital stack.

IMO there are a couple of ways to generate returns:

1) Asset allocation

IMO there are a couple of ways to generate returns:

1) Asset allocation

This could be to CRE itself or within asset classes of MF, industrial, Medical, Retail, Office, etc for example. Or within strategies of debt, mezz/pref equity, or equity, or many combinations of the above and factoring in location exposure, IE I would take the sunbelt right now

over the Dakota’s (price pending).

2) Idiosyncratic risk

This may be the part of your portfolio where you “pick” assets to generate outsize returns, which is what I suspect most people use CRE for. If that’s the case, why chop off the right tail? If it’s not the case and you

2) Idiosyncratic risk

This may be the part of your portfolio where you “pick” assets to generate outsize returns, which is what I suspect most people use CRE for. If that’s the case, why chop off the right tail? If it’s not the case and you

like yield, why not move up in the cap stack? Some thoughts to be considered here are sponsor specific risk. For an extreme example, imagine if a large chunk of your net worth was invested in one sponsor who had PG’s on a multitude of debt. It takes one default to likely trigger

defaults in others and have loans callable. Almost never an issue with capital is plentiful and risk appetite is on, but that isn’t always the environment.

As we get late cycle, inevitably some of the smarter people I know in the business are moving up in the cap stack and/or

As we get late cycle, inevitably some of the smarter people I know in the business are moving up in the cap stack and/or

have less volume of activity as a value-add to opportunistic equity people.

Pick your spots people and stay safe out there.

This is just a primer, but happy to riff about this as I love thinking about risk.

/thread

Pick your spots people and stay safe out there.

This is just a primer, but happy to riff about this as I love thinking about risk.

/thread

Read on Twitter

Read on Twitter