Twilio has long been one of our favorite companies at SaaStr, combining B2D + B2B, long-tail, SMB + enterprise, and much more

They are >still< growing 52% at $2B+ in ARR

Here are 5 Interesting Learnings from Twilio:

They are >still< growing 52% at $2B+ in ARR

Here are 5 Interesting Learnings from Twilio:

#1. The Top 10 Customers at Twilio have been 15%-20% of its revenue for years.

Yet Twilio has 200,000+ active accounts.

So they work hard to make a long tail AND big whales work together in 1 company

You don't have to choose. Don't let folks force you to.

Yet Twilio has 200,000+ active accounts.

So they work hard to make a long tail AND big whales work together in 1 company

You don't have to choose. Don't let folks force you to.

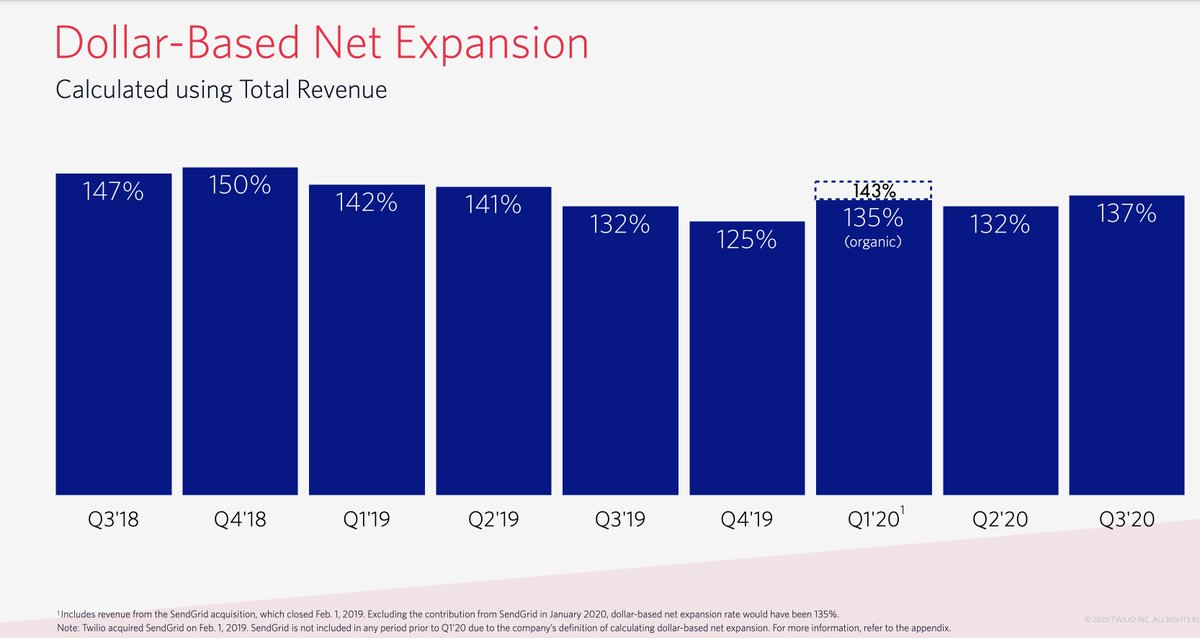

#2. NRR has come down a bit from 140%-150% around the IPO, but is still world-class at 137%.

It's a great reminder NRR does not have to come down as you scale

Accounts can remain less than fully penetrated for many, many years

All the way to $2B+ in ARR

It's a great reminder NRR does not have to come down as you scale

Accounts can remain less than fully penetrated for many, many years

All the way to $2B+ in ARR

#3. Gross Margins were 60% at IPO and have remained high enough to be "SaaS".

Unlike many pure software cos, Twilio has significant network costs

It also has a lot of competition

But by anchoring its brand as the trusted player, GMs have stayed high enough to be "SaaS"

Unlike many pure software cos, Twilio has significant network costs

It also has a lot of competition

But by anchoring its brand as the trusted player, GMs have stayed high enough to be "SaaS"

#4. Twilio had ~2,400 employees at $1B in ARR, or ~$250,000 in revenue per employee

Not as efficient as http://Bill.com the other day, or Zoom at IPO, but a good yardstick to think about at scale

Not as efficient as http://Bill.com the other day, or Zoom at IPO, but a good yardstick to think about at scale

#5. Even with "whale" customers worth $10m+ a year, the average Twilio customer pays just $7k a year for com products, less for Sendgrid/email.

So Twilio is still SMB and B2D at heart. Again, yes you can do both.

So Twilio is still SMB and B2D at heart. Again, yes you can do both.

Finally, Twilio is a reminder that large markets matter

When Twilio started, the API-for-communications market itself was small. But communications overall is huge

As the category became established, Twilio grew at incredible 80% YoY at $1B ARR including Sendgrid, 56% without

When Twilio started, the API-for-communications market itself was small. But communications overall is huge

As the category became established, Twilio grew at incredible 80% YoY at $1B ARR including Sendgrid, 56% without

A deeper dive here: https://www.saastr.com/twilio-crossed-1-billion-in-arr-growing-86-yes-1-billion/

Read on Twitter

Read on Twitter