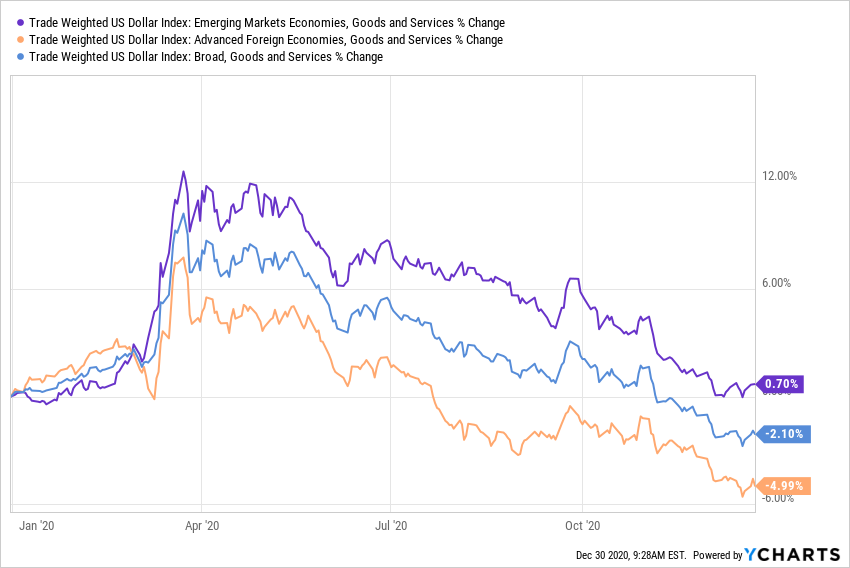

US Dollar Trends

The Fed Trade Weighted Dollar Index fell another 1% over the past month.

The decline was led by the dollar falling against advanced economies as the dollar was down less against emerging market economies

1)

The Fed Trade Weighted Dollar Index fell another 1% over the past month.

The decline was led by the dollar falling against advanced economies as the dollar was down less against emerging market economies

1)

The Fed's trade-weighted indexes are my preferred US dollar aggregates, far better than popular measures like the $DXY due to the concentration

The USD is down 7% across the board in the last six months.

2)

The USD is down 7% across the board in the last six months.

2)

Surprisingly, the USD is still up on the year relative to EM economies

With exceptions, the USD moves counter to global industrial growth

An industrial boom generally puts downward pressure on safe-haven dollars in exchange for more risk while economies are accelerating

3)

With exceptions, the USD moves counter to global industrial growth

An industrial boom generally puts downward pressure on safe-haven dollars in exchange for more risk while economies are accelerating

3)

When the USD falls in conjunction with rising industrial commodities and strong manufacturing data, the evidence points towards continued growth and inflationary pressure in the goods sector.

4)

4)

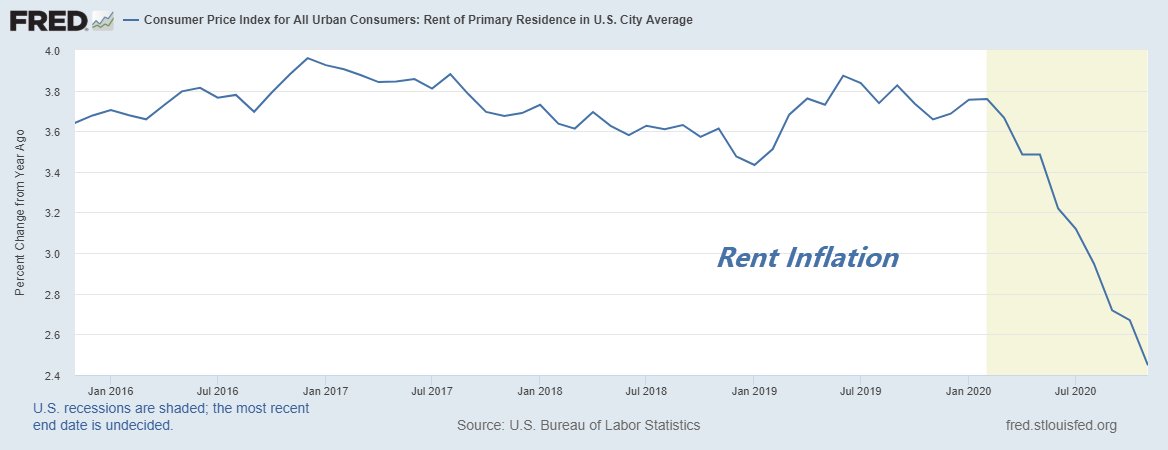

Without the recent surge in goods inflation, the US economy would likely be very near deflation as the inflation rate in the services economy continues to decline.

5)

5)

Over the long-run, the winning FX will be the country that can sustain the highest real interest rates over time.

The highest real interest rates will likely come from the country that can sustain the highest real economic growth rate.

6)

The highest real interest rates will likely come from the country that can sustain the highest real economic growth rate.

6)

The USD is in a long-term bull market, up 20%-30% against both advanced economies & EM economies

I expect the USD to continue falling as long as the global industrial upturn remains intact

When global industrial growth declines, the USD will resume its multi-year bull rally

7)

I expect the USD to continue falling as long as the global industrial upturn remains intact

When global industrial growth declines, the USD will resume its multi-year bull rally

7)

Read on Twitter

Read on Twitter