Congress is threading the needle in terms of timing with the latest COVID relief package.

Personal income, after a massive surge, is about to fall below the pre-pandemic trendline.

Some thoughts on November's Personal Income & Outlays report:

1)

Personal income, after a massive surge, is about to fall below the pre-pandemic trendline.

Some thoughts on November's Personal Income & Outlays report:

1)

The most important metric for real consumption is real disposable personal income.

Real DPI spiked during the pandemic due to enhanced UI and stimulus checks.

Since April, real DPI has been declining as the withdrawal of stimulus has outpaced the increase in wages.

2)

Real DPI spiked during the pandemic due to enhanced UI and stimulus checks.

Since April, real DPI has been declining as the withdrawal of stimulus has outpaced the increase in wages.

2)

Real personal income excluding transfer payments also declined in November which means the income drop was not just from a lack of stimulus, there was pressure to core income.

3)

3)

Wages and salaries continue to increase, no question a good sign, but the monthly gains are fading rapidly.

4)

4)

As a result of weaker income growth, real consumption growth also declined in November and rolled over on a year over year basis.

5)

5)

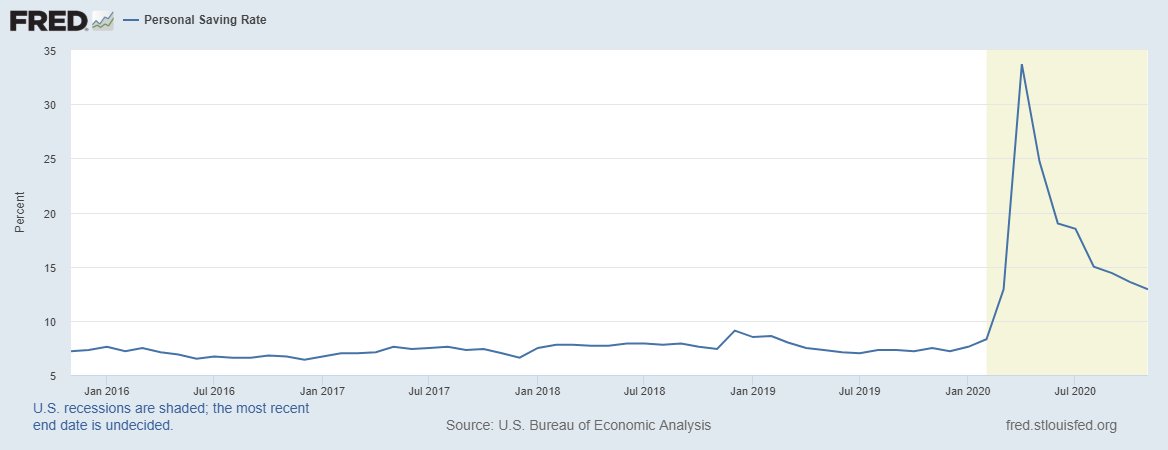

The personal savings rate remains high relative to the pre-pandemic baseline.

We shouldn't expect a full normalization of the savings rate.

Savings typically increases after major shocks (pandemic)

6)

We shouldn't expect a full normalization of the savings rate.

Savings typically increases after major shocks (pandemic)

6)

One key metric for this recovery is the consumption ratio (durables/services)

A surge in durables consumption jump-started a global manufacturing recovery.

November showed signs of that finally slowing down

7)

A surge in durables consumption jump-started a global manufacturing recovery.

November showed signs of that finally slowing down

7)

Without more stimulus, real DPI would have likely fallen below the pre-pandemic trendline and started a consumer balance sheet deleveraging.

Stimulus is likely to hit in the next few weeks which will help keep real DPI elevated and remove some left tail consumer risk.

8)

Stimulus is likely to hit in the next few weeks which will help keep real DPI elevated and remove some left tail consumer risk.

8)

Using government debt to supplement consumption, while necessary, is a very poor use of debt and one that will keep downward pressure on the velocity of money and keep deflationary pressure alive.

9)

9)

@threadreaderapp unroll

Read on Twitter

Read on Twitter