Ahead of this weekend’s probable final episode of a tumultuous four-and half-year process,

Ahead of this weekend’s probable final episode of a tumultuous four-and half-year process,here below the ultimate #BrexitThread on everything you need to know about the economics of Brexit before Sunday’s #negotiations climax

1/14 https://www.niesr.ac.uk/brexit-negotiations

The 2016 decision to leave the EU has materially altered our prospects but #Policy has not responded. We warned as much in 2016 with an Open Letter from the Directors of @NIESRorg, @CEP_LSE and @TheIFS

@PJTheEconomist @johnvanreenen @s_machin_

2/14 https://www.niesr.ac.uk/blog/leaving-eu-would-almost-certainly-damage-our-economic-prospects

@PJTheEconomist @johnvanreenen @s_machin_

2/14 https://www.niesr.ac.uk/blog/leaving-eu-would-almost-certainly-damage-our-economic-prospects

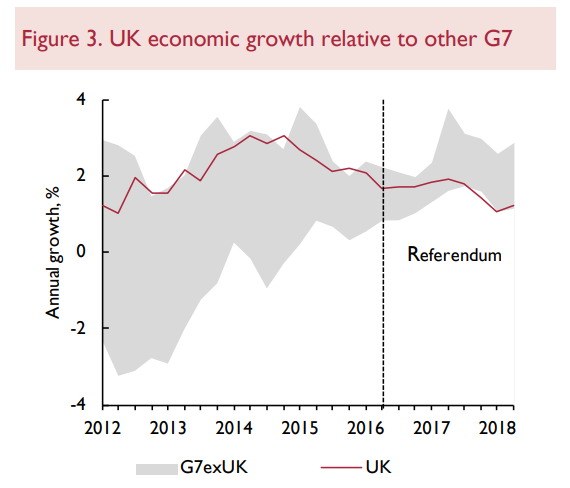

With news of a #deal or #NoDeal expected any day now, a reminder that by 2018 UK's GDP was already 2% lower than if we had voted to Remain, as described in this paper we published at the time. But it was as much about #uncertainty leading to stasis

3/14

https://www.niesr.ac.uk/sites/default/files/publications/NIESR%20Report%20Brexit%20-%202018-11-26.pdf

3/14

https://www.niesr.ac.uk/sites/default/files/publications/NIESR%20Report%20Brexit%20-%202018-11-26.pdf

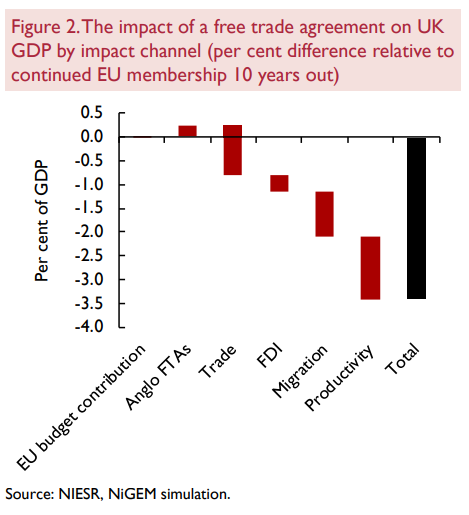

We then estimated that by 2030 the loss in #GDP due to Brexit would rise to some 4.0% under a Free Trade Agreement or 5-6% under an Orderly No Deal. #Trade volume, foreign investment and #productivity would all be lower whether an #FTA is signed or not.

4/14

4/14

A year ago we estimated the long run #GDP loss at 3-4% under new PM Johnson’s deal, though we believed it would quite a stretch to have such a #deal in place by 2021…

5/14

#BrexitDeal

#NoDealBrexit

https://www.niesr.ac.uk/publications/economic-impact-prime-minister-johnsons-new-brexit-deal

5/14

#BrexitDeal

#NoDealBrexit

https://www.niesr.ac.uk/publications/economic-impact-prime-minister-johnsons-new-brexit-deal

…with the largest effects in areas significantly exposed to EU #trade, and any public spending cuts more obviously impacting on areas more reliant on the #publicsector

#Brexit

#UKregions

6/14

https://www.niesr.ac.uk/publications/economic-impact-prime-minister-johnsons-new-brexit-deal

#Brexit

#UKregions

6/14

https://www.niesr.ac.uk/publications/economic-impact-prime-minister-johnsons-new-brexit-deal

In an Op-ed by the Director @jagjit_chadha we called for a #policy initiative to reflect and act on the #Brexit shock and help us break out of the doldrums

7/14

https://www.niesr.ac.uk/blog/breaking-out-doldrums

https://www.niesr.ac.uk/blog/breaking-out-doldrums

7/14

https://www.niesr.ac.uk/blog/breaking-out-doldrums

https://www.niesr.ac.uk/blog/breaking-out-doldrums

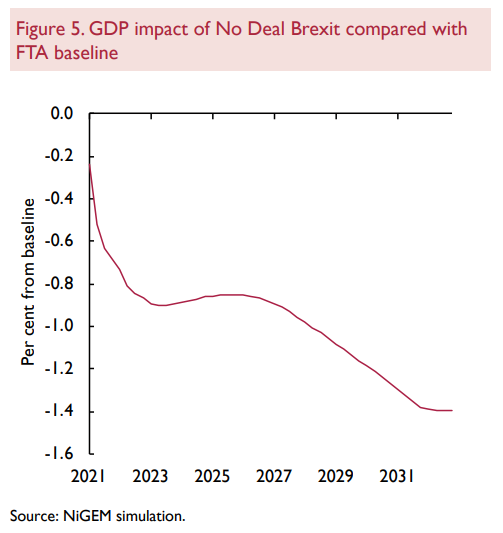

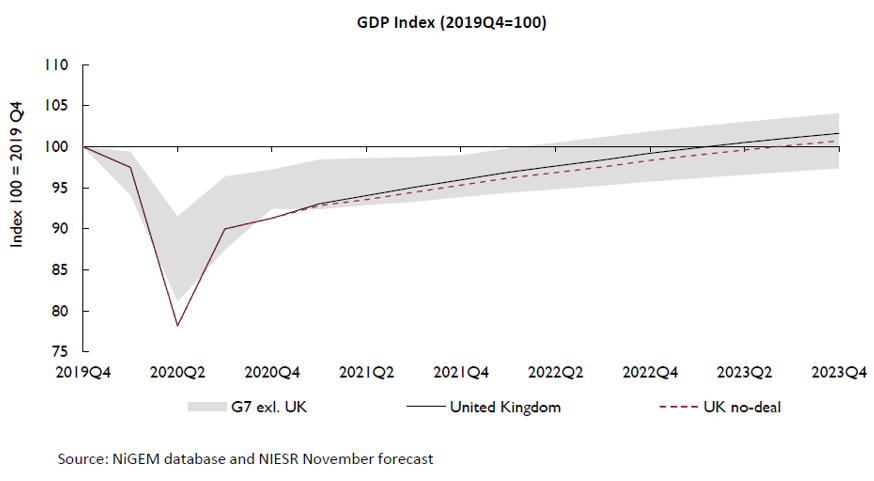

A lot has happened since then, most dramatically #COVID19. Does that mean [ #Brexit / #NoDeal] will pass unnoticed? We looked at this in our November Review, estimating that even though some of the reduction in #GDP due to...

8/14

8/14

... #Brexit had already taken place pre-Covid-19, an orderly ‘No Deal’ would leave us even worse off than our FTA baseline

9/14

https://www.niesr.ac.uk/sites/default/files/publications/UK%20November%202020%20-final%2B.pdf

9/14

https://www.niesr.ac.uk/sites/default/files/publications/UK%20November%202020%20-final%2B.pdf

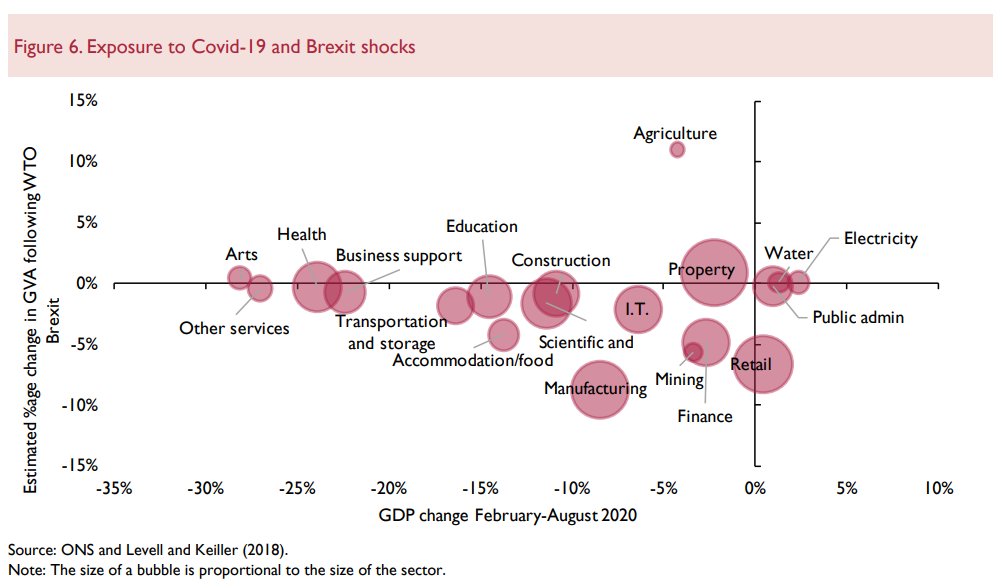

…but #Brexit is likely to damage sectors (finance, manufacturing, mining) in the long run relatively unaffected by #COVID19 as well as retail, which was badly hit by #lockdown but recovered quite quickly

10/14

https://www.niesr.ac.uk/sites/default/files/publications/UK%20November%202020%20-final%2B.pdf

10/14

https://www.niesr.ac.uk/sites/default/files/publications/UK%20November%202020%20-final%2B.pdf

Under both our FTA baseline and an orderly #NoDeal scenario, UK is expected to have a slower recovery from the #pandemic compared to other advanced economies, with the recovery likely to take longer under the latter

11/14

11/14

What next? For a start do take a look at our Director @jagjit_chadha’s lecture series for @GreshamCollege outlining an approach to a Blueprint for #BrexitBritain

12/14

https://www.gresham.ac.uk/series/blueprint-for-brexit-britain

12/14

https://www.gresham.ac.uk/series/blueprint-for-brexit-britain

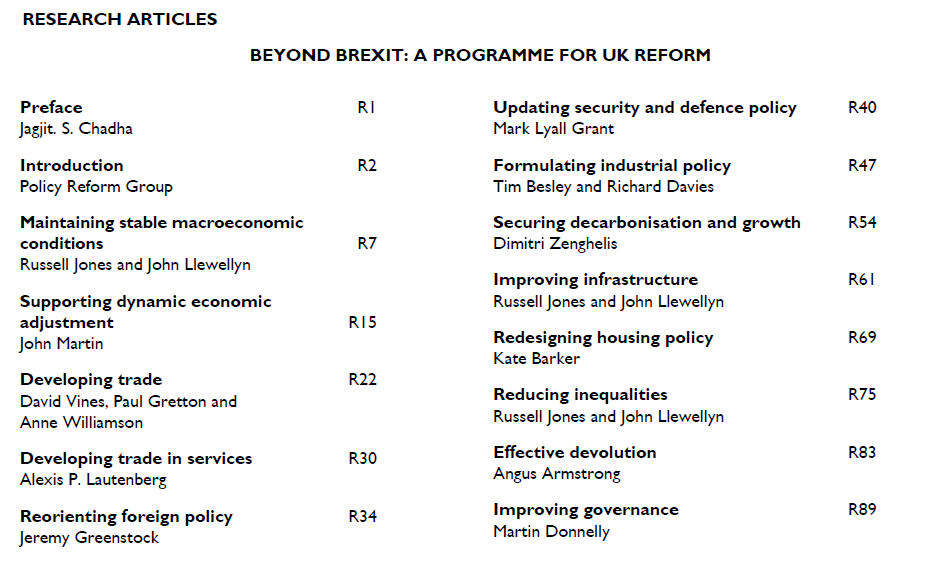

Our 250th Special Issue of the National Institute Economic Review published last year 'Beyond Brexit: A programme for UK Reform'

@PRG_org

13/14

#NIESRreview

https://www.cambridge.org/core/journals/national-institute-economic-review/volume/AFAED13F4924EB9E2E9E47BCE46AFA15

@PRG_org

13/14

#NIESRreview

https://www.cambridge.org/core/journals/national-institute-economic-review/volume/AFAED13F4924EB9E2E9E47BCE46AFA15

Finally for our #Brexit pages and other research, including #blogs, op-eds, research articles and lectures

14/14

#BrexitResearch https://www.niesr.ac.uk/britain-after-brexit

14/14

#BrexitResearch https://www.niesr.ac.uk/britain-after-brexit

Read on Twitter

Read on Twitter