Slack crossed $1,000,000,000 in ARR in perhaps its last earnings as a public company

What can we learn?

5 things:

1. Slack is still >significantly< growing its customer base, even at $1B ARR.

Slack is growing its customer base 35% YoY. That's high at $1B ARR.

What can we learn?

5 things:

1. Slack is still >significantly< growing its customer base, even at $1B ARR.

Slack is growing its customer base 35% YoY. That's high at $1B ARR.

2. 1,000+ $100k ACV Customers, 49% revenue from Big Customers.

Slack has 140,000 customers yes ... but 1,000 of them are the whales and pay $100k+. Slack is more enterprise than you might think.

Slack has 140,000 customers yes ... but 1,000 of them are the whales and pay $100k+. Slack is more enterprise than you might think.

3. While 49% enterprise / 51% SMB now, Slack isn't going >more< enterprise.

That ratio has stayed consistent, even with high net negative churn.

That means Slack is accelerating in the SMB market. My biggest surprise.

That ratio has stayed consistent, even with high net negative churn.

That means Slack is accelerating in the SMB market. My biggest surprise.

4. 40% of revenue from outside U.S.

While this isn't a new trend, it's fairly high. When you see growth outside the U.S., jump on it.

While this isn't a new trend, it's fairly high. When you see growth outside the U.S., jump on it.

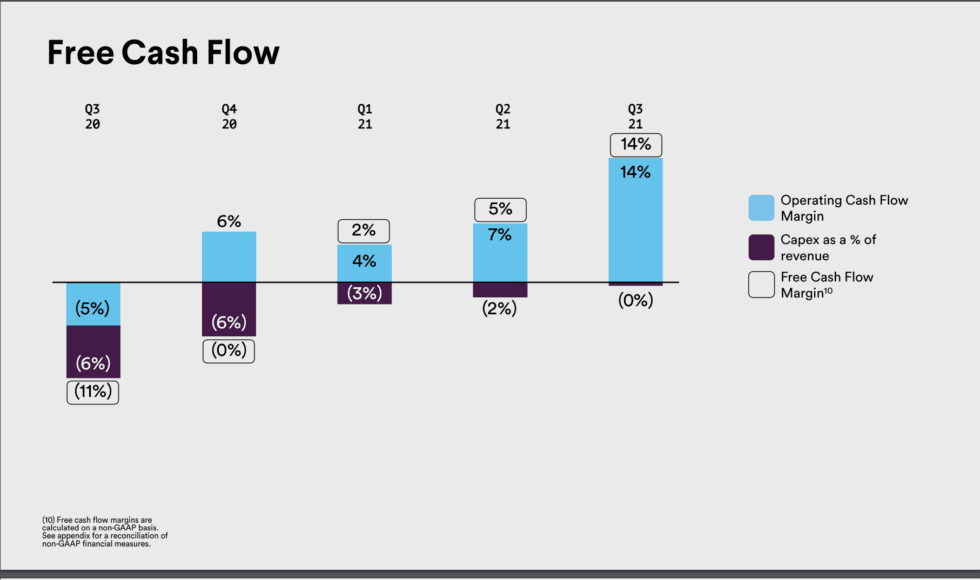

5. Slack is generating significant free cash flow.

In the earlier days of SaaS, there was a lot of criticism about why SaaS companies weren’t generating more cash. Slack’s chart here is a good illustration of why it can take time, but when it comes, it really comes on strong:

In the earlier days of SaaS, there was a lot of criticism about why SaaS companies weren’t generating more cash. Slack’s chart here is a good illustration of why it can take time, but when it comes, it really comes on strong:

A last note: net retention, while still strong, has come down from 134% to 123%. That's less common.

Is it competition? Or just getting better at closing "all the seats" up front?

It's not clear. It's still strong. But a reminder you can never rest here.

Is it competition? Or just getting better at closing "all the seats" up front?

It's not clear. It's still strong. But a reminder you can never rest here.

A deeper dive here: https://www.saastr.com/5-interesting-learnings-from-slack-at-1b-in-arr/

Read on Twitter

Read on Twitter