A lot of people seem comforted by the Fed downplaying NAIRU as sufficient to prevent hiking too soon in the future, but I think this is affected by recency bias....

... I think people look at the below target inflation of 2019, and the general below target inflation of 2013-2019 as demonstrating that we weren't at full-employment much more clearly than any NAIRU concept would. So just trust inflation, right?...

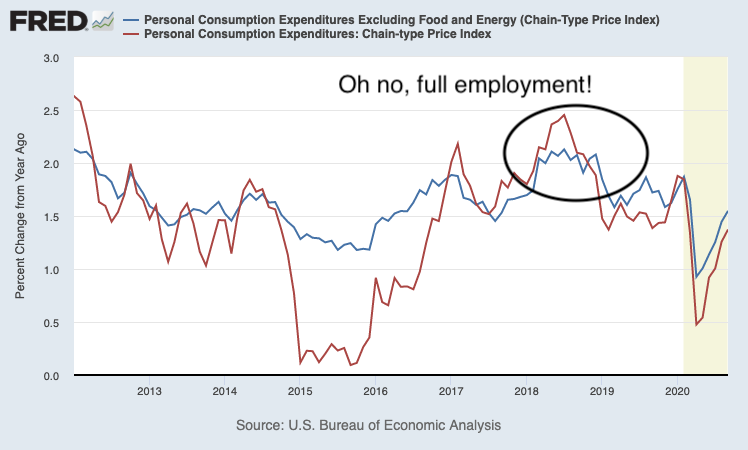

I think this is ignoring the inflation scares of the recovery. Specifically for basically all of 2018, core PCE was at or above target and PCE was above target. This is why the Fed hiked four times in 2018.

Had we been nihilists about NAIRU I don't believe it would have prevented those hikes. This is why we can't rely on mere open mindedness. Inflation is very noise and inconsistent and even the core is driven by transient shocks.

The only way to see through the noise of 2018 was taking a *strong position on labor market slack*. Not a nihilistic position that it's some unknowable, measurable concept.

We cannot be certain, but NAIRU was never considered certain. What we need to do is take as strong of a position on prime epop and 1990s labor market levels as a we did on NAIRU historically. If we do not, misleading inflation & NAIRU intuition is going to cause bad rate hikes.

Read on Twitter

Read on Twitter