93% GROWTH

93% GROWTH

It had a run of 765%, taking the stock from $4 to $34.5 in *LESS THAN 6 MONTHS*

Mobile usage

is BOOMING

is BOOMING  and this company is MONETISING THIS

and this company is MONETISING THIS

Can this stock keep it up and deliver on its market cap south of$ 2.9B?

What is NEXT?

What is NEXT?

Continued

Digital Turbine $APPS is a tech company from Austin, TX  that started in 2011 and has around 210 employees

that started in 2011 and has around 210 employees

Over 40 mobile operators (e.g. Verizon, T-mobile, AT&T) and OEMs

(e.g. Verizon, T-mobile, AT&T) and OEMs  (Original Equipment Manufacturers such as Samsung, Xiaomi, HTC) use their services

(Original Equipment Manufacturers such as Samsung, Xiaomi, HTC) use their services

that started in 2011 and has around 210 employees

that started in 2011 and has around 210 employees

Over 40 mobile operators

(e.g. Verizon, T-mobile, AT&T) and OEMs

(e.g. Verizon, T-mobile, AT&T) and OEMs  (Original Equipment Manufacturers such as Samsung, Xiaomi, HTC) use their services

(Original Equipment Manufacturers such as Samsung, Xiaomi, HTC) use their services

$APPS describes itself as “simplifying content discovery by delivering it directly to the device”

From a very high level it may at first seem confusing what this company offers

it may at first seem confusing what this company offers

From a very high level

it may at first seem confusing what this company offers

it may at first seem confusing what this company offers

In very simple terms $APPS has built a software that mobile phone manufacturers

$APPS has built a software that mobile phone manufacturers  (Samsung and the likes) and mobile operators

(Samsung and the likes) and mobile operators  can integrate to the devices they sell

can integrate to the devices they sell

This software then acts as an “app-installation / recommendation-engine” directly on the smartphone

$APPS has built a software that mobile phone manufacturers

$APPS has built a software that mobile phone manufacturers  (Samsung and the likes) and mobile operators

(Samsung and the likes) and mobile operators  can integrate to the devices they sell

can integrate to the devices they sellThis software then acts as an “app-installation / recommendation-engine” directly on the smartphone

How does that generate sales?

DYNAMIC INSTALLS

DYNAMIC INSTALLS  $APPS makes money by licensing this software to OEMs

$APPS makes money by licensing this software to OEMs  and mobile phone operators (accounting for 86% of sales in 2019)

and mobile phone operators (accounting for 86% of sales in 2019)

$APPS licenses its software to OEMs and operators

$APPS licenses its software to OEMs and operators

DYNAMIC INSTALLS

DYNAMIC INSTALLS  $APPS makes money by licensing this software to OEMs

$APPS makes money by licensing this software to OEMs  and mobile phone operators (accounting for 86% of sales in 2019)

and mobile phone operators (accounting for 86% of sales in 2019) $APPS licenses its software to OEMs and operators

$APPS licenses its software to OEMs and operators

ENGAGEMENT OPPORTUNITIES

ENGAGEMENT OPPORTUNITIES  14% of its sales are derived from SingleTap Installs, Smart Folders, Notification, Media Hub

14% of its sales are derived from SingleTap Installs, Smart Folders, Notification, Media Hub

$APPS gets paid by app makers to promote their app directly on the users’ smartphone

$APPS gets paid by app makers to promote their app directly on the users’ smartphone

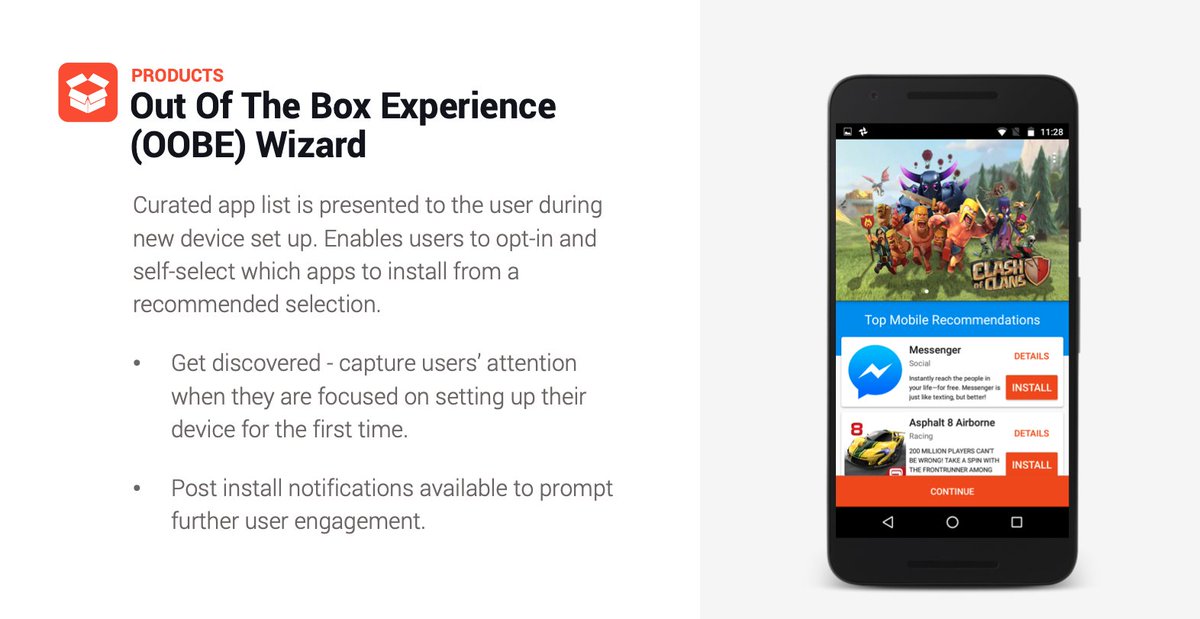

DYNAMIC INSTALLS  This starts once the new user unpacks its new phone (Out of the Box Experience - OOBE)

This starts once the new user unpacks its new phone (Out of the Box Experience - OOBE)

The users sets up its account and then get directed to a “Let’s set up you apps”

The users sets up its account and then get directed to a “Let’s set up you apps”  page where the OEM or operator can propose apps to the user

page where the OEM or operator can propose apps to the user

This starts once the new user unpacks its new phone (Out of the Box Experience - OOBE)

This starts once the new user unpacks its new phone (Out of the Box Experience - OOBE)

The users sets up its account and then get directed to a “Let’s set up you apps”

The users sets up its account and then get directed to a “Let’s set up you apps”  page where the OEM or operator can propose apps to the user

page where the OEM or operator can propose apps to the user

This enables the user to directly and seamlessly install the apps it is interested in on its phone

This enables the user to directly and seamlessly install the apps it is interested in on its phone A win-win for the OEM or operator as they can charge the companies whom they are promoting their apps for

A win-win for the OEM or operator as they can charge the companies whom they are promoting their apps for

Also, at the time of the set up, some apps get automatically pre-installed (based on user profile and demographics)

Also, at the time of the set up, some apps get automatically pre-installed (based on user profile and demographics) This enables to OEM or operator to install apps that its user might want

This enables to OEM or operator to install apps that its user might want

These pre-installed apps are sponsored by the app maker (Facebook, Uber, Twitter, Pandora, Starbucks, Target…) and the money goes into the OEM or operator’s pocket

These pre-installed apps are sponsored by the app maker (Facebook, Uber, Twitter, Pandora, Starbucks, Target…) and the money goes into the OEM or operator’s pocket

DYNAMIC INSTALLS  account for 86% of $APPS sales

account for 86% of $APPS sales  $APPS has now added products to generate sales

$APPS has now added products to generate sales  during the LIFE / USAGE of the device

during the LIFE / USAGE of the device

ENGAGEMENT OPPORTUNITIES such as SingleTap Installs, Smart Folders, Notification, Media Hub

such as SingleTap Installs, Smart Folders, Notification, Media Hub

account for 86% of $APPS sales

account for 86% of $APPS sales  $APPS has now added products to generate sales

$APPS has now added products to generate sales  during the LIFE / USAGE of the device

during the LIFE / USAGE of the device

ENGAGEMENT OPPORTUNITIES

such as SingleTap Installs, Smart Folders, Notification, Media Hub

such as SingleTap Installs, Smart Folders, Notification, Media Hub

ENGAGEMENT OPPORTUNITIES  are paid for by app makers

are paid for by app makers  and promoted by $APPS

and promoted by $APPS  through the software it installed on smartphones

through the software it installed on smartphones

The money paid by app makers goes into $APPS’ pocket

The money paid by app makers goes into $APPS’ pocket

are paid for by app makers

are paid for by app makers  and promoted by $APPS

and promoted by $APPS  through the software it installed on smartphones

through the software it installed on smartphones

The money paid by app makers goes into $APPS’ pocket

The money paid by app makers goes into $APPS’ pocket

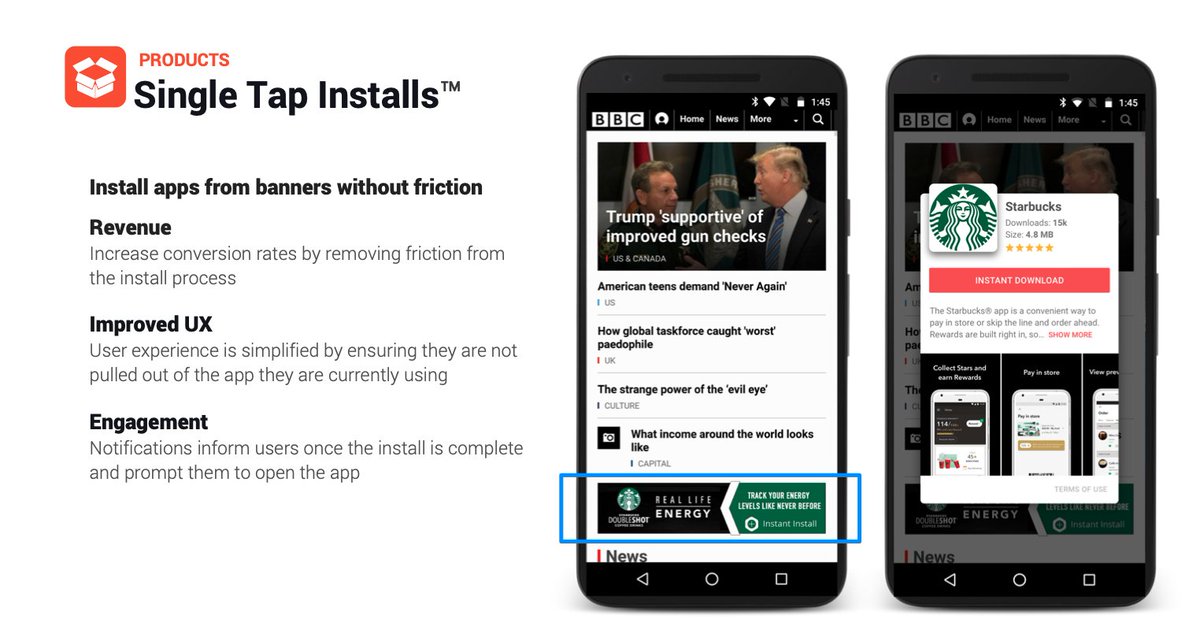

SingleTap Installs works as a small ad that is placed in the middle of a browser

SingleTap Installs works as a small ad that is placed in the middle of a browser  This ad promotes the download of a apps

This ad promotes the download of a apps When the users clicks on the ad

When the users clicks on the ad  it DIRECTLY downloads the app

it DIRECTLY downloads the app  No need to jump over the an app store

No need to jump over the an app store

According to $APPS, this increases conversion rates up to 10 times and it is already available on over 270m devices

According to $APPS, this increases conversion rates up to 10 times and it is already available on over 270m devicesNext to SingleTap Installs, $APPS also offers

Notifications, Media Hub and Smart Folder

Through its Notifications, Media Hub and Smart Folder products, $APPS proposes the download of additional apps to the users

Through its Notifications, Media Hub and Smart Folder products, $APPS proposes the download of additional apps to the users

Users can place their gaming apps into a “Games Folder”

Users can place their gaming apps into a “Games Folder”  $APPS then proposes matching games

$APPS then proposes matching games  to the user in instant download

to the user in instant download

Third parties can send notifications to the users on special occasions

Third parties can send notifications to the users on special occasions  (promotions, important events….) enabling these to instant download the app

(promotions, important events….) enabling these to instant download the app

Now what  This company is all about installing apps on smartphones

This company is all about installing apps on smartphones  How is that market evolving on a global level

How is that market evolving on a global level  ?

?

$APPS caters to Android devices as they can add their own builds on top of the OS

$APPS caters to Android devices as they can add their own builds on top of the OS

This company is all about installing apps on smartphones

This company is all about installing apps on smartphones  How is that market evolving on a global level

How is that market evolving on a global level  ?

? $APPS caters to Android devices as they can add their own builds on top of the OS

$APPS caters to Android devices as they can add their own builds on top of the OS

$AAPL isn’t really permissive to that extent and plans to make the life of advertisers even harder on its platform

$AAPL isn’t really permissive to that extent and plans to make the life of advertisers even harder on its platform

First things first, let’s look at the ANDROID / iOS share of devices

In the U.S. around 53% of smartphones are running iOS and 47% Android

In the U.S. around 53% of smartphones are running iOS and 47% Android

In the E.U. around 26% of smartphones are running iOS and 73% Android

In the E.U. around 26% of smartphones are running iOS and 73% Android

In the U.S. around 53% of smartphones are running iOS and 47% Android

In the U.S. around 53% of smartphones are running iOS and 47% Android In the E.U. around 26% of smartphones are running iOS and 73% Android

In the E.U. around 26% of smartphones are running iOS and 73% Android

In Asia around 17% of smartphones are running iOS and 83% Android

In Asia around 17% of smartphones are running iOS and 83% Android In LATAM around 11% of smartphones are running iOS and 89% Android

In LATAM around 11% of smartphones are running iOS and 89% Android In Africa around 11% of smartphones are running iOS and 87% Android

In Africa around 11% of smartphones are running iOS and 87% Android These market shares have been STABLE over the last year

These market shares have been STABLE over the last year

$APPS sales are BOOMING in its most important geographies

U.S. and Canada sales reached $ 38m up 79% YoY

U.S. and Canada sales reached $ 38m up 79% YoY

EU and Africa sales reached $ 15m up 118% YoY

EU and Africa sales reached $ 15m up 118% YoY

Asia sales reached $ 5.2m up 173% YoY

Asia sales reached $ 5.2m up 173% YoY

LATAM sales reached $0.2m - Flat

LATAM sales reached $0.2m - Flat

U.S. and Canada sales reached $ 38m up 79% YoY

U.S. and Canada sales reached $ 38m up 79% YoY

EU and Africa sales reached $ 15m up 118% YoY

EU and Africa sales reached $ 15m up 118% YoY Asia sales reached $ 5.2m up 173% YoY

Asia sales reached $ 5.2m up 173% YoY LATAM sales reached $0.2m - Flat

LATAM sales reached $0.2m - Flat

These are great numbers  But what is the smartphone and apps market telling us?

But what is the smartphone and apps market telling us?

Smartphone sales are plateauing at around 1.5B units sold a year

Smartphone sales are plateauing at around 1.5B units sold a year

Users kept their smartphone on average 20 to 24 months in 2014 but this number has risen to 33 months in 2019

Users kept their smartphone on average 20 to 24 months in 2014 but this number has risen to 33 months in 2019

But what is the smartphone and apps market telling us?

But what is the smartphone and apps market telling us? Smartphone sales are plateauing at around 1.5B units sold a year

Smartphone sales are plateauing at around 1.5B units sold a year Users kept their smartphone on average 20 to 24 months in 2014 but this number has risen to 33 months in 2019

Users kept their smartphone on average 20 to 24 months in 2014 but this number has risen to 33 months in 2019

Sales of smartphone hardware are stagnating what about smartphone usage?

55% of internet consumption is now done through a mobile device

55% of internet consumption is now done through a mobile device  Up from 27% in 2016

Up from 27% in 2016

Consumers spent 3 hours and 40 minutes a day on mobile devices in 2019 - up 35% since 2017

Consumers spent 3 hours and 40 minutes a day on mobile devices in 2019 - up 35% since 2017

55% of internet consumption is now done through a mobile device

55% of internet consumption is now done through a mobile device  Up from 27% in 2016

Up from 27% in 2016 Consumers spent 3 hours and 40 minutes a day on mobile devices in 2019 - up 35% since 2017

Consumers spent 3 hours and 40 minutes a day on mobile devices in 2019 - up 35% since 2017

Spend across all app stores on games in set to reach $ 100B in 2020

Spend across all app stores on games in set to reach $ 100B in 2020 Mobile ad spend is set to reach $ 240B in 2020 - up 26M from 2019

Mobile ad spend is set to reach $ 240B in 2020 - up 26M from 2019 App downloads reached 204B in 2019 - up 45% from 2016

App downloads reached 204B in 2019 - up 45% from 2016

It should be clear now, consumers are not buying as many smartphones

It should be clear now, consumers are not buying as many smartphones

But smartphone usage, app downloads and mobile ad spent are BOOMING

But smartphone usage, app downloads and mobile ad spent are BOOMING

$APPS still has a large runaway for growth  It’s software is currently installed on only 13% of Android devices

It’s software is currently installed on only 13% of Android devices

With its ENGAGEMENT OPPORTUNITIES

With its ENGAGEMENT OPPORTUNITIES  $APPS is playing right into the increased smartphone usage and monetising this

$APPS is playing right into the increased smartphone usage and monetising this

Here are some key figures

It’s software is currently installed on only 13% of Android devices

It’s software is currently installed on only 13% of Android devices

With its ENGAGEMENT OPPORTUNITIES

With its ENGAGEMENT OPPORTUNITIES  $APPS is playing right into the increased smartphone usage and monetising this

$APPS is playing right into the increased smartphone usage and monetising this

Here are some key figures

It has delivered over 3.9B app pre-loads since launch

It has delivered over 3.9B app pre-loads since launch Their Application Media software was installed on 43m devices during Q1 ’20 for a total of 450m devices to date

Their Application Media software was installed on 43m devices during Q1 ’20 for a total of 450m devices to date Growth is fuelled by news deals with Samsung (13 out 43m new devices), LG, Xiaomi and major telcos

Growth is fuelled by news deals with Samsung (13 out 43m new devices), LG, Xiaomi and major telcos

How does that translate in sales?

YoY growth has reached 93% (historical avg. at +35%) with revenues of $59m (vs $39m in prev. Q)

YoY growth has reached 93% (historical avg. at +35%) with revenues of $59m (vs $39m in prev. Q)

Gross margin of 44% (lower than most #SaaS stocks such as $AYX $FSLY)

Gross margin of 44% (lower than most #SaaS stocks such as $AYX $FSLY)

Op margin 18% with an EBT of $10.32m (better than most #SaaS Stocks)

Op margin 18% with an EBT of $10.32m (better than most #SaaS Stocks)

YoY growth has reached 93% (historical avg. at +35%) with revenues of $59m (vs $39m in prev. Q)

YoY growth has reached 93% (historical avg. at +35%) with revenues of $59m (vs $39m in prev. Q) Gross margin of 44% (lower than most #SaaS stocks such as $AYX $FSLY)

Gross margin of 44% (lower than most #SaaS stocks such as $AYX $FSLY) Op margin 18% with an EBT of $10.32m (better than most #SaaS Stocks)

Op margin 18% with an EBT of $10.32m (better than most #SaaS Stocks)

What about their balance sheet?

Company has $65m current assets (27% of that is cash) vs $ 79 m in current liabilities

Company has $65m current assets (27% of that is cash) vs $ 79 m in current liabilities

Out $191m in assets, $ 69m are made of goodwill and $ 43m of intangible assets (representing “developed technology” and “customer relationships”)

Out $191m in assets, $ 69m are made of goodwill and $ 43m of intangible assets (representing “developed technology” and “customer relationships”)

Company has $65m current assets (27% of that is cash) vs $ 79 m in current liabilities

Company has $65m current assets (27% of that is cash) vs $ 79 m in current liabilities Out $191m in assets, $ 69m are made of goodwill and $ 43m of intangible assets (representing “developed technology” and “customer relationships”)

Out $191m in assets, $ 69m are made of goodwill and $ 43m of intangible assets (representing “developed technology” and “customer relationships”)

Net debt stand at ($ 0.7m) and the company is CF positive at around $ 6m

Net debt stand at ($ 0.7m) and the company is CF positive at around $ 6m

Looking forward  The Good Side

The Good Side

Huge runaway for international expansion

Huge runaway for international expansion  Most non-iPhone users are outside the US and revenue base outside US is still SMALL

Most non-iPhone users are outside the US and revenue base outside US is still SMALL

The Good Side

The Good Side Huge runaway for international expansion

Huge runaway for international expansion  Most non-iPhone users are outside the US and revenue base outside US is still SMALL

Most non-iPhone users are outside the US and revenue base outside US is still SMALL

Telcos and OEMs need these additional revenue streams

Telcos and OEMs need these additional revenue streams  $APPS is the only company that can offer this service on a global scale and in a robust manner

$APPS is the only company that can offer this service on a global scale and in a robust manner

Expanding its revenue streams over the smartphone market

Expanding its revenue streams over the smartphone market  $APPS has hinted entering the TV market where OEM would load the software directly into their products

$APPS has hinted entering the TV market where OEM would load the software directly into their products

Apps are not going away anytime soon and ASO (App Store Optimisation) becoming the new SEO

Apps are not going away anytime soon and ASO (App Store Optimisation) becoming the new SEO  Even better than ASO, just have your app pre-installed or recommended!

Even better than ASO, just have your app pre-installed or recommended!

Here are the risks one should not forget

In the same spirit as $AAPL, $GOOG starts restricting the access to its software

In the same spirit as $AAPL, $GOOG starts restricting the access to its software

OEM and operators start building up this software on their own and negotiate terms with sponsors on their own

OEM and operators start building up this software on their own and negotiate terms with sponsors on their own

In the same spirit as $AAPL, $GOOG starts restricting the access to its software

In the same spirit as $AAPL, $GOOG starts restricting the access to its software OEM and operators start building up this software on their own and negotiate terms with sponsors on their own

OEM and operators start building up this software on their own and negotiate terms with sponsors on their own

$DDOG is on our watchlist

$DDOG is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Please note that this is not a recommendation to buy - You are responsible for conducting your own research

Please note that this is not a recommendation to buy - You are responsible for conducting your own research

Here is a review for $APPS - would love to hear your take on the matter

@kghufran

@MorettiPd

@eshrum40

@takorinn371

@kghufran

@MorettiPd

@eshrum40

@takorinn371

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Subscribe now

Subscribe now  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Subscribe now

Subscribe now  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ IMF

✑ StatCounter

✑ KoreaTimes

✑ AppAnnie

✑ eMarketer

✑ MindSea

Sources

✑ Investor presentation

✑ Company website

✑ IMF

✑ StatCounter

✑ KoreaTimes

✑ AppAnnie

✑ eMarketer

✑ MindSea

Read on Twitter

Read on Twitter