So I finally tried Affirm (to pay for a pair of glasses from Warby Parker).

First #BNPL experience and honestly, it just left me with more questions.

Particularly in anticipation of Affirm’s (rumored) IPO.

Thread

First #BNPL experience and honestly, it just left me with more questions.

Particularly in anticipation of Affirm’s (rumored) IPO.

Thread

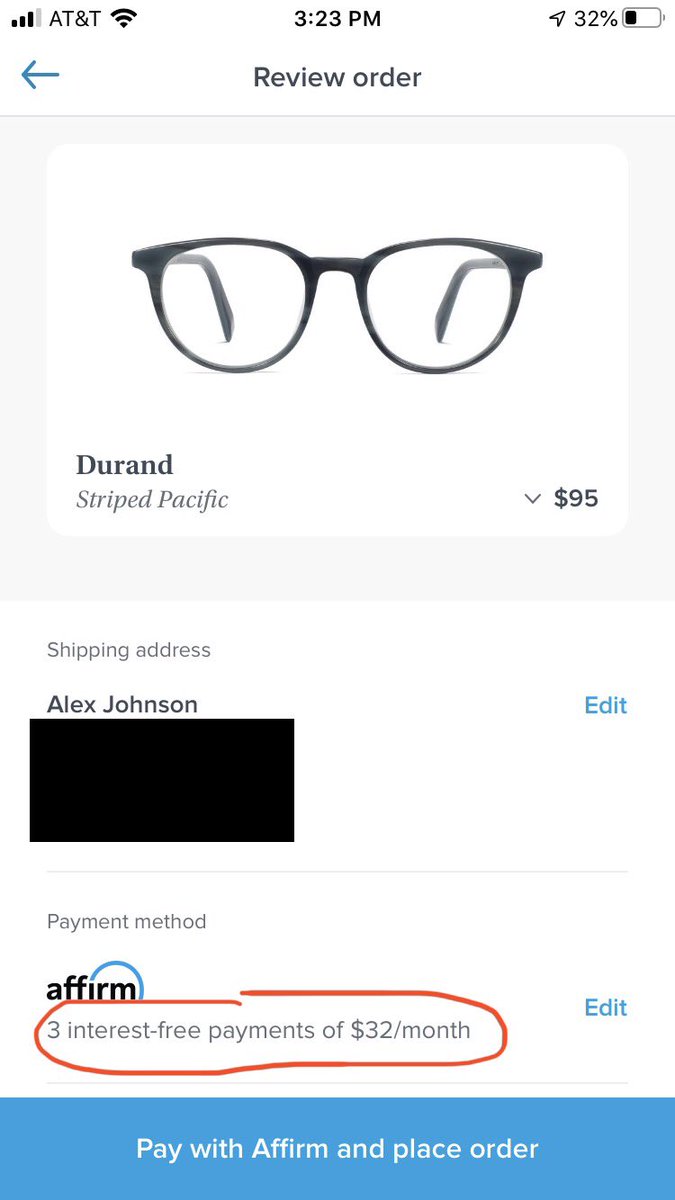

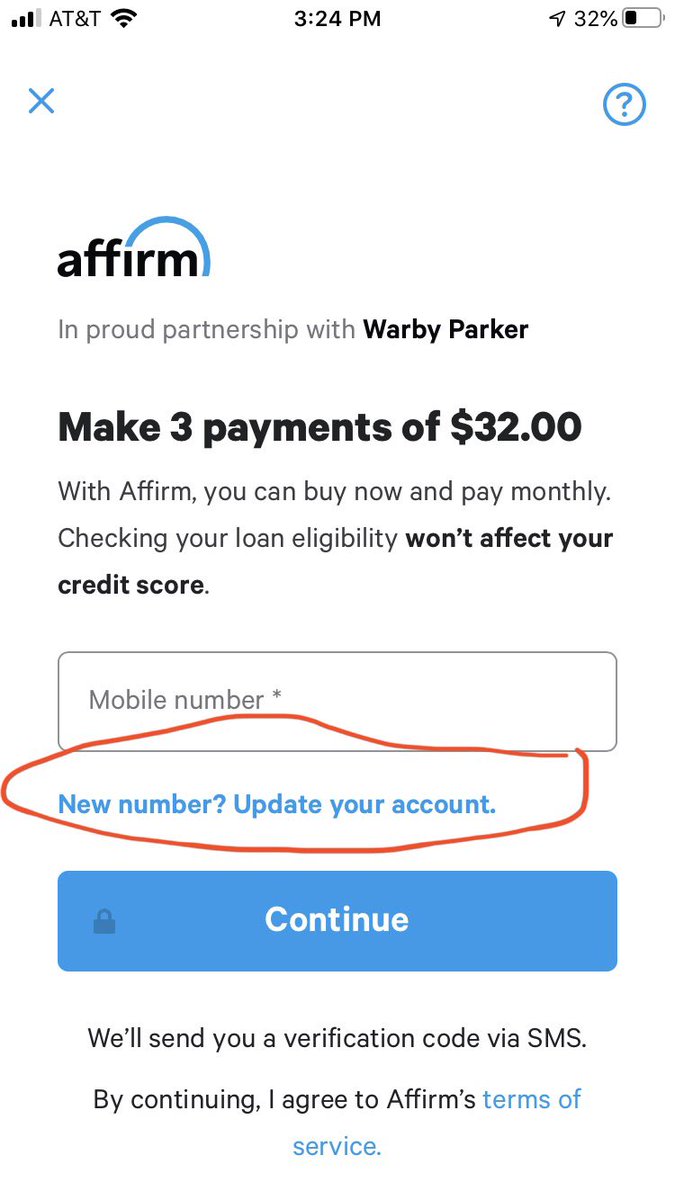

So Warby Parker advertises Affirm as a payment option, prominently within the checkout process flow (embedded finance!), and specifically says that the payments will be interest free.

What’s weird about that is that Affirm doesn’t know anything about me yet.

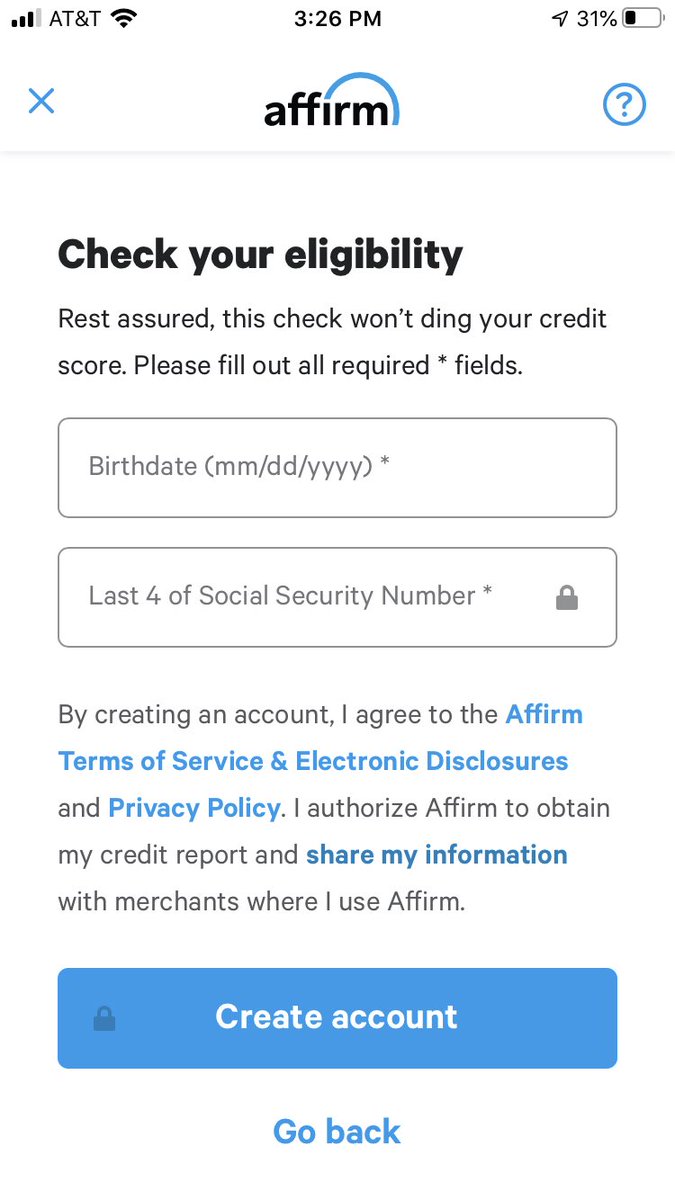

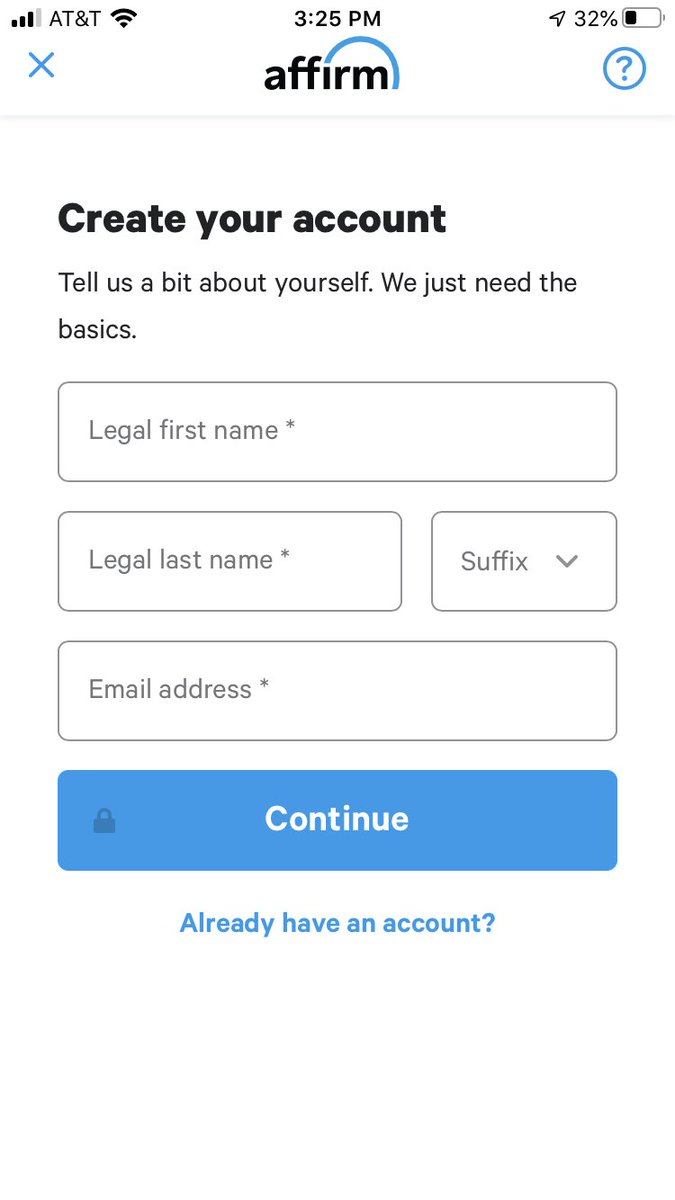

Once I click checkout, THEN Affirm redirects me to their form in order to prequalify me (a type of FCRA prescreen that is consumer-initiated but isn’t a hard credit inquiry).

Once I click checkout, THEN Affirm redirects me to their form in order to prequalify me (a type of FCRA prescreen that is consumer-initiated but isn’t a hard credit inquiry).

But until they check, they don’t know if I’m qualified for 0% interest.

Remember, only about one third of Affirm borrowers qualify for 0% interest.

So...

QUESTION #1: Do some Warby Parker customers see the 0% interest offer during checkout, but don’t get approved for it?

Remember, only about one third of Affirm borrowers qualify for 0% interest.

So...

QUESTION #1: Do some Warby Parker customers see the 0% interest offer during checkout, but don’t get approved for it?

The theory of embedded finance is that inserting a relevant financial service within the context of a non-financial activity leads to a more convenient experience for the customer, which produces a higher conversion rate for the merchant (Warby Parker, in this case).

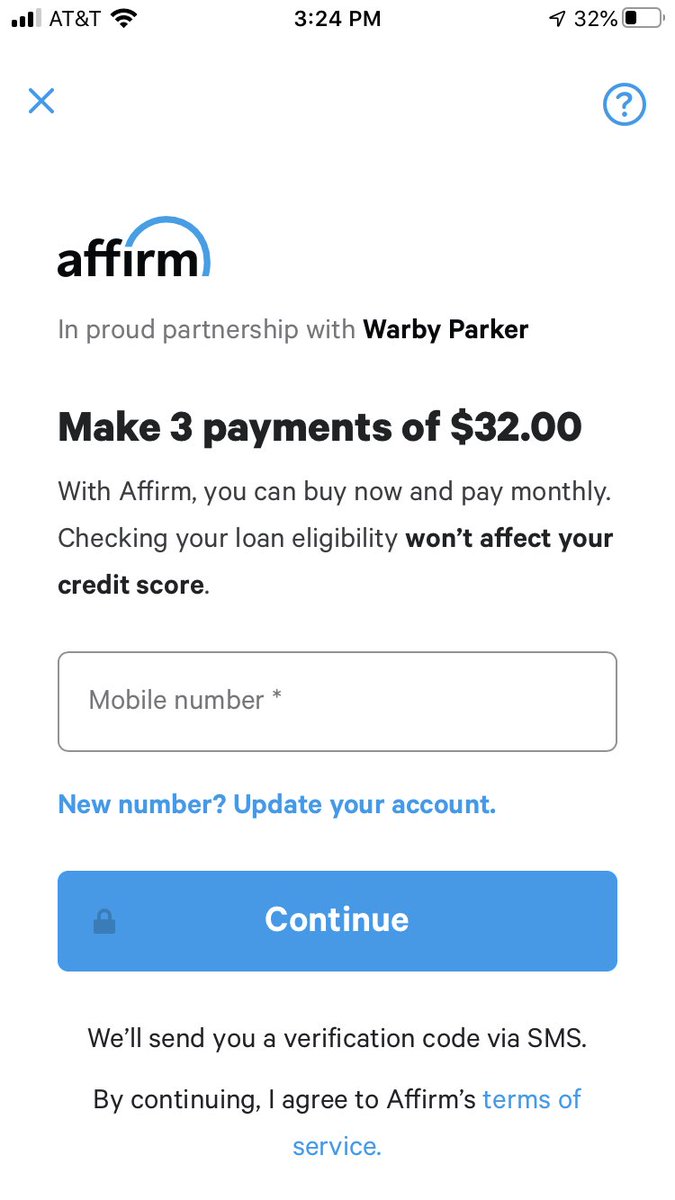

What’s odd is that the process of signing up for Affirm, in the checkout flow for Warby Parker, was WAY MORE WORK than it would have been to just use a credit card.

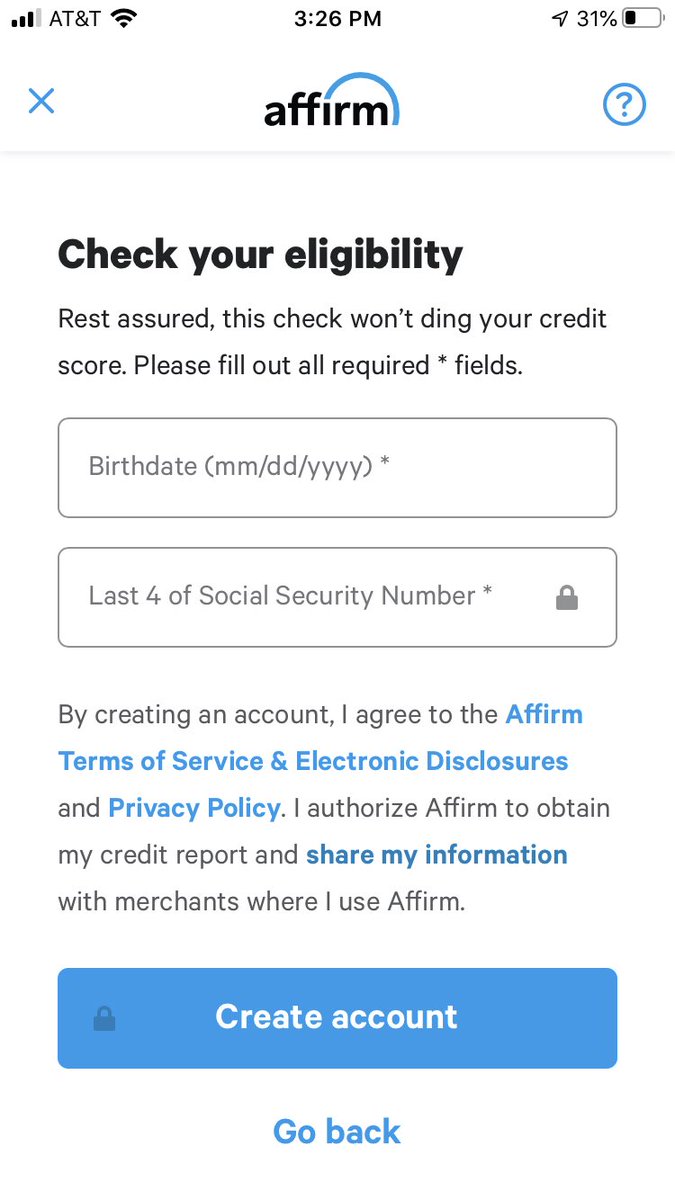

You have to plug in your phone # and an SMS verification code, create an Affirm account, check your eligibility...

You have to plug in your phone # and an SMS verification code, create an Affirm account, check your eligibility...

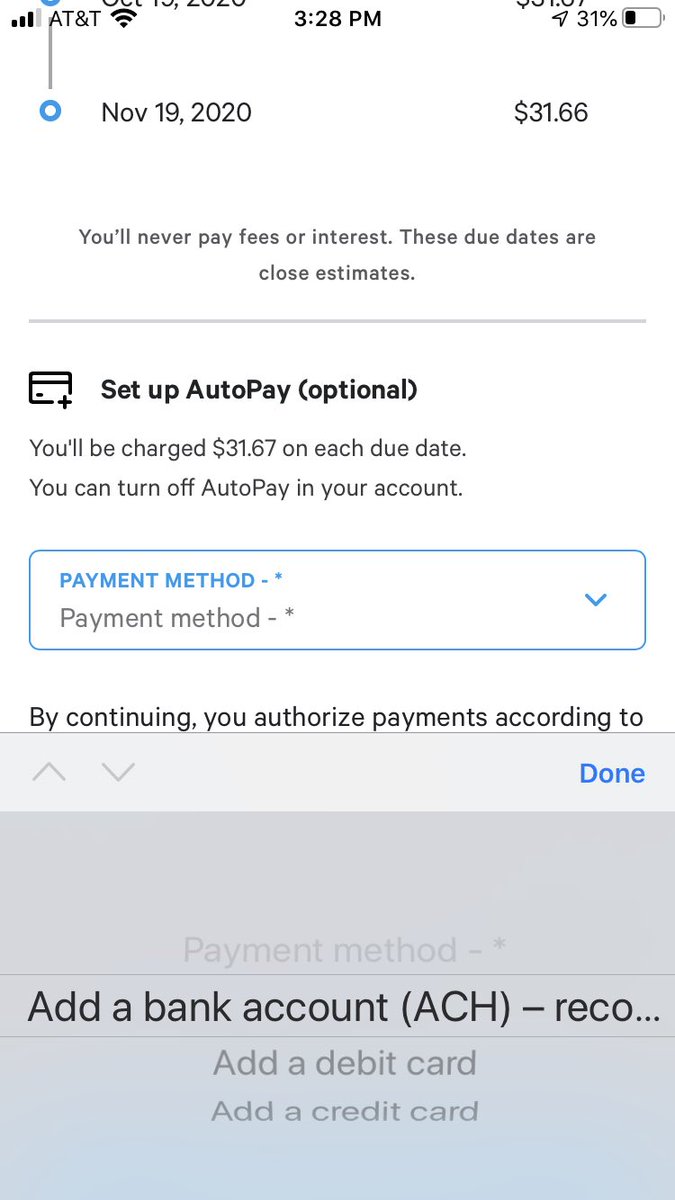

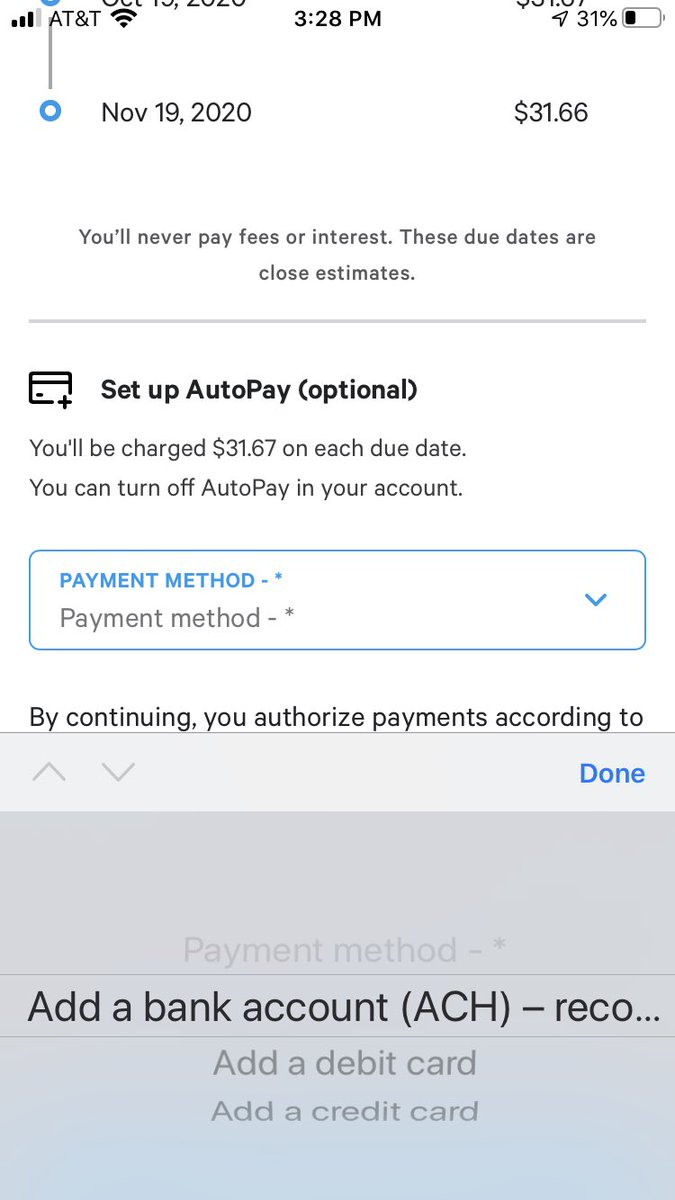

Then, once you’re approved, you have the option to set up auto pay (which I’m guessing most borrowers do in the moment).

In fairness, the process for an existing Affirm customer (who’s eligibility and auto pay preferences are already known) seems like it’s much easier.

It looks like they try to catch all those customers up front when they enter their mobile #

It looks like they try to catch all those customers up front when they enter their mobile #

But that’s still kinda odd. I mean what percentage of new Warby Parker customers are likely to already be Affirm customers?

How many active customers does Affirm have?

Which leads me to...

How many active customers does Affirm have?

Which leads me to...

QUESTION #2: Is Affirm only a more convenient payment option for existing Affirm customers? And if so, is that a good fit with merchants that sell high-dollar, infrequently-purchased goods like glasses and mattresses, and exercise bikes?

Finally, the value prop of #BNPL for customers (apart from convenience, which we just covered) is that it is more fair and transparent than credit cards.

From Affirm’s perspective, credit cards are very bad, dangerous tools that most people should never use.

From Affirm’s perspective, credit cards are very bad, dangerous tools that most people should never use.

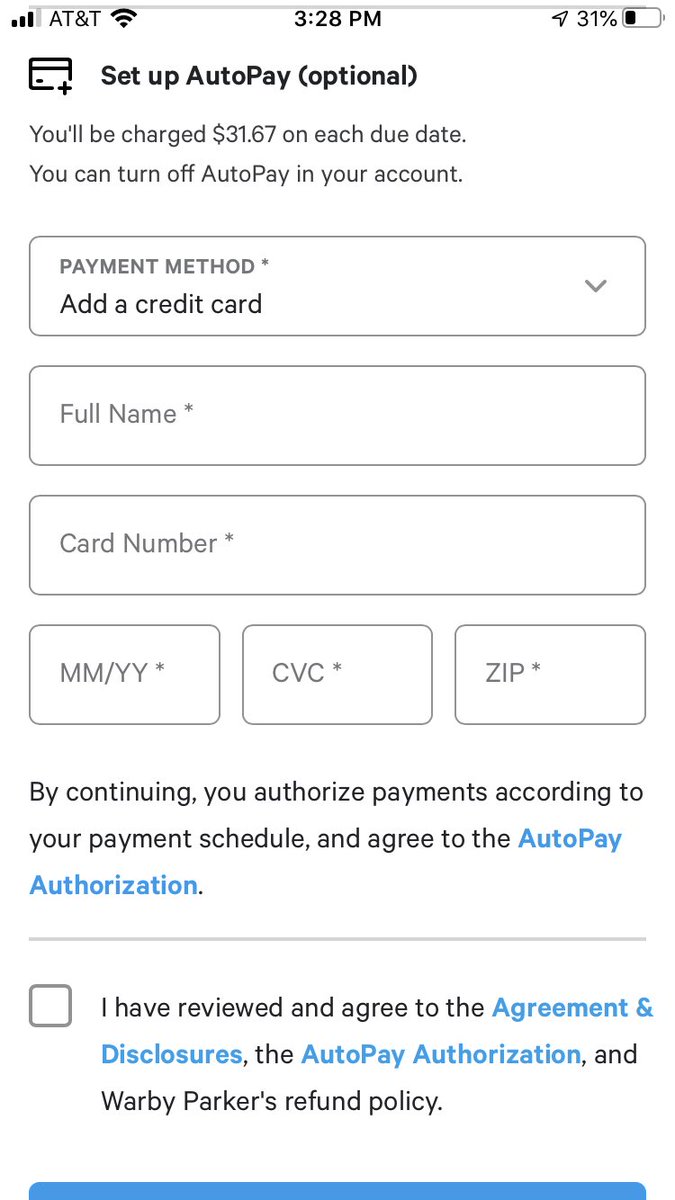

I get it. You want to give customers as many options as possible to pay you back (even if you have to pay interchange for some of those options), but...

QUESTION #3: How many Affirm customers end up adding to their revolving debt by paying off Affirm loans with credit cards?

QUESTION #3: How many Affirm customers end up adding to their revolving debt by paying off Affirm loans with credit cards?

Read on Twitter

Read on Twitter