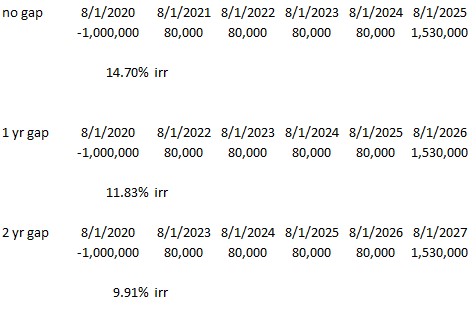

For @max_arbitrage & @JasonMutiny below is a simple example of cash drag. The first scenario is capital gets called and deployed instantly. The next two scenarios are assumed that you commit and don't make anything on the money (in reality you probably put it in tbills and make a

measly 1-2%). Scenario 1 is it takes a yr to deploy your capital and scenario 2 is 2 yrs to deploy. Same return stream in all three.

This is the handy erosion in returns investment managers don't tell you about. In fact, it can get even worse as larger PE shops will use lines of credit to take down assets and avoid calling capital in until the last minute. Industry tends (we're guilty of this too) bases IRR

on when they call your capital, not when you subscribe your capital. Prudent question to ask how long from subscription to deployment on average.

Some larger UNHW investors may be able to get large & affordable bank lines to essentially do the same thing the PE shops are doing,

Some larger UNHW investors may be able to get large & affordable bank lines to essentially do the same thing the PE shops are doing,

but in reverse and use the line to fund their capital commitments and then pay it down over time or by selling other assets.

While I truly like the fund concept for pooled risk, there are trade-offs of funds vs syndicated deals and cash drag is a big component.

While I truly like the fund concept for pooled risk, there are trade-offs of funds vs syndicated deals and cash drag is a big component.

Read on Twitter

Read on Twitter