Ever wondered what your bootstrapped SaaS might be worth?

A Twitter thread crash course on bootstrapped SaaS valuation

A Twitter thread crash course on bootstrapped SaaS valuation

#SaaS #founders #bootstrapping #exitstrategy #valuation

A Twitter thread crash course on bootstrapped SaaS valuation

A Twitter thread crash course on bootstrapped SaaS valuation

#SaaS #founders #bootstrapping #exitstrategy #valuation

The short story is that the market determines the value of your biz. In other words, your company’s value is the point where what you’re willing to sell for, and what a buyer is willing to pay meet. Selling a business is really similar to selling a house in that way.

The sweet spot is where the founder gets a dream exit — not just a good number, but also a good outcome for their customers and team — and the buyer gets a fair price.

But how do you come up with a value range that covers that sweet spot?

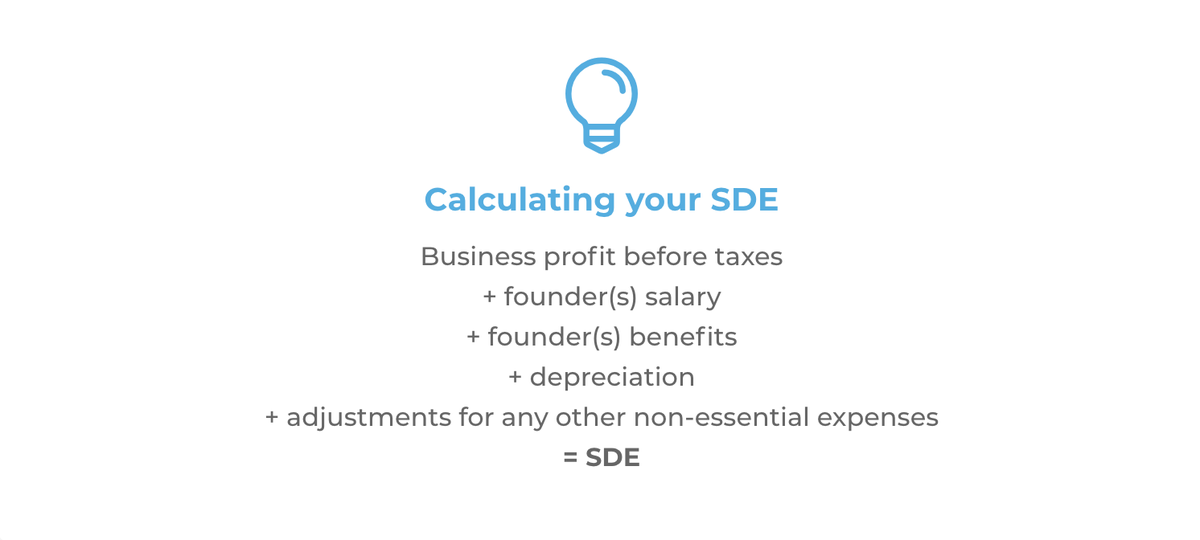

For *most* bootstrapped founders, you’re going to use SDE (Seller’s Discretionary Earnings) as your base formula for calculating value. It’s a simple formula that tries to estimate cash flow for a new owner.

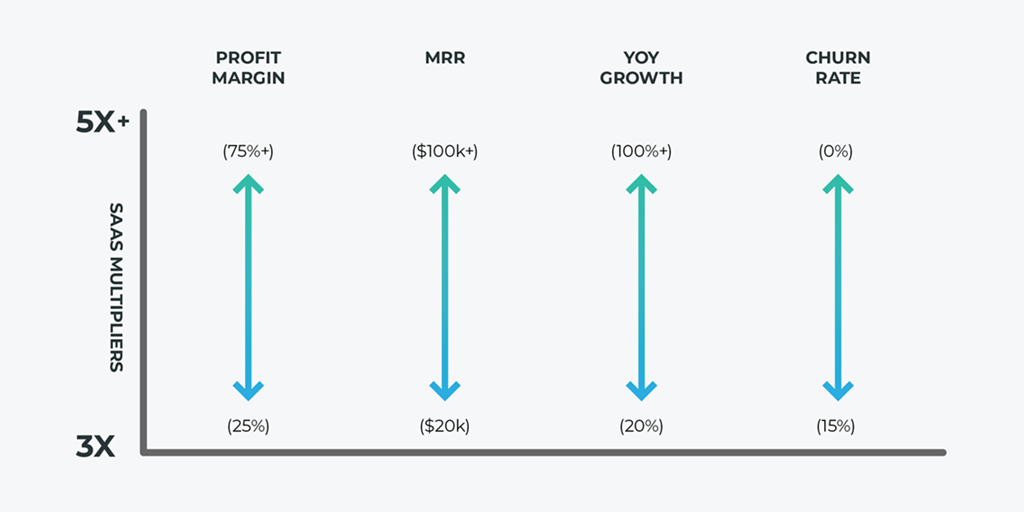

If SDE is an attempt to measure how much cash a business can bring in to a new owner, the multiplier is a measure of the business’s long-term potential value. For smaller, bootstrapped SaaS (that are profitable and growing) those multipliers tend to range between 3x and 5x+.

Businesses with higher profit margins, MRR, TAM (Total Addressable Market) and YoY growth rates, and lower customer and revenue churn will have multiples on the higher end of that range.

Businesses with higher profit margins, MRR, TAM (Total Addressable Market) and YoY growth rates, and lower customer and revenue churn will have multiples on the higher end of that range.

On the outside of that range, a lower multiplier can come into effect if the business is flat, or declining. Or multipliers could spike past 5x if your YoY growth is insane, or in a strategic acquisition.

On the outside of that range, a lower multiplier can come into effect if the business is flat, or declining. Or multipliers could spike past 5x if your YoY growth is insane, or in a strategic acquisition.

The next step of valuation? Getting to a whole number and a sale you’re happy with. For more on that, when revenue-based valuations come into play, and the intangibles you should consider in any valuation (or sale), keep reading  : https://bit.ly/2ZPaFDJ

: https://bit.ly/2ZPaFDJ

: https://bit.ly/2ZPaFDJ

: https://bit.ly/2ZPaFDJ

Read on Twitter

Read on Twitter