4.8 million jobs returned in June; we're still 15 million in the hole.

Unemployment fell to 11.1%, but after accounting for misclassification, it's probably about 1 percentage point higher. So real unemployment fell from around 16% to 12%.

Unemployment fell to 11.1%, but after accounting for misclassification, it's probably about 1 percentage point higher. So real unemployment fell from around 16% to 12%.

Today's employment news is from early/mid June, and therefore somewhat stale. It refers to probably the best point where all states had lifted shelter in place orders, but the second wave had yet to emerge.

A simple summary: The job market is truly dreadful; latest data show it’s somewhat less dreadful than before.

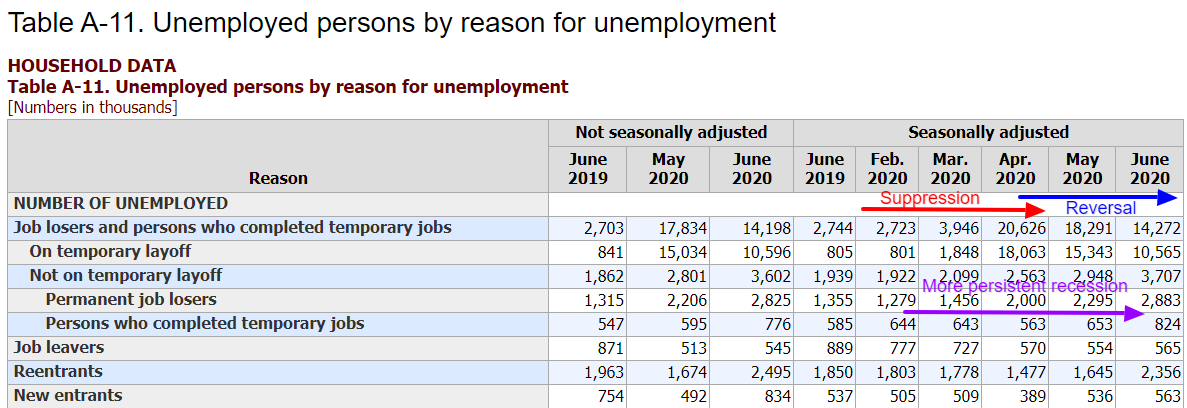

Signs that the economy is shifting from short-term (and quickly-reversed) suppression -- as recalls from temporary layoffs account for more all of the fall in unemployment -- toward the longer-lasting recessionary phase, as permanent job losers rose by 588k to 2.9 million.

Here's what I'm talking about. We're starting to see more evidence of lasting damage to the economy. The excitement of undoing the lockdowns will fade; the problem is the permanent job losers who'll be left behind.

Betsey remains obsessed with dentists, because it's a useful proxy for tracking the suppression-then-re-opening part of this business cycle.

The question remains: Even once all the dentists are back at work, what will the rest of the economy look like? https://twitter.com/BetseyStevenson/status/1278670019795333124

The question remains: Even once all the dentists are back at work, what will the rest of the economy look like? https://twitter.com/BetseyStevenson/status/1278670019795333124

Lemme graph it for you.

An economic story in two acts.

1. Suppression: Shut down the economy, then a rapid re-opening.

\\ /

\\ /

\\/

2. Recession: The more lasting damage from the businesses that won't make it:

\\

\\ _________

\\ /

\\__/

An economic story in two acts.

1. Suppression: Shut down the economy, then a rapid re-opening.

\\ /

\\ /

\\/

2. Recession: The more lasting damage from the businesses that won't make it:

\\

\\ _________

\\ /

\\__/

Point is, massive job loss in April, then rapid bounceback follows almost mechanically from shutting down then re-opening.

The more important question is how much lasting damage has been done, and how long will it persist. It's too early to have much clarity about any of that.

The more important question is how much lasting damage has been done, and how long will it persist. It's too early to have much clarity about any of that.

If all furloughed workers were to return to work—that is, if the suppression phase were to end soon and happily—then unemployment would be 7%.

That's grim.

It suggests there's a more durable recession lurking behind today's optimistic headlines. https://twitter.com/jasonfurman/status/1278674335532802048

That's grim.

It suggests there's a more durable recession lurking behind today's optimistic headlines. https://twitter.com/jasonfurman/status/1278674335532802048

Of course we want to celebrate the good news that millions of workers are being recalled. But as we look ahead, the question is what sort of economy we'll be left with when the mechanics of re-opening no longer boost monthly job gains.

This morning's initial claims report revealed that 2.3 million people applied for unemployment insurance (regular state + federal PUA) *last week*. This many new people entering the jobless queue this far past the shutdowns suggests that deeper recessionary forces are taking hold

A useful perspective for showing the influence of both short-run suppression (which is rapidly reversing) and longer-run recession (which is likely still building): https://twitter.com/JedKolko/status/1278673520914882560

This basically never happens, because in more normal times many of the jobless aren't covered by UI. Partly, this is because Congress expanded UI coverage, and partly it's another sign of how weak the labor market is. https://twitter.com/JayCShambaugh/status/1278678767846776839

I've always liked @Austan_Goolsbee's baseball analogy.

Today's jobs numbers are like a 5-run inning, which is pretty good news, particularly after a 3-run inning last month.

But the opposition put 21 runs on the board in the first inning, so we're still in a pretty deep hole.

Today's jobs numbers are like a 5-run inning, which is pretty good news, particularly after a 3-run inning last month.

But the opposition put 21 runs on the board in the first inning, so we're still in a pretty deep hole.

Listen to Ernie. https://twitter.com/ernietedeschi/status/1278660995209220098

An anecdotal measure of how engaged people are in economic news: My mother-in-law just asked me whether I had heard the latest jobs numbers.

(Full disclosure: She's also @BetseyStevenson's mom.)

(Full disclosure: She's also @BetseyStevenson's mom.)

Read on Twitter

Read on Twitter