1/ How do economics ideas affect policy-makers? A few thoughts on Minneapolis Fed presidents and macroeconomists in the 1960s to 1980s (trying to sort out some material, so messy, possible mistakes)

First, the chronology:

First, the chronology:

2/ Seems the habit of drawing on economists’ expertise at the MinFed began with Hugh Galusha (chair 65-71). A tax expert and accountant, he was the last non econ-PhD chair, huge focus on Feds’ regional responsibilities & on small banks

Galusha set up annual “Baconian dialogues” bringing together businessmen, bankers, intellectuals, civil society leaders for 2 days conversations. He also took Minnesota econ John Kareken as permanent consultant (MIT PhD, worked w/ Solow on monetary policy lags, consultant NYFed)

4/ After sudden death, succeeded by MacLaury (71-77): PhD Harvard, NY Fed; OECD; US Treasury, Monetary affairs, very adverse to inflation. He voted against Burns’ decision to loosen irates. After Minneapolis Fed tenure, became president of Brookings

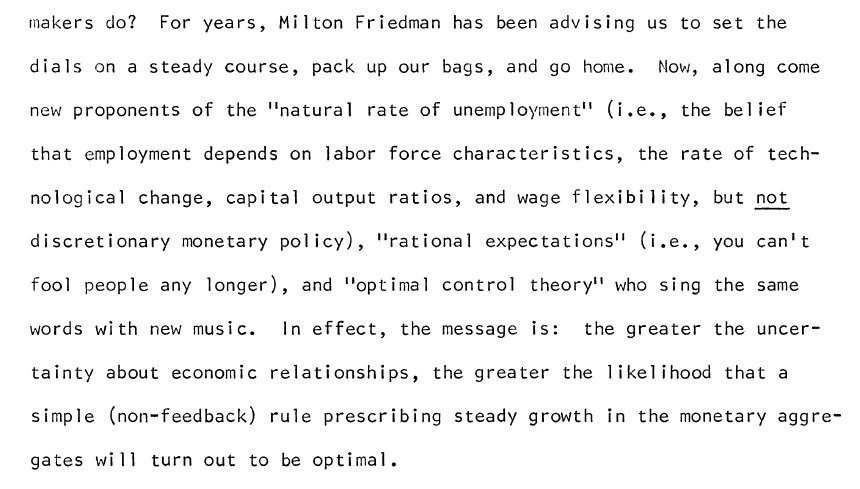

5/ MacLaury had a deep command of economic research, including macroeconometric modeling and its limits (see below). In spite of inflation aversion, his main target, in the early 70s, was the "redoubtable Professor Friedman." Was hesitant to drop discretionary policies

6/ By 1975, however, MacLaury acknowledged in a talk at London US embassy that idea of "an exploitable tradeoff b/w employment & inflation “has come under increasing attack.” Maybe b/c changes in workforce composition, or b/c the public has “wised up” & react more rapidly

7/ By the end of his talk, Minneapolis Fed chair MacLaury endorsed publicly announced aggregates target for money supply growth

(The talk largely dealt with economic forecasting. So he also vulgarized the Lucas critique. In 1975. At the London US embassy…)

8/ In the 1990s however, MacLaury ex-post reflected on the “rational expectations revolution” brewing in his own research dpt, and how it seemed to restrict the range of Fed’s influence on the US economy, and was therefore bound to be unpopular among Fed officials

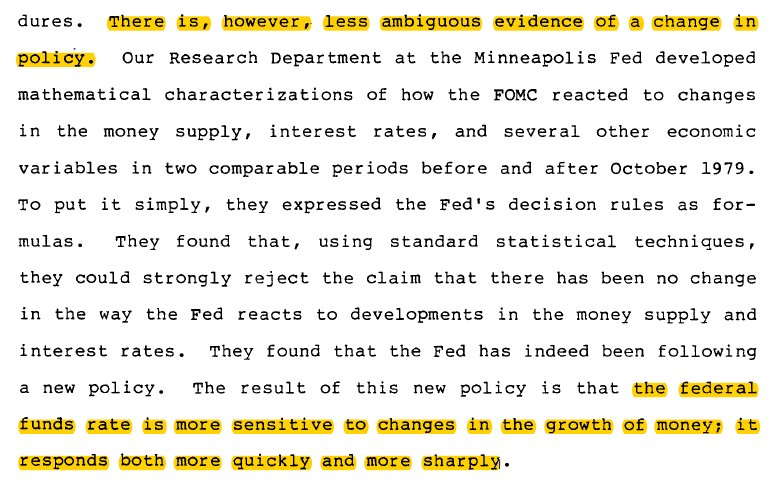

9/ While MacLaury was aware of the implication of Minnesota economists’ ideas for monetary policy, he argued it had never influenced his FOMC votes. For his successor, it was the exact opposite... (cliffhanger)

10/M. Willes (77-80) was born is Salt Lake City, yet not saline at all. Columbia PhD on lags in monetary policy. Headed Penn Fed research dpt. Published abt expectations in academic journals. Currency&Banking Committee. Philly Fed operations director. Chaired Minneap. Fed at 35!

11/ Willes was the one who brought Rational Expectations to Fed. These ideas infused his thoughts & econ outlook. He translated them into his FOMC votes, & his discourses to bankers & businessmen. In a 1977 speech to North Dakota bankers, he hammered there was "no tradeoff"

12/ see fuller account in paper by Young & McGregor on Fed presidents as public intellectual: survey St Louis’s Roos (monetarist), Min’s Willes (new classical), and Philly’s Eastburn (Keynesian), their econ vision, and how they voted in FOMC in late 1970s https://read.dukeupress.edu/hope/article-abstract/45/suppl_1/166/38684

13/they show how Fed chairs' reporting of local business mood in 70s (in the “beige book”) was influenced by their research dpts: Eastburn was concerned w/ effect of price uncertainty on consumption/investment, Willes w/ high inflation expectations & self-fulfilling character:

14/ Next chair, Corrigan (80-84) had ≠ style: PhD econ Fordham 71, NY Fed, assistant to Volker & Basel Committee chairman, yet busy implementing banking pricing & deregulating acts. Didn’t like to go in the details of the work carried by his “research dpt” in his speeches.

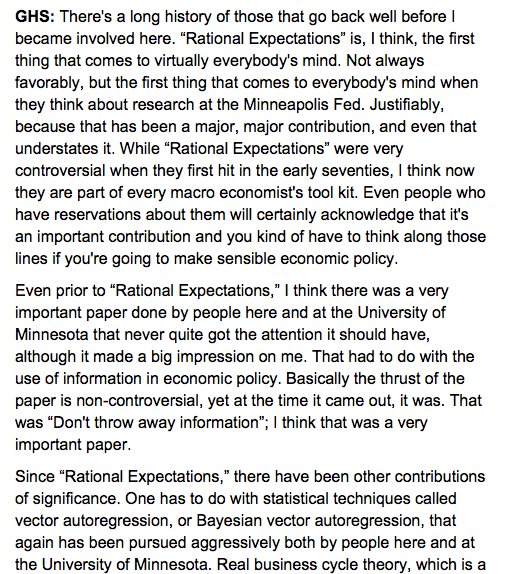

15/ For longstanding chair G. Stern (1985-2009; PhD Econ Rice, NY Fed, consultant, Minneapolis Fed director of research), rational expectations had stabilized and normalized (excerpt 1991 interview). Or I'm just too tired to god further.

16/ Few concluding thoughts: first, regional fed presidents are influential, not only b/c they vote at FOMC, but also as econ educators of bankers, businessmen, citizens, through the many public talks they give during their tenure

17/ 2nd, huge diversity in how permeable they are to the ideas of Minnesota econ. Depends on 1) appetence for academic research vs operations; 2) hot issues of the time ( implementing financial market & banking regulations, fighting stagflation, etc) ....

18/ 3) what they view is the role of Feds research dpts: for some, like Corrigan (maybe MacLaury), it is to provide analysis & forecasting, for others (Willes), it is to provide hot new ideas on how monetary policies should be conducted ....

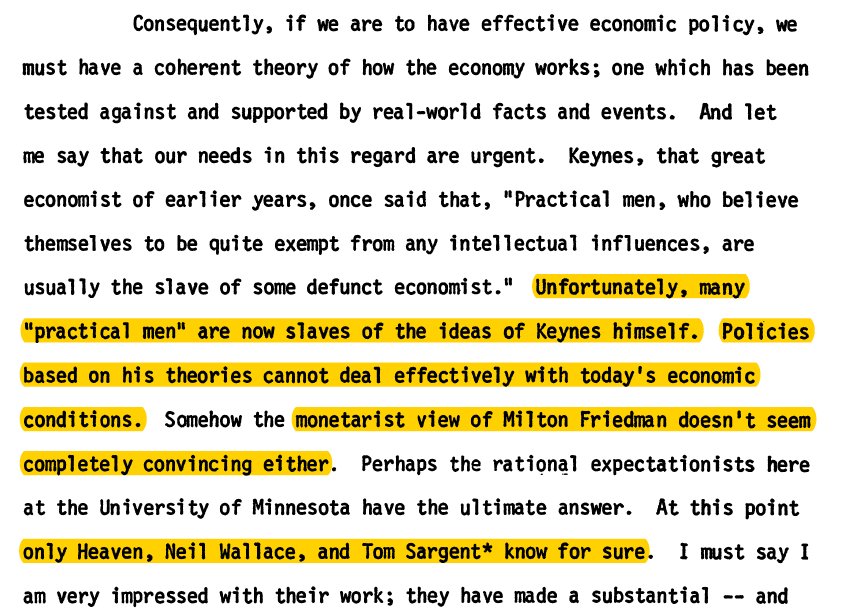

19/ Corrigan thus acknowledged his “research dpt,” but Willes was keen on citing specific contributions : "only heaven, Neil Wallace and Tom Sargent know for sure," what the right monetary policy is, he said in a 1977 talk at the University of Minnesota

20/ END

(postcredit scene: Minneapolis Fed chairman Willes answering a question on the difference between monetarists and new classical econs at 1977 UMinnesota talk mentioned above)

(postcredit scene: Minneapolis Fed chairman Willes answering a question on the difference between monetarists and new classical econs at 1977 UMinnesota talk mentioned above)

Note: since I wrote this thread, @MinneapolisFed has celebrated 50y of research-policy association by bringing Prescott, Sargent, Sims and Wallace together to reminisce.

watch here:

watch here:

Read on Twitter

Read on Twitter