Gold has severe flaws. Physical locality makes it less secure and far more transactionally local, and thus more vulnerable to politics and less sound, than we can now achieve with Bitcoin, with good key management and taking advantage of its trust-minimized global settlement. https://twitter.com/MrHodl/status/991676293052813312

Aztecs took gold tribute from their subject tribes. Spanish conquistadors looted the Aztecs. Sir Francis Drake looted Spanish galleons. Seizing gold vaults was a universal war objective. Many politicians have controlled monetary systems by controlling gold. Now we can do better.

Probably the biggest flaw with the monetary metals (gold, sil er, and copper) is that they are costly to assay/validate. This led making people vulnerable to (i.e. requiring them to trust) centralized entities such as coin minters and bank note issuers, said trust often abused.

Some of the same craft skills & tech that gave us the industrial revolution also made it much easier to counterfeit coins. As fake coins spread, use of bank notes grew.

Here's a fake silver dollar made in Birmingham via a technique invented in Sheffield.

https://www.coincommunity.com/articles/swamperbob_8_reales_birmingham_counterfeit.asp

Here's a fake silver dollar made in Birmingham via a technique invented in Sheffield.

https://www.coincommunity.com/articles/swamperbob_8_reales_birmingham_counterfeit.asp

Bank notes further increased trust, i.e. vulnerability. to the actions of third parties. Gold came to be held in centralized vaults, and IOUs for much more than the gold actually held were issued -- fractional reserve banking (FRB). https://twitter.com/bitstein/status/1145438009636085760

Governments helped set up the largest banks, which printed even more bank notes and used them to buy government debt. These banks became (Bank of England) or were set up as (Federal Reserve) note-issuing monopolies, which we now call central banks.

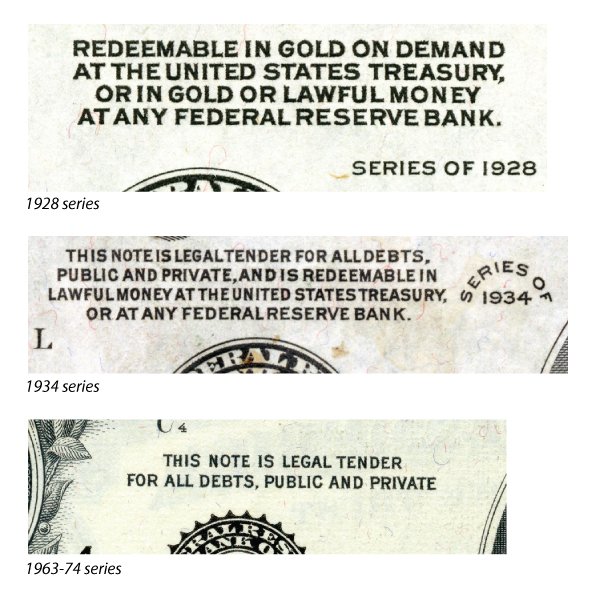

Eventually default turned these gold IOU paper notes into fiat. BofE started refusing to honor its notes in 1931. The Fed reduced the amount of gold it would redeem a dollar for in 1933, restricted gold trade by targeting the centralized bank vaults, and went full fiat in 1971.

Here's an example showing how, despite authority resemblance

https://unenumerated.blogspot.com/2016/07/artifacts-of-wealth-patterns-in_15.html

the fundamental nature of U.S. dollars radically changed over the course of the 20th century. They look very similar, but the kind of money they represent is radically different.

ht @jp_koning

https://unenumerated.blogspot.com/2016/07/artifacts-of-wealth-patterns-in_15.html

the fundamental nature of U.S. dollars radically changed over the course of the 20th century. They look very similar, but the kind of money they represent is radically different.

ht @jp_koning

Read on Twitter

Read on Twitter