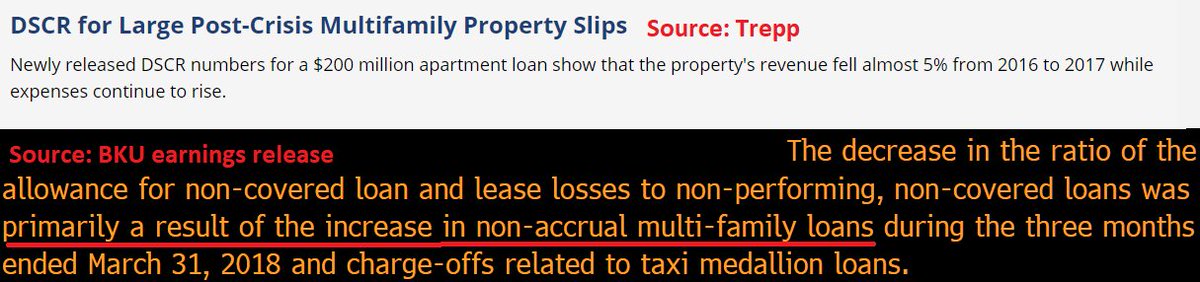

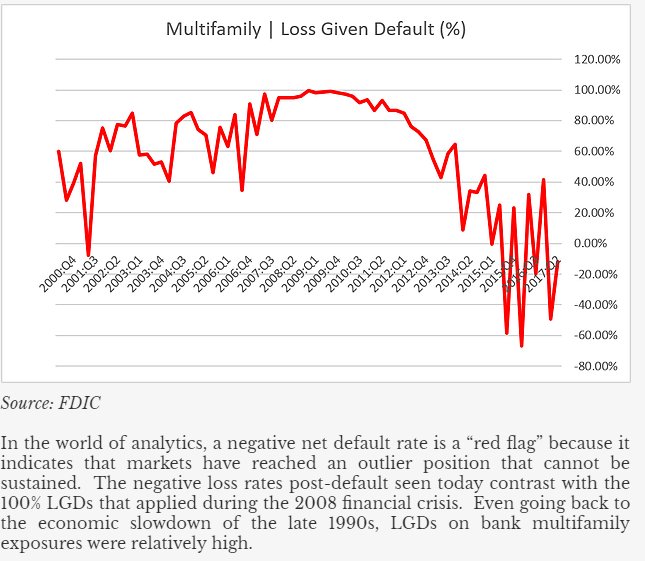

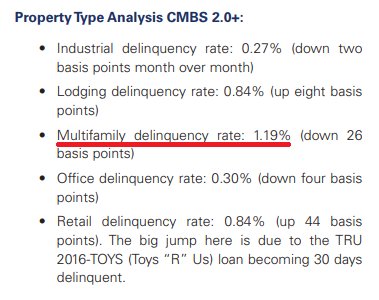

Multi-family credit has been as good as it gets for the last few years. We may be starting to see a reversion to the mean

h/t @rcwhelan

https://www.theinstitutionalriskanalyst.com/single-post/2017/11/20/Is-Multifamily-Lending-a-Threat-to-US-Banks

h/t @rcwhelan

https://www.theinstitutionalriskanalyst.com/single-post/2017/11/20/Is-Multifamily-Lending-a-Threat-to-US-Banks

More color on the $BKU comment on multi-family

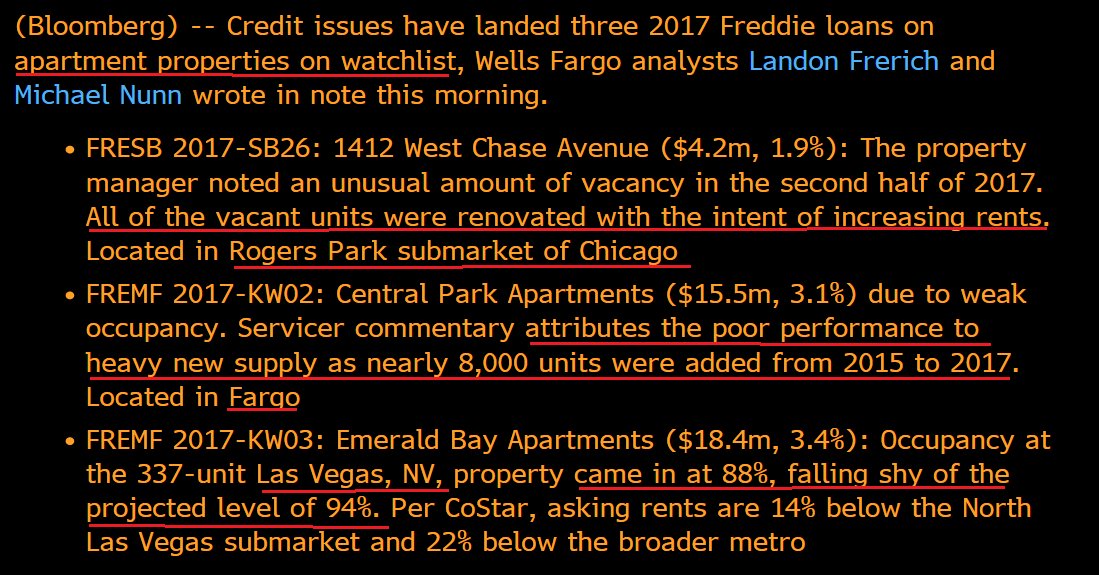

After renovation, property isn't leasing up according to plan

After renovation, property isn't leasing up according to plan

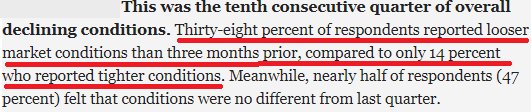

NMHC reports 10th straight quarter of looser rental markets

http://www.calculatedriskblog.com/2018/04/nmhc-apartment-market-tightness-index.html?utm_source=feedburner&utm_medium=twitter&utm_campaign=Feed%3A+CalculatedRisk+%28Calculated+Risk%29

http://www.calculatedriskblog.com/2018/04/nmhc-apartment-market-tightness-index.html?utm_source=feedburner&utm_medium=twitter&utm_campaign=Feed%3A+CalculatedRisk+%28Calculated+Risk%29

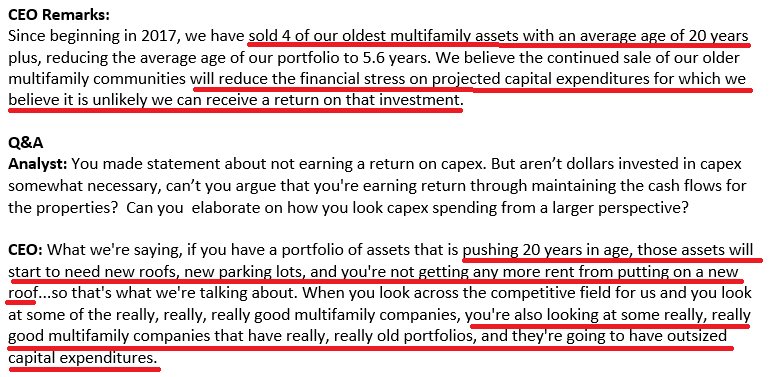

Very interesting comments from $APTS CEO on older multi-family assets.

"We can't earn a return from maintenance capex like new roof or parking lot."

Do cap rates of older MF properties provide a margin of safety for this unavoidable capex? #cre

"We can't earn a return from maintenance capex like new roof or parking lot."

Do cap rates of older MF properties provide a margin of safety for this unavoidable capex? #cre

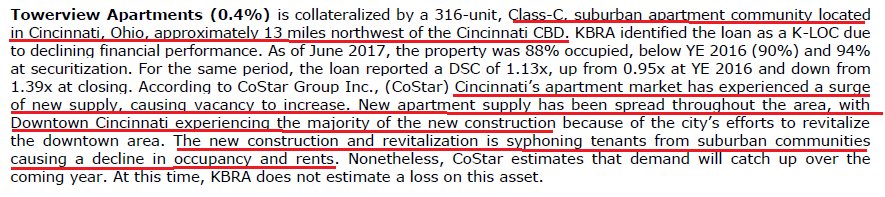

Another weak MF report $AIV

Apt complex in Cincy suburbs showing deteriorating results as new builds downtown draw tenants, with ripple effect on surrounding rents and occupancy.

Costar seems to think things will improve, but Cincy population has been virtually flat since 2010. Stay tuned. #multifamily

Costar seems to think things will improve, but Cincy population has been virtually flat since 2010. Stay tuned. #multifamily

$WFC concerned about frothy transactions in CRE

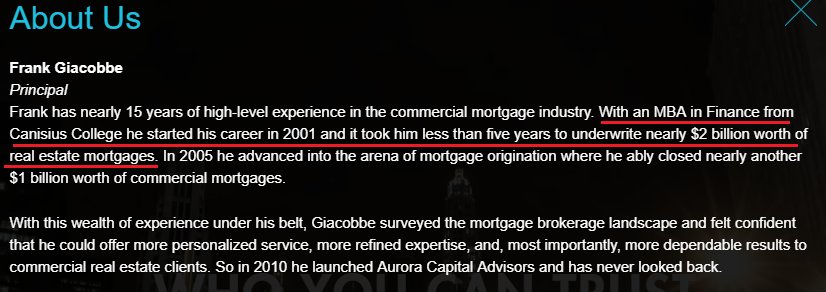

Looks like we have our first significant multi-family lending fraud of the cycle.

Curiously, no word from $ABR about the indictments which became public last week.

Curiously, no word from $ABR about the indictments which became public last week.

The defendants are sponsors of projects that serve as collateral for over 150 CMBS loans totaling $1.7B according to Morgan Stanley. Stay tuned.

Home page of the mortgage broker, Aurora Capital Advisors, that handled the origination of the fraudulent multi-family CMBS loans discussed earlier this week. Can't make it up:

May registered the lowest y/y rent increases for apartments since 2010

https://www.rentcafe.com/blog/rental-market/rentcafe-apartment-market-report-may-2018/

https://www.rentcafe.com/blog/rental-market/rentcafe-apartment-market-report-may-2018/

Norhtpointe Apartments, Euclid, OH (nr Cleveland)

Occupancy 69% due, in part, to rat infestation

Owner unwilling to support cash flow shortfall

Foreclosure proceedings in progress

#multifamily

Occupancy 69% due, in part, to rat infestation

Owner unwilling to support cash flow shortfall

Foreclosure proceedings in progress

#multifamily

$AVB pulls the ripcord on Manhattan multifamily after rents roll over

h/t @SMulholland_

https://www.bloomberg.com/news/articles/2018-06-18/avalonbay-is-said-to-offer-a-50-stake-in-manhattan-apartments

h/t @SMulholland_

https://www.bloomberg.com/news/articles/2018-06-18/avalonbay-is-said-to-offer-a-50-stake-in-manhattan-apartments

"Cleveland's multifamily boom not slowing yet"

Cleveland metro population still falling, downtown must be drawing people from the burbs.....probably going to be some MF defaults out there

http://www.rejournals.com/cleveland-s-multifamily-boom-not-slowing-yet-20180618

Cleveland metro population still falling, downtown must be drawing people from the burbs.....probably going to be some MF defaults out there

http://www.rejournals.com/cleveland-s-multifamily-boom-not-slowing-yet-20180618

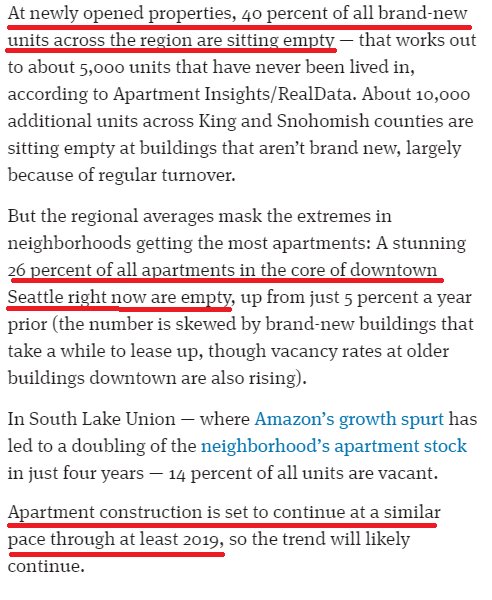

Seattle rent growth goes negative as new multifamily supply overwhelms demand. 40% of newly built units are vacant.

h/y @ByRosenberg https://www.seattletimes.com/business/real-estate/free-amazon-echo-2-months-free-rent-2500-gift-cards-seattle-apartment-glut-gives-renters-freebies/

h/y @ByRosenberg https://www.seattletimes.com/business/real-estate/free-amazon-echo-2-months-free-rent-2500-gift-cards-seattle-apartment-glut-gives-renters-freebies/

Commentary from Reis on multifamily market:

More here: http://www.calculatedriskblog.com/2018/06/reis-apartment-vacancy-rate-increased.html?utm_source=feedburner&utm_medium=twitter&utm_campaign=Feed%3A+CalculatedRisk+%28Calculated+Risk%29

More here: http://www.calculatedriskblog.com/2018/06/reis-apartment-vacancy-rate-increased.html?utm_source=feedburner&utm_medium=twitter&utm_campaign=Feed%3A+CalculatedRisk+%28Calculated+Risk%29

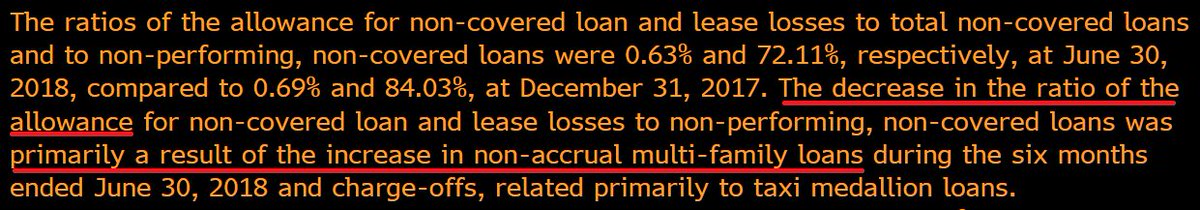

$BKU references an increase in non-accrual multifamily loans as primary driver of lower coverage ratio for NPLs

$BKU 's NYC multifamily loan book saw $215MM run off in Q2 due to "few opportunities to lend at good risk adjusted returns"

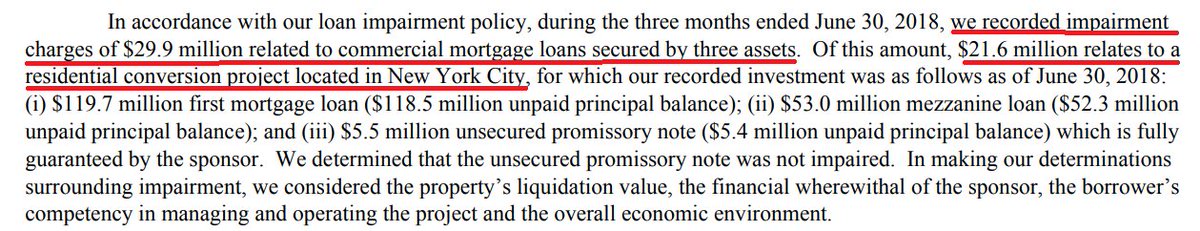

$STWD takes $22MM impairment on $171MM NYC multifamily (condo conversion) loan. Claim that $15MM related to timing of cash flows - DCF calc (project is taking longer to sell out) and that they won't lose money on the loan. Claim prices of condos close to underwritten values

That said, $STWD CEO Sternlicht says will see "all kinds of problems" in very high end NYC multifamily - cites Steinway condo deal on 57th street as example.

Manhattan apartment sellers taking an ax to asking prices.

3BR in Tribeca listed at less than price paid by seller in 2015.

h/t @OshratCarmiel

3BR in Tribeca listed at less than price paid by seller in 2015.

h/t @OshratCarmiel

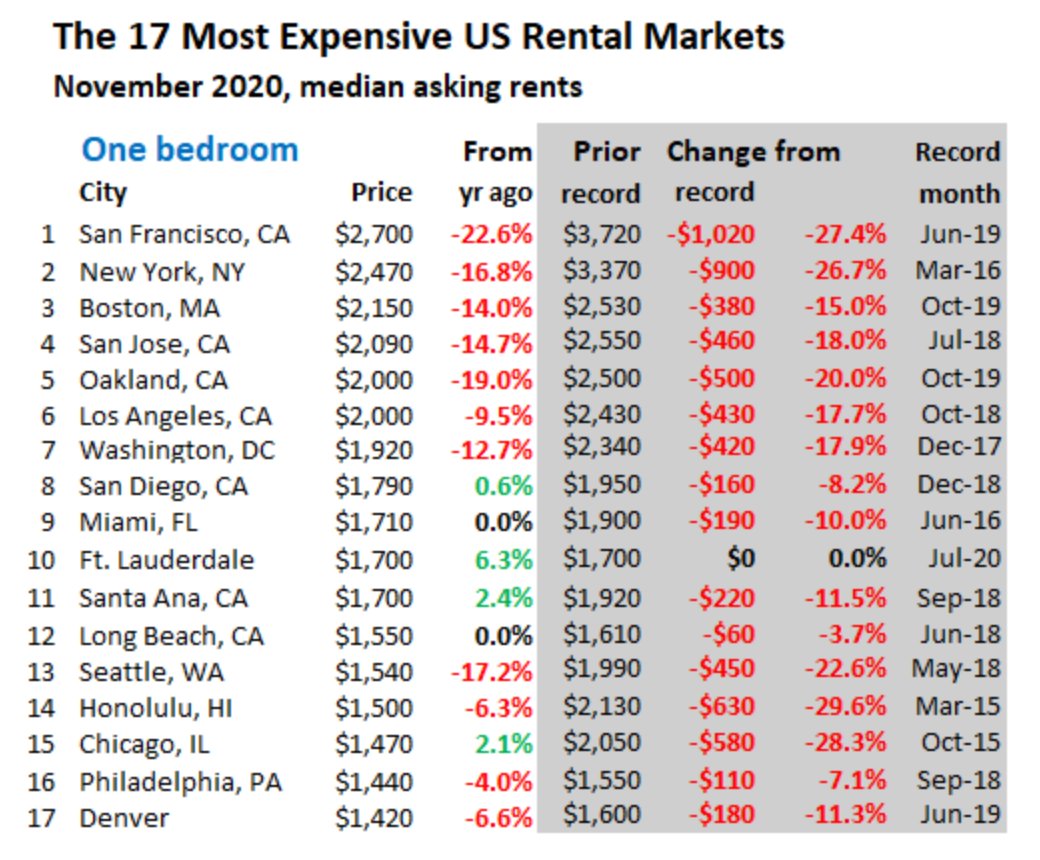

Rent growth now below 1% in most major markets, ~1/3 show declining rents.

What margin of safety is there in multi family properties bought with LSD cap rates?

https://www.bloomberg.com/news/articles/2018-09-07/rental-glut-sends-chill-through-the-hottest-u-s-housing-markets

What margin of safety is there in multi family properties bought with LSD cap rates?

https://www.bloomberg.com/news/articles/2018-09-07/rental-glut-sends-chill-through-the-hottest-u-s-housing-markets

Rents on Manhattan apartment leases signed in August down 2% y/y

Concessions offered on 35% of leases vs 24% a year ago.

Vacancy rate down to 1.58% vs 2.27% y/y #Multifamily

h/t @OshratCarmiel

Concessions offered on 35% of leases vs 24% a year ago.

Vacancy rate down to 1.58% vs 2.27% y/y #Multifamily

h/t @OshratCarmiel

Still moar price cuts on NYC condo and coop listings - the most in 12 years for the first week of September

h/t @OshratCarmiel

h/t @OshratCarmiel

Are Chinese banks bailing out a bunch of EB-5 investors in the 125 Greenwich St. condo project? Odd to see so many Chinese banks in one deal when outflows of money being discouraged. https://therealdeal.com/2018/09/21/125-greenwich-supertall-closes-on-473m-debt-package/

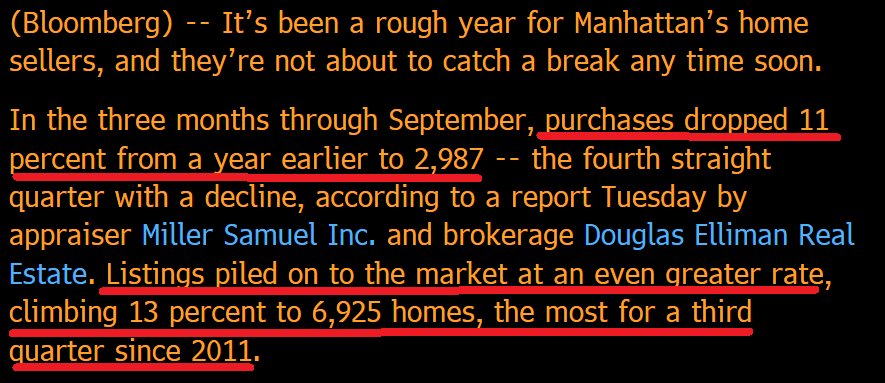

Q4 promises to be worse, as signed contracts for Manhattan apts were the lowest for a Q3 since 2008.

$AVB pulls the rip cord on Manhattan multi family assets:

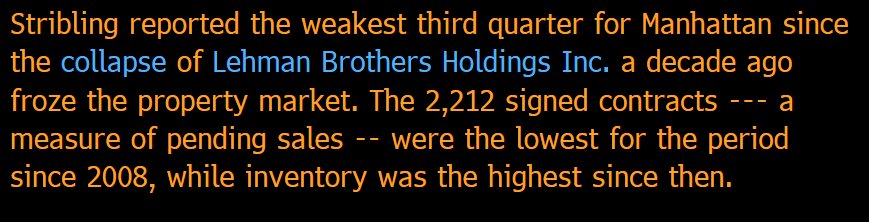

8 Spruce Street aka "New York by Gehry" a "trophy multifamily property" says Fitch, w/ 3.64% cap rate

Now losing some of its shine in soft rental market

NOI down ~10% in last 2 yrs even w/ occ up a tick

3.87% loan coupon - "Anticipated repayment date" 11/1/24

I'll take the over

Now losing some of its shine in soft rental market

NOI down ~10% in last 2 yrs even w/ occ up a tick

3.87% loan coupon - "Anticipated repayment date" 11/1/24

I'll take the over

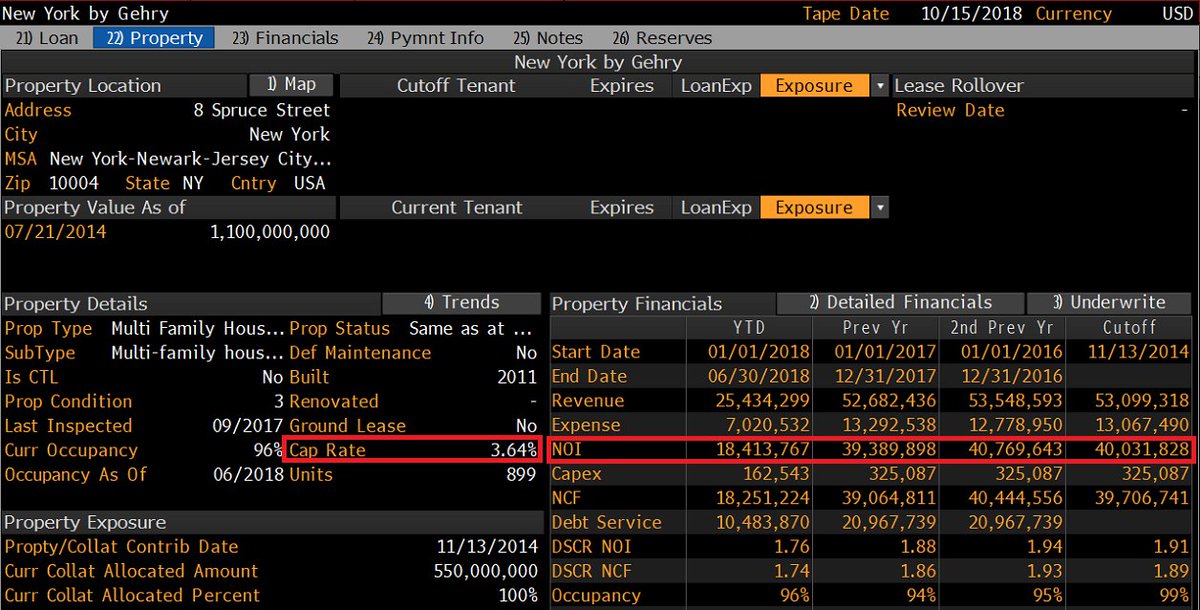

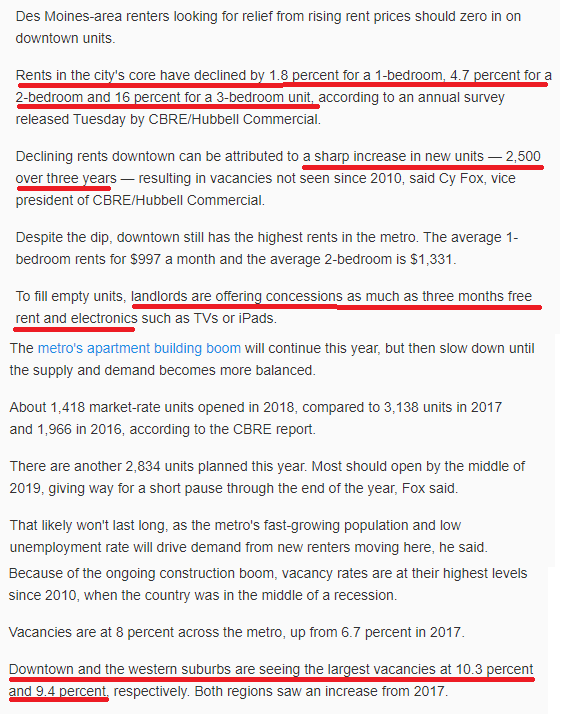

Softer multifamily markets are not just a coastal thing, now appearing in flyover country. The downtown Des Moines area has seen a 45% increase in rental units in the last three years, vacancy rates have gone from 2% to 10+%. Concessions of up to 3 months rent being offered.

$EQR call notes:

70-75% of new leases in NYC and DT SFO getting 2 months free rent.

Q2 occupancy ~flat w some concession increase

Turnover up materially in Aug & Sept put pressure on occupancy and rents

Oct - modest uptick in renewals an applications

Too soon to call a bottom

70-75% of new leases in NYC and DT SFO getting 2 months free rent.

Q2 occupancy ~flat w some concession increase

Turnover up materially in Aug & Sept put pressure on occupancy and rents

Oct - modest uptick in renewals an applications

Too soon to call a bottom

2/70% of the concessions offered were in NYC/SFO/BOS

Most applicants in these markets are "deal seekers"

ie, in-market tenants seeking lower rents

Suburban market concessions rare, pricing generally flat

Their tenants still have jobs, just don't want to live in urban core now

Most applicants in these markets are "deal seekers"

ie, in-market tenants seeking lower rents

Suburban market concessions rare, pricing generally flat

Their tenants still have jobs, just don't want to live in urban core now

3/ $EQR Notes:

NYC - people still leaving, NJ most popular destination

Deal seekers=75% Q3 move-ins, up 15% y/y

UWS & UES better than rest of Manhattan

Occupancy 90%, 88% for studios

Furnishing some studios for ST office rentals, some hourly

October activity a little stronger

NYC - people still leaving, NJ most popular destination

Deal seekers=75% Q3 move-ins, up 15% y/y

UWS & UES better than rest of Manhattan

Occupancy 90%, 88% for studios

Furnishing some studios for ST office rentals, some hourly

October activity a little stronger

4/ $EQR Notes

SFO - "most challenged market", escalating concessions

Occ 93%, DT SFO=87%

DT SFO 5% discount to Oakland vs 15% premium pre-Covid

South Bay threatened by new supply

Slight uptick in Oct renewals

SFO - "most challenged market", escalating concessions

Occ 93%, DT SFO=87%

DT SFO 5% discount to Oakland vs 15% premium pre-Covid

South Bay threatened by new supply

Slight uptick in Oct renewals

5/ $EQR Notes

Seattle - 95% occ, elevated turnover in Capital Hill, CBD

Protests/CHAZ impacting Capital Hill market

Now seeing concessions in these market

House prices continuing to rise rapidly

Expect quick rebound when things turn

Seattle - 95% occ, elevated turnover in Capital Hill, CBD

Protests/CHAZ impacting Capital Hill market

Now seeing concessions in these market

House prices continuing to rise rapidly

Expect quick rebound when things turn

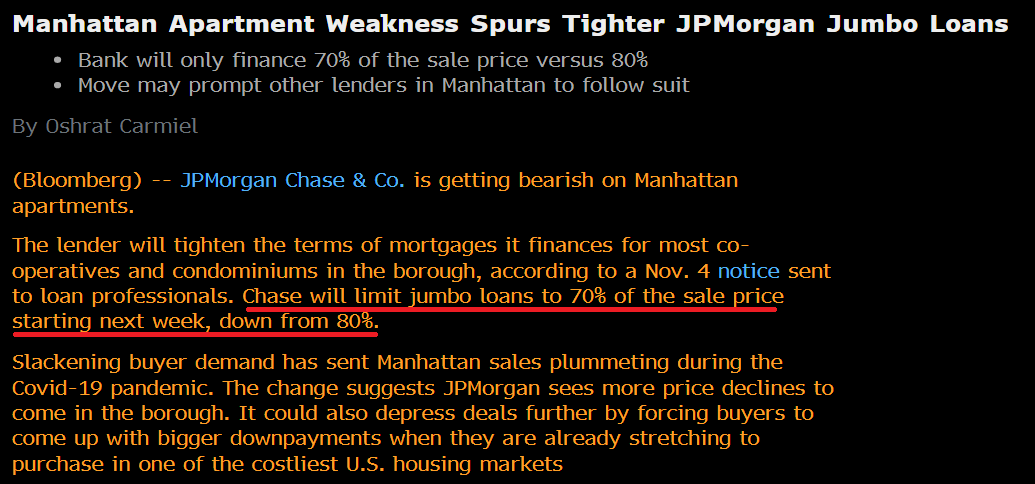

That creaking sound you hear is $JPM tightening the credit spigot for Manhattan condos and coops.

Max LTV on jumbos will be 70% going forward down from 80%

Max LTV on jumbos will be 70% going forward down from 80%

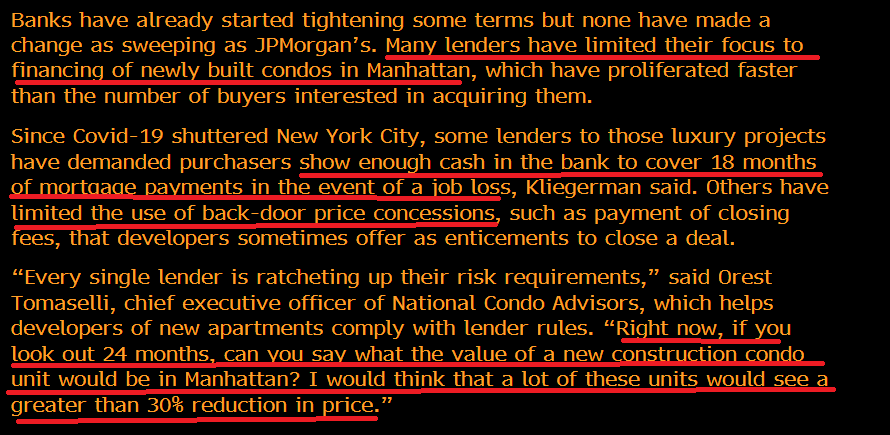

Other NYC lenders tightening the screws on new build condos.

Requiring cash reserve escrows and limiting back door pricing concessions.

30% price cuts over next two years?

Requiring cash reserve escrows and limiting back door pricing concessions.

30% price cuts over next two years?

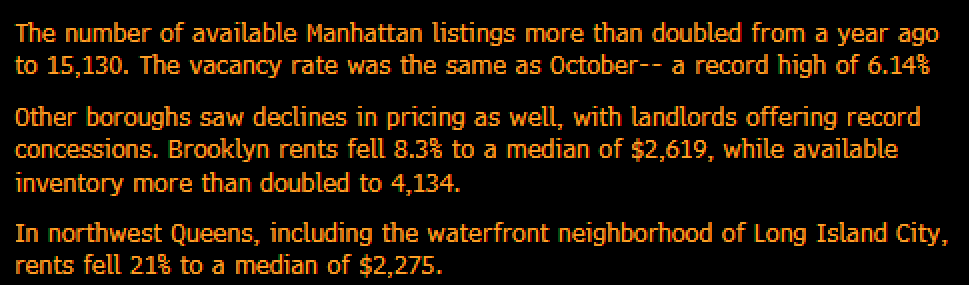

Nominal studio rents in Manhattan are down 17% y/y to $2,245, effective rents (adj for free rent) are $2,069

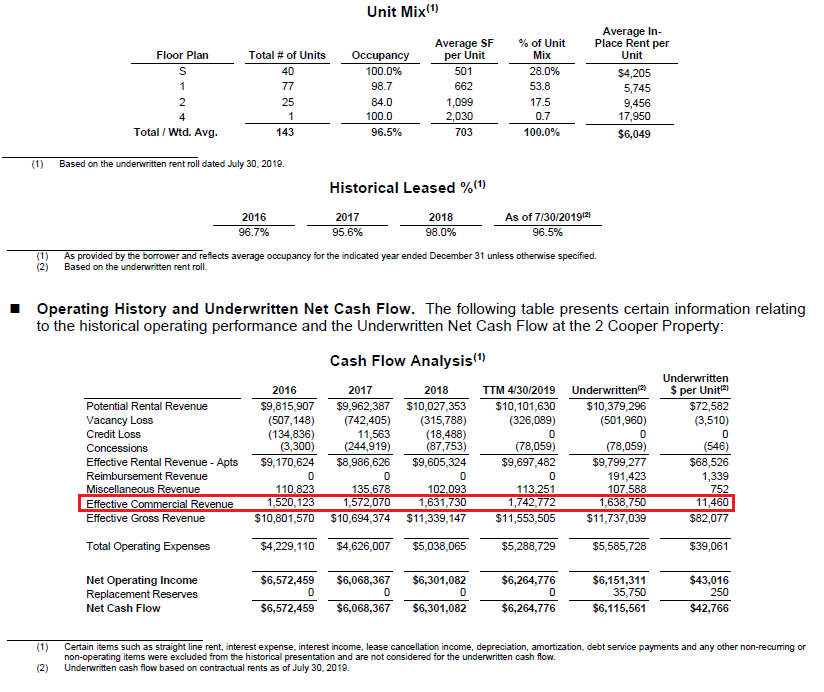

2 Cooper Square, 143 unit MF in NYC (East Village) goes 30 days delinquent.

22K ft Crunch Fitness on the ground floor.

22K ft Crunch Fitness on the ground floor.

2 Cooper Square was built in 2010, acquired by current sponsors David Werner and Isaac Kassirer in Sept 2019 for $100MM

There is a ground lease and preferred equity in the deal. Things could get spicy.

There is a ground lease and preferred equity in the deal. Things could get spicy.

Crunch was about 15% of the rent roll, I'm guessing they haven't paid in a while.

$4K per month for a studio also isn't happening in this market.

Stay tuned.

$4K per month for a studio also isn't happening in this market.

Stay tuned.

One57 condo sells at 50% haircut to its 2014 purchase price (from developer)

$ARI owns a big slug of mezz debt on a project just down the street. At last report, their exit strategy was an "inventory loan" YMMV

$ARI owns a big slug of mezz debt on a project just down the street. At last report, their exit strategy was an "inventory loan" YMMV

Read on Twitter

Read on Twitter