1/ $STWD took $34MM mark to market charge in Q3 against its JV interest in a portfolio of 4 regional malls

Charge necessitated by updated appraisal value of properties as part of refinancing

Charge necessitated by updated appraisal value of properties as part of refinancing

2/ Importantly, #malls are 91% occupied w sls/ft of $558, so solidly in "A" category

However, all cash flow from #malls will be needed for capex & debt service, with no FCF to JV

However, all cash flow from #malls will be needed for capex & debt service, with no FCF to JV

3/ This highlights:

I) A #malls not immune from valuation pressures

II) Capex needed to keep #malls competitive going up

III) Mall debt terms likely w shorter WAL which consume more of FCF

I) A #malls not immune from valuation pressures

II) Capex needed to keep #malls competitive going up

III) Mall debt terms likely w shorter WAL which consume more of FCF

For 1 yr loan extension, $STWD agreed to $25MM loan paydown, $9.6MM additional amort/yr, 25bp rate bump and cash trap on excess cash flow.

#Malls behind the $STWD #CMBS were bought from $TCO in 2014:

Mall at Wellington Green, Wellington, FL

Northlake Mall, Charlotte

Mall at Patridge Creek, Clinton Township, MI (NE Detroit suburbs)

MacArthur Center, Norfolk

Mall at Wellington Green, Wellington, FL

Northlake Mall, Charlotte

Mall at Patridge Creek, Clinton Township, MI (NE Detroit suburbs)

MacArthur Center, Norfolk

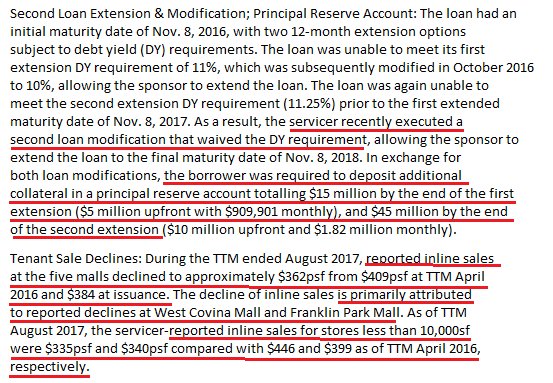

The retail unit of Starwood Capital (which manages $STWD ) bought 7 #malls from Westfield $WFD in 2013 and funded 5 of them with the SCGT 2013-SRP1 #CMBS

Similar to the #malls $STWD bought from $TCO , these malls have underperformed expectations, and additional collateral had to be put up to extend the #CMBS loans

West Covina, CA and Franklin Park (Toledo) #malls have been particularly hard hit & are now clearly B malls. Tenants moving to percentage rents is a bad sign.

This highlights that #retail weakness is impacting the low end of the class A #mall spectrum & may inform some of the recent activist interest in the #mall space. Stay tuned.

One more securitization of Starwood Capital (parent of $STWD) owned malls

These were part of the purchase from $TCO in 2014

Similar to others, had to pay down loan to extend

Notable drop in NCF since origination

These were part of the purchase from $TCO in 2014

Similar to others, had to pay down loan to extend

Notable drop in NCF since origination

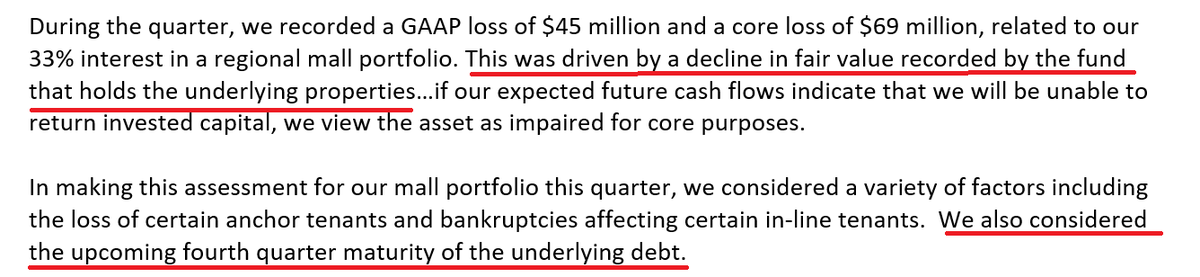

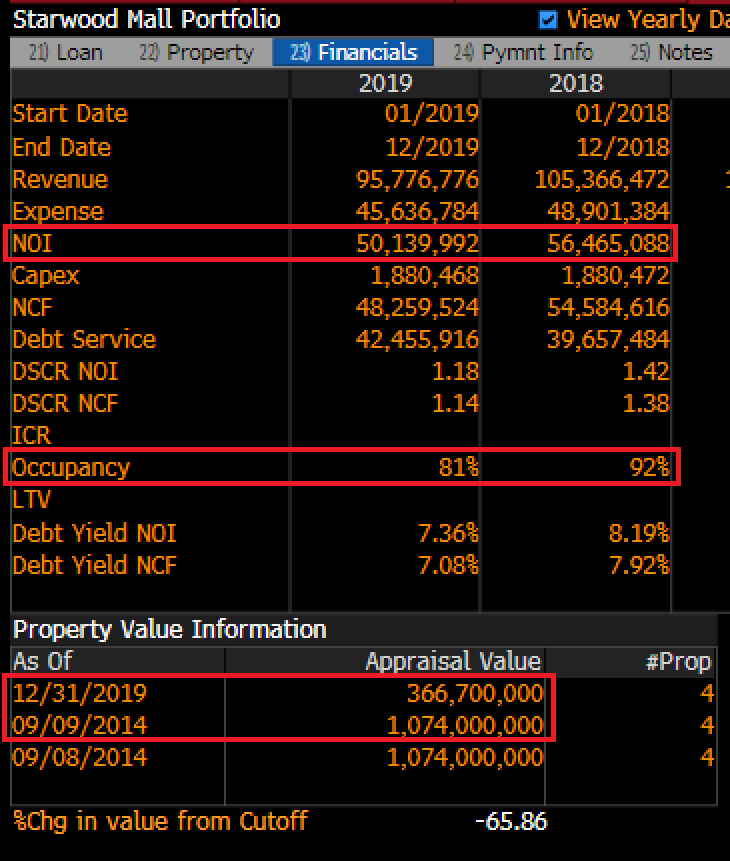

1/The next shoe dropped today on $STWD 's mall adventure. To recap, $STWD has an equity interest in a partnership that owns a portfolio of malls that were acquired in 2014. The deal was funded in part with a CMBS loan. In Q317, $STWD took a 20% haircut on its partnership interest

2/That was prompted by an agreement to extend the CMBS loan, which required a modest paydown with the extension, and a cash trap of all excess cash flow during the term of the extension (maturity now 12/19). Fast forward to Q1 19, the partnership holding the malls....

3/ wrote down the fair value, prompting $STWD to take another 30% haircut on its carrying value. Ominously, on the call, $STWD referenced the upcoming CMBS debt maturity as a factor in its thinking. Cap rates for the malls at loan issuance were in the low to high 6 range.

4/ But NOI has fallen 20% since issuance, and with announced anchor closings, run rate is probably closer to 30%. Using a likely debt yield in the low teens and ~$50MM NOI, the $686MM loan isn't going to roll.

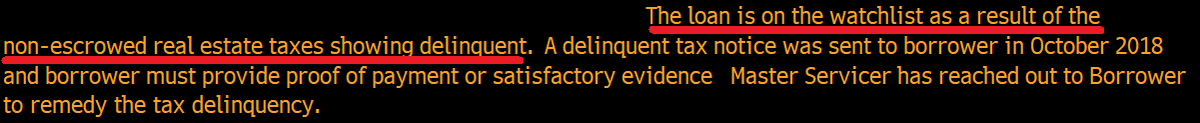

5/ The failure to pay last year's property taxes suggests Starwood has reach the same conclusion. From the servicer's report.....

6/ So consider this haircut to value on this asset a down payment on a complete write down by $STWD between now and Q4.

7/On the call $STWD CEO Sternlicht said "nobody really knows where mall cap rates are." While there's an element of truth to that, there are enough data points to triangulate on to conclude the loan here is underwater, & there's a lack of interest in throwing good money after bad

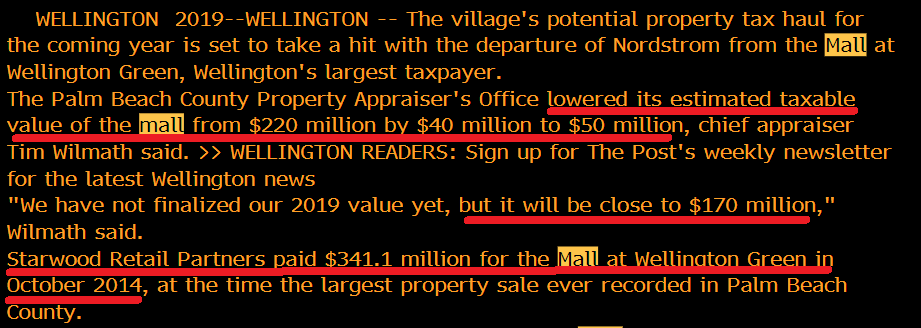

8/ The county assessor will haircut the value of the Mall at Wellington Green, one of the malls in the $STWD securitization by ~20% this year

9/ An update on SRPT 2014-STAR, the CMBS deal that kicked off this thread and is backed by 4 malls that Starwood Capital bought from $TCO back in 2014.

Publicly traded $STWD owns a piece of the equity in the partnership that owns the malls backing this debt - that equity was

Publicly traded $STWD owns a piece of the equity in the partnership that owns the malls backing this debt - that equity was

10/ Written off in full, with the final installment coming in Q419 when the loan went into default at maturity.

The malls are still generating income ($50MM down from 70MM in 2014) and had a DSCR of 1.19X for the full year last year, but was unable to refi at maturity.

The malls are still generating income ($50MM down from 70MM in 2014) and had a DSCR of 1.19X for the full year last year, but was unable to refi at maturity.

11/ At which point, Starwood engaged in some jingle mail and defaulted.

There was mention in the servicer's report about a restructuring proposal, but that has been shelved for now due to the fog of Covid.

The key piece of news in the May servicer's report was...

There was mention in the servicer's report about a restructuring proposal, but that has been shelved for now due to the fog of Covid.

The key piece of news in the May servicer's report was...

12/ The updated appraisal, which shows the value having fallen by 2/3rds since 2014 to $367MM for the 4 malls.

This is a cap rate of nearly 14% based on TTM NOI, and is likely higher than that on NTM.

h/t @Catie1130

This is a cap rate of nearly 14% based on TTM NOI, and is likely higher than that on NTM.

h/t @Catie1130

13/ This rerating risk at the time of refi has been looming over mall values for the last several years, and is the key risk that mall bulls have overlooked.

Over the last year, it had started to come home to roost with increasing frequency.

Over the last year, it had started to come home to roost with increasing frequency.

14/ In the post-Covid world, you will see a tsunami of these jingle mail defaults as the euthanization of zombie retailers goes into overdrive and mall owners do the math on what these properties are now worth.

Read on Twitter

Read on Twitter