With Yolo-ers on Spring Break, call options are getting cheaper. Some friends and I made a tool https://www.dankoptions.com to find the "Dankest" call options - those that are cheapest given a stock's historical price movement.

Here are 10 plays that are interesting. A thread

Here are 10 plays that are interesting. A thread

1/ Given that AstraZeneca $AZN is in the news every day & key to global vaccination, the $60, Jan '22 Calls are interesting. Wall Street pegs the stock at $88 in 1 year well above July highs. Even at @ Cowen's $66 target, $AZN has a 180% IRR on the $1.00 calls.

2/ Energy Transfer $ET gave a $11B 2021 EBITDA guide for 2021 which means it's only 6.7x fwd EBITDA, 1/2 the market. It has a clean energy unit that's been around since 2012. If it trades to UBS rough target of $14 by Jan '22 you make 376% on Jan '22 $8 calls.

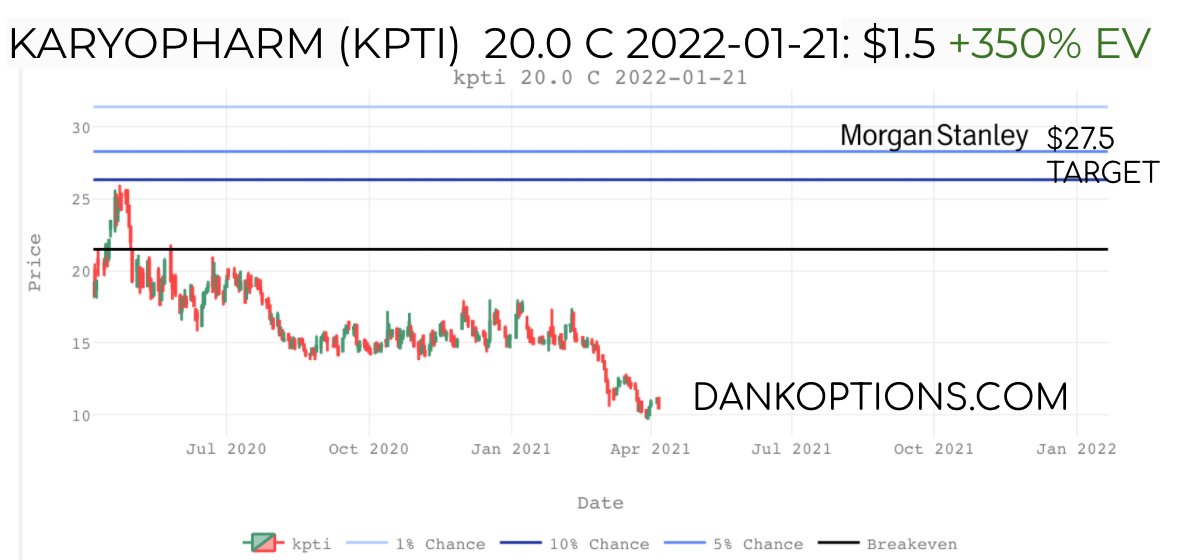

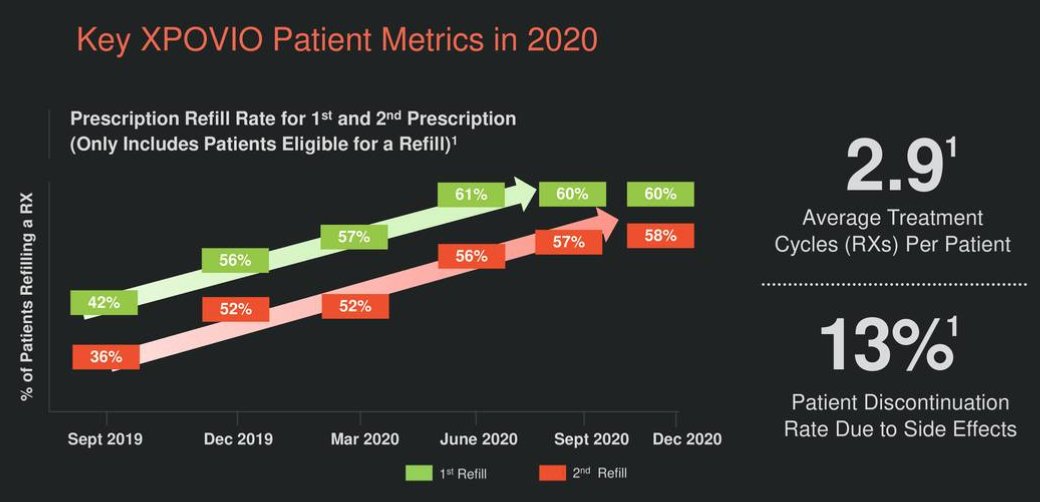

3/ Karyopharm $KPTI provided positive updates on its XPovio drug in February, and Morgan Stanley has a $32 target on the stock due to European Commission drug approval comments. If it gets to $27.5 by Jan '22, a $20 call pays off 360%

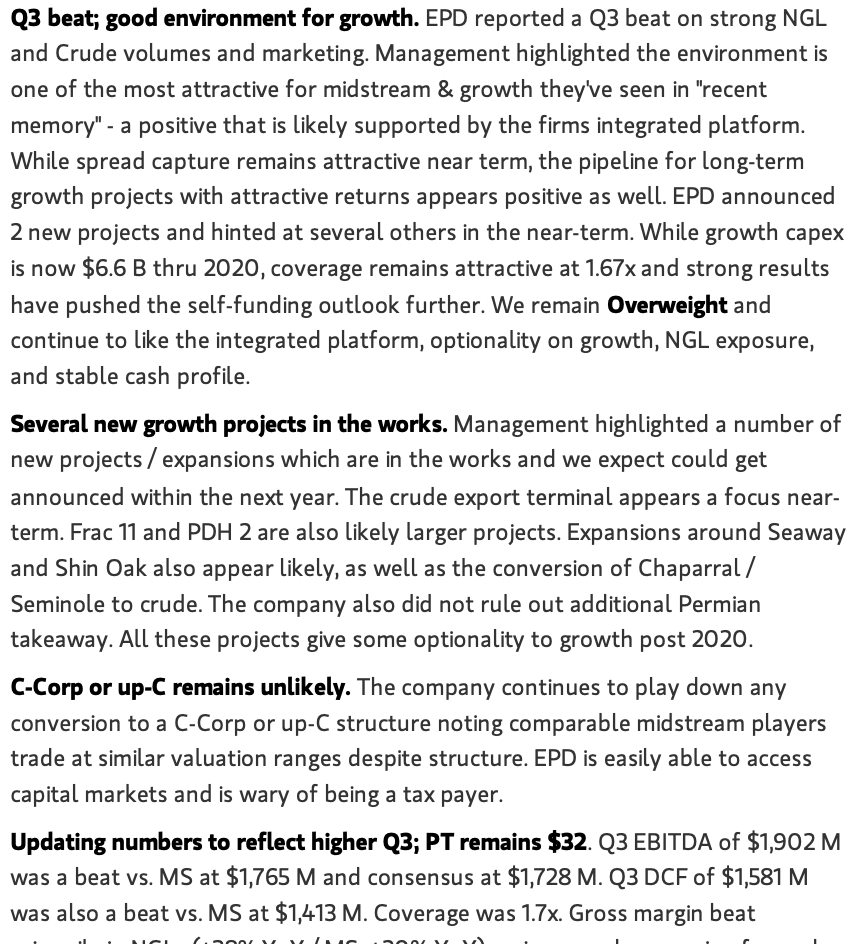

4/ Enterprise Product Partners $EPD is an energy play with long running excellent gross margins. Morgan Stanley has a $32 price target citing surprisingly bullish Permian outlook. If $EPD hits $30 by Jan '22, the $25 Calls pay out over 500%. Good inflation hedge

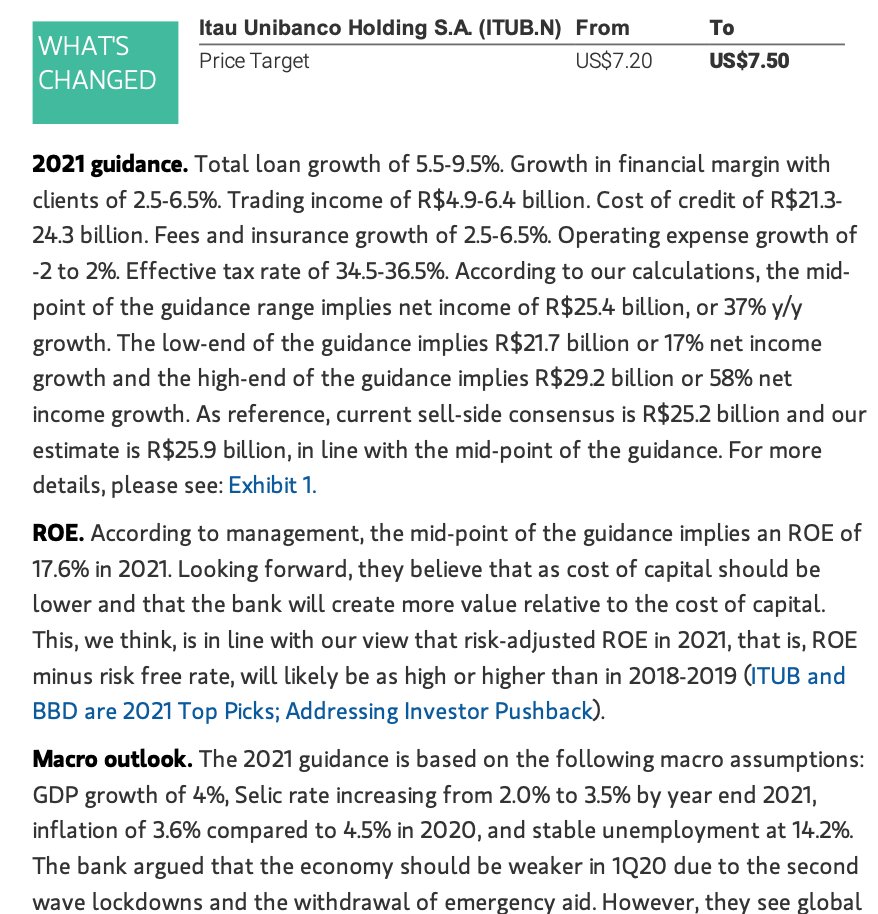

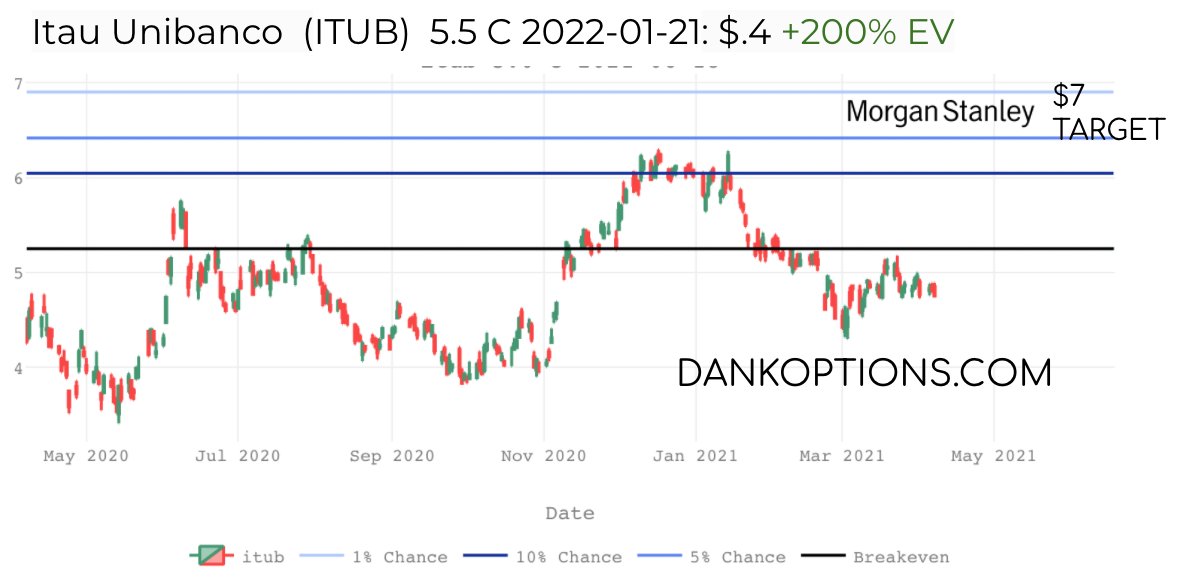

5/ Itau Unibanco $ITUB, Morgan Stanley sees running to $7.5 - citing 24 million digital customers, 58% net income growth and improving credit quality with explosive mortgage origination growth in Latam. If $ITUB runs to $7 by Jan '22, the $5.5 calls pay off 200%+

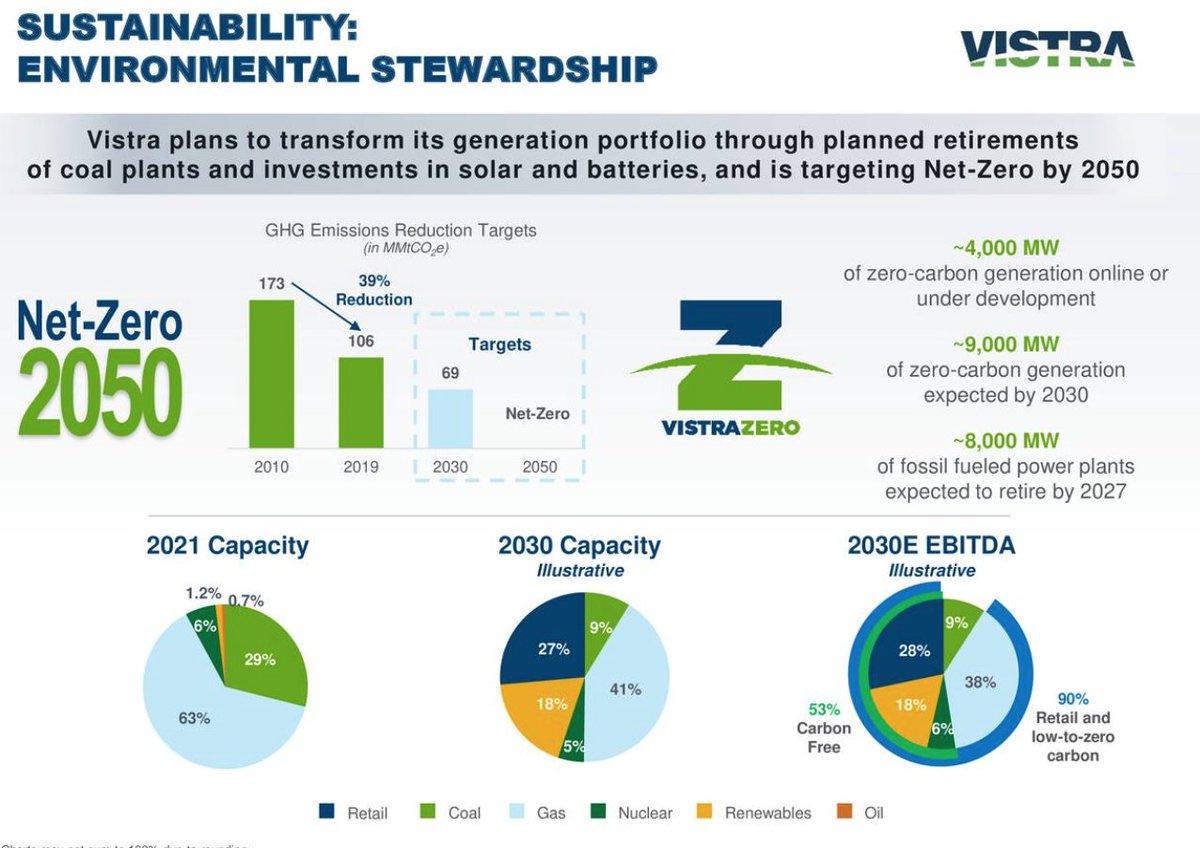

6/ Vistra $VST took a bit of a hit due to the Texas freeze, but should be a beneficiary of Biden's pledge for low carbon grid stability as outlined in February. MS has a $29 target on the stock and if it trades to $27 by Jan '22, the $20 calls more than double

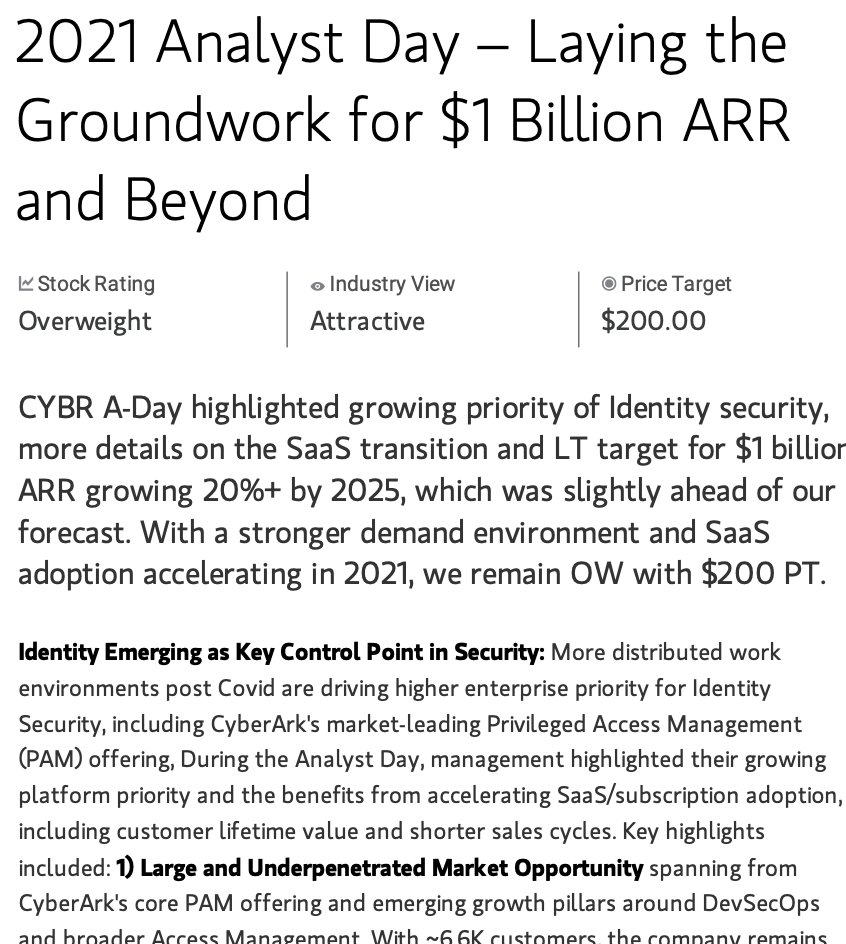

7/ Cyberark $CYBR - a $5b company had a strong analyst day outlining a plan to hit $1B of ARR in Cybersecurity SAAS by 2025. Palantir has a $40B market cap and a $1.5B ARR run rate. MS sees the stock at $200. If $CYBR runs to $187 by Jan '22 the $155 calls more than double

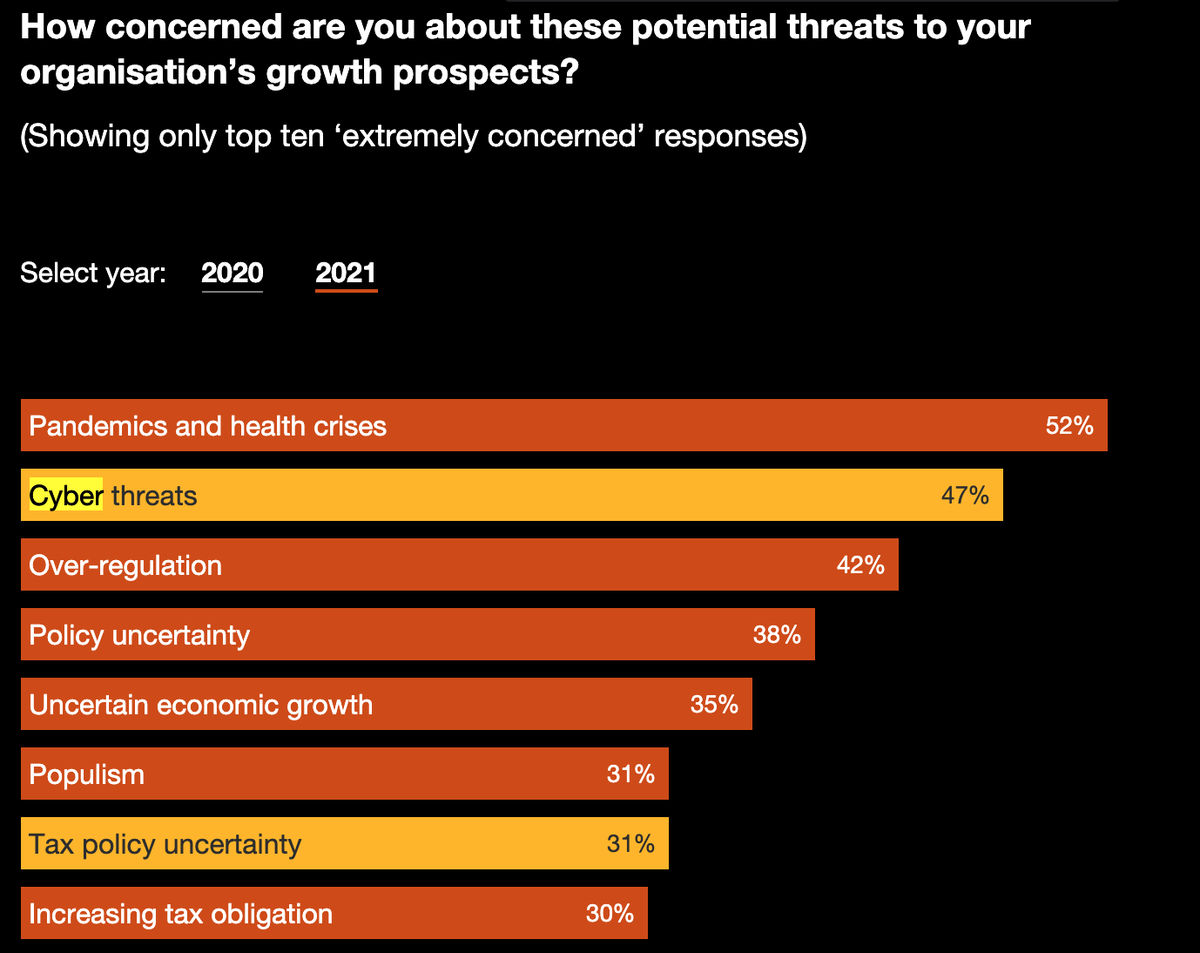

8/ Palo Alto Networks $PANW is another best in class Cyber Security name. PWC's CEO survey showed Cyber as C Suite's top investment priority outside of Covid for 2021. MS sees the stock at $515 within 12 mos. If $PANW trades to $478 by Jan '22 the $420 calls pay out 100%+

9/ Amazon $AMZN has underperformed Google by 28%+ ytd but the street is underestimating its huge advantage from checkout history as it rolls out its DSP and OTT advertising offerings. MS sees the stock at $4200 and 3600 calls payout over 100% by Jan 2022 if it gets there

10/ What's a dank option list without an Electric Vehicle play? MS sees $FSR at $40 due to positive FoxConn traction pointing to potential collaboration with Apple on EVs. With a strong pullback, the $22.5 Jan 2022 FSR calls payout over 200% at $35 just north of ATH.

11/ I hope you've found this call option bouquet as dank as I have. In conclusion: 1] The options screener is here http://tinyurl.com/5yn3vpb9 2] E-Trade provides Morgan Stanley research for free 3] The decline of yolo-ers makes these plays more appealing but DYOR. Best of luck

Read on Twitter

Read on Twitter