Last note on PayPal BNPL is pricing: PayPal's normal processing fee, undercuts other BNPL providers by up to ~50%.

@CharlieZvible points out that this doesn't matter as long as BNPL provider drives conversion, higher AOV etc. (great merchant quotes) https://twitter.com/CharlieZvible/status/1361824434768777219

@CharlieZvible points out that this doesn't matter as long as BNPL provider drives conversion, higher AOV etc. (great merchant quotes) https://twitter.com/CharlieZvible/status/1361824434768777219

I would generally agree, but wonder

a. Does Affirm actually bring new demo (Afterpay yes)

b. What happens if PayPal (or Cash App offering BNPL, more below) has even higher conversion and brings even more demand (tens of millions MAUs, rewards system) + new demo, at lower price

a. Does Affirm actually bring new demo (Afterpay yes)

b. What happens if PayPal (or Cash App offering BNPL, more below) has even higher conversion and brings even more demand (tens of millions MAUs, rewards system) + new demo, at lower price

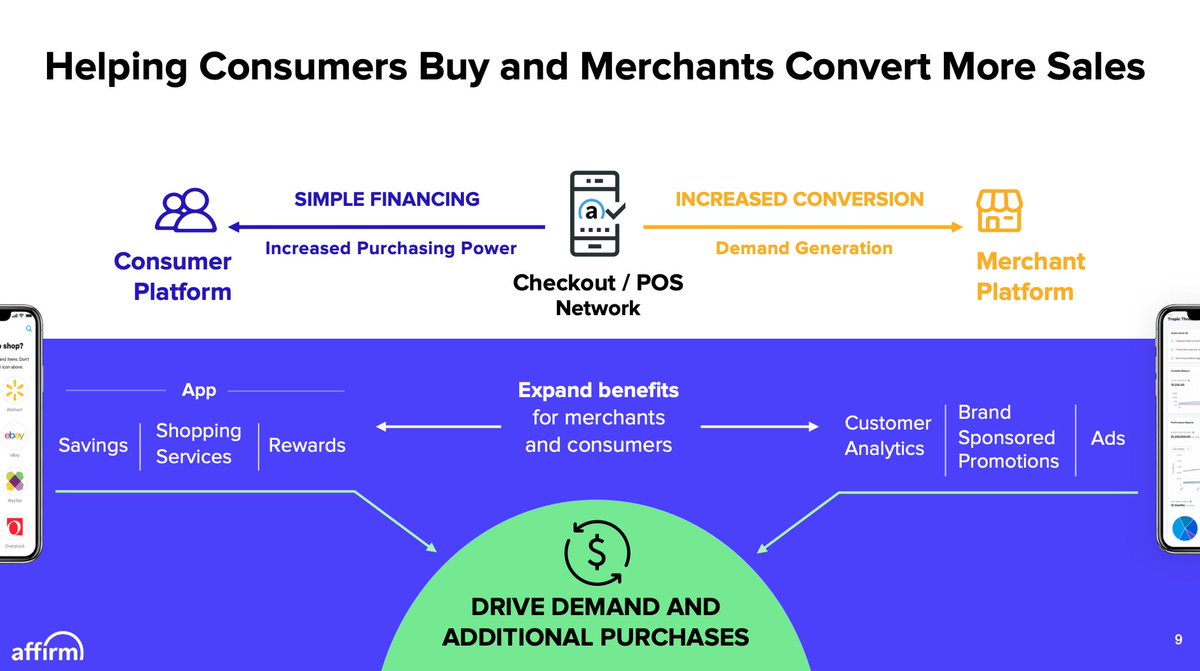

Affirm is pushing two-sided narrative hard (conversion + demand aggregation/generation), and wants "to expand into higher frequency purchases by investing in our split pay product, ramping up our partnership with Shopify and making strategic investments in marketing.”

That makes sense, because how can you build a brand through usage frequency if your customers use you to buy a Peleton once very 10 years?

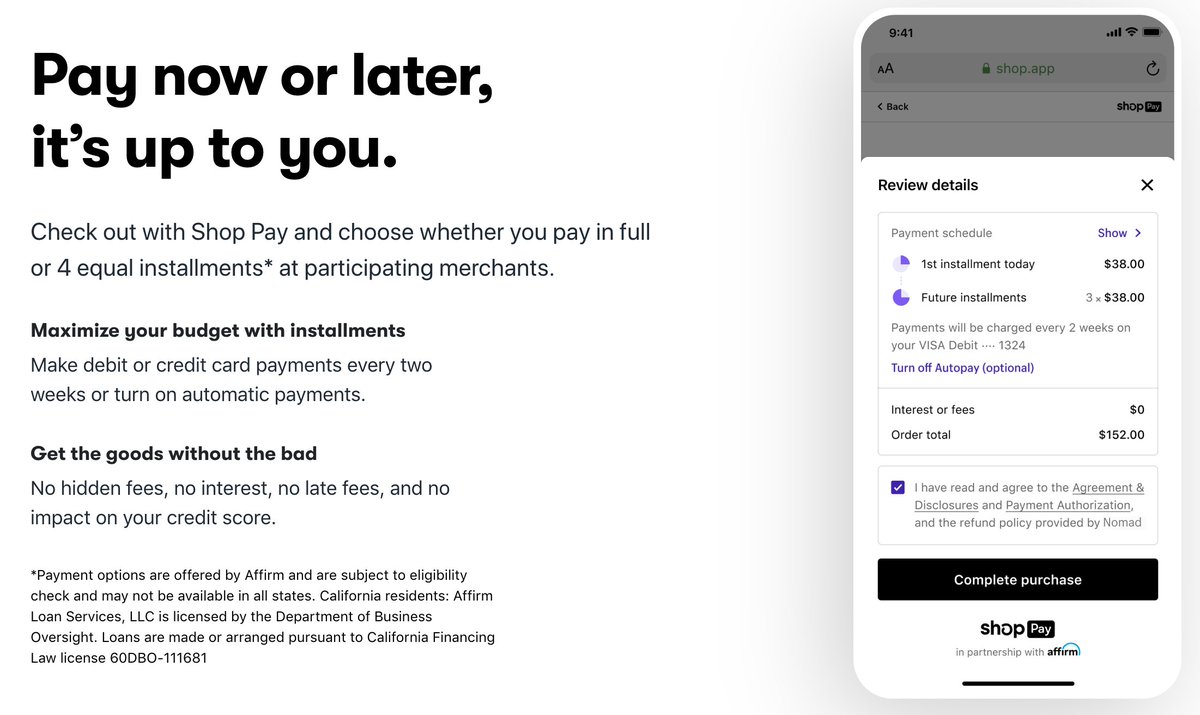

The Shopify partnership (again, unclear how it shows in Affirm's # of merchants), could help, but:

The Shopify partnership (again, unclear how it shows in Affirm's # of merchants), could help, but:

It's a Shop Pay product powered by Affirm, Shopify's words in press release are clear. If buyers could track pymts in Shop app, not Affirm app, (not sure how works) would be little value add for Affirm. +Seems like Shopify could cut Affirm out easily. Shop fintech team is 10/10.

Out of the BNPL providers, Afterpay probably has done the best job at organically building brand+demand by focusing on particular purchase category: Fashion.

- People love buying clothes

- People love tech/brand that enables more clothes buying

- People buy clothes frequently

- People love buying clothes

- People love tech/brand that enables more clothes buying

- People buy clothes frequently

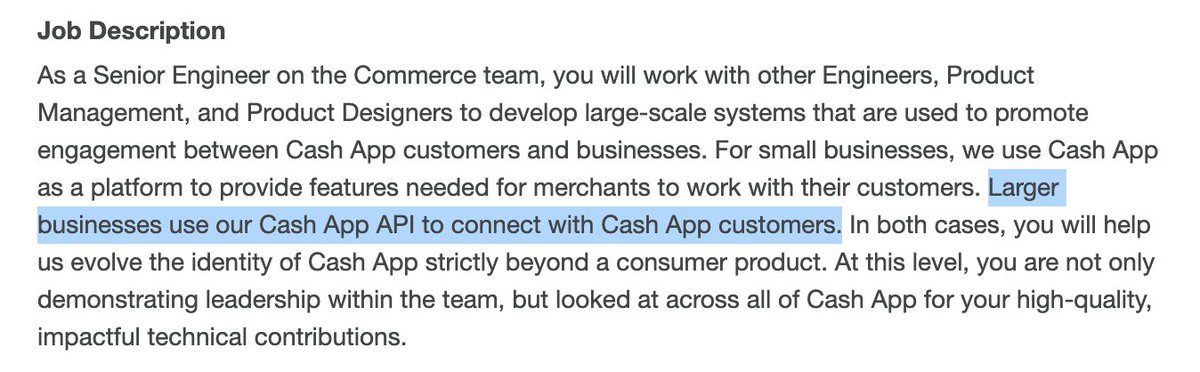

Talking about organic demand aggregation, don't forget about another competitor coming into this space: Cash App.

Cash App clearly has ambitions two grow its merchant network beyond the Square platform, read from "commerce" job description below.

Cash App clearly has ambitions two grow its merchant network beyond the Square platform, read from "commerce" job description below.

It's not hard to imagine Cash App offering BNPL at standard Cash App for Business pricing (roughly same as PayPal BNPL, 50% less than BNPL providers).

Cash App has ~35m MAUs already familiar w/ fully built proprietary Boost rewards platforms for merchants to plug into.

Cash App has ~35m MAUs already familiar w/ fully built proprietary Boost rewards platforms for merchants to plug into.

(Slowly coming to and end..)

With different players apparently going for the same price (two-sided network: merchants +consumer demand generation/aggregation), how should we think about how the market will play out?

One perspective is to borrow @bgurley's marketplace framework.

With different players apparently going for the same price (two-sided network: merchants +consumer demand generation/aggregation), how should we think about how the market will play out?

One perspective is to borrow @bgurley's marketplace framework.

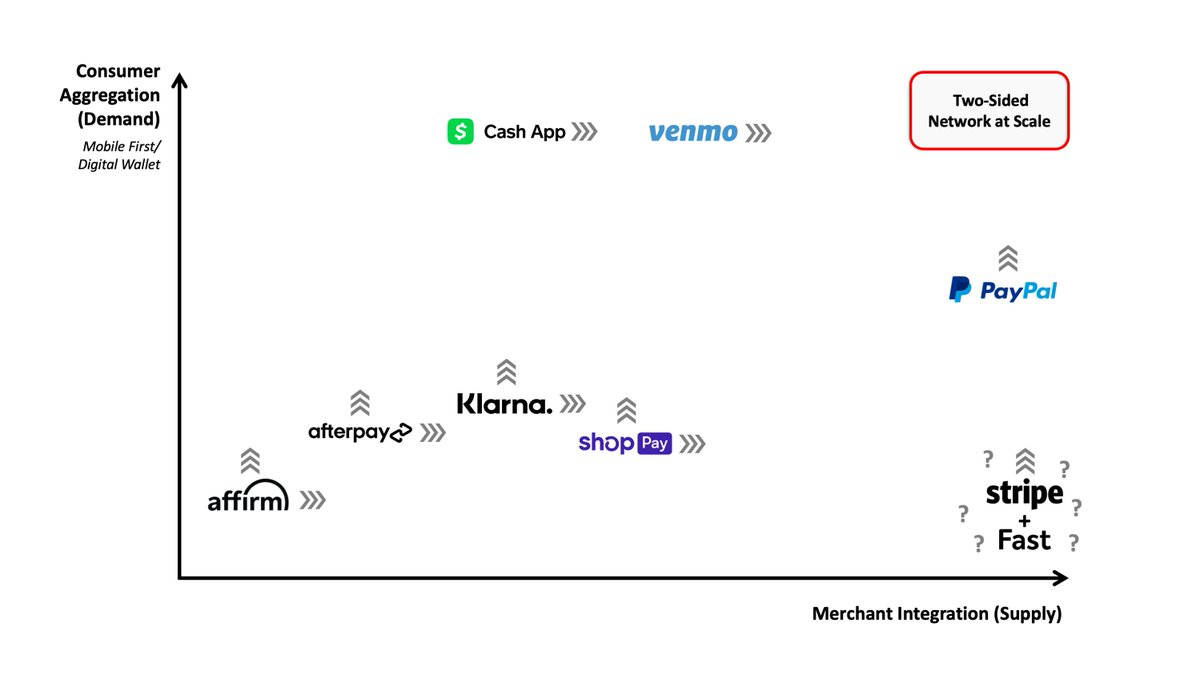

Bill Gurley stresses that organically building demand is crucial and more difficult than aggregating supply.

In this case:

Demand: Aggregation of consumers mobile-first/ in digital wallet for merchants to 'tap into'

Supply: Broad merchant network https://twitter.com/bgurley/status/1252701838496825345

In this case:

Demand: Aggregation of consumers mobile-first/ in digital wallet for merchants to 'tap into'

Supply: Broad merchant network https://twitter.com/bgurley/status/1252701838496825345

Put another way: Which players face least amount of friction in successfully assembling demand+supply?

Visually, this could look like below.

It should be easier for players already having aggregated demand to leverage their scale to build supply, as opposed to other way around.

Visually, this could look like below.

It should be easier for players already having aggregated demand to leverage their scale to build supply, as opposed to other way around.

Cash App, Venmo would be positioned best to do so conceptually, although it takes effort to convert users into a somewhat new use case (online B2C payments).

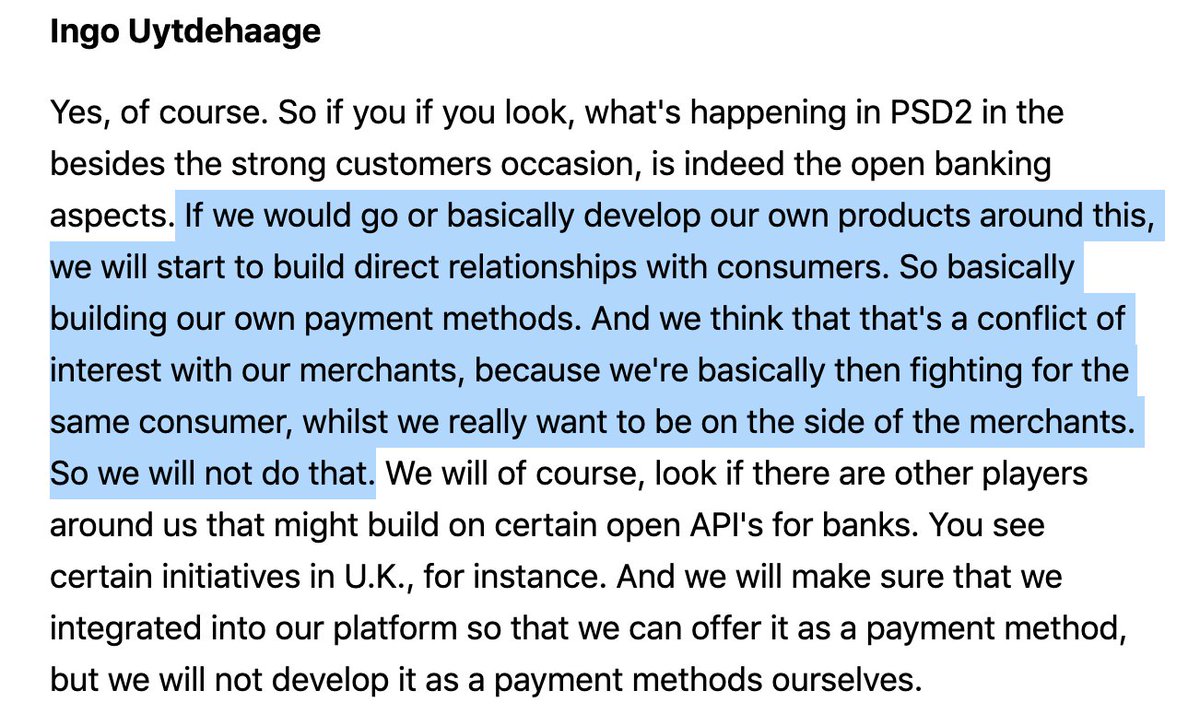

Could PSPs such as Stripe (invested in Fast) move to consumer? Adyen on last earnings call said no, conflict of interest.

Could PSPs such as Stripe (invested in Fast) move to consumer? Adyen on last earnings call said no, conflict of interest.

Existing wallet players should have more powerful pitch/value prop. to merchants on the demand aggregation/generation side, and even on conversion they could (out)compete w/ BNPL providers as their underwriting capabilities could be superior due to data collected across products.

If they serve merchants better on both demand generation and conversion while undercutting pricing by 50% (as PayPal does today), they could quickly rise to be an established checkout/payment method, putting pressure on others.

On the other hand, Klarna, Afterpay already are well established payment/BNPL methods for millions -- read for example this profile of Klarna's H&M partnership: 50% of mobile checkouts go through Klarna in some markets (I suspect that's Sweden): https://www.klarna.com/assets/sites/2/2020/06/08133719/ReferenceCase_HM_Eng-1.pdf

Curious your thoughts and critique on how this space will play out.

Read on Twitter

Read on Twitter