Risk is currently many sigmas above what it was at any other point since 09 and in some cases at ATH. Some aspects like extreme leverage, positioning, valuations, bullish skew, etc...are covered ad nauseam. I would like to focus on some less appreciated aspects of risk.

(1/N)

(1/N)

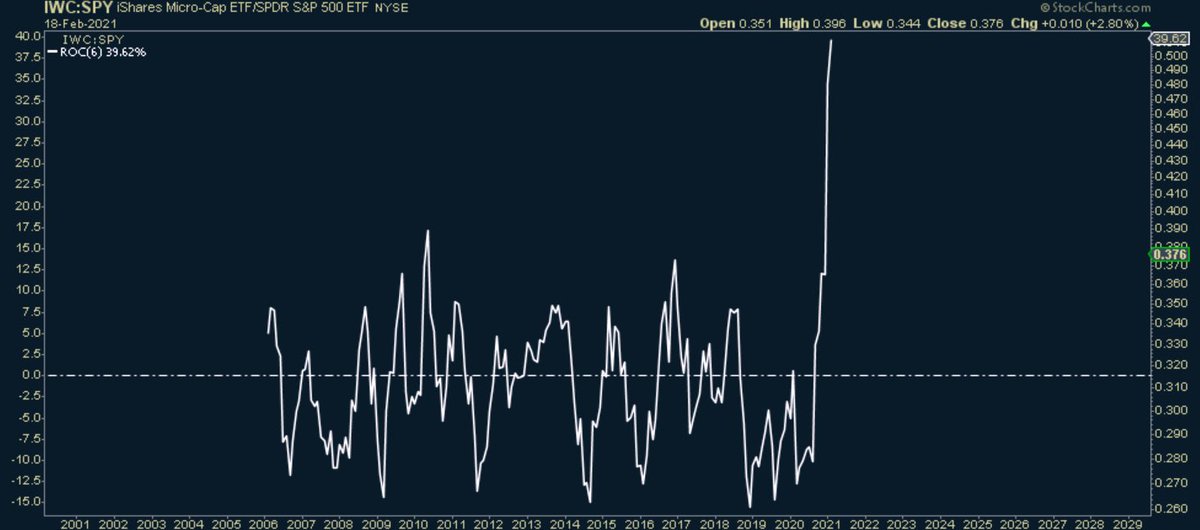

Illiquidity risk is nearing peaks here. Micro-cap outperformance is at extremes. Here is the 6m ROC of IWC/SPY. This drive towards illiquidity is reflexive, as the flows compress the bid-ask spreads and suppresses the perception of risk.

(2/N)

(2/N)

Same is happening in credit. Ambihud price impact measures and bid-ask spreads in IG have improved to the point where illiquid names have been outperforming liquid ones since Nov 20. Clearly the erosion of CRP(75% of CCC names are trading > par) is driving this push.

(3/N)

(3/N)

Duration risk is also at extremes. World Govies indices have gained 2 years of duration since ‘13. In credit, duration in US IG is at ATH. To give a measure of what duration risk is practically, a 40 bp rise in US30 yields => 4% drop in price.

(4/N)

(4/N)

To conclude, few really measure the potential consequences of this toxic combination of erosion of upside convexity, concentration of illiquidity, extreme leverage and tilted positioning. For now the $ is bailing everyone and everything, but that won’t last.

Read on Twitter

Read on Twitter