Yesterday, I had indicated how NEER over values the INR compared to REER since the former doesn’t account for inflation differentials and how this over-valuation builds up over time.

I have some further interesting analysis on this. Preliminary though. [thread] https://twitter.com/sonaliranade/status/1362382013034995715

I have some further interesting analysis on this. Preliminary though. [thread] https://twitter.com/sonaliranade/status/1362382013034995715

Plotted on this linear regression chart is annual growth in GVA vs over-valuation of the INR. The startling fact to emerge is that Growth in GVA is negatively correlated with growth in the economy. Over last 25 years, higher the degree of over-valuation, lower the GVA growth.

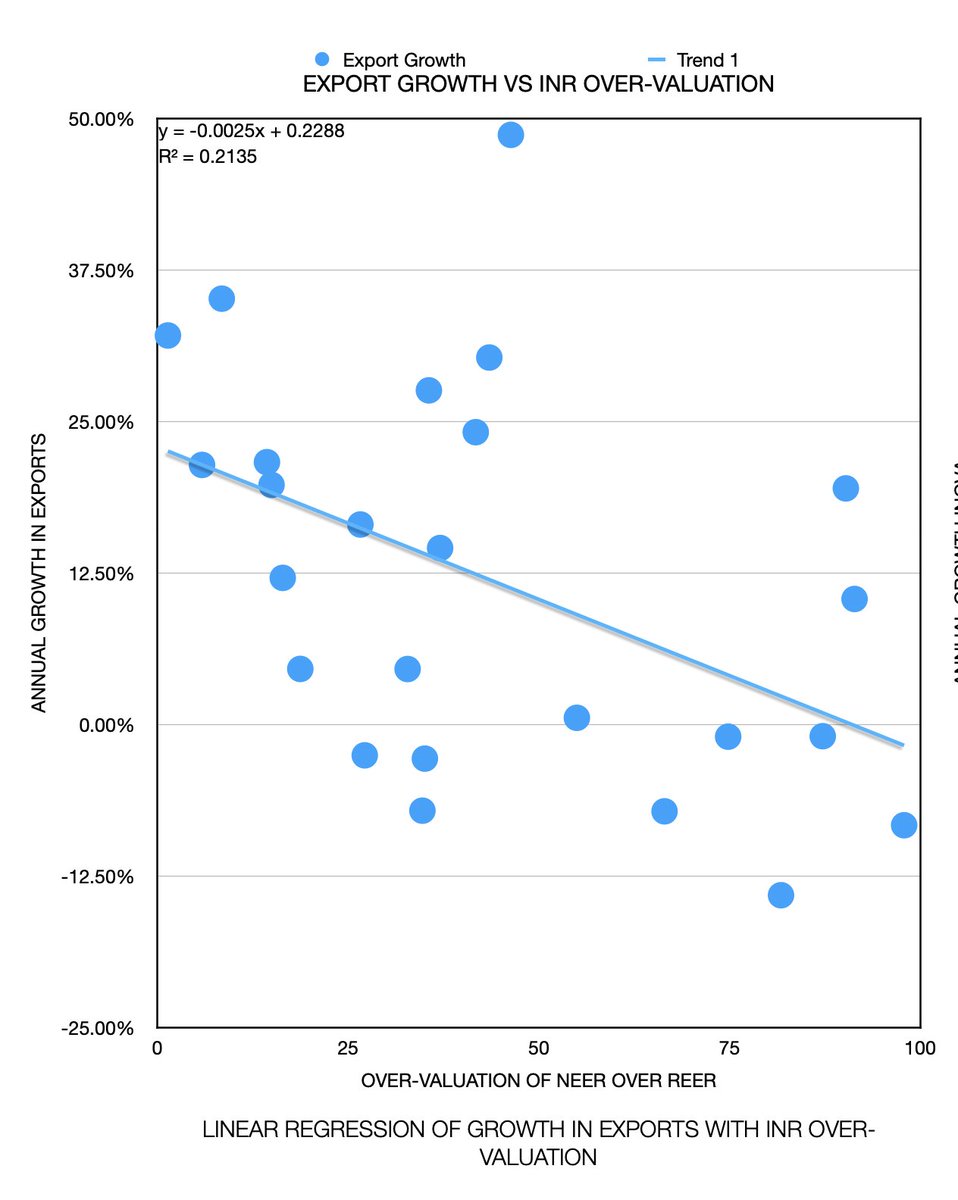

The second regression is that of Annual growth in merchandise exports vs degree of over-valuation in INR.

As one would expect, over last 25 years, Growth in annual exports is negative correlated with an over-valued INR.

As one would expect, over last 25 years, Growth in annual exports is negative correlated with an over-valued INR.

The 3rd regression is that of growth in export of invisibles [software services & the like] with the degree of over-valuation in INR.

Same story. Growth in exports of software services etc is negatively correlated with the degree of over-valuation.

Same story. Growth in exports of software services etc is negatively correlated with the degree of over-valuation.

The regression equation and R2 are given in each chart in the top left hand corner.

I think there is little doubt that growth in exports of goods and services is negatively correlated with degree of over-valuation in the INR.

BUT so is overall GDP. That is a huge point 2 note.

I think there is little doubt that growth in exports of goods and services is negatively correlated with degree of over-valuation in the INR.

BUT so is overall GDP. That is a huge point 2 note.

Read on Twitter

Read on Twitter

![The 3rd regression is that of growth in export of invisibles [software services & the like] with the degree of over-valuation in INR.Same story. Growth in exports of software services etc is negatively correlated with the degree of over-valuation. The 3rd regression is that of growth in export of invisibles [software services & the like] with the degree of over-valuation in INR.Same story. Growth in exports of software services etc is negatively correlated with the degree of over-valuation.](https://pbs.twimg.com/media/Eul9UgzVkAATT3v.jpg)