Black Swans Are Not Just Unlikely Events

A Short And Interesting Thread For Normies

/0

A Short And Interesting Thread For Normies

/0

Most people use the term "black swan" to mean something very unlikely, like a person being struck by lightning.

But to me, it has a deeper meaning, with a lesson embedded in it. /1

But to me, it has a deeper meaning, with a lesson embedded in it. /1

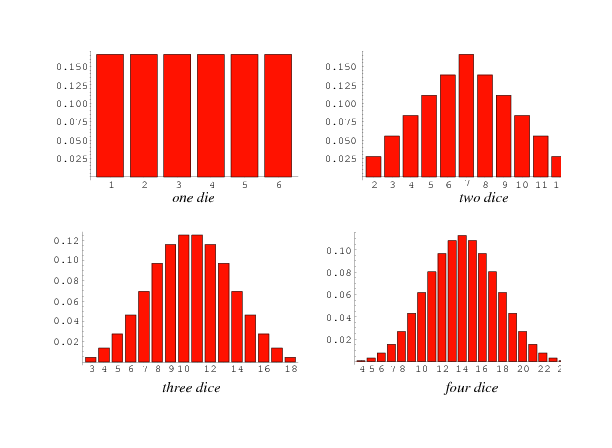

To understand it, imagine we roll some standard, 6 sided dice.

When each roll is independent, the sum is distributed like this (shown for rolling 1, 2, 3, 4 dice): /2

When each roll is independent, the sum is distributed like this (shown for rolling 1, 2, 3, 4 dice): /2

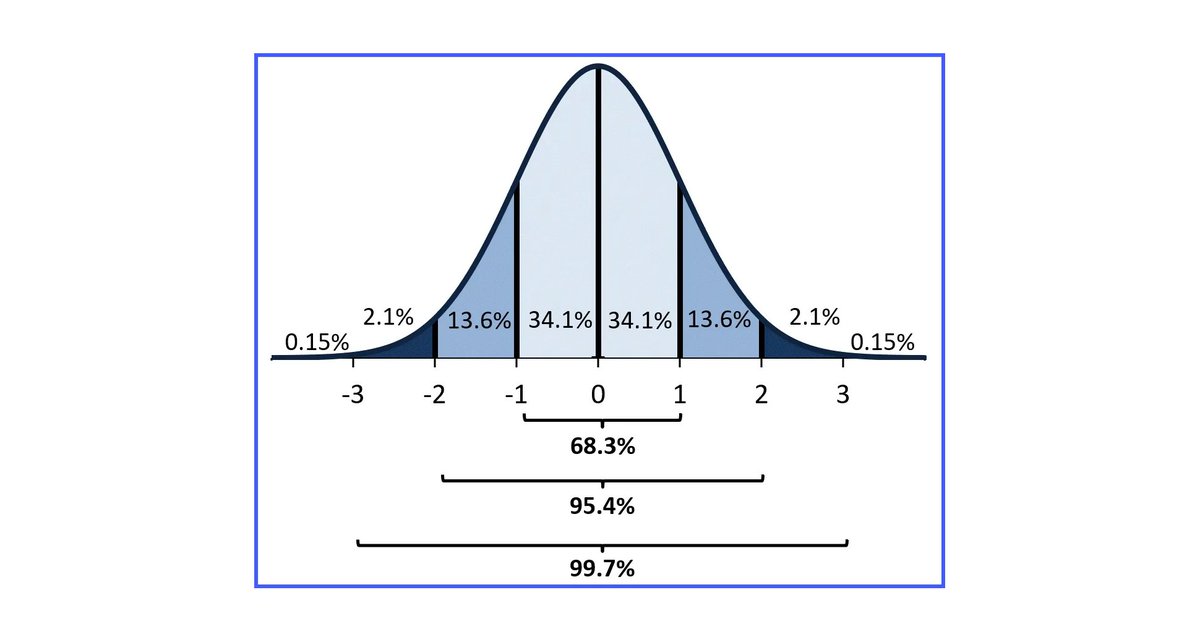

The distribution of their sum is approximated by a normal distribution (a so called "bell curve"). There is something called a standard deviation (sigma), and so you can calculate the odds of having an event higher than 3 sigma are approximately 0.15%. /3

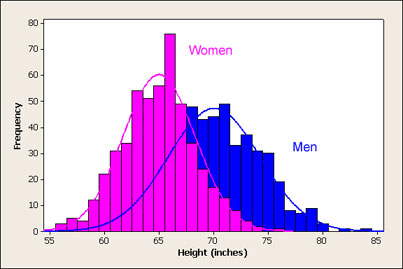

Normal distributions occur very frequently. For example, a person's height is normally distributed. Whenever you have a sum of independent random variables, they behave in this way. /4

Thus, you may calculate, for example, that a man has an average height of 70 inches and a standard deviation of 3 inches, and so the probability a random man is taller than 79 inches would be 0.15%. /5

A closely related distribution is the lognormal distribution, which occurs when you take a product instead of a sum. This suggests that the factors of income are multiplicative.

For example, US household incomes are lognormally distributed. /6

For example, US household incomes are lognormally distributed. /6

Now to the point. In a model, you have some assumptions, which if not true, can give you wild results.

If you believe wealth is normally distributed, you may be very surprised to learn there are people with $100 billion dollars. /7

If you believe wealth is normally distributed, you may be very surprised to learn there are people with $100 billion dollars. /7

The most dangerous assumption of all is that you are dealing with independent variables.

For example, you could make a market on dice rolling. /8

For example, you could make a market on dice rolling. /8

The odds of rolling a 6 on a die 5 times in a row are 7776 to 1.

Say you bet $5000 versus $1 that this won't happen. Your bet is +EV.

But if the die is loaded, you are completely fucked.

/9

Say you bet $5000 versus $1 that this won't happen. Your bet is +EV.

But if the die is loaded, you are completely fucked.

/9

This applies for all sorts of "black swans", like Trump's election.

If you assumed in 2016 the polls are independent, and started laying big odds on Clinton, you got fucked.

(In 2020, the market caught up and understood this idea better.)

/10

If you assumed in 2016 the polls are independent, and started laying big odds on Clinton, you got fucked.

(In 2020, the market caught up and understood this idea better.)

/10

If you shorted $GME huge thinking that it wouldn't be bid to $400, you got fucked.

In general, people can erroneously apply a normal or lognormal distribution to model events that are not distributed in this way.

/11

In general, people can erroneously apply a normal or lognormal distribution to model events that are not distributed in this way.

/11

So, in closing:

A black swan is not just an unlikely event.

Outcomes that seem incredibly unlikely may be much more likely than you think if the evidence or parts are not independent.

fin/12

A black swan is not just an unlikely event.

Outcomes that seem incredibly unlikely may be much more likely than you think if the evidence or parts are not independent.

fin/12

Read on Twitter

Read on Twitter