. @ONS PSF data out this morning provides a fiscal assessment ahead of the March budget. Borrowing is the highest April to January (10 months) on record at £270.6bn but borrowing is a bit better than feared in January.

A short thread…

A short thread…

Main news since the OBR’s November forecast is that the economy has turned out stronger as we have adapted to lockdowns…

…but the health crisis is worse too – with more restrictions in place at the start of 2021 than expected.

How will this affect the public finances?

…but the health crisis is worse too – with more restrictions in place at the start of 2021 than expected.

How will this affect the public finances?

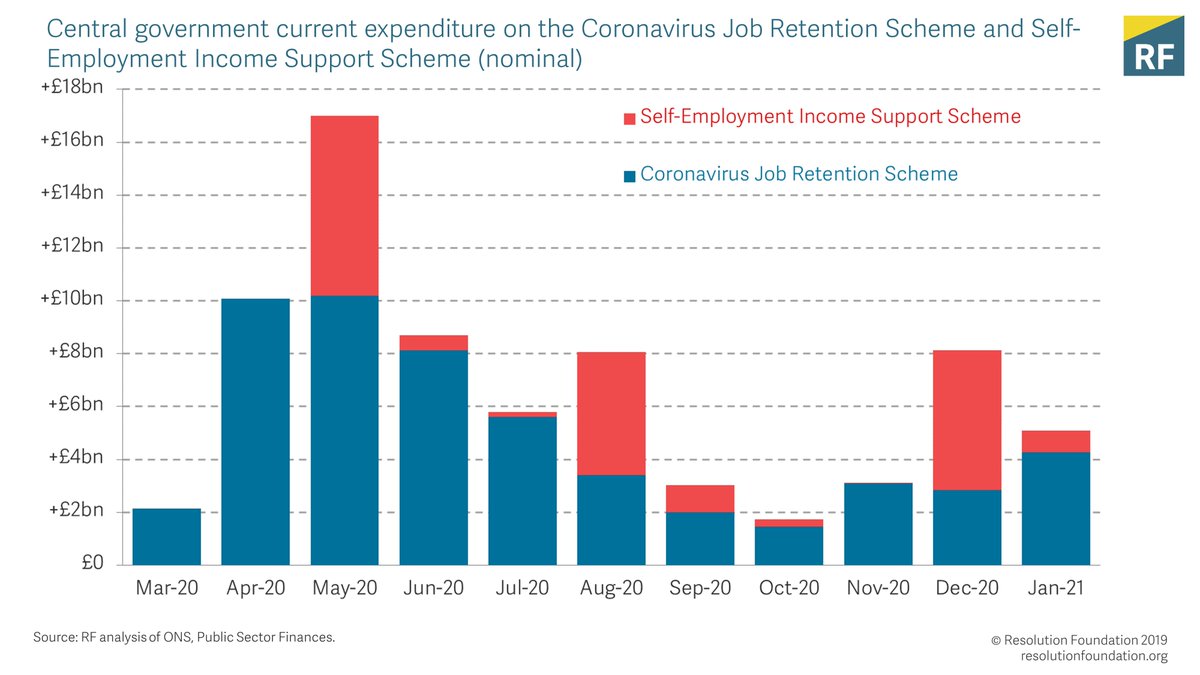

Probably the biggest news is on the spending side – where there’s more spending on support.

This month’s data show spending on the JRS is the highest since July at £4.3bn.

So far this year £53.3bn has been spent on the JRS with a further £19.6bn on SEISS.

This month’s data show spending on the JRS is the highest since July at £4.3bn.

So far this year £53.3bn has been spent on the JRS with a further £19.6bn on SEISS.

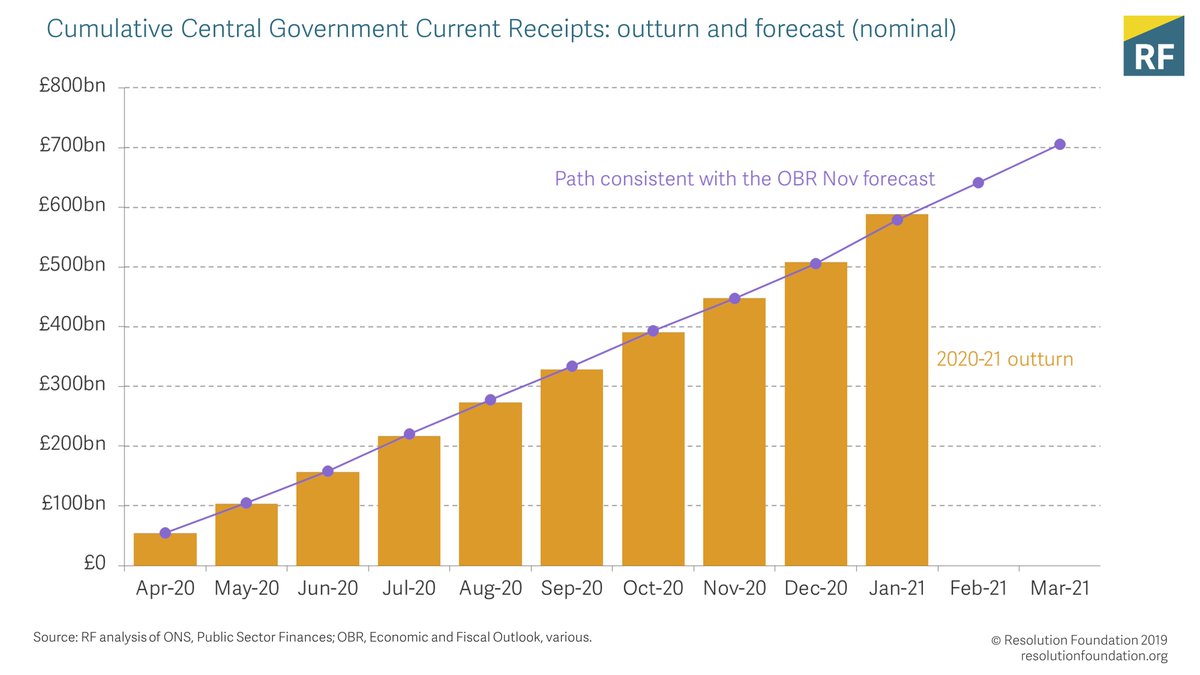

Receipts are down on 2019. But, are holding up suggesting that the impact of new lockdown is offset by stronger-than-expected starting point for the economy. Also reflects success of govt measures to insure incomes - furloughed workers still paying tax.

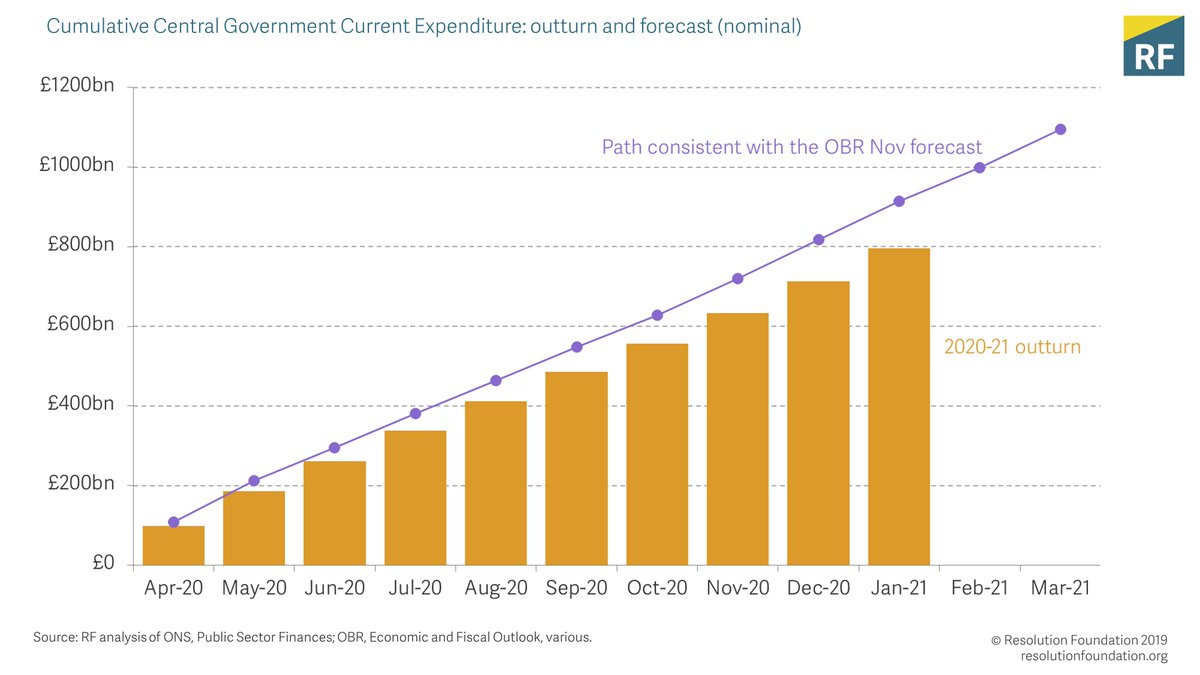

Bit more news on the spending side where – while very large in absolute terms – spending in January is below the OBR’s November forecast.

Of course, much of this shortfall reflects the OBR’s upfront recording of future write-offs associated with the pandemic loan schemes.

Of course, much of this shortfall reflects the OBR’s upfront recording of future write-offs associated with the pandemic loan schemes.

Debt has risen to 97.9% of GDP in January, to reach £2,114.6bn.

This is the highest debt-to-GDP ratio since the financial year ending (FYE) 1962.

This is the highest debt-to-GDP ratio since the financial year ending (FYE) 1962.

This chart reminds you that the cost of servicing this higher debt has actually been falling and look set to remain low for the foreseeable future. This reduces the pressure on the Chancellor to reduce the deficit in the near term…

So this morning’s data suggest that the starting point for the Budget could – if anything – be a little better than expected at the time of the OBR’s November forecast.

The Chancellor faces big decisions on policy.

He must make sure that he extends the support measures for families and businesses while social distancing remains in place.

See our report published yesterday on what needs to happen on income support: https://www.resolutionfoundation.org/publications/long-covid-in-the-labour-market/

He must make sure that he extends the support measures for families and businesses while social distancing remains in place.

See our report published yesterday on what needs to happen on income support: https://www.resolutionfoundation.org/publications/long-covid-in-the-labour-market/

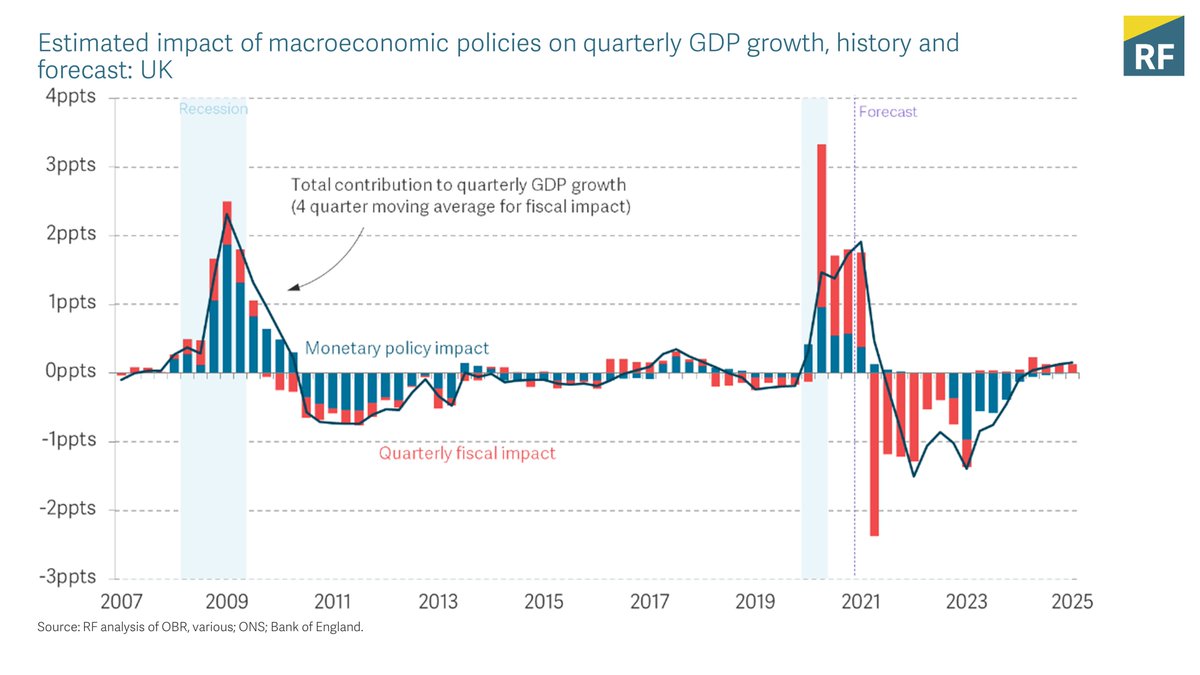

But, when the vaccine is rolled out, the Chancellor will need to put in place measures to boost the economy.

On *current* plans, fiscal policy is going to start to become a very significant growth through the course of this year (see red bars in our fiscal impact measure).

On *current* plans, fiscal policy is going to start to become a very significant growth through the course of this year (see red bars in our fiscal impact measure).

What is needed is large-scale targeted support that prioritises boosting those parts of the economy most affected by the crisis.

Failing to do so would mean more economic damage.

Failing to do so would mean more economic damage.

Read on Twitter

Read on Twitter