Today @drnigelclarkeja made a MAJOR announcement re: the upcoming budget — which is a bountiful harvest (dividend anyone?!?) of prudent seeds that were planted a few years ago.

@CentralBankJA will be paying a one-off ~$33B dividend to GOJ this year.

//Thread

#FinanceTwitterJa

@CentralBankJA will be paying a one-off ~$33B dividend to GOJ this year.

//Thread

#FinanceTwitterJa

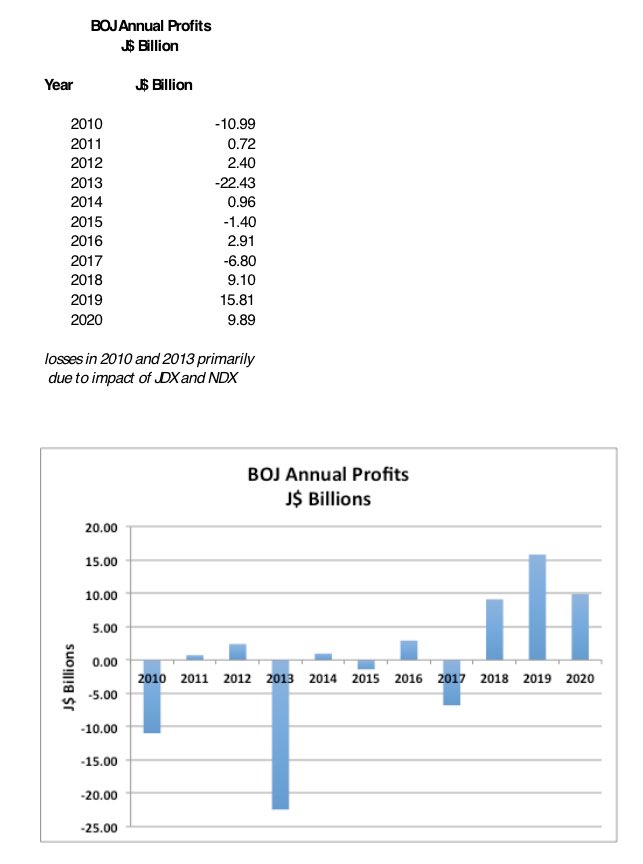

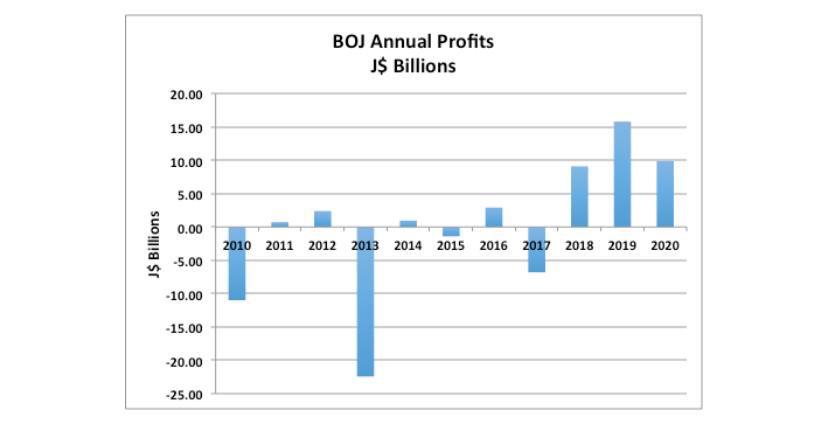

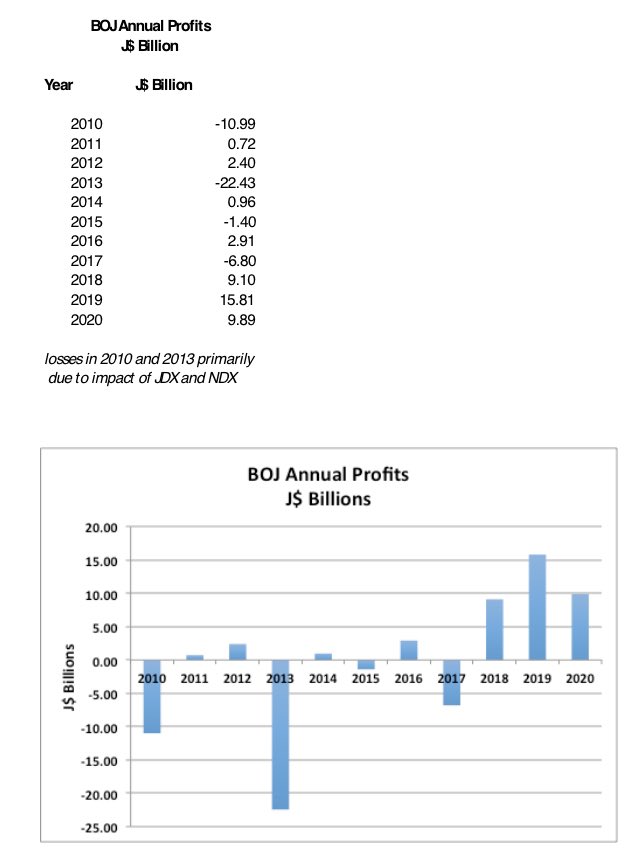

BOJ profits:

- 2018: $9.1B

- 2019: $15.81B

- 2020: $9.89B

Before 2018, BOJ produced meager profits occasionally and big losses from time to time.

To understand why this is, you have to understand at a high level how this all works.

BOJ is kinda like a normal bank...

- 2018: $9.1B

- 2019: $15.81B

- 2020: $9.89B

Before 2018, BOJ produced meager profits occasionally and big losses from time to time.

To understand why this is, you have to understand at a high level how this all works.

BOJ is kinda like a normal bank...

in the sense that it takes deposits from its customers (ie commercial banks and other financial institutions) and pays interest (now it is nominal, effectively ~0) and they lend to these same customers and charge interest.

So their operational profits are the difference.

So their operational profits are the difference.

Again, this is an oversimplification but just to illustrate the principle.

Then, what they also used to do (pre 2018) is “defend the dollar”, ie whenever JMD weakens by a larger amount than normal, they would intervene to “strengthen” the JMD.

The issue this creates is....

Then, what they also used to do (pre 2018) is “defend the dollar”, ie whenever JMD weakens by a larger amount than normal, they would intervene to “strengthen” the JMD.

The issue this creates is....

they are effectively absorbing a loss to move the JMD artificially.

Those losses are initially taken out of their operational profits they generate from normal lending operations (Net Interest Income) which I spoke about earlier, then when all of those operational profits...

Those losses are initially taken out of their operational profits they generate from normal lending operations (Net Interest Income) which I spoke about earlier, then when all of those operational profits...

are wiped out, GOJ (aka the taxpayer) is on the hook to make up the difference.

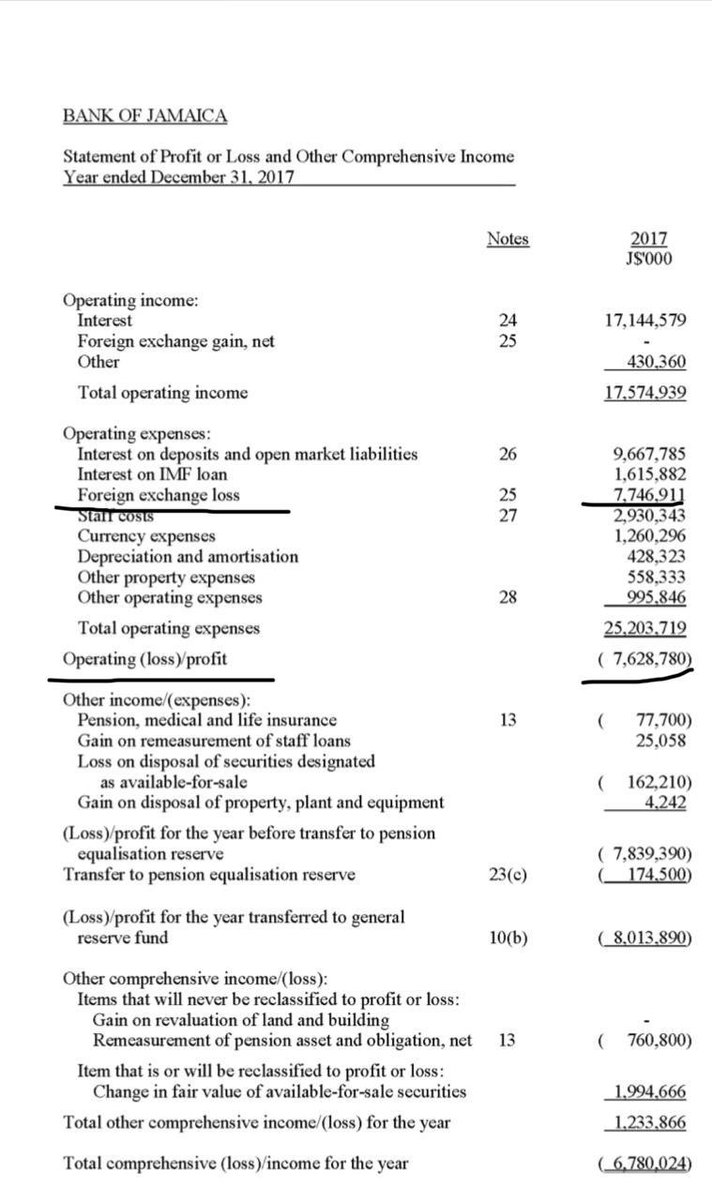

To illustrate this point, check out the Comprehensive Income Statement from BOJ in 2017 below.

Notice the F/X loss vs Operational Loss.

This is why we don’t want BOJ “defending” the JMD.

To illustrate this point, check out the Comprehensive Income Statement from BOJ in 2017 below.

Notice the F/X loss vs Operational Loss.

This is why we don’t want BOJ “defending” the JMD.

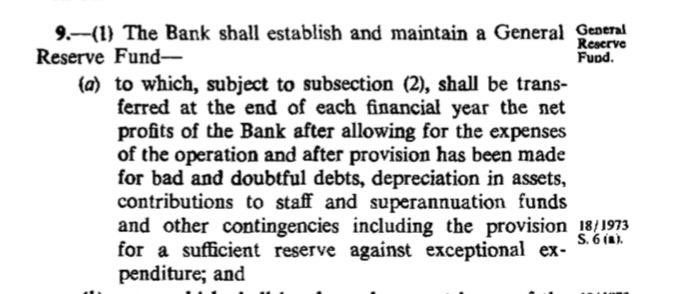

So all of those years when BOJ posted those losses, GOJ owed them (per the current BOJ Act - Section 9(1)(a)).

So per the existing BOJ Act, profits after specific expenses are covered, are mandated to be transferred to GOJ and when there are losses, GOJ is mandated to cover those losses.

In 2018/19 & 2019/20 GOJ cleared off all of those outstanding balances it had for BOJ (aka paid BOJ).

In 2018/19 & 2019/20 GOJ cleared off all of those outstanding balances it had for BOJ (aka paid BOJ).

So because GOJ cleared its outstanding balance, 2021 is the first year when they could start fresh and receive the profits that BOJ had accumulated.

Since 2018, BOJ has shifted to an inflation targeting regime where all they focus on is inflation being between 4% - 6%.

Since 2018, BOJ has shifted to an inflation targeting regime where all they focus on is inflation being between 4% - 6%.

They only intervene in the FX markets when there are insufficient buyers or sellers, not when the JMD jumps or dips.

In other words, they no longer absorb huge FX losses just to “prop up” the JMD.

They allow the market to decide what the price of the JMD is.

In other words, they no longer absorb huge FX losses just to “prop up” the JMD.

They allow the market to decide what the price of the JMD is.

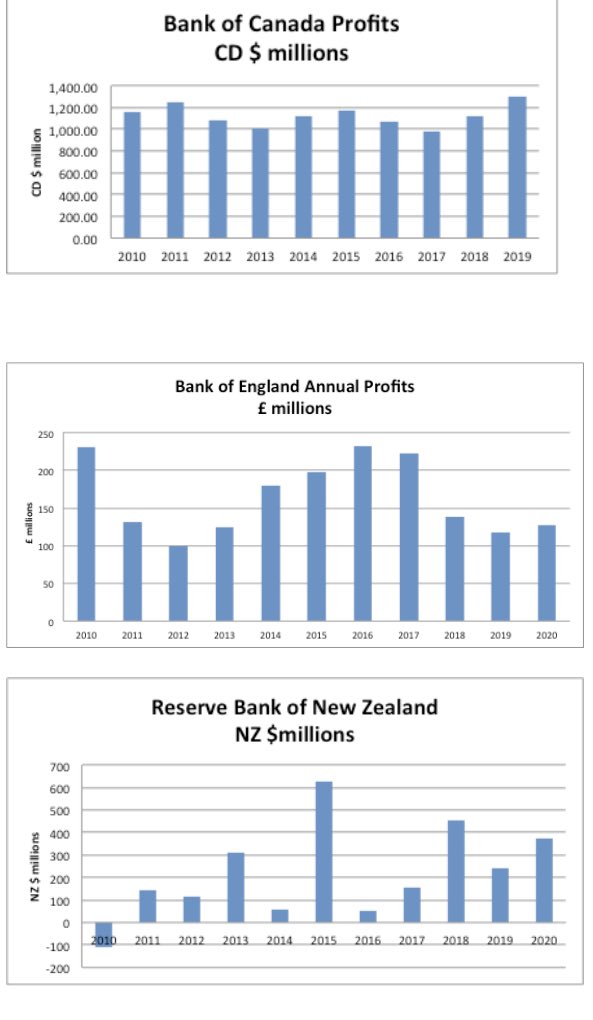

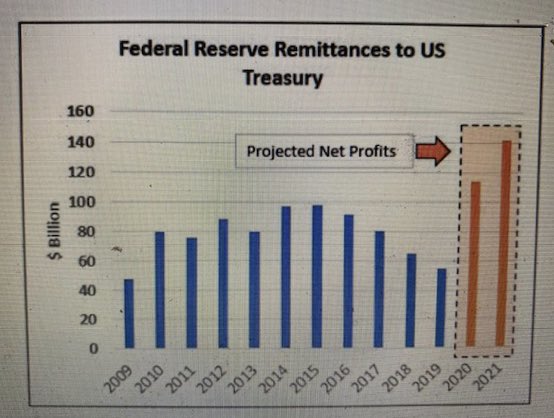

This is an international best standard practiced by the US, Canada, England, Australia, New Zealand and more.

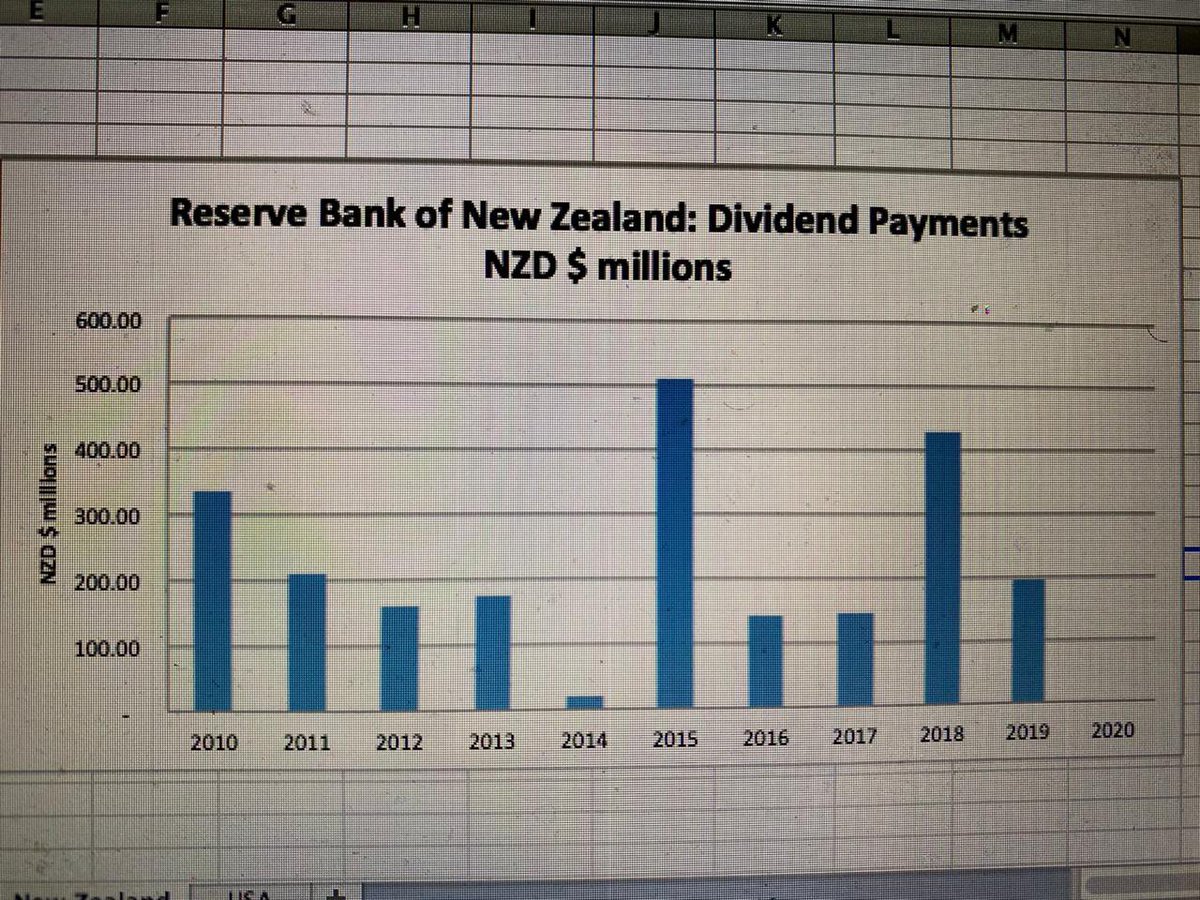

It’s also an international best standard for the central bank to pay dividends to the central government.

It’s also an international best standard for the central bank to pay dividends to the central government.

So, in a real sense, GOJ (and the taxpayers) are receiving a much needed dividend at a time when GOJ’s tax revenues were hit significantly.

This is the definition of reaping a good harvest from prudent policy.

In this case, this is prudent monetary policy.

This is the definition of reaping a good harvest from prudent policy.

In this case, this is prudent monetary policy.

For every year that BOJ used to defend the JMD, and subsequently post losses, we all (taxpayers) were robbed of those dividends.

This is another reason why I am such a strident supporter of the inflation targeting regime.

This is another reason why I am such a strident supporter of the inflation targeting regime.

I look forward to hearing the actual opening of the Budget debate in a few weeks, to see what that looks like.

But I was pleasantly surprised when I heard Dr. Clarke announce this in Parliament today that I felt compelled to explain it in a thread.

But I was pleasantly surprised when I heard Dr. Clarke announce this in Parliament today that I felt compelled to explain it in a thread.

Read on Twitter

Read on Twitter