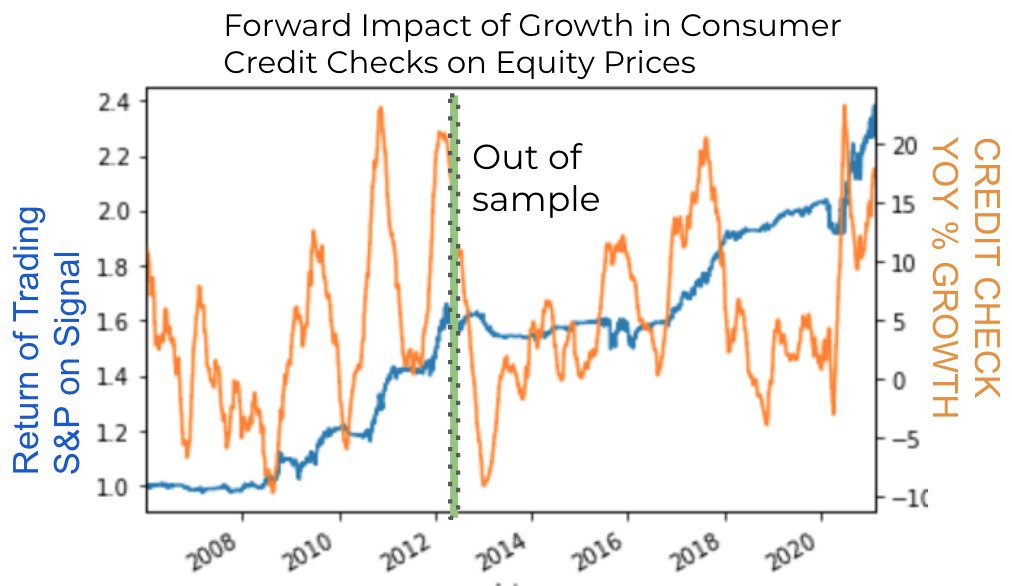

In 2012, I was tasked with using a large scale transaction database to find the forward leading behavior that would have predicted the 2008 crash and cohort level economic declines. The answer? "credit checks". This is key to understanding the bull case for stocks. Thread

1/ Analyzing transaction data for real time spend isn't useful because it gives you no time to prepare. The question was - what pulls back first *before* people stop spending? It turns out people get their credit checked before making big financial decisions (house, car etc)

2/ Not only is this true at a micro level - it's true at a macro level. Aggregating demand for non-recurring credit checks (Merchant Category Code 7321 for the rogue analysts out there) gives you a picture of expanding supply and demand side credit, which predicts the S&P 500.

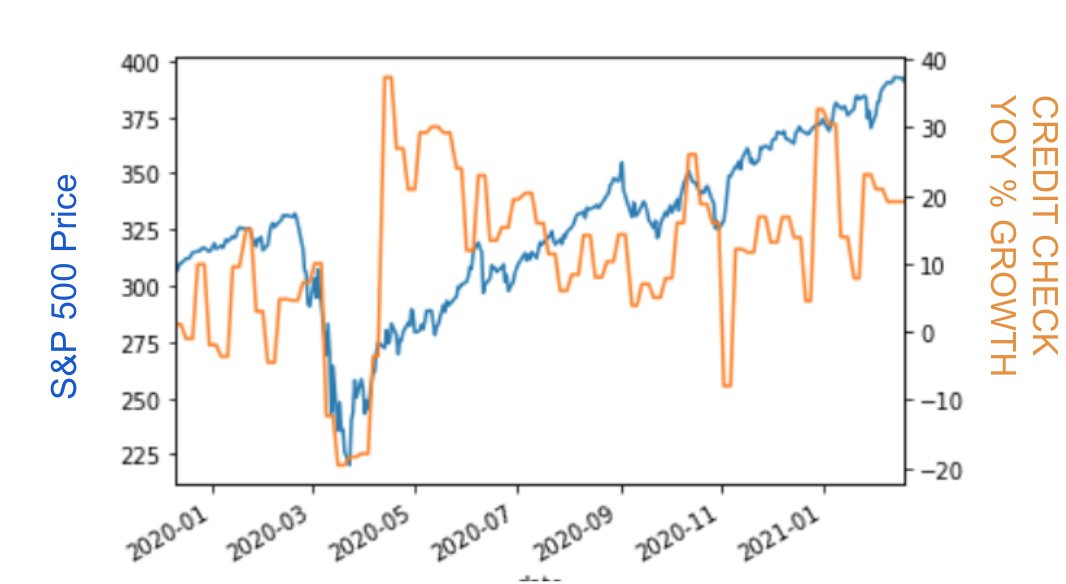

3/ The Covid crisis was much faster, but not fundamentally different Below you can see that the market declined along with consumer credit growth, and consumer credit growth went parabolic before the bulk of the recent equity rally. Right now interest in credit checks is +20%.

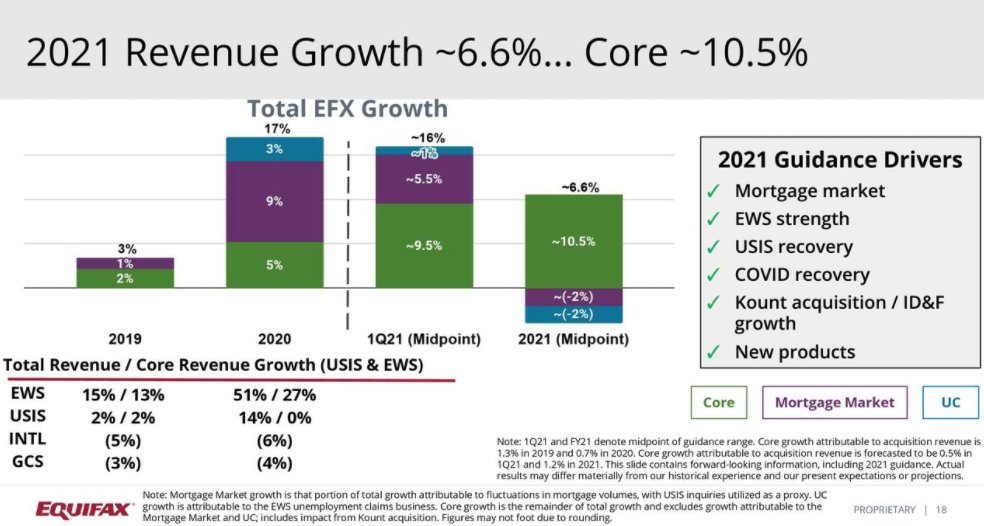

4/ As you might imagine, Equifax (credit reporting agency) guidance is a solid source for forward commentary on this indicator. Animal spirits growth in home equity values & resulting credit has caused raised 2021 midpoint guidance substantially vs both '20 and '19 growth rates

5/ The bears in the market are currently pointing to market structure and structural long term problems with the fed put. These might be valid criticisms, but a double digit credit check growth rate makes a high bar for saying the consumer won't be there & banks won't deliver

6/ One interpretation of the speculative mania in stocks is certainly dystopian - people are hopeless and gambling. Another interpretation is that they're feeling confident and have some money to bet on Gamestop call options. I can see either argument - lean towards the first.

7/ Yes - the sell off in the long bond concerns me but it hasn't come in tandem with EM, High Yield or IG funding problems of any magnitude. With consumer credit strong, that means there's a veritable monsoon of cash waiting to hit a reopened economy. Too obvious? Perhaps.

8/ I think the drop in stocks will come when inflationary pressure and "K Shaped recovery" concerns lead to the Fed's mandate becoming questioned. But that's a long term problem, and in the near term -- credit expansion rules. I prefer expressing short beta thru HY/EM credit / FX

Read on Twitter

Read on Twitter