1-A thread on today's press release from $GXU $GVXXF regarding their updated PFS and #uranium production. https://investingnews.com/news/uranium-investing/goviex-updates-madaouela-project-pre-feasibility-study-start-up-capital-and-operating-costs-reduced/

2-My preliminary view is that there are pieces of information included in this press release that are not well communicated. Let's start with the tons produced.

The 2015 PFS had Madouela producing 2690000 lbs on avg over 21 years, vs 2021 PFS at 2482500 over 20 years.

The 2015 PFS had Madouela producing 2690000 lbs on avg over 21 years, vs 2021 PFS at 2482500 over 20 years.

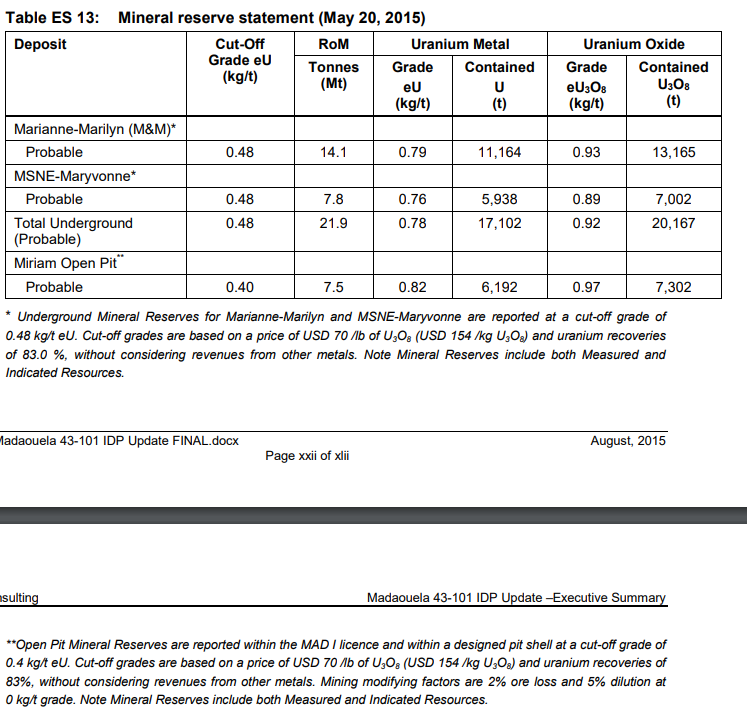

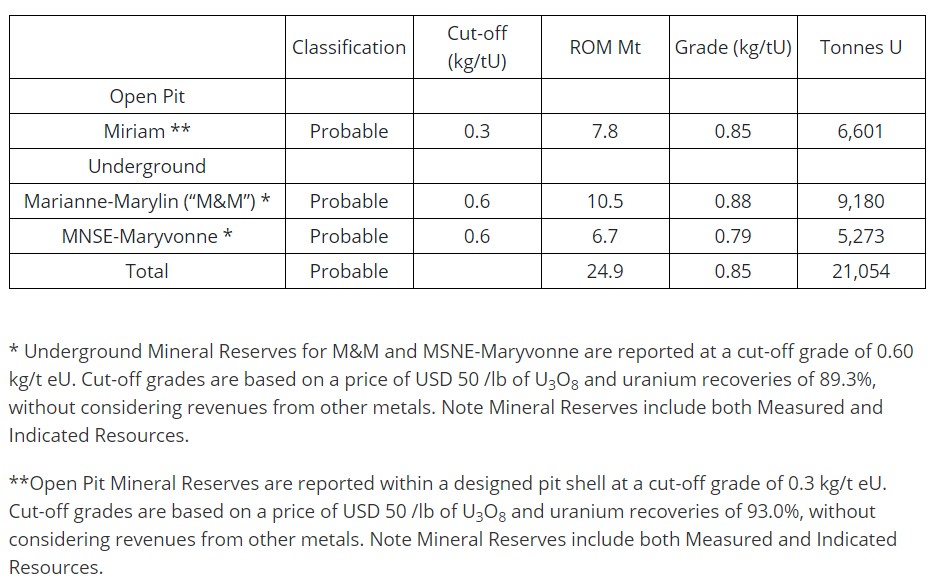

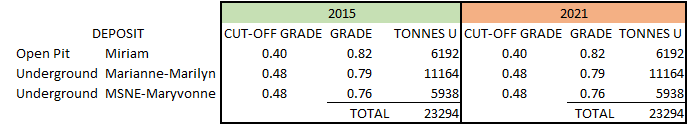

3-The net impact of this change is a reduction of 6.8 mm lbs over the mine's life. Before getting upset about this, you need to understand what caused this change. To reach that production #, the 2015 PFS valued the resource using a $70 #uranium price. The 2021 uses $50.

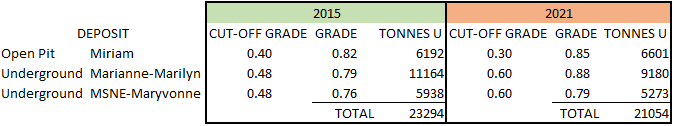

4-The key change between the two, is that by increasing the cut-off grade, $GXU #GVXXF can render the mine profitable at a much lower price of $55 (even $50), rather than the $70 of the 2015. I've summarized the changes to highlight the point.

5-The effect of this reduction of #uranium tons does not make for an apples to apples comparison between the 2015 and 2021 PFS. At $70/lb and using the lower grade, the current PFS would earn more than its predecessor.

6-The 2021 PFS has production cash costs of $22.18 US/lb, whereas the 2015 had it at $24.49 US/lb. Initial and sustaining capital is only slightly lower at $648 million US vs $676 million US previously.

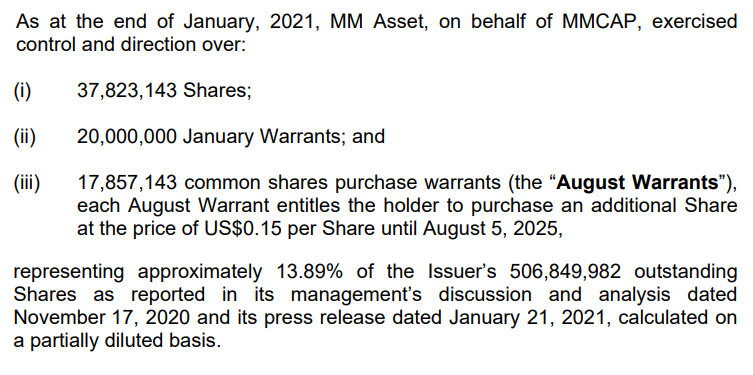

7-The 2015 PFS and related press release was silent on financing, whereas today's release is clear that "Under the Updated PFS, the open pit alone has the potential to service debt of USD 150-180 million at a #U3O8 price of USD 50-55 per pound". That is 1/2 the initial outlay.

8-There are two things that cannot be overlooked when building a mine. You need to be able to produce at a price that makes the mine competitive, and you need to limit the risk. The 2015 PFS used a $70 price and ablation technology, which was never used in a producing U mine.

9-The $55 U price does not make this the cheapest mine, but moves it down on the cost curve. Ideally though, it would make sense for them to start at $55 with customers and ladder the price up. The low NPV of $117 million should have been presented as a minimum, not a target.

10-I think the point $GXU $GVXFF was trying to make is that they believe that they now have a plan that they can present to bankers, at a price level that can attract customers, and gets them into production. At least that is what I interpreted.

Read on Twitter

Read on Twitter