Markets are still on razor’s edge here. But it is encouraging that volatility have migrated mostly towards FX. The likely scenario here is for the $ to absorb most of the ripple effects of the rates sell-off by giving a last tailwind to equities and EM portfolio flows

1/N

1/N

This could minimize volatility beyond OpEx (large expiration = will whipsaw). The market has been able to absorb not one, but two major unwinds in the last weeks. The L/S eq unwind following $GME and the rates vol shock. Yet, underneath the surface cracks are multiplying.

2/N

2/N

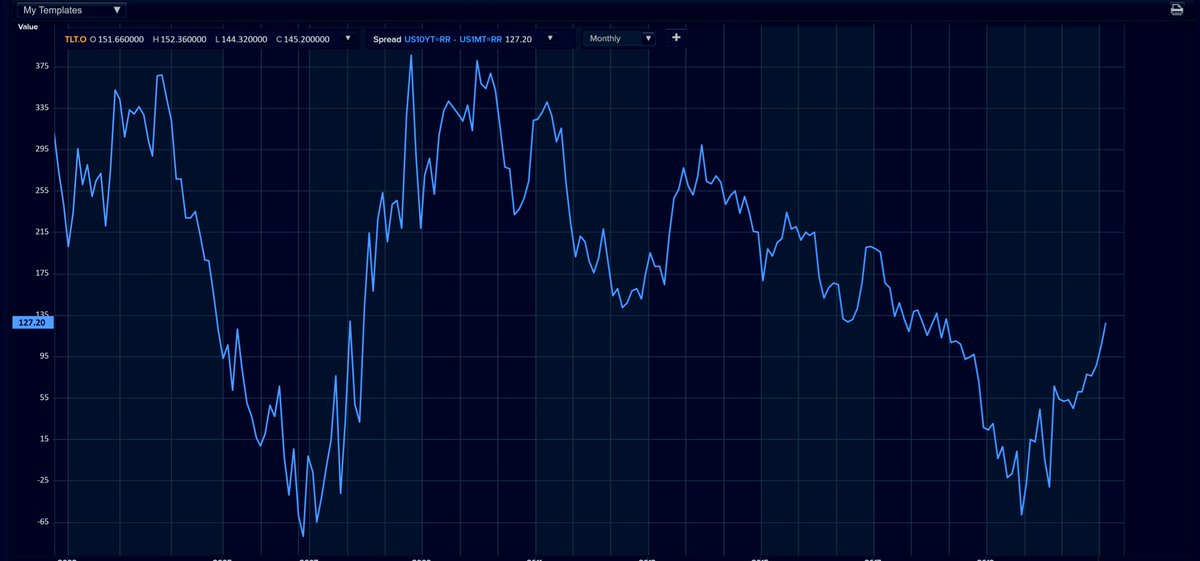

Now that rates have risen quickly, everyone is waking up to the fact that higher rates come with higher rates vol and spreads vol partly because of the increased convexity hedging needs. Global debt levels are nothing like 2013 (a good 70 $ tn. above)

3/N

3/N

And duration and credit risk are significantly higher. As an example, ICE BoA World Sovereign Bond Index saw its duration move up from 6,5 to 8,5 years over that period. So the system is very levered and deeply short convexity (and well aware of it., hence yesterday’s move)

4/N

4/N

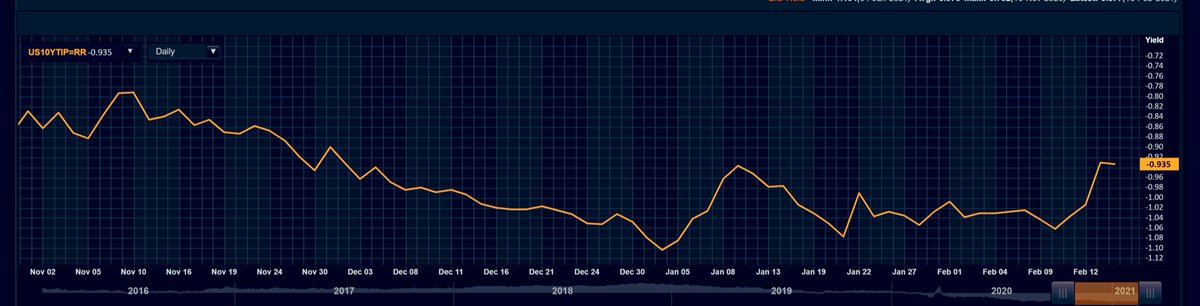

While swap spreads relaxed a bit, Reals started moving up after a tense 30y TIPs auction. For now, am not particularly alarmed by the move in reals, especially that the Inflation Swap curve remains well supported but should it accelerate, it will feed into cross-assets vol

5/N

5/N

While none of the momentum equity names have broken down yet, lots of cracks are piling up. A- a large chunk of single name gamma will expire on OpEX (OI had bullish skew). B- the last 2 months saw a breakdown of Nasdaq relative to commodities, a rollover in $NDX momentum

6/N

6/N

Read on Twitter

Read on Twitter