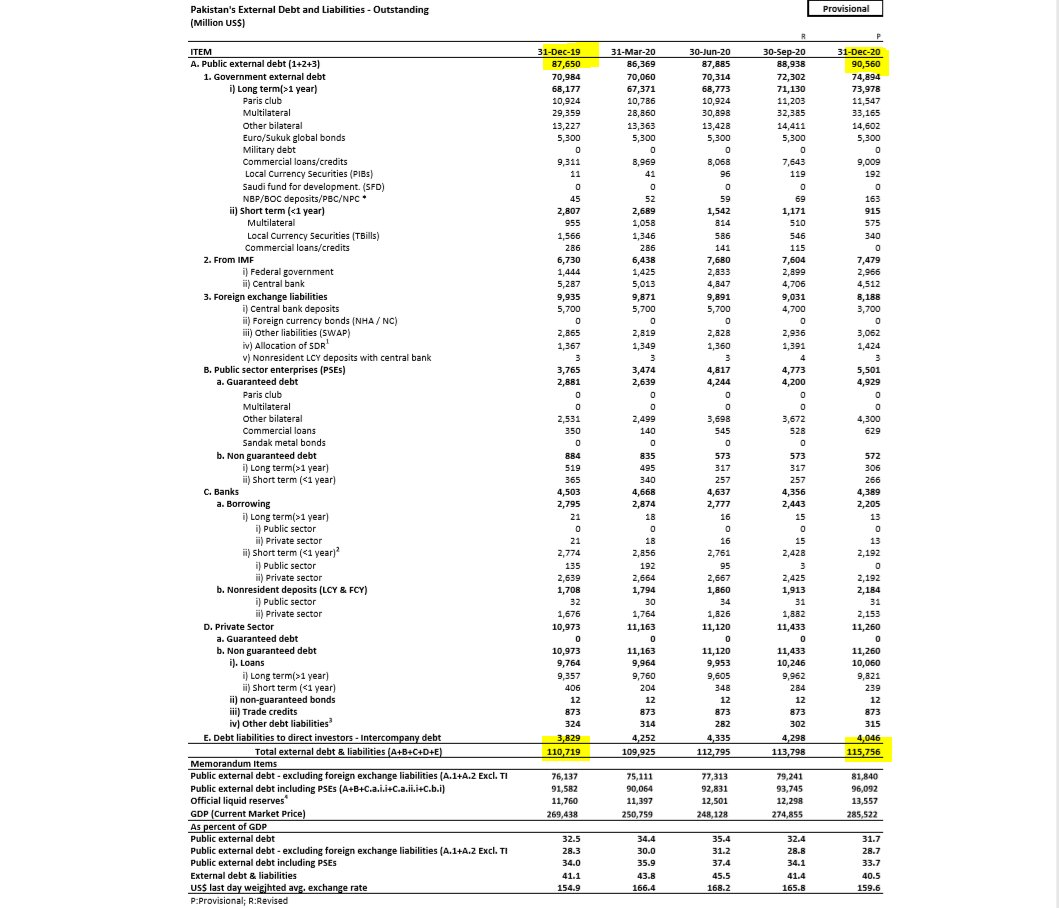

SBP recently released the numbers for External Debt. Here is what they show:

The increase of $2.91 bn in Public External Debt in CY2020 is the lowest increase since CY2014 ($2.724 bn) in absolute terms and the lowest in % terms (3.32%) since CY2013 (-6.12%).

The increase of $2.91 bn in Public External Debt in CY2020 is the lowest increase since CY2014 ($2.724 bn) in absolute terms and the lowest in % terms (3.32%) since CY2013 (-6.12%).

Similarly, the Total External Debt and Liabilities increased by $5.037 bn in CY2020 which is the lowest absolute increase since CY2015 ($4.333 bn) and the lowest in % terms (4.55%) since CY2013 (-4.51%).

Overall, Public External Debt has increased by $15.203 bn or 20.17% from Jun-18 to Dec-20. In comparison, it had increased by $18.372 bn or 32.24% from Dec-15 to Jun-18, the equivalent time period preceding it.

Hence, Public External Debt accumulation slowed down by $3.169 bn in

Hence, Public External Debt accumulation slowed down by $3.169 bn in

absolute terms while the pace of accumulation in % terms was 37.4% less.

Overall, throughout the 5 years from Jun-13 to Jun-18 which roughly corresponds to PMLN's tenure, the Public External Debt increased by $24.112 bn or 47.05%.

Overall, throughout the 5 years from Jun-13 to Jun-18 which roughly corresponds to PMLN's tenure, the Public External Debt increased by $24.112 bn or 47.05%.

That's an annualized increase of 8.02% under PMLN (mostly concentrated in the last 2.5 years when CAD was high).

PTI, despite having to borrow more at the start thanks to the inherited high CAD, restricted the annualized increase to 7.63%.

PTI, despite having to borrow more at the start thanks to the inherited high CAD, restricted the annualized increase to 7.63%.

Looking at the Total External Debt & Liabilities over 5 years of PMLN from Jun-13 to Jun-18, the increase was $34.338 bn or 56.39%. That's an annualized increase of 9.36%.

Under PTI, the increase in EDL over 2.5 years from Jun-18 to Dec-20 has been $20.519 bn or 21.55%.

Under PTI, the increase in EDL over 2.5 years from Jun-18 to Dec-20 has been $20.519 bn or 21.55%.

That's an annualized increase of 8.12%, again less than PMLN's annualized increase over their entire tenure.

These numbers conclusively show that the external debt management has been significantly better under PTI so far as compared to PMLN.

These numbers conclusively show that the external debt management has been significantly better under PTI so far as compared to PMLN.

Read on Twitter

Read on Twitter