1- Options & Earnings - A new thread!

Every option rises in price in anticipation of earnings. This is related to the increase of anticipated volatility (yo vega, she's back).

#fintwit #mintwit $option $AG #option #optiontrades

Every option rises in price in anticipation of earnings. This is related to the increase of anticipated volatility (yo vega, she's back).

#fintwit #mintwit $option $AG #option #optiontrades

2 - But why?

Actually it's simple: earnings are a casino event for the stonk. Nobody knows what will happen, will the stonk crash or rise? Earnings are thus binary, it's a yay or a nay (UK ref. for you @BuyingMyFreedom). Movements post earnings are stronger as well.

Actually it's simple: earnings are a casino event for the stonk. Nobody knows what will happen, will the stonk crash or rise? Earnings are thus binary, it's a yay or a nay (UK ref. for you @BuyingMyFreedom). Movements post earnings are stronger as well.

3 - Here comes Mr. Market Maker. Mr. MM knows this, and they want more money for these call/put options, since they have to secure themselves against more risk.

Makes sense, in classic markets, I sold options on my underlying stonk for premium ( #coveredcall).

Makes sense, in classic markets, I sold options on my underlying stonk for premium ( #coveredcall).

4 - But now let's have a look at the data, illustratively I've used the $AG stonk. Because I love her, she's fab.

Note: I'm bullish on $AG earnings and anticipate a beat, calls are thus a good way to play this, but calls (and poets) will be expensive because of these earnings

Note: I'm bullish on $AG earnings and anticipate a beat, calls are thus a good way to play this, but calls (and poets) will be expensive because of these earnings

5 - Volatility associated with AG, as you can see: two huge bumps:

- March crash

- #silversqueeze

Options are rather expensive now due to the high vega component and it will take a while for that to go away.

Important note: in an agressive bullmarket, vega will never cool down.

- March crash

- #silversqueeze

Options are rather expensive now due to the high vega component and it will take a while for that to go away.

Important note: in an agressive bullmarket, vega will never cool down.

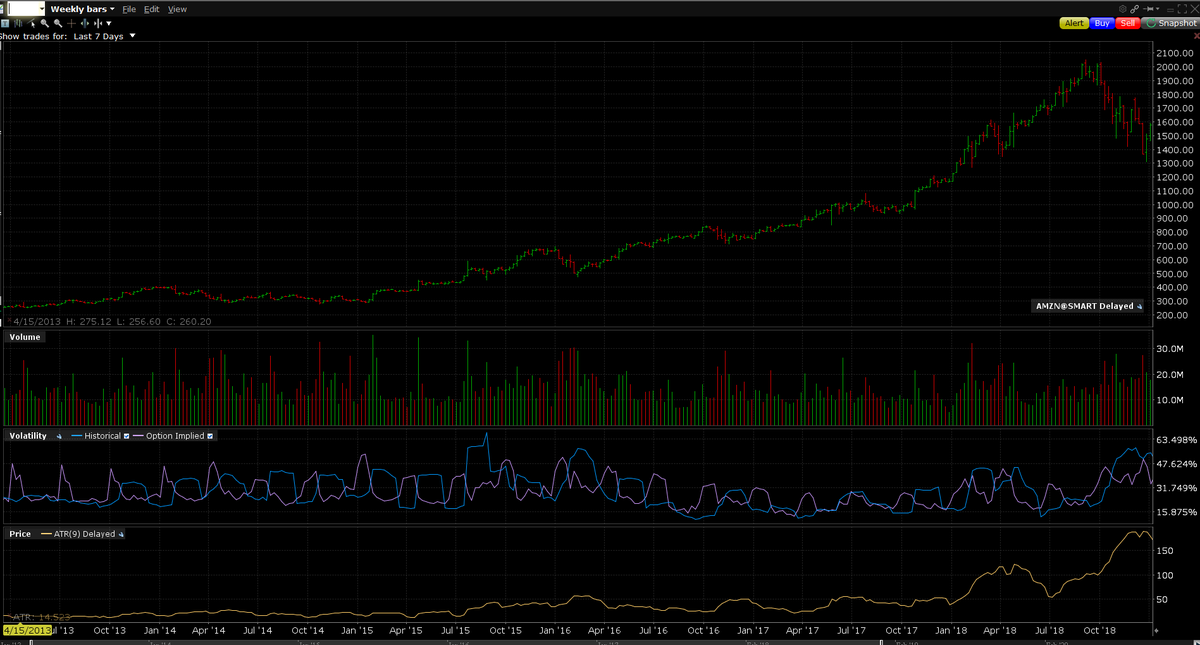

6 - Since these two bumps are an exceptional event, they bias my volatility axis (and i cant change that one). So to illustrate the effect of #earnings I'm gonna zoom in on 2017-2019.

I agree, it's not as clear as regular stocks (next tweet), but that's special to miners

I agree, it's not as clear as regular stocks (next tweet), but that's special to miners

7 - You can thus see Implied volatility rising near earnings, making vega rise up and thus increase the premium you pay for you option.

As a better example: $AMZN earnings are really like a heart beat regarding volatility and thus option premium.

As a better example: $AMZN earnings are really like a heart beat regarding volatility and thus option premium.

8 - That concludes this small informative thread. Just to highlight an option trade doesn't really fancy buying options near earnings (since you'll stonk will have to outperfom, if it does the opposite of what you'd expect or if it stays neutral, you'll lose).

9 - Earnings thus means that premiums will be bloated and are typically the moment when I'm selling options to the market (never fight the market makers, join them).

#fintwit #mintwit #option #optiontrades $ag $option

#fintwit #mintwit #option #optiontrades $ag $option

Read on Twitter

Read on Twitter