There's been a lot of chatter at Morningstar about @ARKInvest's massive asset flows and potential portfolio risks.

After a quiet beginning in 2014, #ARK Innovation ETF ARKK started gaining more attention after its 87% runup in 2017 and portfolio manager @CathieDWood's bullish call on @Tesla in 2018.

The portfolio contained only 48 holdings as of 12/31, with roughly half of its assets concentrated in the top 10 holdings.

The top holding is @Tesla, which made up about 11% of assets as of 12/31. The fund also allocates about 20% of assets to #international #stocks, including @MaterialiseNV @CRISPRTX and @Shopify.

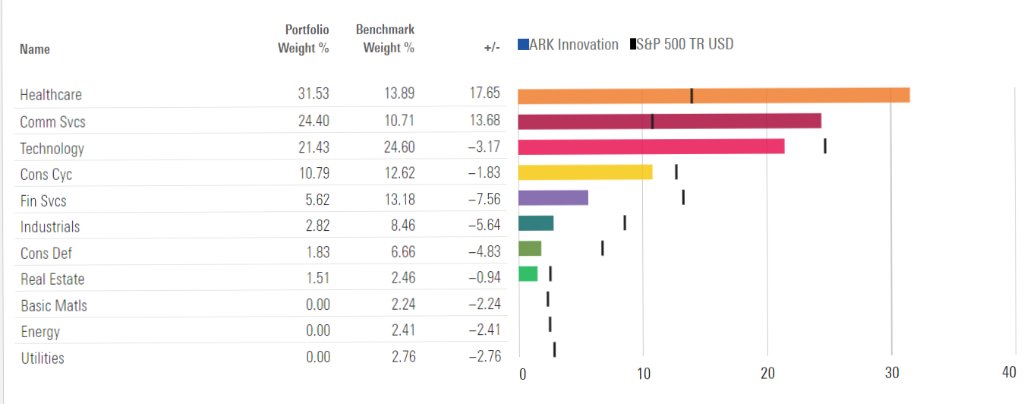

Only 3% of the fund’s portfolio replicates stocks held in the #SP500. And instead of loading up on #technology stocks like most growth-driven managers, @CathieDWood has overweighted healthcare and communications services #stocks.

I used Morningstar's Global Risk Model to analyze the underlying characteristics of ARK Innovation's portfolio holdings. Here is what I found. http://spr.ly/6018HijAw

Read on Twitter

Read on Twitter