1/ I think about this a lot

-7% of stocks provide ALL of total index returns

-60-70% of stocks underperform the index. Very few winners make up for the many losers

-40% of stocks provide negative absolute returns. Nearly half of stocks lose initial capital, ie worse than cash

-7% of stocks provide ALL of total index returns

-60-70% of stocks underperform the index. Very few winners make up for the many losers

-40% of stocks provide negative absolute returns. Nearly half of stocks lose initial capital, ie worse than cash

2/ Results are consistent across industries. Tech & Cons Discr have higher loss rates; Cons Staples & Utilities have lower loss rates

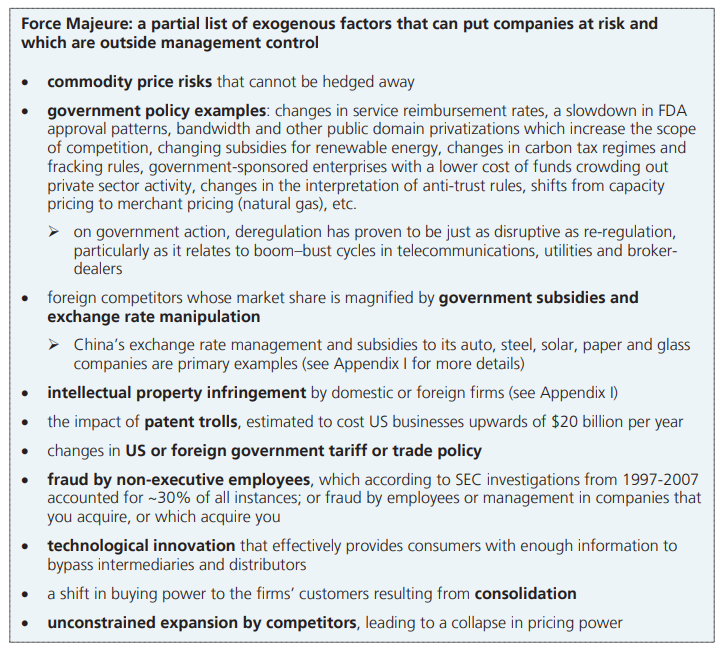

Failure occurred for various reasons. Many companies suffered due to factors outside mgt control: exogenous factors. Below lists some reasons

Failure occurred for various reasons. Many companies suffered due to factors outside mgt control: exogenous factors. Below lists some reasons

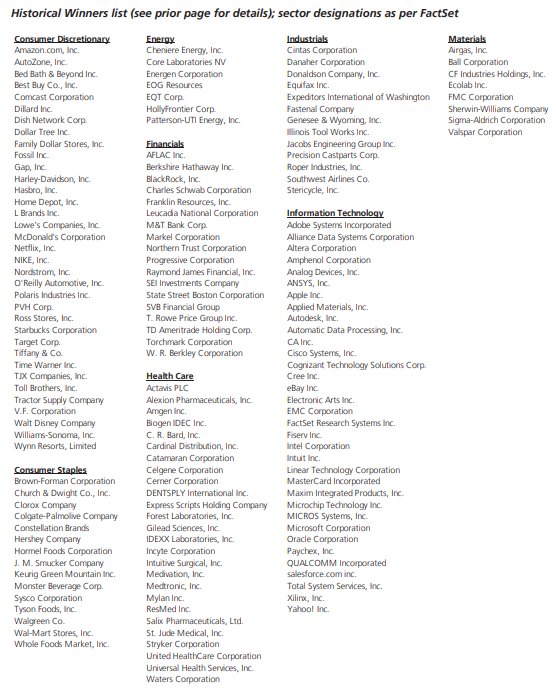

3/ Here is a list of some of the token few winners from the 2014 report. Interesting to see which companies continued to perform well and others that underperformed or were disrupted.

4/ Over the 7000 IPOS since 1980, results do not point to consistently outsized post-IPO performance when compared to diversified equity mkt alternatives.

5/ Here is the 2014 JP Morgan Report analyzing public stock performance between 1980-2014. It provides case studies of catastrophic losses by industry.

https://privatebank.jpmorgan.com/content/dam/jpm-wm-aem/global/pb/en/insights/eye-on-the-market/eotm-the-agony-and-the-ecstasy.pdf

https://privatebank.jpmorgan.com/content/dam/jpm-wm-aem/global/pb/en/insights/eye-on-the-market/eotm-the-agony-and-the-ecstasy.pdf

6/ Important 4 every public stock investor to study past failures, successes & past results to frame expectations for the future

For every investment I like to step back & remember there're VERY FEW big winners. Is this investment a rare winner & why isnt it 1 of the many losers

For every investment I like to step back & remember there're VERY FEW big winners. Is this investment a rare winner & why isnt it 1 of the many losers

Read on Twitter

Read on Twitter