Just released a podcast w/ the CEO of @RebelFoods1, the OG ghost kitchen pioneer of India. The Sequoia-backed company started as a QSR chain w/ 73% of customers having never visited a store. Today it is a machine w/ 3x LTV:CAC and 70% gross margins. 1/

https://anchor.fm/thefeedglobal/episodes/011--The-original-cloud-kitchen-with-Jaydeep-Barman-of-Rebel-Foods-eqjclv

https://anchor.fm/thefeedglobal/episodes/011--The-original-cloud-kitchen-with-Jaydeep-Barman-of-Rebel-Foods-eqjclv

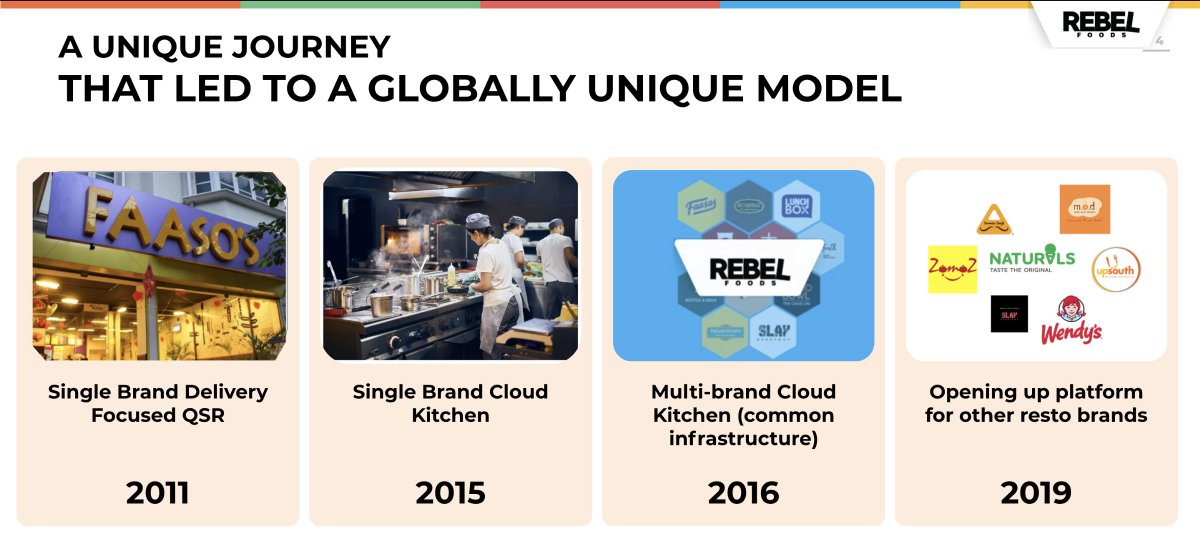

Rebel began a decade ago as Faasos, a QSR Biryani concept that saw 75% of its sales go to delivery. In 2014, the chain was facing headwinds as India's rent/sales ratio is the highest in the world. It started closing locations in favor of ghost kitchens for 1/4 of the cost. 2/

It realized that it could launch more brands from the same kitchen, leveraging the same fixed costs. It built a full-stack operating platform for automating everything from ingredient prep to the actual cooking of its own brands. Rent as a % of sales plummeted to 2% of sales. 3/

It also built Ordermark-like tech that aggregated demand from everything from payment apps to 3rd-party delivery. Rebel also built skins to build custom websites/apps for each of its brands. In most cases it handles the delivery with its own fleet, paying less to 3rd parties. 4/

Amidst the pandemic, the company realized it could further open its platform to other brands like Wendy's and has now onboarded over 15 external franchises onto its network of 320 kitchens in 35 cities. The company plans to get to 500 kitchens in the next 24 months. 5/

Today, DoorDash and Postmates are copying this model albeit a good seven years later. Rebel is armed with over $340mm in funding and counts @CloudKitchens' parent as an investor.

To join in on conversations like these, sign up for the HNGRY newsletter: https://hngry.tv/trends

To join in on conversations like these, sign up for the HNGRY newsletter: https://hngry.tv/trends

Read on Twitter

Read on Twitter