Great investment skew often looks like:

"Value Downside + Venture Upside".

Often, these have a declining high-quality Legacy business (Value) obscuring an emerging Future business (Venture).

1/n

"Value Downside + Venture Upside".

Often, these have a declining high-quality Legacy business (Value) obscuring an emerging Future business (Venture).

1/n

These transitions have 3 Phases:

1) Decline: for a period, the net result is decline, as Legacy shrinks faster than Future grows

2) Flat: Legacy's shrinkage & Future's growth net to near zero

3) Grow: Future begins to outstrip Legacy, revealing itself more fully

2/n

1) Decline: for a period, the net result is decline, as Legacy shrinks faster than Future grows

2) Flat: Legacy's shrinkage & Future's growth net to near zero

3) Grow: Future begins to outstrip Legacy, revealing itself more fully

2/n

If the transition is real, each of those phases offers meaningful real return, moving from potentially explosive returns early, to longer-term compounding.

Generally, risk lowers as you migrate through.

3/n

Generally, risk lowers as you migrate through.

3/n

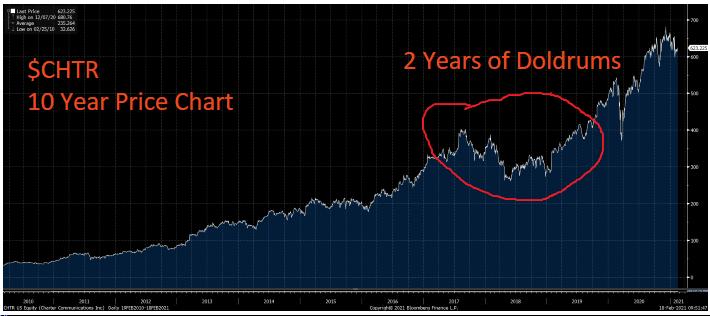

The transition is rarely smooth. Doubt & lack of patience can hit for extended windows.

Likewise, the stock occasionally gets ahead of business reality, causing periods of doldrums.

4/n

Likewise, the stock occasionally gets ahead of business reality, causing periods of doldrums.

4/n

I call Phase 2 the Swimming Duck phase: stillness at the surface, but furious action beneath.

In this phase, there is a de-risking, because the Future business starts to show signs of "inevitable".

5/n

In this phase, there is a de-risking, because the Future business starts to show signs of "inevitable".

5/n

I love Swimming Ducks - TotalCo is not yet growing on net (& often still trades at a value multiple), but the Future business has become quite real. It may only be 20%-40% of the total pie, but it's growing rapidly, ideally with a better economic profile than Legacy.

6/n

6/n

Example 1:

US Cable is in Phase 3 now, with broadband as the Future, already dominating. Broadband has a LONG remaining runway, while video & wired phones shrink.

$CHTR is a 10x over nine years (20x trough to peak), but you would have experienced long periods of doldrums.

7/n

US Cable is in Phase 3 now, with broadband as the Future, already dominating. Broadband has a LONG remaining runway, while video & wired phones shrink.

$CHTR is a 10x over nine years (20x trough to peak), but you would have experienced long periods of doldrums.

7/n

Example 2:

MoneyGram ($MGI) may be in Phase 2. Perhaps it's even better, because its Legacy may not decline for some time and its digital TAM is massive. It's still proving itself out.

[These are not advice; just thoughts]

8/n

MoneyGram ($MGI) may be in Phase 2. Perhaps it's even better, because its Legacy may not decline for some time and its digital TAM is massive. It's still proving itself out.

[These are not advice; just thoughts]

8/n

I'm always hunting for:

Phase 1s to put on my watchlist;

Phase 2s to go deep on;

Phase 3s are for riding.

If you think of any companies that are in this Legacy-to-Future transition, let me know what you think and why they fit.

Thanks!

[end]

Phase 1s to put on my watchlist;

Phase 2s to go deep on;

Phase 3s are for riding.

If you think of any companies that are in this Legacy-to-Future transition, let me know what you think and why they fit.

Thanks!

[end]

Read on Twitter

Read on Twitter