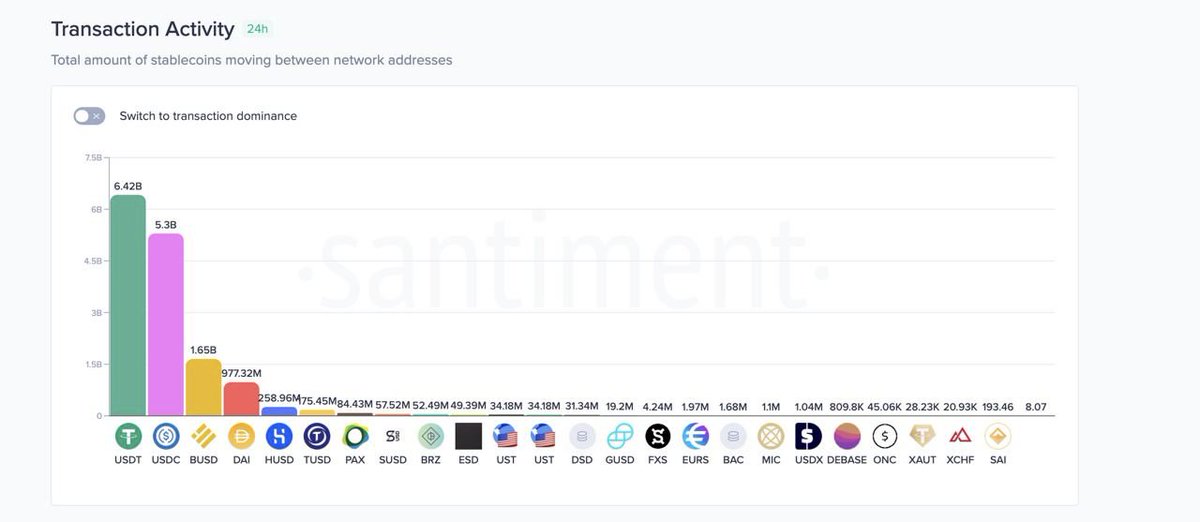

Thread of random power-laws emerging in DeFi

I am mixing up ideas behind pareto principal and power laws in compiling these charts. The core idea is that ~20% of players tend to dominate 80% of a market's share over time. Could skew further

Good read on the matter: https://fs.blog/2017/11/power-laws/

Good read on the matter: https://fs.blog/2017/11/power-laws/

2/9

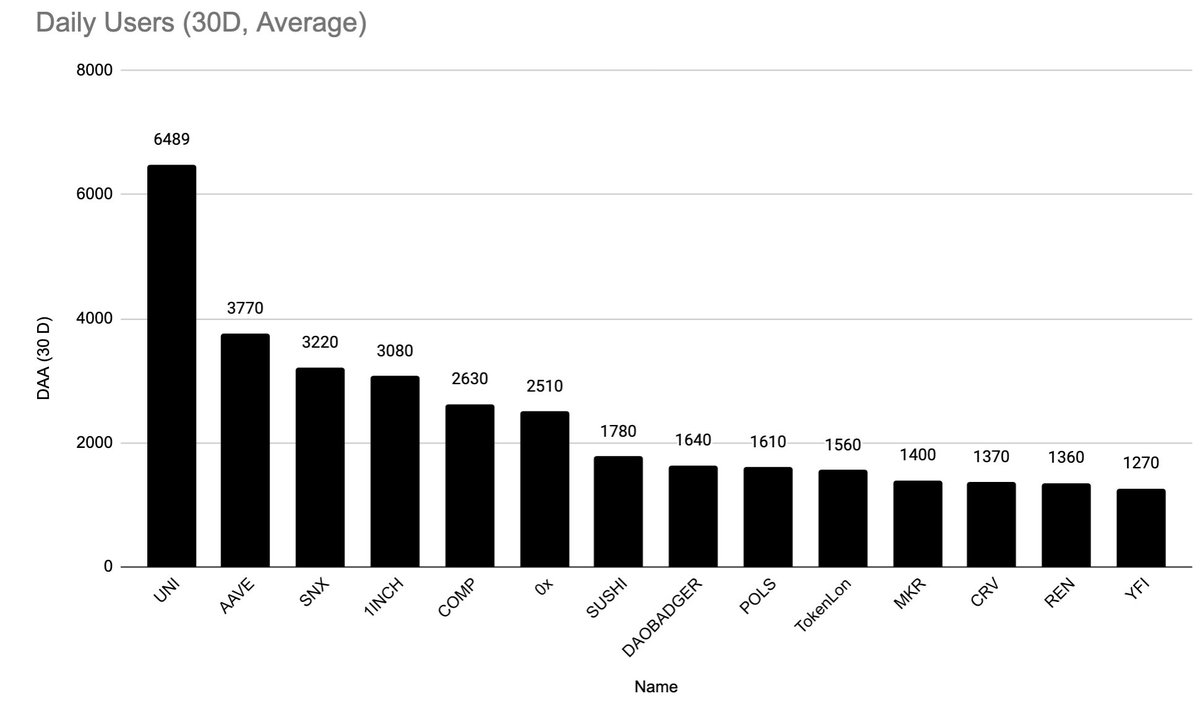

This chart explaining total value locked in decentralised exchanges. Courtesy of @tokenterminal

Likely skewed due to liquidity mining rewards

This chart explaining total value locked in decentralised exchanges. Courtesy of @tokenterminal

Likely skewed due to liquidity mining rewards

4/9

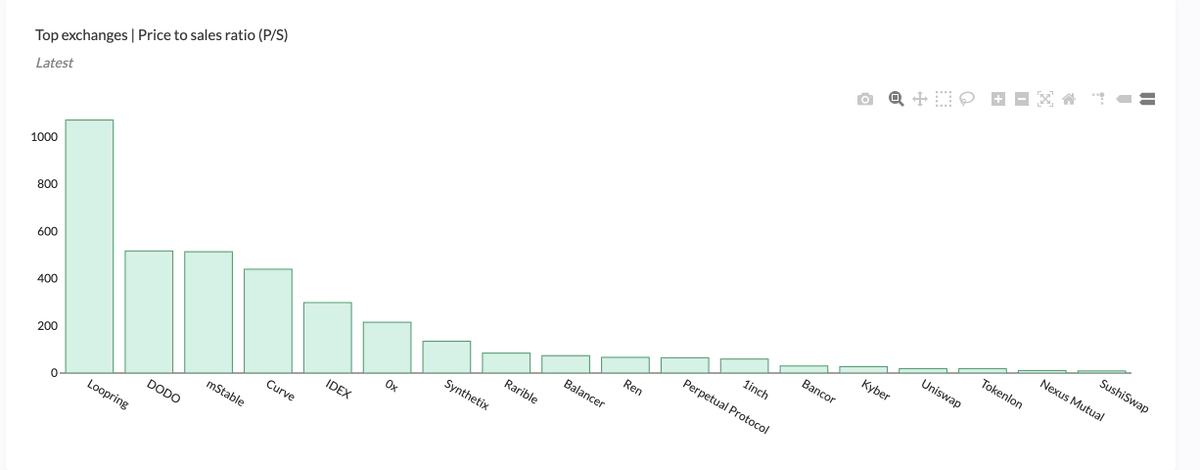

Price to sales ratio compares how exchanges are valued in relation to their revenue. So you want to be on the low end of the spectrum here ideally.

(token terminal is quite cool)

Price to sales ratio compares how exchanges are valued in relation to their revenue. So you want to be on the low end of the spectrum here ideally.

(token terminal is quite cool)

(5/9)

This chart showing distribution of staking rewards on synthetix ( $snx ) - courtesy of @nansen_ai - i exported the data and remade the chart

This chart showing distribution of staking rewards on synthetix ( $snx ) - courtesy of @nansen_ai - i exported the data and remade the chart

(6/9)

Top recipients of $YFI tokens from early farmers according to Nansen along with their balances.

Top recipients of $YFI tokens from early farmers according to Nansen along with their balances.

(7/9)

You can see the same pattern if you check the top recipients of $comp token farming. Quite fascinating tbh

You can see the same pattern if you check the top recipients of $comp token farming. Quite fascinating tbh

(8/9)

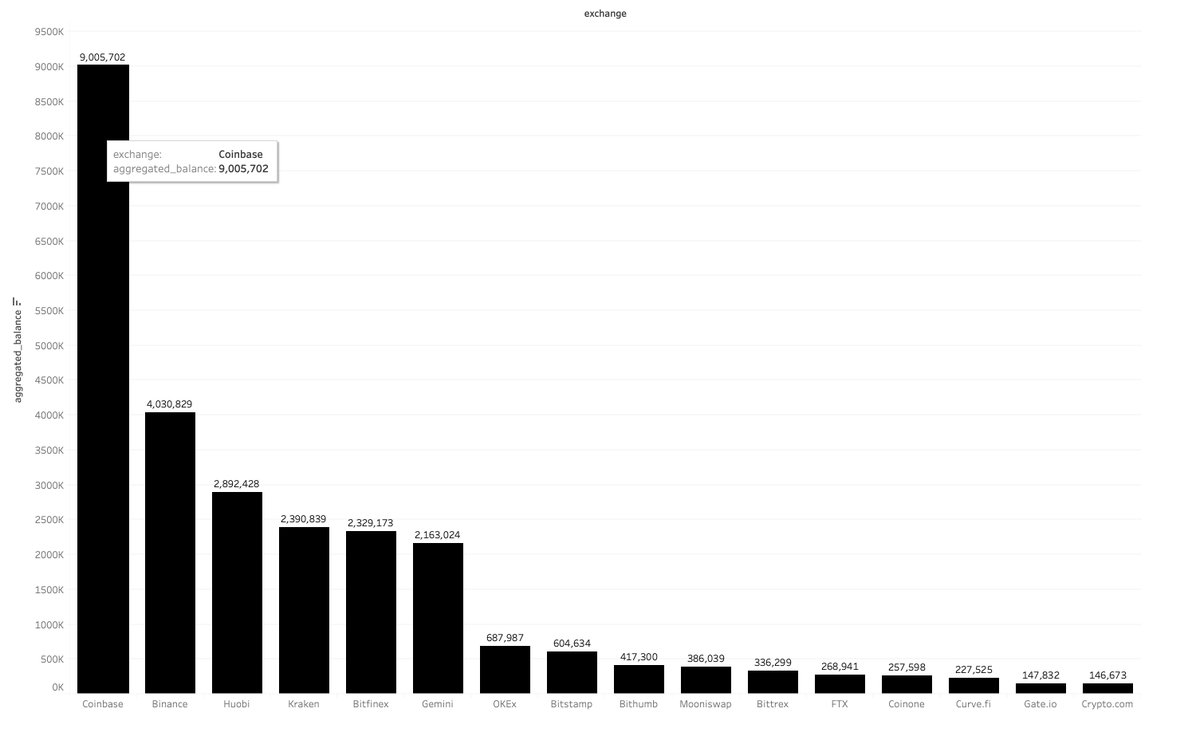

Okay - moving away from farmers and dex. We take a look at ETH balance on exchanges. This is a snapshot of the largest ETH balances on exchanges

Similar patterns will emerge if you check for btc balance, volumes and likely even users.

Okay - moving away from farmers and dex. We take a look at ETH balance on exchanges. This is a snapshot of the largest ETH balances on exchanges

Similar patterns will emerge if you check for btc balance, volumes and likely even users.

Power laws are everywhere and lay the basis for most of venture capital investments. Here are some good reads to learn more about how they affect RoI

1. https://marginalfutility.substack.com/p/the-power-law-in-venture-capital

2. https://michaeltefula.com/what-drives-power-laws/

3. https://angel.co/blog/what-angellist-data-says-about-power-law-returns-in-venture-capital

1. https://marginalfutility.substack.com/p/the-power-law-in-venture-capital

2. https://michaeltefula.com/what-drives-power-laws/

3. https://angel.co/blog/what-angellist-data-says-about-power-law-returns-in-venture-capital

Personally most fascinated by the role high connectivity nodes play in finance/trade. Read the last chapters of Square and the tower for more on that.

Read on Twitter

Read on Twitter