The Starmer economic speech is important moment for macro policy...

With new administration in US “going big” on fiscal stimulus, borrowing rates remaining super-low - Opposition could choose to lean further in same direction, marking break with post financial crisis...

With new administration in US “going big” on fiscal stimulus, borrowing rates remaining super-low - Opposition could choose to lean further in same direction, marking break with post financial crisis...

Govt clearly already has “gone big” in past 12 months in terms of COVID rescue, but there will be an inevitable debate within Govt about just how quickly to apply the breaks to borrowing in rest of Parliament. Treasury argues existing infrastructure plans already were going “big”

So does Starmer “go bigger” than Govt, given significant G7 reflation efforts? Even with no election for years, such argument would affect dynamics of Downing St debate and in turn on length of toleration of high deficits, and so timing of tax rises, end of support policies etc..

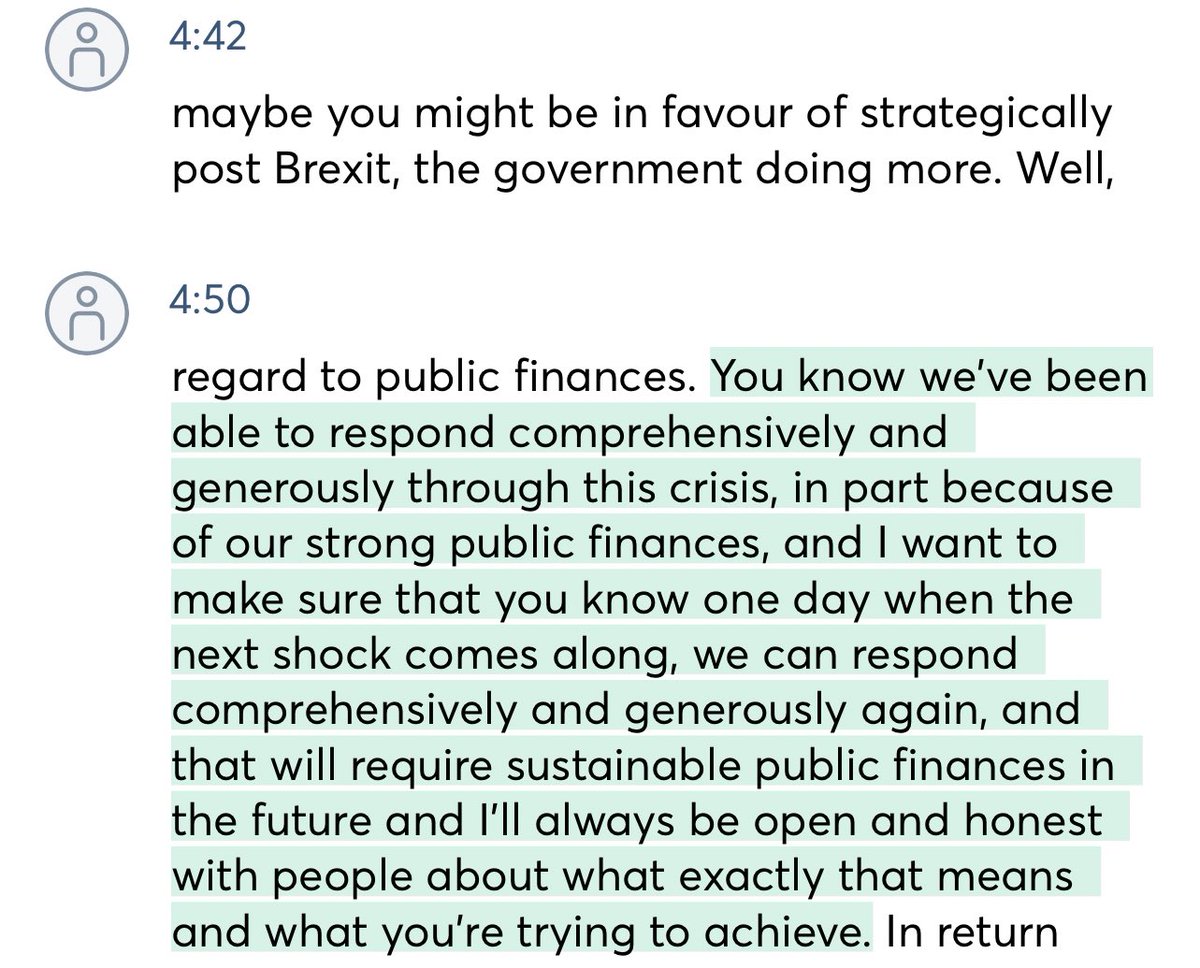

I asked the Chancellor on Friday directly whether the experience of COVID rescue and vaccine success made him a new fan of big spending and government... yielded this interesting response on at Budget being “open and honest” about need for sustainable public finances...

My interpretation of what Chancellor told me is Budget will make argument that tough choices required for “future”& Government believes public broadly accepts. But eg tax rise mostly deferred & it will principally be a crisis rescue and recovery statement https://www.bbc.co.uk/news/business-56039108

Starmer says public finances need to be brought to sustainability over medium to long term not short term - “no time for a second wave of austerity” or “tax rises on businesses or families”...

Starmer says he would introduce a “British Recovery Bond” where millions of savers could get a stake in Britain’s future...

Basic argument - now is not the time for tax rises, even on business, don’t raise more taxes on the public, borrow from their excess savings instead...public finances can be dealt with medium-long term.

Creates a baseline to oppose imminent tax moves, and rollbacks of support...

Creates a baseline to oppose imminent tax moves, and rollbacks of support...

... but nor did he directly call for a massive stimulus package, a la Biden/ Yellen... Government itself says public knows that there will be tax implications to the rescue spending of last year, and that privately can’t compare UK freedom to borrow with US and dollar/ Fed

Treasury would also point to Government plans for “green gilts” - although these are meant for institutional sale, as I understand. Would there be a retail market for this?

Read on Twitter

Read on Twitter