. @RameshPonnuru and I make the case to actually embrace some 'catch-up' inflation this year as it is needed to restore the dollar size of the economy to its pre-pandemic trend path. (1/n) https://www.nytimes.com/2021/02/17/opinion/inflation-federal-reserve.html?smid=tw-share

Put differently, our argument amounts to closing the NGDP Gap. https://www.mercatus.org/publications/monetary-policy/measuring-monetary-policy-ngdp-gap This is not as trivial as some on here make it out to be. (2/n)

Yes, there should be some automatic bounce back as the virus recedes, but as @IvanWerning ( https://economics.mit.edu/files/19351 ), @alpsimsek_econ ( https://www.dropbox.com/s/dg5lv6kqnckb71h/covidDemandAmplification_public.pdf?dl=0), M.Woodford ( https://www.nber.org/papers/w27768 ), etc. show there's no such thing as a clean supply shock. AD is damaged too(3/n)

Consequently, we need the Fed to do no harm and allow 'make-up' nominal income growth to emerge. So far the Fed has signaled it will do so. But warnings by inflation hawks make this task harder. Hence, our call to the Fed to stay the course with 'catch-up' monetary policy. (4/n)

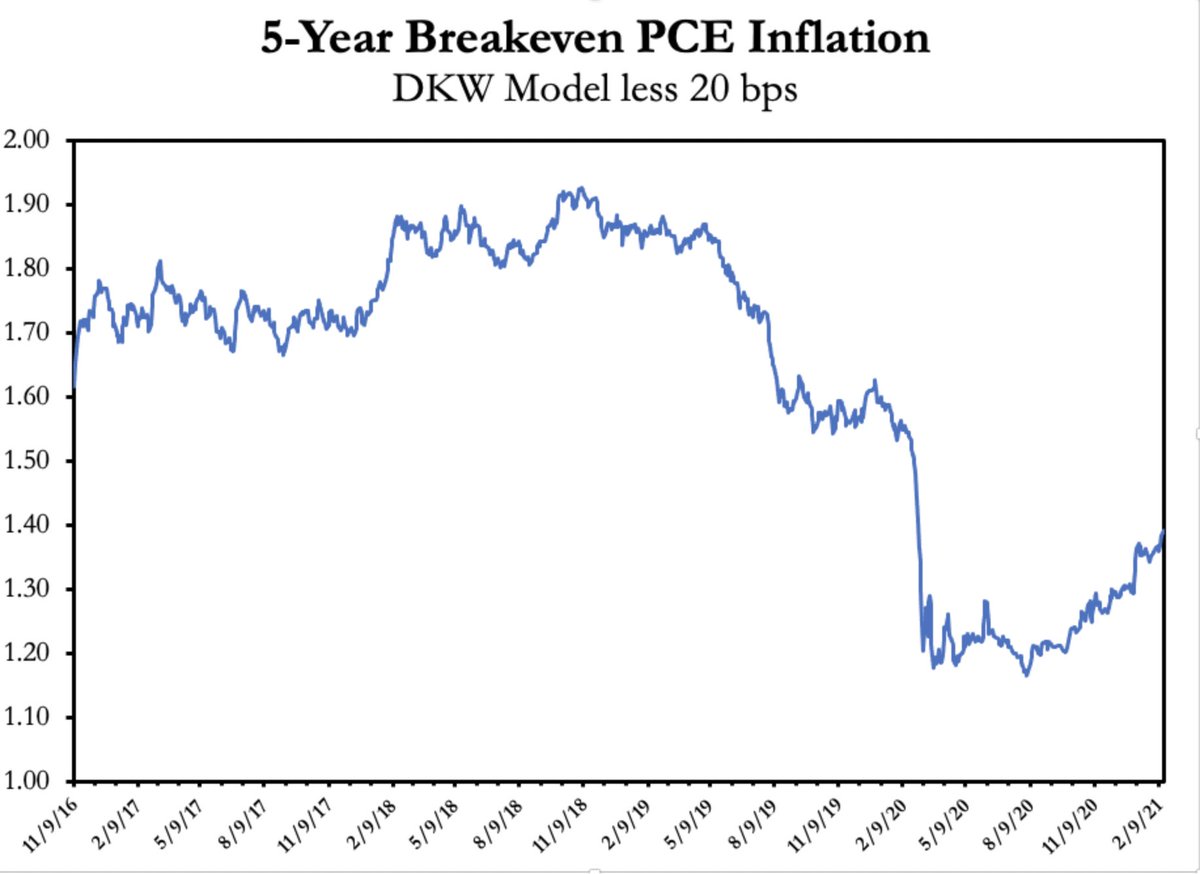

We claim in the OpEd that if the 5-year breakeven inflation rate is (1) converted into PCE & (2) adjusted to account for the Fed's LSAPs in TIPS market, then the actual breakeven inflation rate is less than 1.5%. We get that from the DKW model as of yesterday. (h/t @R_Perli)(5/n)

Read on Twitter

Read on Twitter