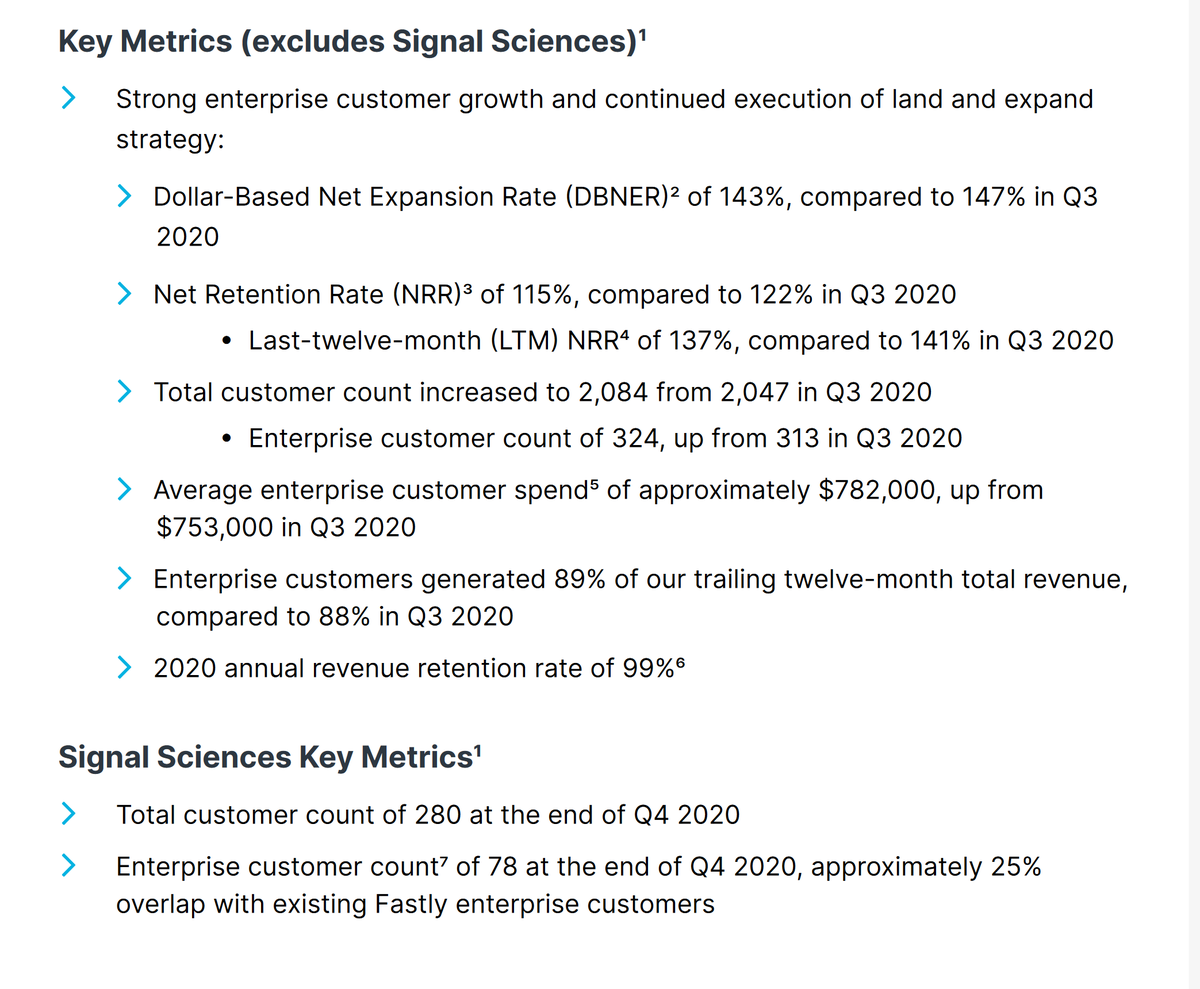

$FSLY Enterprise spend up AGAIN.

"he welcoming response from both Fastly’s and Signal Sciences’ customers to our expanded combined offerings also had a positive impact on our new bookings for this quarter. " $FSLY

$FSLY "We believe security will be a key strategic selling wedge and is essential to our multi-product strategy in 2021 and beyond"

Lot of great nuggets in the report. $FSLY https://investors.fastly.com/files/doc_financials/2020/q4/4Q20-Shareholder-Letter.pdf

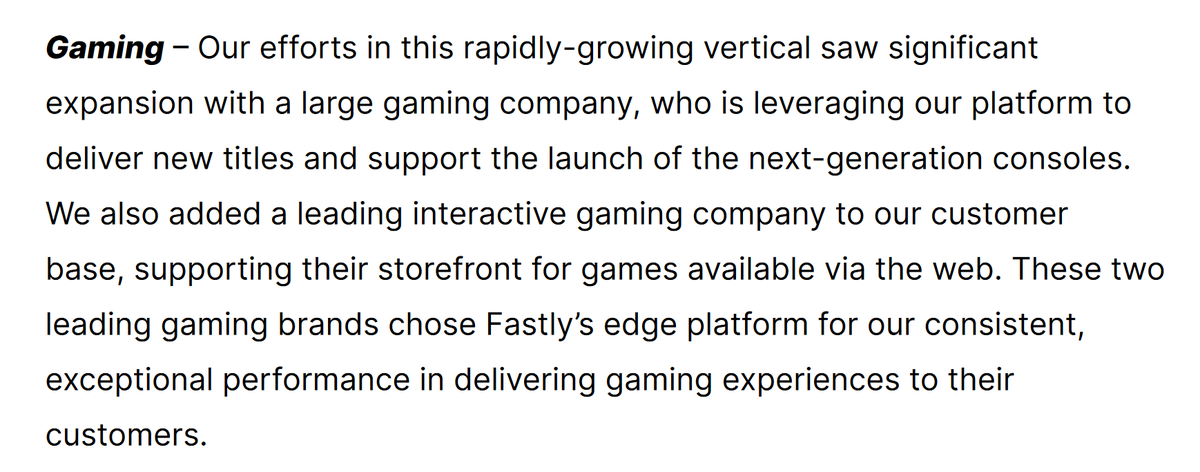

I've always wondered why they aren't getting more into gaming. Looks like that has changed. $FSLY

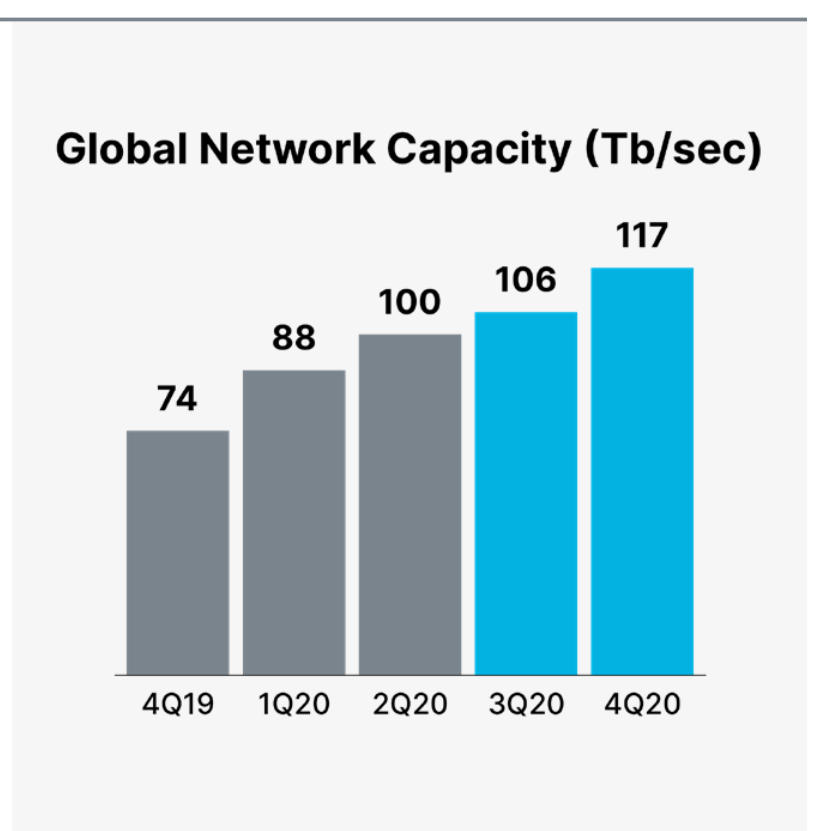

$FSLY Interesting, QoQ capacity re-accelerating last quarter. +11 Tb/sec compared to +6 last Q.

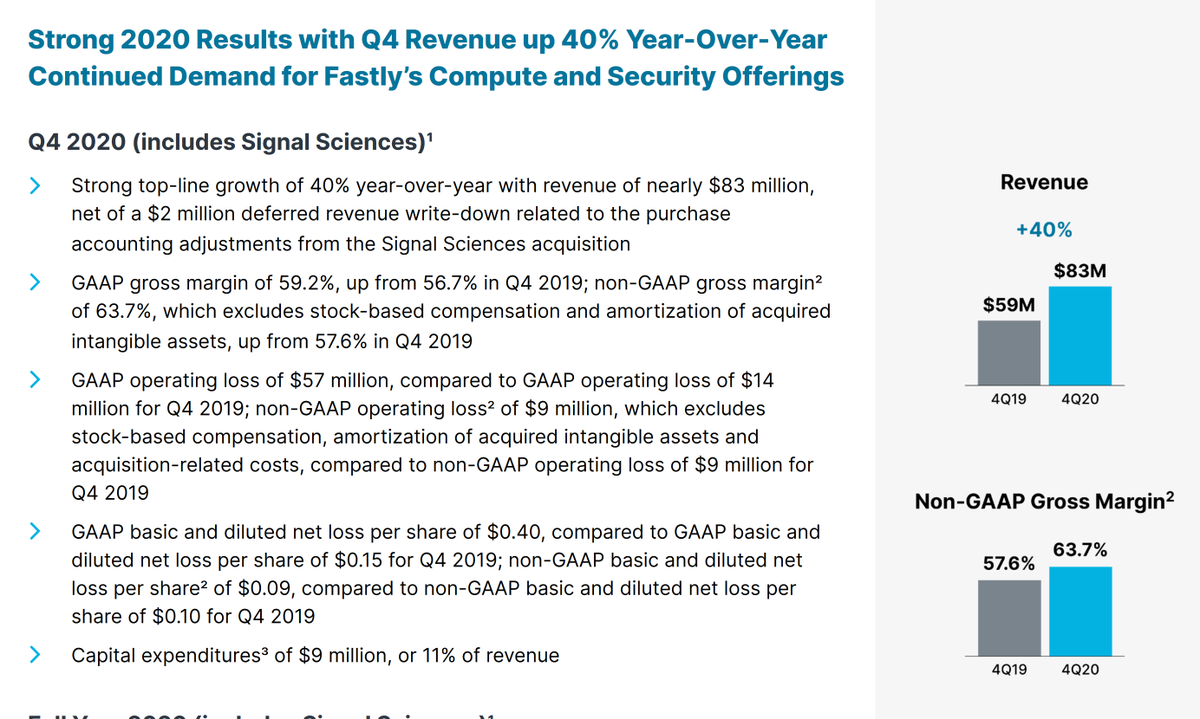

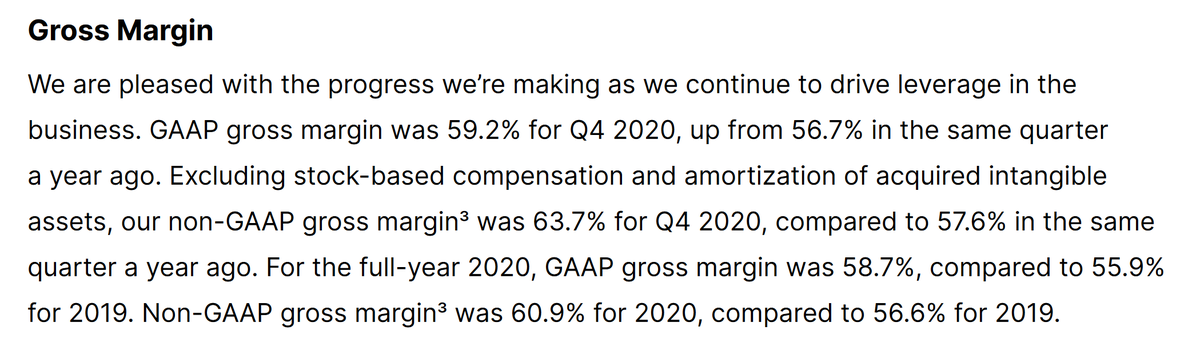

$FSLY I'm happy to see non-GAAP gross margins approaching 64%. Impressive.

Conf call just started. https://event.on24.com/wcc/r/2948629/3C12314B044048FA3C93CDCD644F0C7F

Second statement about business out of CEO Bixby's mouth was about the gaming vertical.

Fastly's web conference Altitude (which I attended) had >2x the attendance from last year.

Cross-sell and upsell EXCEEDED our expectations (with signal sciences) and has begun in Q4..

Introduces the new CRO. 25 years experience in tech sales.

"We will drive continued gross margin improvements over time" (70-75% eventually?)

Q1: "How can you guide capacity/capex expansion so high?"

A: We are encouraged by our new customers and what they are telling us today

A: We are encouraged by our new customers and what they are telling us today

TikTok 2nd Q..: Are they back?

TikTok is still a customer and still relies on us for several important things. TikTok popped over 10% for a short time and other customers may do the same as they grow. We modeled in their future usage. (interesting)

TikTok is still a customer and still relies on us for several important things. TikTok popped over 10% for a short time and other customers may do the same as they grow. We modeled in their future usage. (interesting)

3rd: Impact of SS on expansion rate?

Impact is likely later in the year, SS is subscription based, working on how we will offer that while fastly customers are used to usage based models. (may change).

SS contribution in Q4? We had 8m in Q4, took a 2m haircut as deferred.

Impact is likely later in the year, SS is subscription based, working on how we will offer that while fastly customers are used to usage based models. (may change).

SS contribution in Q4? We had 8m in Q4, took a 2m haircut as deferred.

We are already selling in a bundled fashion with SS so its becoming harder to break it out over time

Q: Clubhouse/audio an opportunity?

A: Yes it is a latency critical operation, just like gaming where we are gaining clients, won't say if they have a client here but it is an opportunity.

A: Yes it is a latency critical operation, just like gaming where we are gaining clients, won't say if they have a client here but it is an opportunity.

Q: How have booking been this yr vs last yr given covid impact?

A: Overall revenue continues to grow, about half of revenue is committed, half is usage. If you look at booking, we are excited, e.g. if you look at security and how fast that is growing. Very excited about c@e.

A: Overall revenue continues to grow, about half of revenue is committed, half is usage. If you look at booking, we are excited, e.g. if you look at security and how fast that is growing. Very excited about c@e.

What % of revenue is application delivery? If you are just thinking SS, it is <10% in Q4 today but growing quickly.

Q: Why did NRR decrease sequentially, is it the large customer?

A: NRR month - denominator we had a very large event in 2019 which makes the comparable more difficult over 2019.

A: NRR month - denominator we had a very large event in 2019 which makes the comparable more difficult over 2019.

Q: Why is gaming a better opportunity now?

A: Gaming companies are realizing that the performance aspect of gaming is becoming more and more important. There are not a lot of options at a global scale for this speed. Lots of opps for compute in this market.

A: Gaming companies are realizing that the performance aspect of gaming is becoming more and more important. There are not a lot of options at a global scale for this speed. Lots of opps for compute in this market.

..people seeing lots of opportunity for logic and compute at the edge. People are learning new use cases and how edge could be used in the future. Gaming is always at the front of technology.

Spend reflects acquisition of SS. We want to spend more on brand and R&D. Invest in G&A to build scale. Q4 is a good preview of how we can scale into 2021.

On new CRO Brett: We see tremendous opportunity in the security story. Customers are coming to us looking for security. People see us as the on-ramp to the 3 clouds so there is a lot we can do there. (He is going ham on the security side on this call :))

Q: How do you think about the kind of traffic you allow onto the network?

A: We are looking to spend energy focused on the high value end of the market. There is a lot of high value business out there, people are realizing that performance matters. 2020 put this into focus.

A: We are looking to spend energy focused on the high value end of the market. There is a lot of high value business out there, people are realizing that performance matters. 2020 put this into focus.

Midterm level GM goal is 70%. Focus on high value traffic will lead there.

They said on call they wanted to reuse forward guidance at about 30% growth for the business as they did for 2020. Sounds like guidance is a sandbag, they don't want to piss off wall street again.

Q: What is included in assumptions for 2021 guidance?

A: We are being conservative based on current visibility. In terms of macro, we hope for a normalized year and not planning for anything special.

A: We are being conservative based on current visibility. In terms of macro, we hope for a normalized year and not planning for anything special.

Q (FINALLY) on revenue from C@E:

A: 2021 is a year of learning for use cases and verticals for C@E, not meaningful revenue (as I expected) until later in the year.

A: 2021 is a year of learning for use cases and verticals for C@E, not meaningful revenue (as I expected) until later in the year.

^ aligns with what I expected from them. People still don't realize that C@E isn't meaningful revenue for Fastly at this point. Its like another business.

They reiterated how they do not take low margin commodity traffic. High value only.

Q on SS contribution:

Revenue from SS is going to blend together in Q1 2021. Our products are being sold together, revenue will be included together. There will be no breakout of revenue moving forward.

Revenue from SS is going to blend together in Q1 2021. Our products are being sold together, revenue will be included together. There will be no breakout of revenue moving forward.

Q on headcount:

We added 150 empls from SS. Ended 2020 at 939. Will add folks but not at the same clip as Q4. By the end of 2021 we will evaluate headcount and see how much return we are seeing from the large increase in hires.

We added 150 empls from SS. Ended 2020 at 939. Will add folks but not at the same clip as Q4. By the end of 2021 we will evaluate headcount and see how much return we are seeing from the large increase in hires.

Q: Try to quantify COVID impact, will it slow growth?

A: We are seeing more ppl use the internet, behavior and habits have changed. We believe there are sustainable changes to the digital transformers. We don't know if there is a new normal. Digital is taking a growing role...

A: We are seeing more ppl use the internet, behavior and habits have changed. We believe there are sustainable changes to the digital transformers. We don't know if there is a new normal. Digital is taking a growing role...

... security is taking a larger role in overall traffic. It takes a totally different role to protect workloads. Two reasons to be optimistic 1) Dx 2) Security. SAID GUIDANCE CONSERVATIVE AGAIN.

Q: Share the role of TT? Is the traffic gone or types they can remove and types that stay on?

A: They remain an important customer, strong relationship, very close to them, modeled them in. We continue to diversify and get more large customers..

A: They remain an important customer, strong relationship, very close to them, modeled them in. We continue to diversify and get more large customers..

.. our model will rely on certain large customers as we have large growing enterprises.

(makes sense, they have pins, shop, etc.)

(makes sense, they have pins, shop, etc.)

Call over. TLDR: SECURITY SECURITY SECURITY, C@E getting started in 2021. They sandbagged guidance. TikTok still a customer but <10% of course. They are selling SS+Fastly products side-by-side right now.

Read on Twitter

Read on Twitter