1/28 #BITCOIN  TO 100K?200K?300K TARGET SIR?

TO 100K?200K?300K TARGET SIR?

In this monthly update I’ll go through a lot of underlying models/metrics to find out where we are in the cycle and what is about to come.

All just my humble opinion ofcourse. Wanna nail this ride?

TLDR at 26-28

Let's Go!

TO 100K?200K?300K TARGET SIR?

TO 100K?200K?300K TARGET SIR?In this monthly update I’ll go through a lot of underlying models/metrics to find out where we are in the cycle and what is about to come.

All just my humble opinion ofcourse. Wanna nail this ride?

TLDR at 26-28

Let's Go!

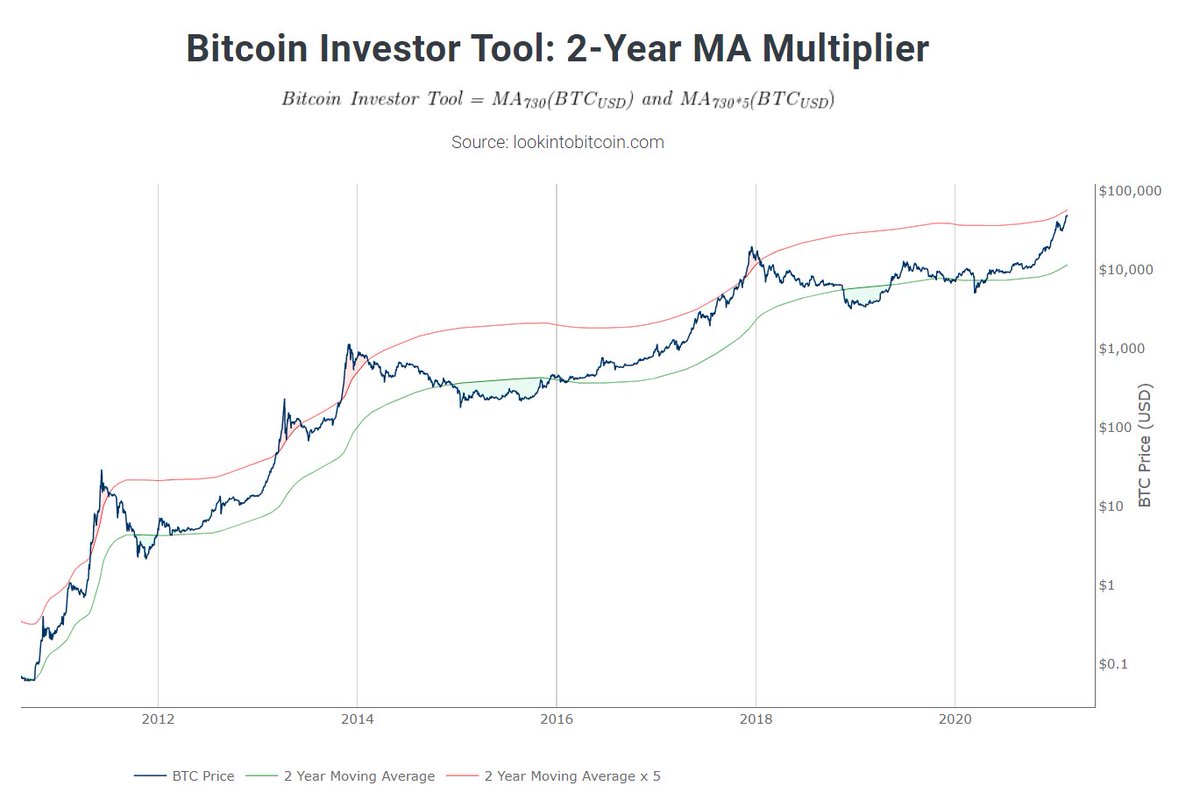

2/ 2 Year MA Multiplier

This indicator uses the 2Y MA. Green line is the 2Y MA, red is the same MA x5

2ya MA multiplier is rising fast and at ~57k rn.

Screams mid ’17 PA to me, like in the last update many models did.

Hugging it for months to come?

This indicator uses the 2Y MA. Green line is the 2Y MA, red is the same MA x5

2ya MA multiplier is rising fast and at ~57k rn.

Screams mid ’17 PA to me, like in the last update many models did.

Hugging it for months to come?

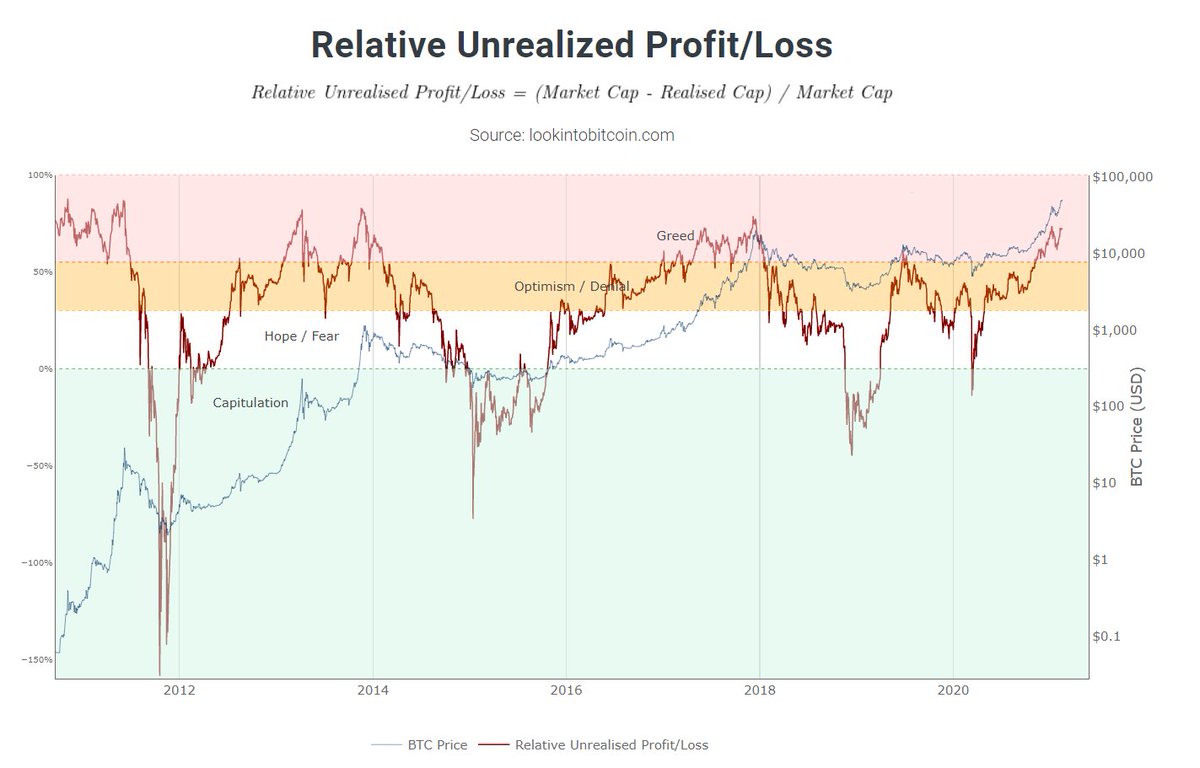

3/ Relative Unrealized Profit/Loss

Paper p/l in $Btc.

Market is overheating, everybody is in paper profits, we are greedy f*cks, but as the saying goes:

Markets can stay irrational longer than you can stay solvent, untill end of 21 at least, if history rhymes again.

Paper p/l in $Btc.

Market is overheating, everybody is in paper profits, we are greedy f*cks, but as the saying goes:

Markets can stay irrational longer than you can stay solvent, untill end of 21 at least, if history rhymes again.

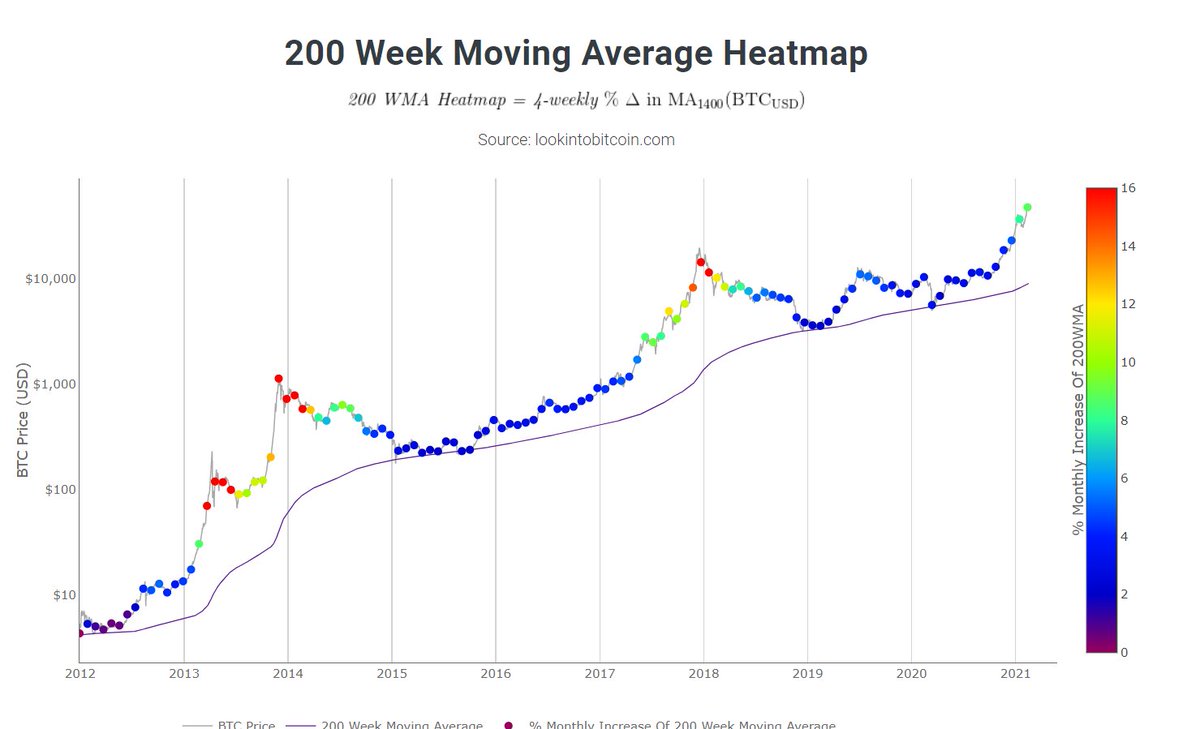

4/ 200 Week MA Heatmap

#Bitcoin likes to bottom out near the 200W MA

likes to bottom out near the 200W MA

Colors r attached to % increase of MA

Blue/purple = Buying opportunity

Orange/red = TP opp

The bigger the distraction, the more parabolic price goes, simply said

Just entered green, fun part, hodl tight!

#Bitcoin

likes to bottom out near the 200W MA

likes to bottom out near the 200W MAColors r attached to % increase of MA

Blue/purple = Buying opportunity

Orange/red = TP opp

The bigger the distraction, the more parabolic price goes, simply said

Just entered green, fun part, hodl tight!

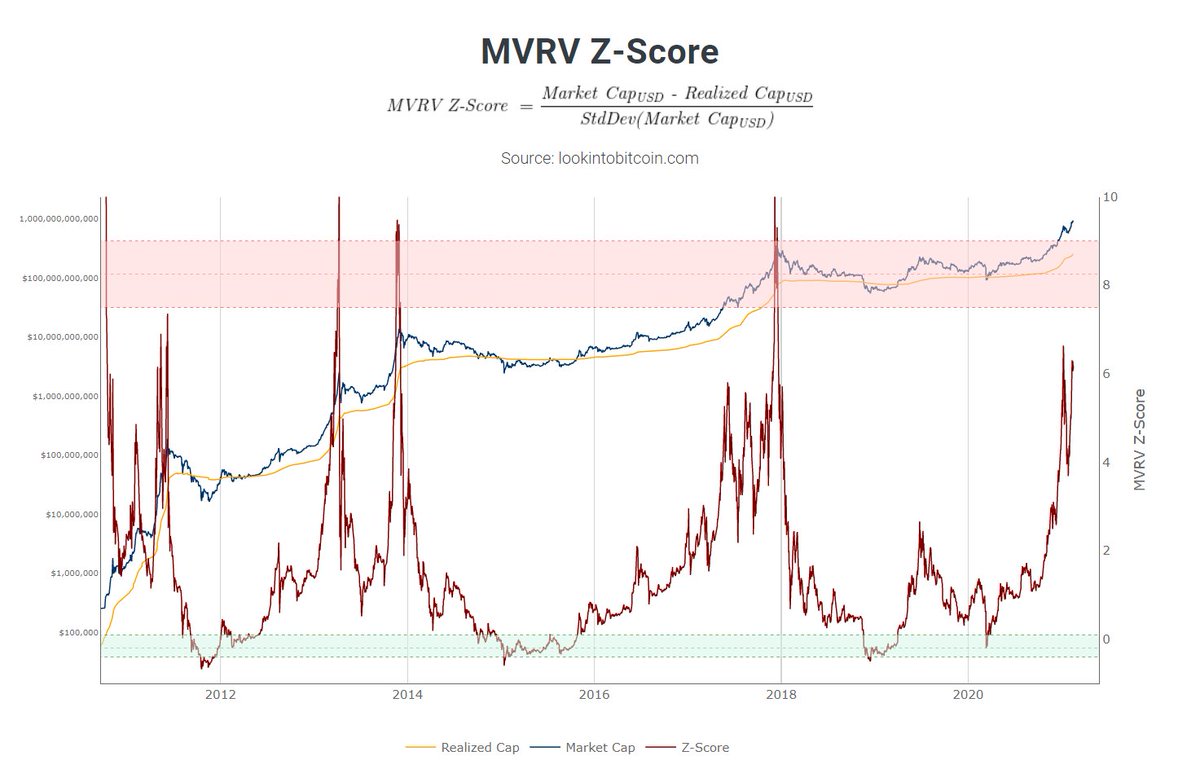

5/ MVRV Z-score.

To identify periods when $Btc is extremely under/overvalued.

Green= MV unusually far below RV, buying opp

Red=MV unusually high above RV, TP opp.

Now: heating up again after a good correction.

Nice uptick in realized value.

To identify periods when $Btc is extremely under/overvalued.

Green= MV unusually far below RV, buying opp

Red=MV unusually high above RV, TP opp.

Now: heating up again after a good correction.

Nice uptick in realized value.

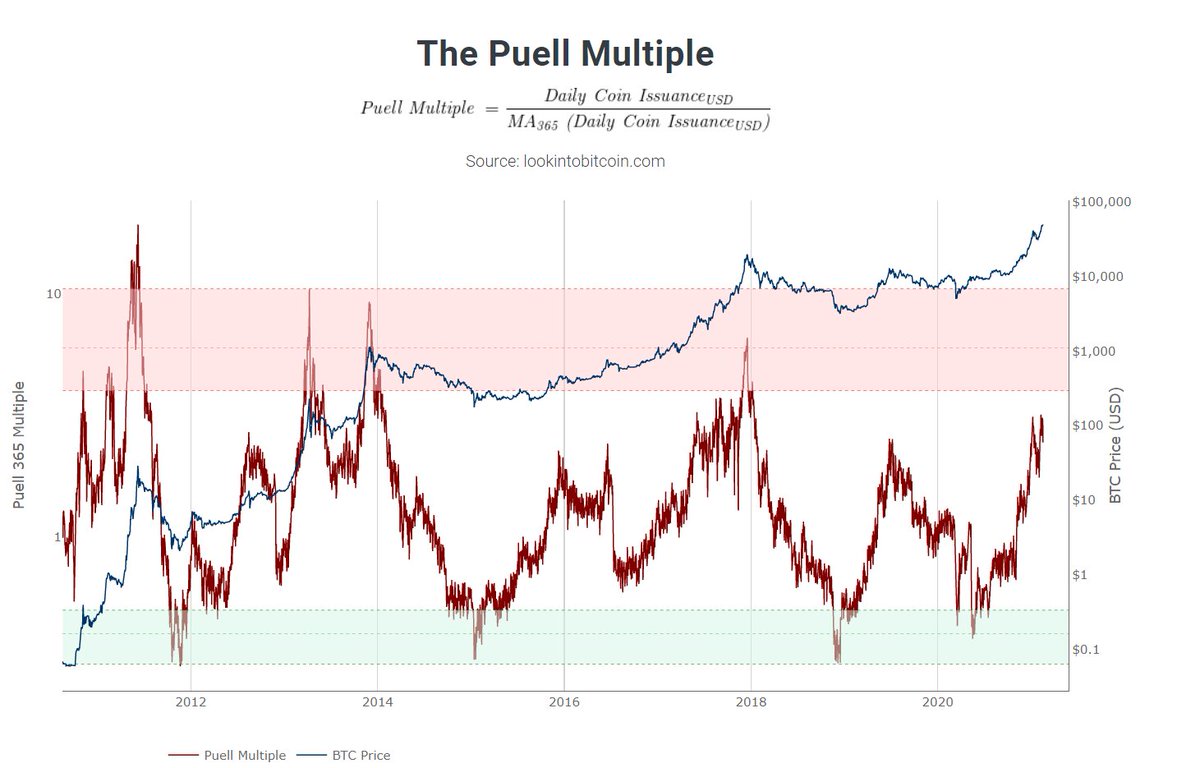

6/ Puell Multiple

It’s about value of #Bitcoins being mined and entering the ecosystem.

Green: Value of Bitcoins being issued is extremely low. Buy here

Red: The opposite. Sell here

Let’s stay below red fort he time being, shall we?

It’s about value of #Bitcoins being mined and entering the ecosystem.

Green: Value of Bitcoins being issued is extremely low. Buy here

Red: The opposite. Sell here

Let’s stay below red fort he time being, shall we?

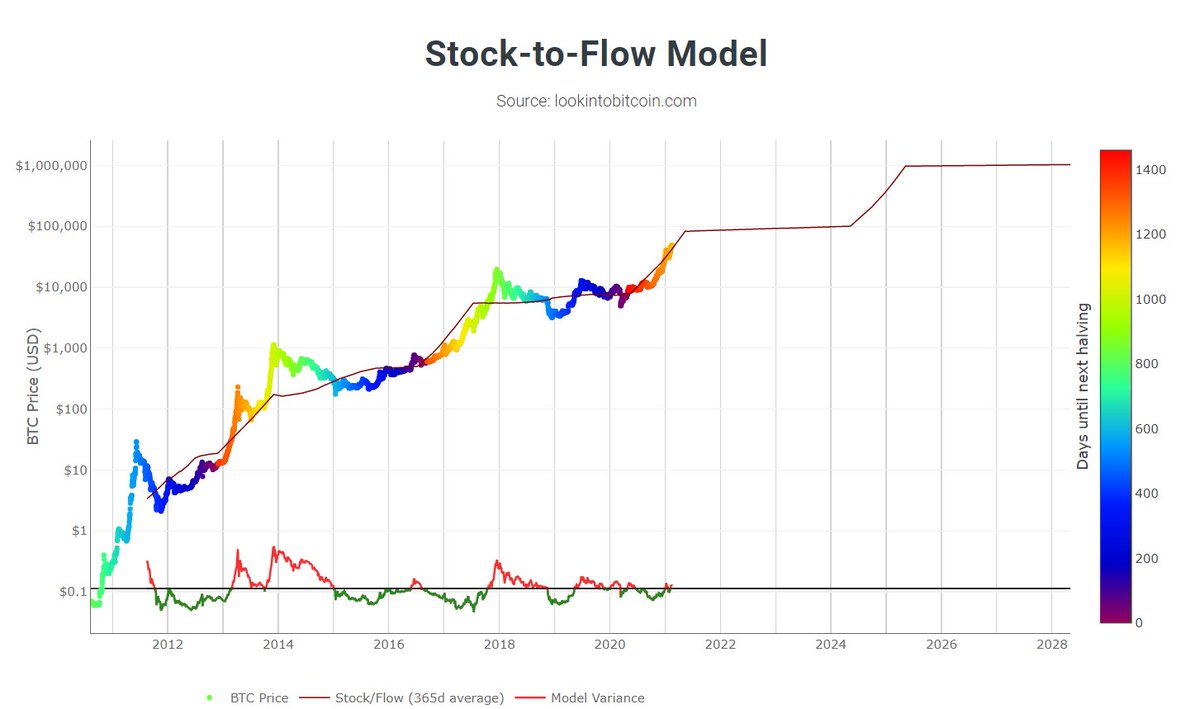

7/ Stock to flow model

Hated & Loved on #CT

Simply put: $Btc is scarce, limited supply. More demand, less flow (halvening): Number goes up.

100k is closer than you think :) It’s going even more rapid than “expected”.

Hated & Loved on #CT

Simply put: $Btc is scarce, limited supply. More demand, less flow (halvening): Number goes up.

100k is closer than you think :) It’s going even more rapid than “expected”.

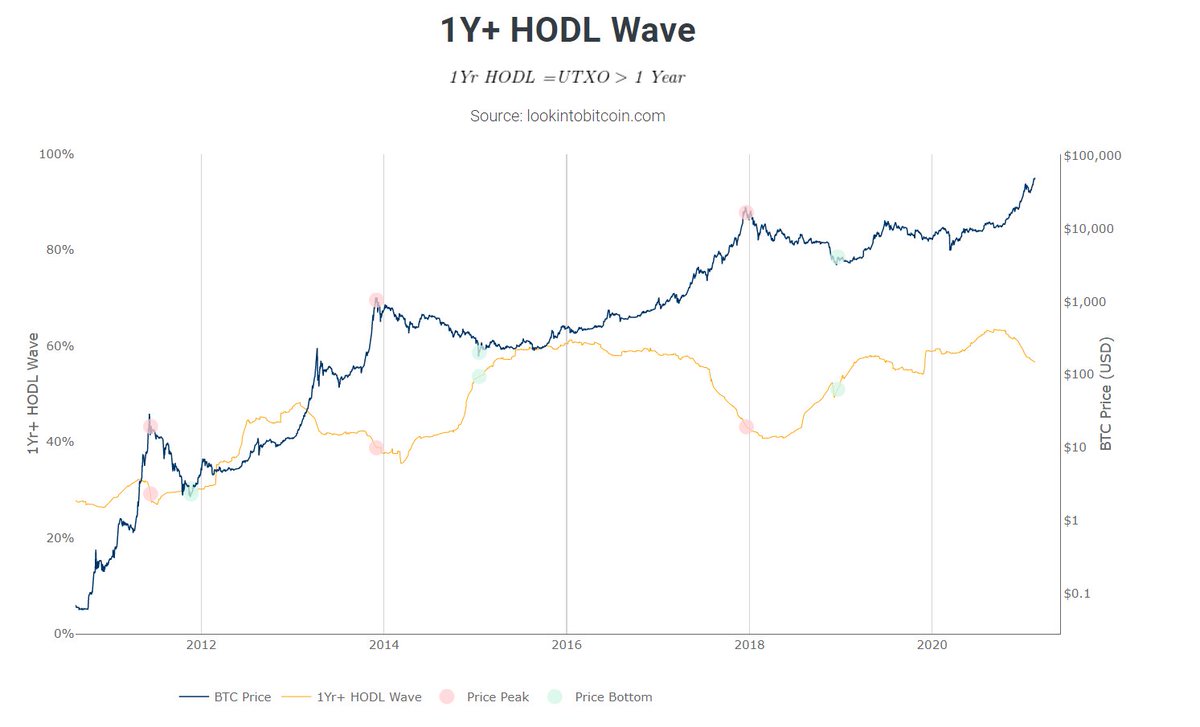

8/ 1Y+ Hodl Wave

#Bitcoins that haven’t moved for more than 1 year. If $Btc goes parabolic, 1Y+ decreases, because there is profit taking. Notice how 1Y+ Hodl went down whole 2017

Right now there is some decent profit taking going on. Makes sense, after a ~10x from march, right?

#Bitcoins that haven’t moved for more than 1 year. If $Btc goes parabolic, 1Y+ decreases, because there is profit taking. Notice how 1Y+ Hodl went down whole 2017

Right now there is some decent profit taking going on. Makes sense, after a ~10x from march, right?

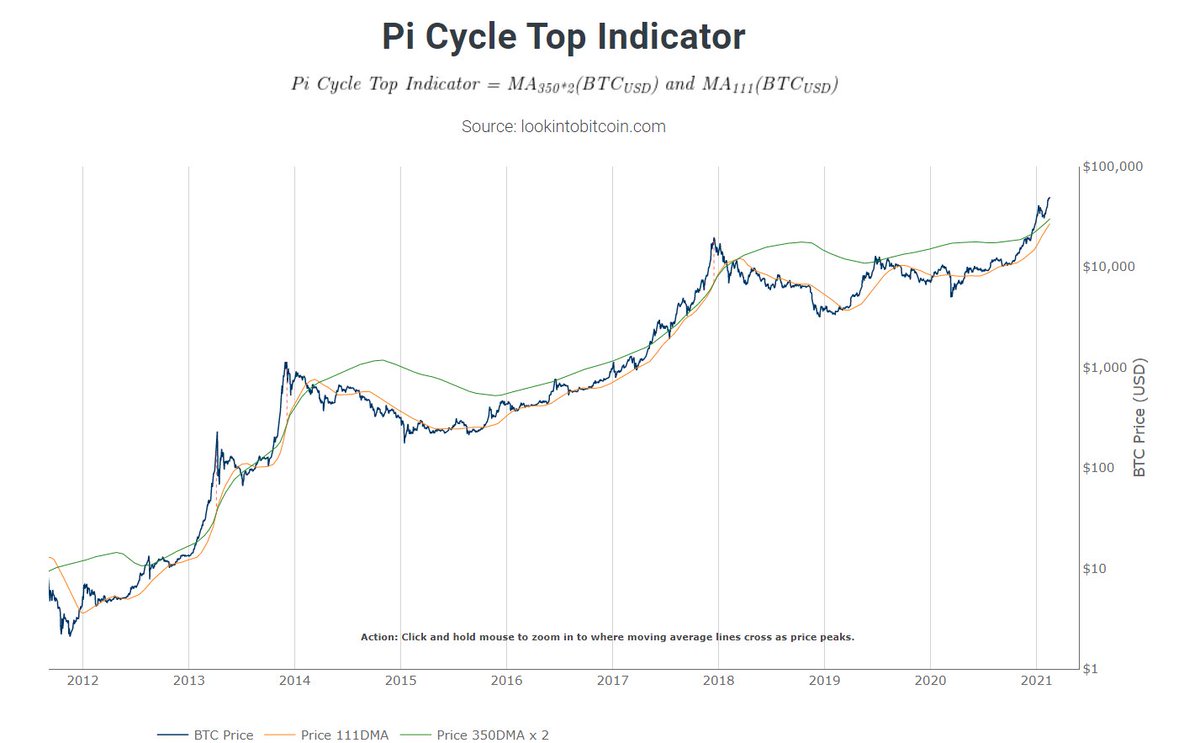

9/ Pi cycle top indicator

Has historically “called” the top of a full bull market cycle high to within 3 days! It uses 2 not so common MA’s.

Usefull to indicate whether the market is very overheated.

Mr Green, just stay above Mr Yellow, TY!

Has historically “called” the top of a full bull market cycle high to within 3 days! It uses 2 not so common MA’s.

Usefull to indicate whether the market is very overheated.

Mr Green, just stay above Mr Yellow, TY!

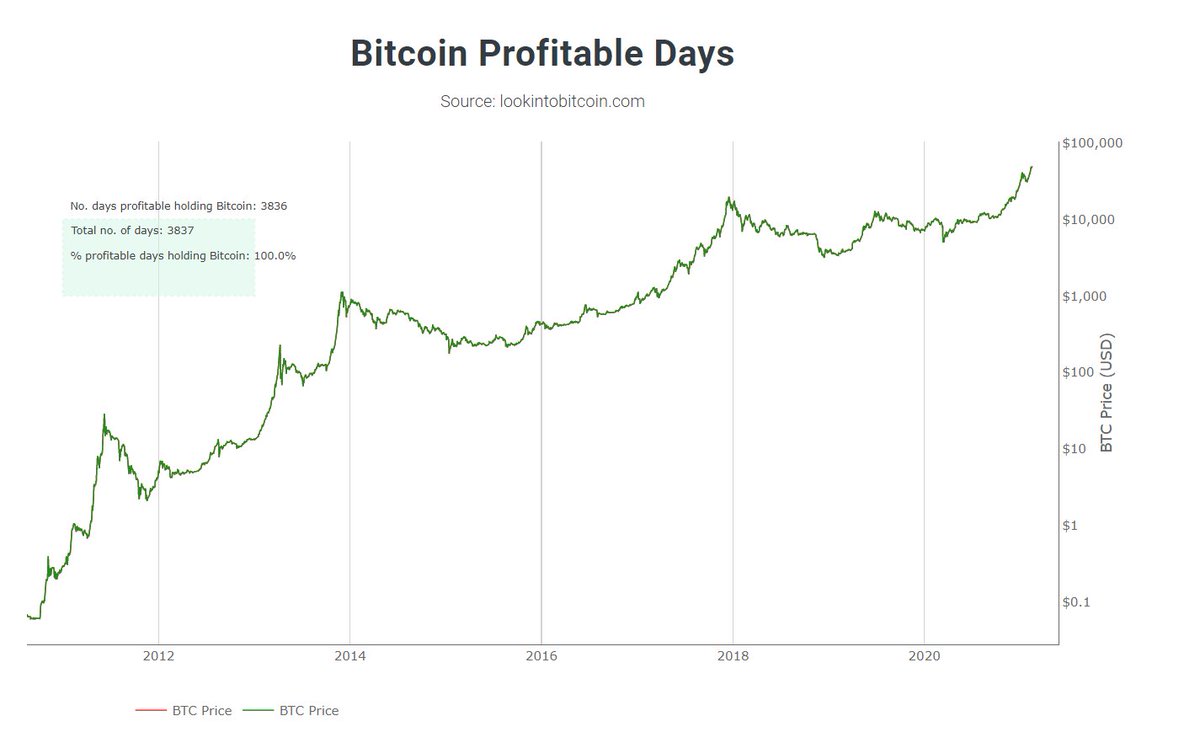

10/ Bitcoin profitable days

100%. We are all-in profits, yeeeehhh.

(Don't forget to actually TAKE profits

(Don't forget to actually TAKE profits )

)

100%. We are all-in profits, yeeeehhh.

(Don't forget to actually TAKE profits

(Don't forget to actually TAKE profits )

)

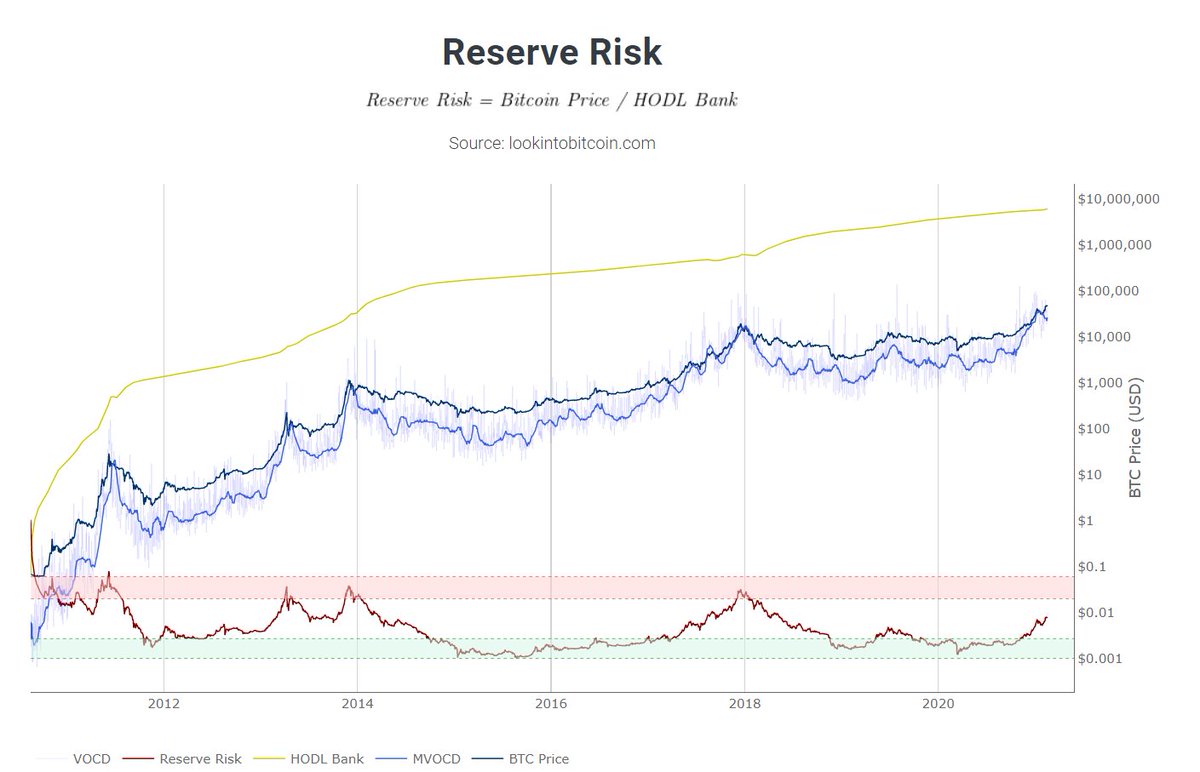

11/ Reserve Risk

Confidence high? Price low? R/R to invest is attractive: green zone.

We’ve just left the green zone, again feels like mid ’17 to me.

Buy green, sell red. Simple shit.

Wanna know more? https://www.lookintobitcoin.com/charts/reserve-risk/

Confidence high? Price low? R/R to invest is attractive: green zone.

We’ve just left the green zone, again feels like mid ’17 to me.

Buy green, sell red. Simple shit.

Wanna know more? https://www.lookintobitcoin.com/charts/reserve-risk/

12/ Bitcoin logarithmic growth curves

% of price growth decreases, but bottoms and tops will be higher. Narrowing. No cycle top before $100K? Highly possible imho (I said that below 10k too, quiet, anon )

)

Flipping the middle band. booliesj

% of price growth decreases, but bottoms and tops will be higher. Narrowing. No cycle top before $100K? Highly possible imho (I said that below 10k too, quiet, anon

)

)Flipping the middle band. booliesj

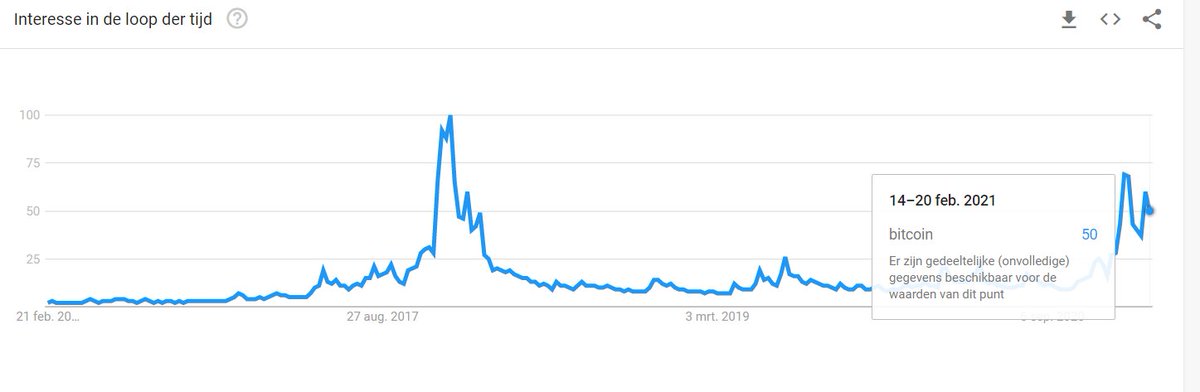

13/ Google trends

Finally we got some pleb attention. Look at the media. After we crossed ath, it is suddenly everywhere again. Look at Tesla being all over lately. I think we’ll exceed previous high a lot this year.

Finally we got some pleb attention. Look at the media. After we crossed ath, it is suddenly everywhere again. Look at Tesla being all over lately. I think we’ll exceed previous high a lot this year.

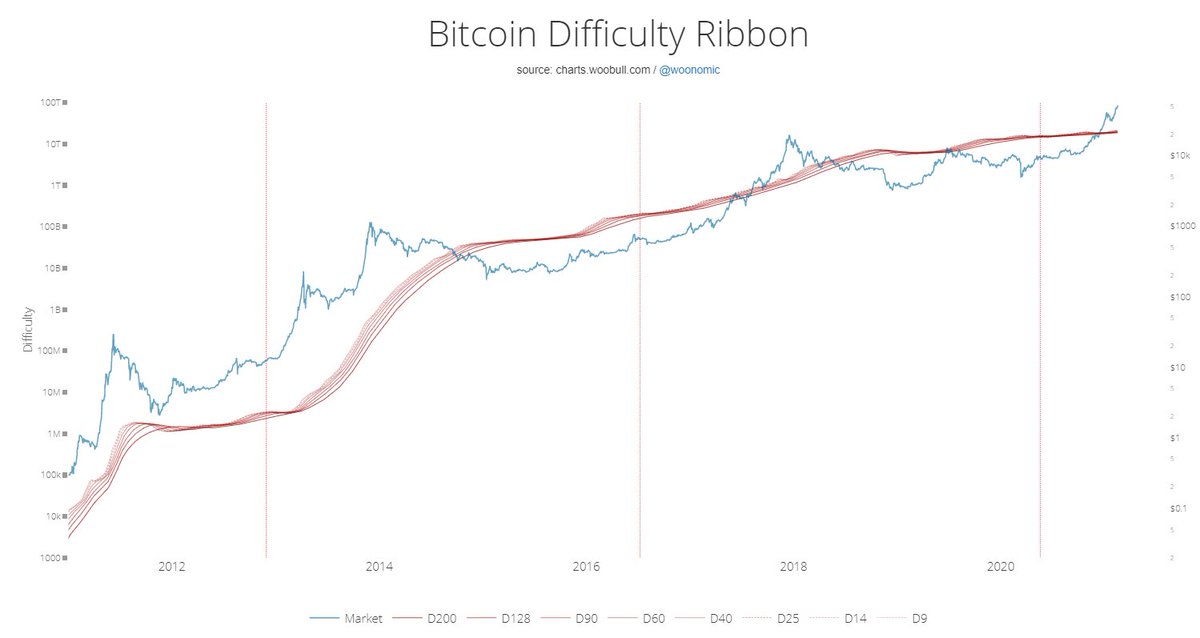

14/ Difficulty Ribbon

To view miner capitulation, signals times when buying is sensible

When network difficulty reduces rate of climb: weak miners leave, strong miners survive: less sell pressure.

Best time to buy is where the Ribbon compresses (I’m not saying buy here )

)

To view miner capitulation, signals times when buying is sensible

When network difficulty reduces rate of climb: weak miners leave, strong miners survive: less sell pressure.

Best time to buy is where the Ribbon compresses (I’m not saying buy here

)

)

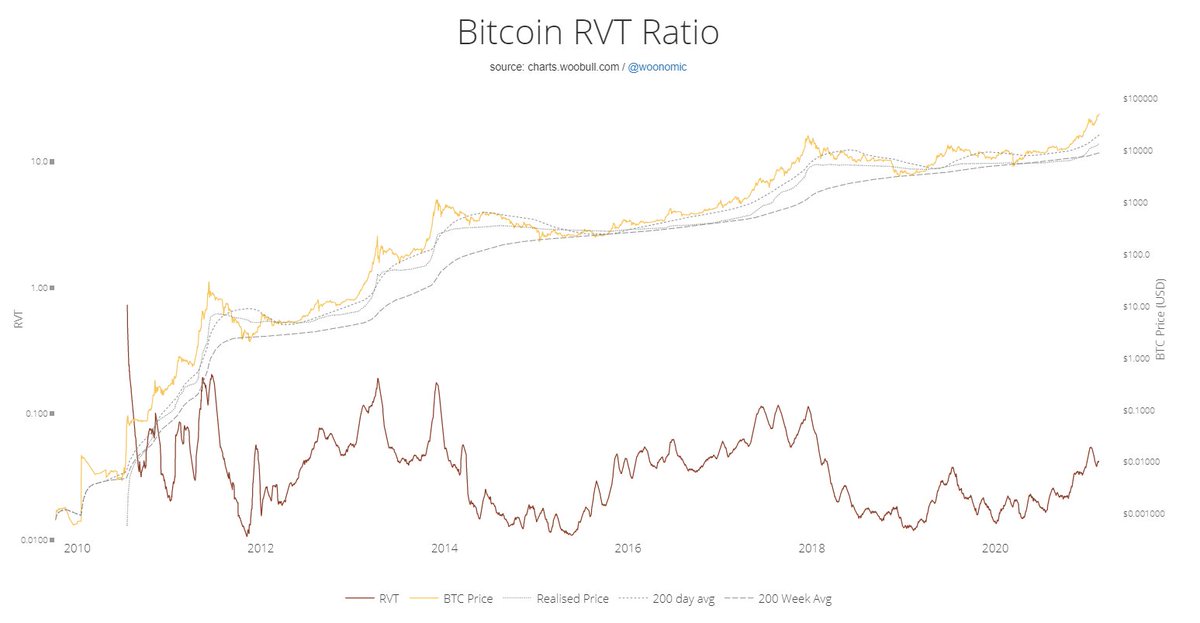

15/ (1/2) Bitcoin RVT Ratio (Realised Value to Transaction Ratio)

It compares transaction volume to the relevant valuation.

RTV Ratio uses Realised market cap. That is a Bitcoin value model representing average cost basis of the entire market, also discounting lost coins.

It compares transaction volume to the relevant valuation.

RTV Ratio uses Realised market cap. That is a Bitcoin value model representing average cost basis of the entire market, also discounting lost coins.

16/ (2/2) Bitcoin RVT Ratio

RVT high/increasing: Price overvalued

RVT low/decreasing: Price undervalued

RVT sideways: sustainable valuation, relative to transaction volume.

Now: We just had a nice correction. Up again plz

RVT high/increasing: Price overvalued

RVT low/decreasing: Price undervalued

RVT sideways: sustainable valuation, relative to transaction volume.

Now: We just had a nice correction. Up again plz

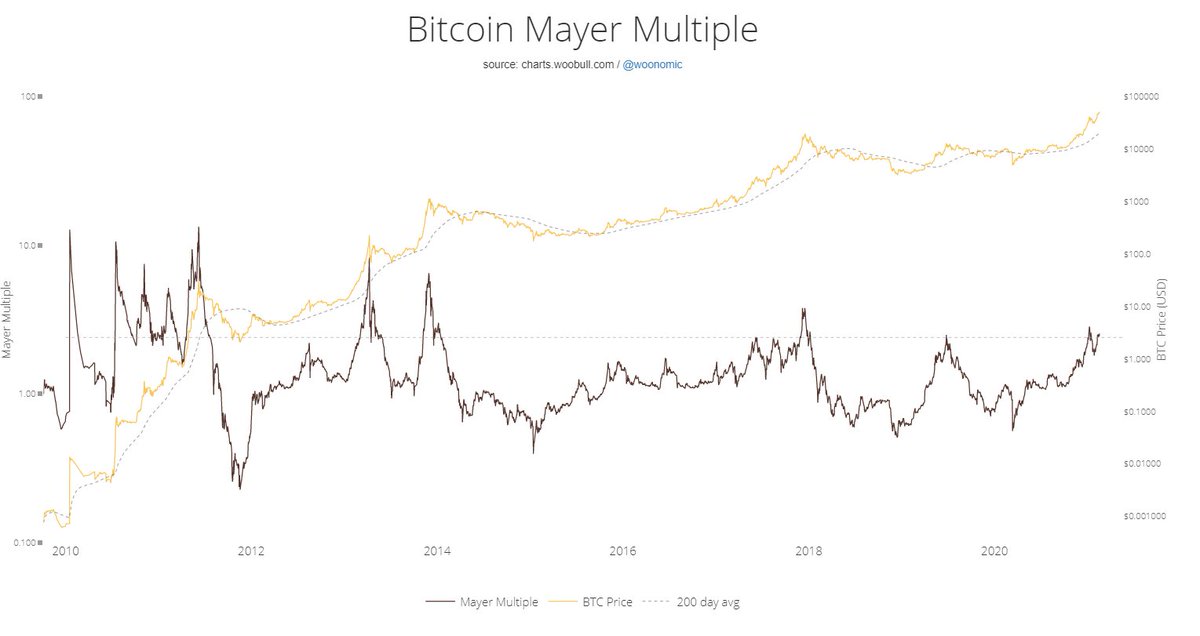

17/ Mayer multiple

A measurement to see if btc is under/overvalued, HTF, plotted against it’s 200 D ma.

The Bitcoin market as a whole becomes larger, thus less volatile, so the peaks on this indicator are becoming less high.

Now: We had a nice correction, room for growth

A measurement to see if btc is under/overvalued, HTF, plotted against it’s 200 D ma.

The Bitcoin market as a whole becomes larger, thus less volatile, so the peaks on this indicator are becoming less high.

Now: We had a nice correction, room for growth

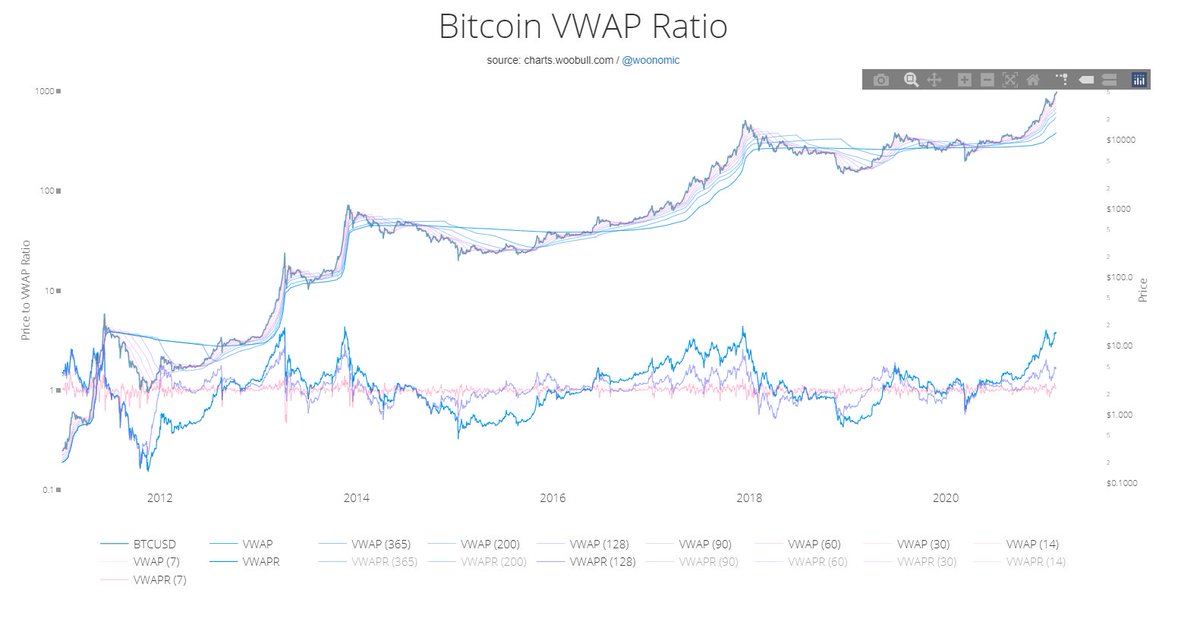

18/ Bitcoin Vwap

Vwap combines power of volume with price action. Usefull to confirm a trend or to time entry/exit points. To determine the average price market participants payed fort heir coins. It’s also a kind of a trend flow.

Vwap combines power of volume with price action. Usefull to confirm a trend or to time entry/exit points. To determine the average price market participants payed fort heir coins. It’s also a kind of a trend flow.

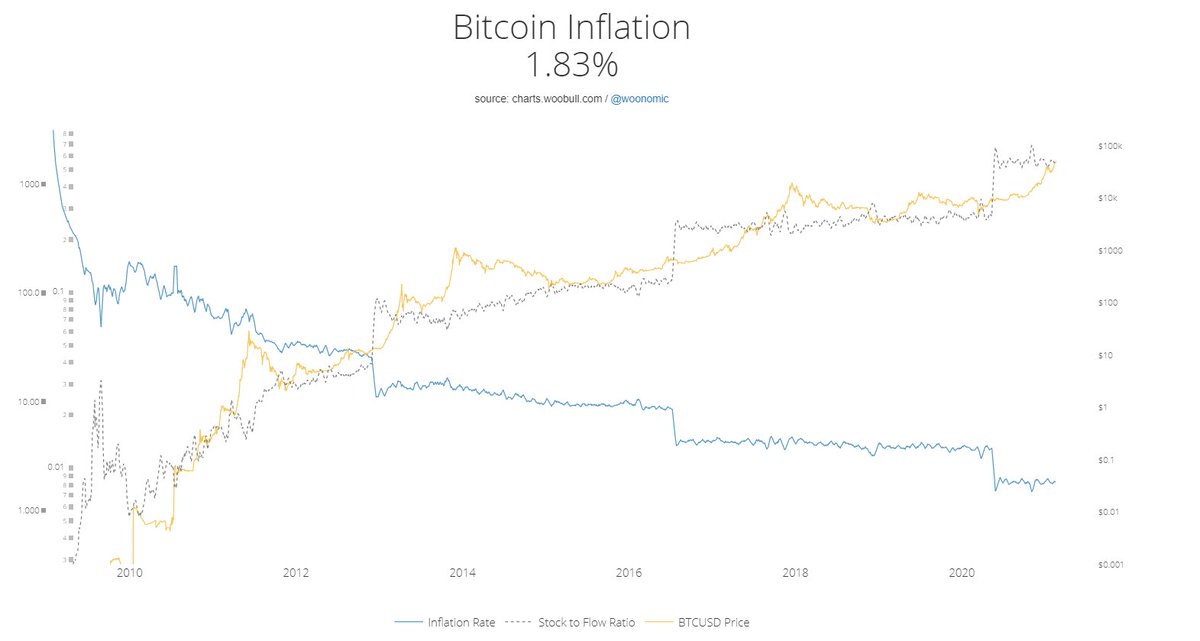

19/ Bitcoin inflation rate

I think this one speaks for itself if you know something about inflation

It will keep on decreasing after each halving.

I think this one speaks for itself if you know something about inflation

It will keep on decreasing after each halving.

20/ Halvings

The fresh supply miners will recieve for mining a block get’s cut in half every ~4 years. We’ve recently witnessed a halving last may. Reward for miners cut in half means price has to be high enough for them to keep active . So are they?

Yes, Read on…

The fresh supply miners will recieve for mining a block get’s cut in half every ~4 years. We’ve recently witnessed a halving last may. Reward for miners cut in half means price has to be high enough for them to keep active . So are they?

Yes, Read on…

21/ Hash rate

Measuremet of the computing power of the Btc network.

The higher the hash rate, the more miners active, the more secure the network. Dips have been absorved fast. Bullish

Just falling a lil bit after ATH.

Still dip buying mentality!

Measuremet of the computing power of the Btc network.

The higher the hash rate, the more miners active, the more secure the network. Dips have been absorved fast. Bullish

Just falling a lil bit after ATH.

Still dip buying mentality!

23/ Long term estimated view

Question yourself. Do you want to short an asset that looks like this or do you accumulate the dips?

Oh no! It’s overbought! Bitcoin stayed overbought on the M for a whole year prev cycles.

Betting against #Bitcoin is like the Harakiri

is like the Harakiri

Question yourself. Do you want to short an asset that looks like this or do you accumulate the dips?

Oh no! It’s overbought! Bitcoin stayed overbought on the M for a whole year prev cycles.

Betting against #Bitcoin

is like the Harakiri

is like the Harakiri

24/ Abbreviations

MA= Moving Average

P/L= Profit/Loss

DCA= Dollar Cost Averaging

MC= Market Cap

TP= Take Profit

#CT= Crypto Twitter

Ath= All time high

HODL= Hold On for Dear Life

R/R= Risk/Reward Ratio

Imo= in my opinion

MA= Moving Average

P/L= Profit/Loss

DCA= Dollar Cost Averaging

MC= Market Cap

TP= Take Profit

#CT= Crypto Twitter

Ath= All time high

HODL= Hold On for Dear Life

R/R= Risk/Reward Ratio

Imo= in my opinion

25/ Resources

While making this thread, I used the following websites:

https://www.lookintobitcoin.com/

https://charts.woobull.com/

https://glassnode.com/

https://cryptoquant.com

While making this thread, I used the following websites:

https://www.lookintobitcoin.com/

https://charts.woobull.com/

https://glassnode.com/

https://cryptoquant.com

26/ (1/3) TLDR; After a nice 30% correction, we’ve cooled off the underlying models/metrics. There is plenty of room for growth.

Price and model wise it still looks a lot like mid 2017 to me.

Price and model wise it still looks a lot like mid 2017 to me.

27/(2/3) Don’t get yourself rekt changing your bias based on a 1h chart. Zoom out, every day/week. Keeps yourself calm.

Fundamentals and the charts don’t lie. We had a severe correction, but are trending up hard again.

Fundamentals and the charts don’t lie. We had a severe correction, but are trending up hard again.

Read on Twitter

Read on Twitter