1/ $QS is +20% b/c $MS Adam Jonas initiated coverage w/ a BUY today. Read his repot. It was stupid:

-Not 1 word re: Toyota/Pana's solid-state batteries (SSB)

-Not 1 word mentioned about 8 other rivals

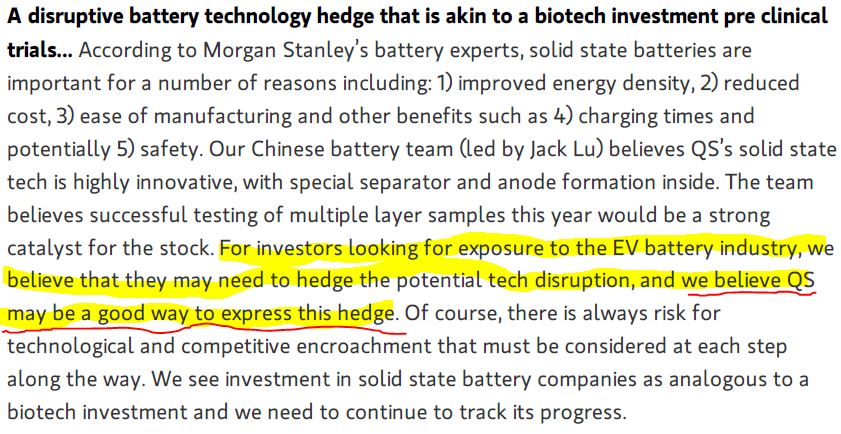

-1st page says that $QS is a "good hedge"

THREAD:

-Not 1 word re: Toyota/Pana's solid-state batteries (SSB)

-Not 1 word mentioned about 8 other rivals

-1st page says that $QS is a "good hedge"

THREAD:

2/ $QS has good mgmt & VW as a 25% holder. SSBs are the holy grail of the BEV industry & here's why:

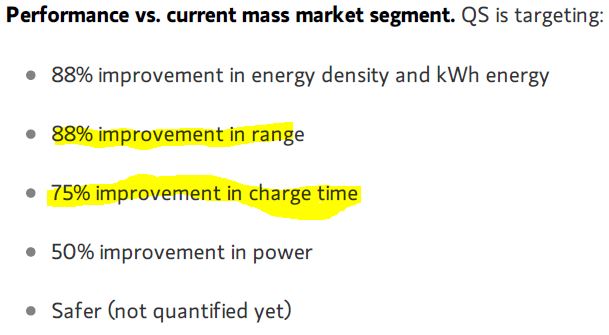

-88% better range

-75% better charging time

This is huge b/c BEVs could charge in 15 min to 80% & drive at least 500 Km (413m).

But, I've covered Panasonic for 15yrs.

-88% better range

-75% better charging time

This is huge b/c BEVs could charge in 15 min to 80% & drive at least 500 Km (413m).

But, I've covered Panasonic for 15yrs.

3/ But, I've watched Panasonic's losses w/ its $TSLA business for the past 5yrs:

-Pana has lost ~$1bn in the past 5yrs

-Pana thought they'd get 10% OP margins, now 5%

-Avg OPM is -3% of sales

$QS will be just another parts maker who can be squeezed at a carmaker's whim.

-Pana has lost ~$1bn in the past 5yrs

-Pana thought they'd get 10% OP margins, now 5%

-Avg OPM is -3% of sales

$QS will be just another parts maker who can be squeezed at a carmaker's whim.

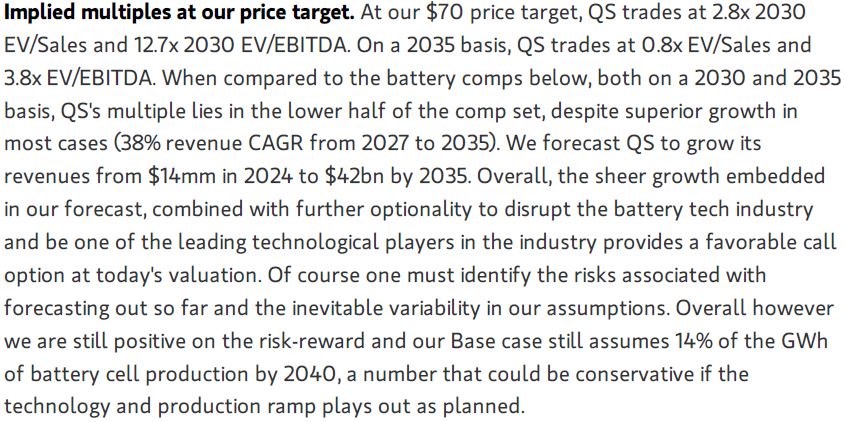

4/ $MS Jonas sees $QS fair value at $70 or $26bn, same as Nissan. Let's put that into perspective:

-$QS won't see profits till 2027

-CCP-backed CATL trades at EV/sales of 0.6x 2025 est

-CATL's 2025 OPM is estimated at 14%

$QS still losing money in 2025

There's a good reason:

-$QS won't see profits till 2027

-CCP-backed CATL trades at EV/sales of 0.6x 2025 est

-CATL's 2025 OPM is estimated at 14%

$QS still losing money in 2025

There's a good reason:

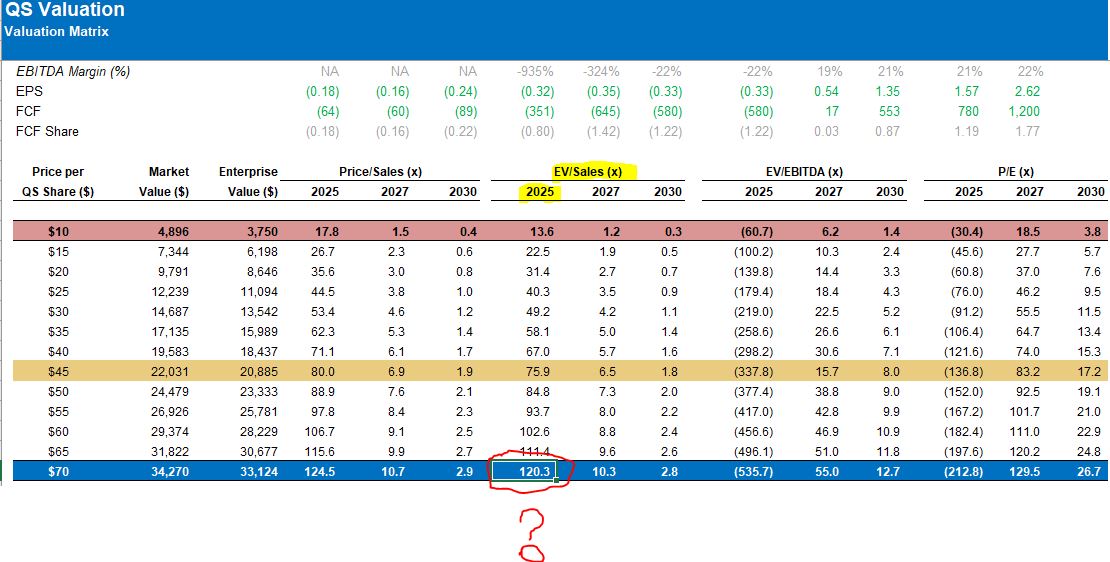

5/ $MS sees $QS fair value at $70 or a market cap of $26bn, just over Nissan's.

-$MS est of $QS fair value is 120x 2025 EV/sales

-CATL, which has CCP backing, trades at 0.6x

-Samsung SDI w/ a rack record at 198x

-LG Chem same at 14x

I think $MS is fishing for a financing deal.

-$MS est of $QS fair value is 120x 2025 EV/sales

-CATL, which has CCP backing, trades at 0.6x

-Samsung SDI w/ a rack record at 198x

-LG Chem same at 14x

I think $MS is fishing for a financing deal.

Read on Twitter

Read on Twitter