1/ Aggregators had a breakout year in 2020, with platforms like @1inchExchange and @zapper_fi recording significant growth

The best part? YTD numbers indicate 2021's growth is about to dwarf 2020's https://www.delphidigital.io/reports/defi-aggregators/

The best part? YTD numbers indicate 2021's growth is about to dwarf 2020's https://www.delphidigital.io/reports/defi-aggregators/

2/ For the uninitiated, aggregators are platforms that gather information from DeFi protocols and make all of it accessible from a single interface

1inch Exchange, for example, aggregates liquidity from over 20 individual DEXes

1inch Exchange, for example, aggregates liquidity from over 20 individual DEXes

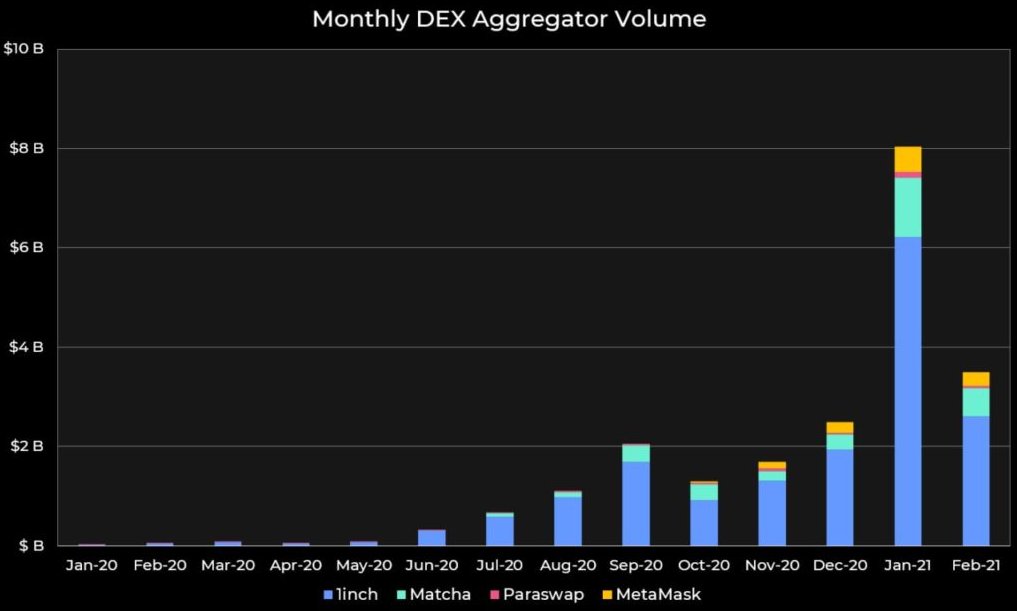

3/ 1inch, Matcha, and Paraswap facilitated $9.3 billion of volume in 2020

As of Feb. 16, @1inchExchange has recorded close to $10 billion – in just the first 46 days of 2021

This growth was incited by the launch of the 1inch Liquidity Protocol and the 1INCH token

As of Feb. 16, @1inchExchange has recorded close to $10 billion – in just the first 46 days of 2021

This growth was incited by the launch of the 1inch Liquidity Protocol and the 1INCH token

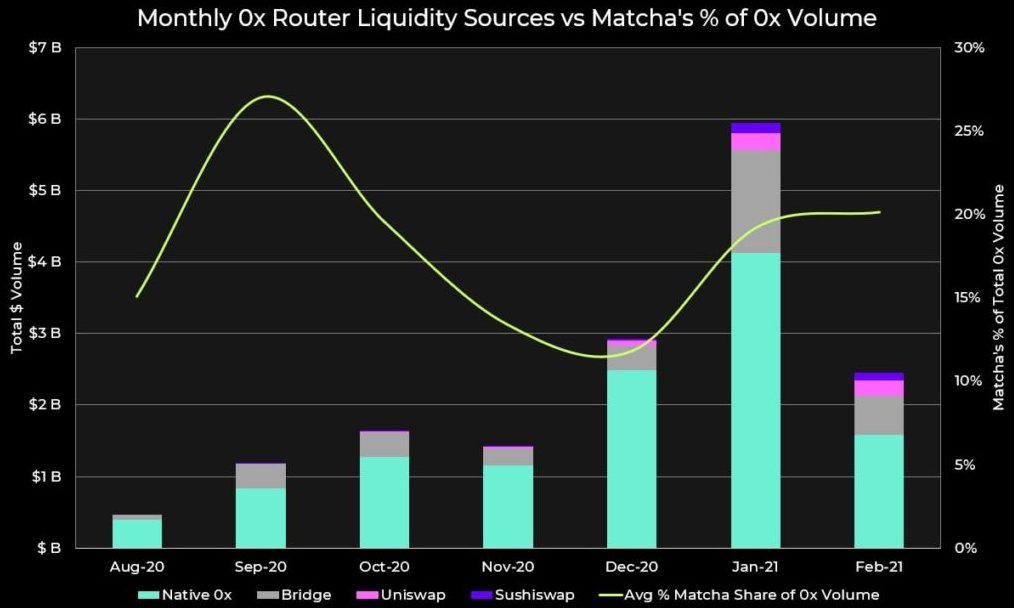

4/ @matchaxyz is also becoming a hotspot for DeFi traders thanks to its sleek UI

Matcha uses the 0x protocol to offer traders the best execution price

Matcha has grown from averaging $1 mn of daily volume in its first month to over $40 mn a day in Jan 2021

Matcha uses the 0x protocol to offer traders the best execution price

Matcha has grown from averaging $1 mn of daily volume in its first month to over $40 mn a day in Jan 2021

5/ Liquidity aggregators include DEX aggregators as well as the likes of @Instadapp and @DeFiSaver, both of which aggregate money markets (borrowing)

But spot market activity trounces everything else in DeFi at the moment, so DEX aggregators naturally had more traction

But spot market activity trounces everything else in DeFi at the moment, so DEX aggregators naturally had more traction

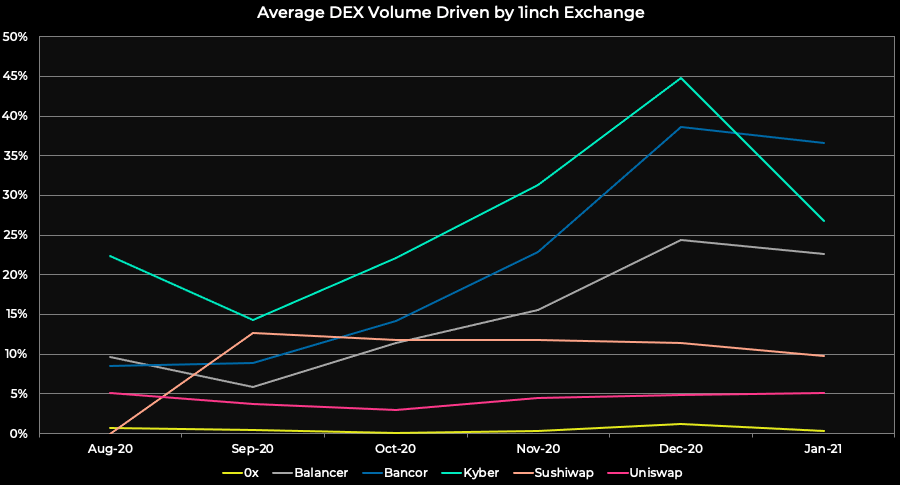

6/ It's interesting to see how aggregators have the ability to rework the DEX hierarchy

Uniswap and Sushiswap lead general purposes DEXes in volume and liquidity

But if you've used an aggregator for fairly large trades, you would notice you get routed to other DEXes too

Uniswap and Sushiswap lead general purposes DEXes in volume and liquidity

But if you've used an aggregator for fairly large trades, you would notice you get routed to other DEXes too

7/ 38% and 36% of volume on @KyberNetwork and @Bancor respectively has come from @1inchExchange between Dec 2020 and Jan 2021

This is in part because Bancor's single-sided AMM and Kyber's quote based model end up being more capital efficient for larger trades

This is in part because Bancor's single-sided AMM and Kyber's quote based model end up being more capital efficient for larger trades

8/ Uniswap and Sushiswap still comprise a majority of all aggregator volume, but this is mostly because of the sheer amount of liquidity these DEXes have – not because they're the most efficient

9/ In an aggregator-centric world, liquidity protocols will compete on efficiency alone, since the aggregation platforms handle the user experience (UX)

If aggregators come to own the user relationship, investors, including myself, will be forced to re-think their theses

If aggregators come to own the user relationship, investors, including myself, will be forced to re-think their theses

10/ Yield aggregators like @iearnfinance and @harvest_finance were only conceived in 2020, but what a year they had

Both protocols serviced over a billion dollars each at the height of the yield farming craze

As the two add more auto-farming strats, I expect growth to amplify

Both protocols serviced over a billion dollars each at the height of the yield farming craze

As the two add more auto-farming strats, I expect growth to amplify

11/ UX aggregators like @zapper_fi and @zerion_io are trying to be the front page of DeFi

The idea is that users will eventually use these platforms as a means of accessing everything in DeFi from a unified interface

UX aggregators could end up owning the user relationship

The idea is that users will eventually use these platforms as a means of accessing everything in DeFi from a unified interface

UX aggregators could end up owning the user relationship

12/ The goal of aggregators is to make DeFi efficient and easy to use

I believe aggregators will play a crucial role in onboarding the next gen of DeFi users

Non crypto natives will be put off by having to visit a bunch of websites to get what they need

Aggregators fix this

I believe aggregators will play a crucial role in onboarding the next gen of DeFi users

Non crypto natives will be put off by having to visit a bunch of websites to get what they need

Aggregators fix this

13/ You can check out the full report here if you're an insights tier subscriber to @Delphi_Digital

And if you aren't subscribed...wtf are you waiting for?

https://www.delphidigital.io/reports/defi-aggregators/

And if you aren't subscribed...wtf are you waiting for?

https://www.delphidigital.io/reports/defi-aggregators/

Read on Twitter

Read on Twitter