Where did the BTC go?

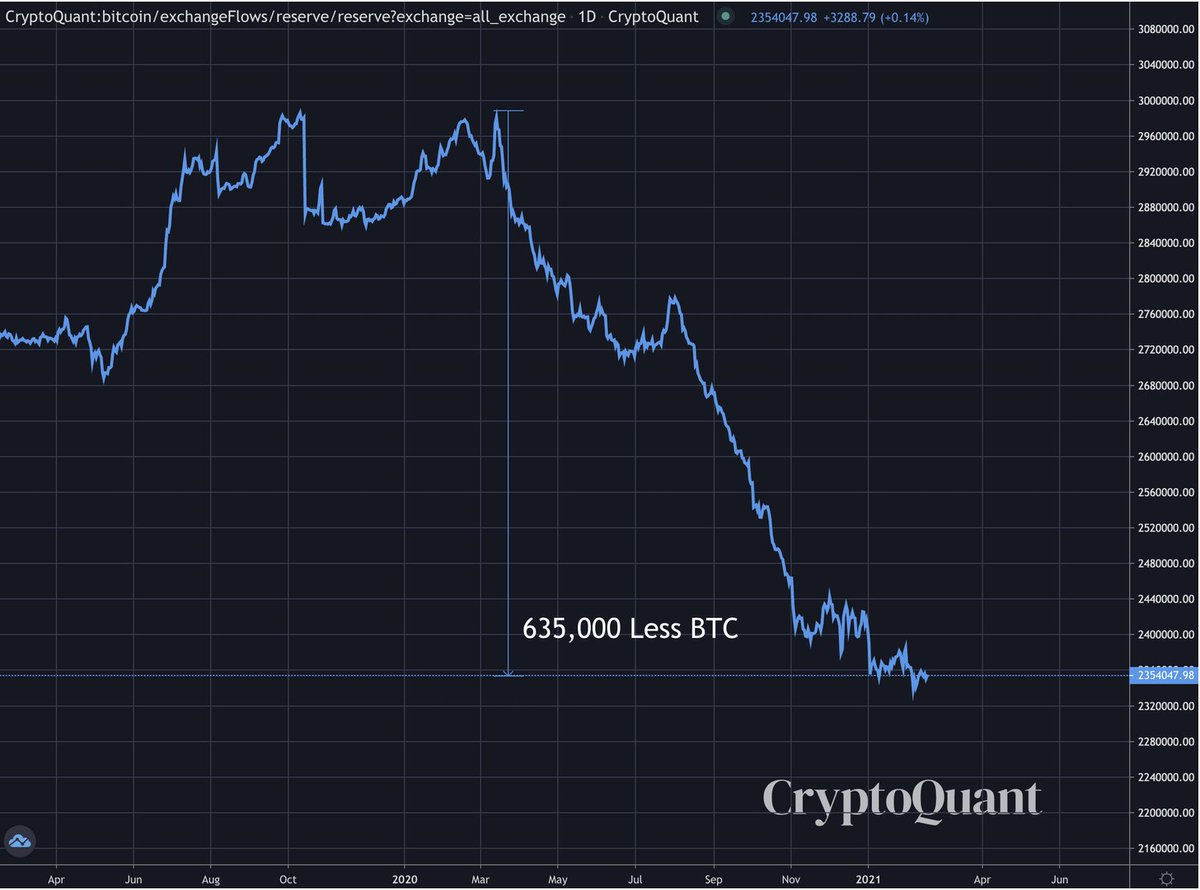

3 Sectors are driving the liquidity crisis seen in the chart below courtesy of @cryptoquant_com

Here's a thread on who they are and what it means moving forward

(If you liked this content, subscribe to our free newsletter: http://jarvislabs.substack.com/welcome )

3 Sectors are driving the liquidity crisis seen in the chart below courtesy of @cryptoquant_com

Here's a thread on who they are and what it means moving forward

(If you liked this content, subscribe to our free newsletter: http://jarvislabs.substack.com/welcome )

Approximately 635,000 BTC have exited exchanges since early 2020.

It's predominately going to three areas.

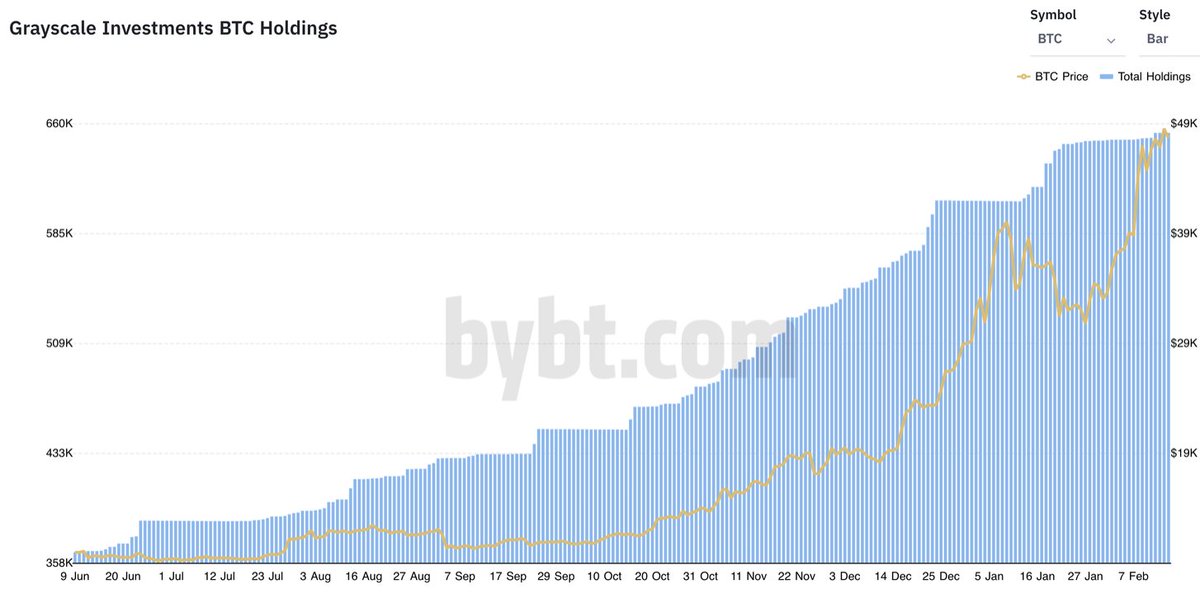

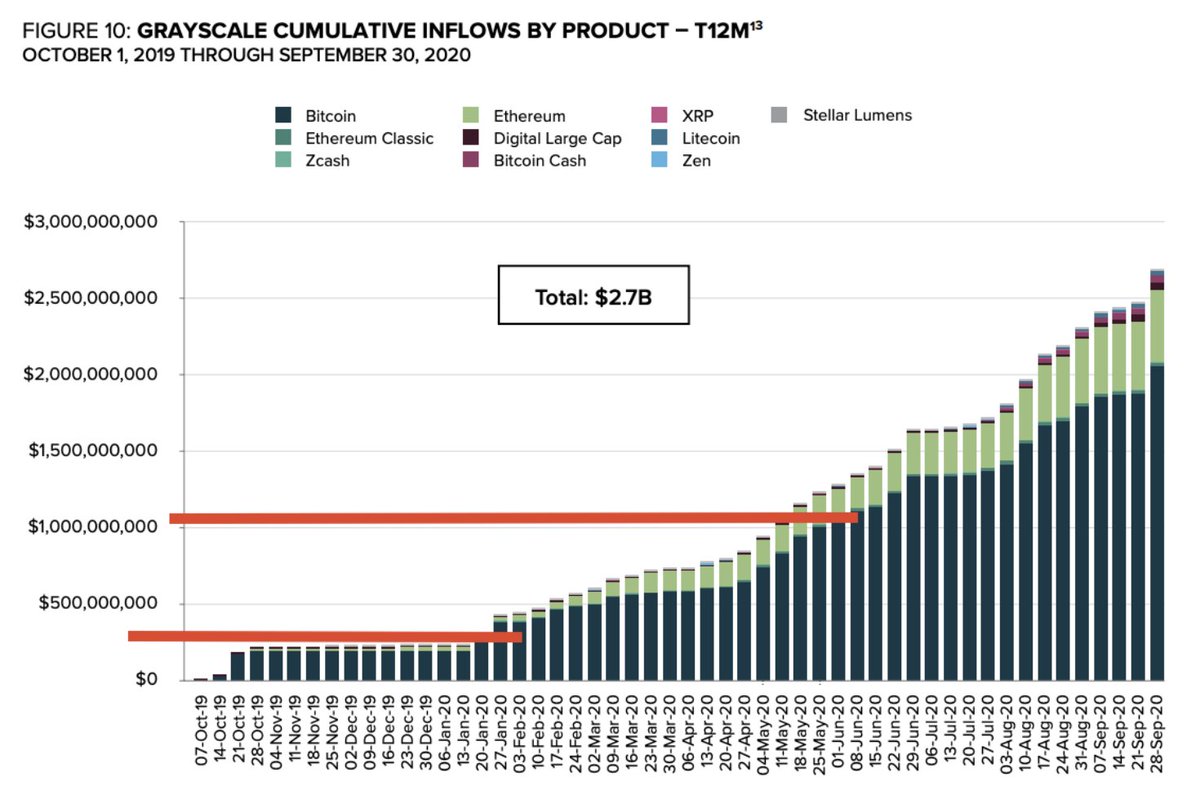

1. The 'Prince of Pump' @Grayscale (is this new title @BarrySilbert approved?)

2. Corporations/Institutions

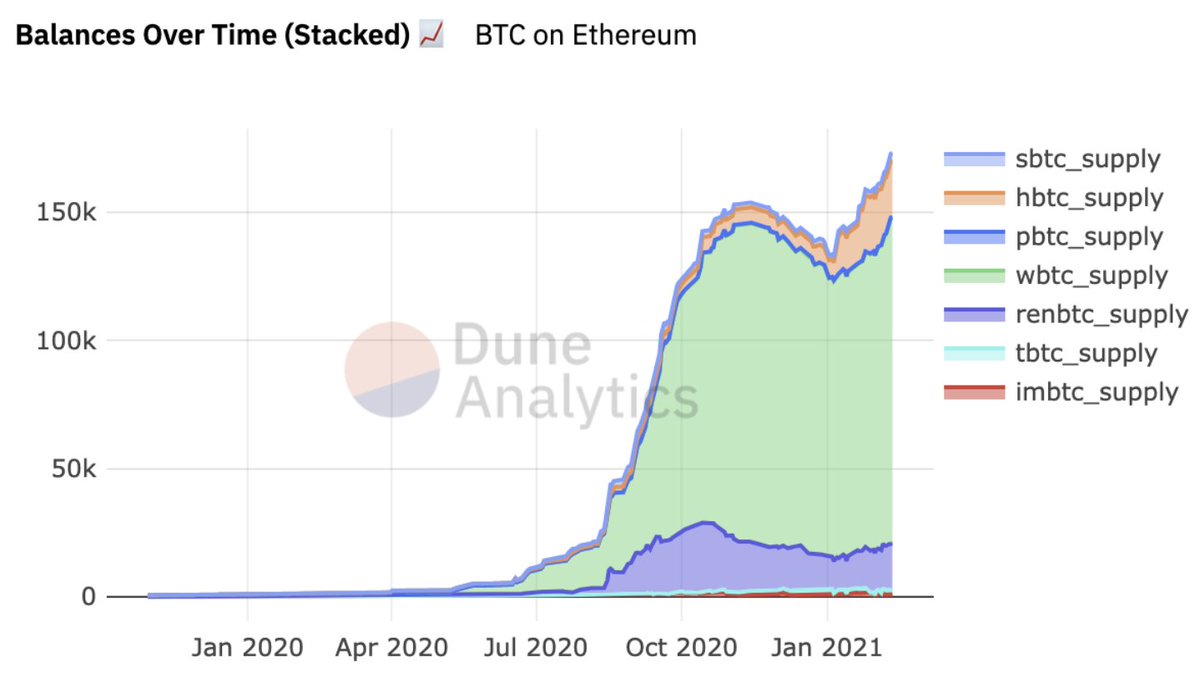

3. DeFi

Here are some charts showing this

It's predominately going to three areas.

1. The 'Prince of Pump' @Grayscale (is this new title @BarrySilbert approved?)

2. Corporations/Institutions

3. DeFi

Here are some charts showing this

From early 2020 to the June date, we need to look at Quarterly Report. Back of the envelope math suggest 90k BTC using an average price of $8,250/BTC.

So 390k to the Grayscale vacuum cleaner.

So 390k to the Grayscale vacuum cleaner.

Corporations/Institutions

@michael_saylor at MicroStrategy: 71k BTC during this span.

@elonmusk at Tesla: Let's say about 42k BTC using an avg price of $35k/BTC.

Square, Bitwise, Stone Ridge Holdings, Ruffer (yes sold back some, but still relevant): 72k

185k BTC to this group

@michael_saylor at MicroStrategy: 71k BTC during this span.

@elonmusk at Tesla: Let's say about 42k BTC using an avg price of $35k/BTC.

Square, Bitwise, Stone Ridge Holdings, Ruffer (yes sold back some, but still relevant): 72k

185k BTC to this group

Add them up... -100k. Huh?

We didn't account for miners nor look at Corp. wallets and if they store them on an exchange. This is more for a macro view of the market and outside the scope of the point here.

The takeaway, these three areas are sucking up BTC.

So?

We didn't account for miners nor look at Corp. wallets and if they store them on an exchange. This is more for a macro view of the market and outside the scope of the point here.

The takeaway, these three areas are sucking up BTC.

So?

Grayscale is a one way vehicle.

Corporations operate on the timeline of years, not months.

DeFi usage is not speculative, it's more as collateral.

(A liquidity crisis is brewing... I think @nic__carter will like that mention.)

These entities will define this boom/bust cycle.

Corporations operate on the timeline of years, not months.

DeFi usage is not speculative, it's more as collateral.

(A liquidity crisis is brewing... I think @nic__carter will like that mention.)

These entities will define this boom/bust cycle.

I'm suggesting a second narrative will form over the second phase of this bull market. The first narrative is Gold 2.0 and corporations/institutions are adopting it.

The second, BTC is collateral.

Does @michael_saylor need to go to a bank for a loan when he has 71k BTC?

The second, BTC is collateral.

Does @michael_saylor need to go to a bank for a loan when he has 71k BTC?

He can instantly access liquidity when he needs it. Permissionless and instant.

Investors don't need to sell BTC to access its value. This narrative will grow in the later stages of this cycle. Which means this cycle will have less speculators than prior.

Investors don't need to sell BTC to access its value. This narrative will grow in the later stages of this cycle. Which means this cycle will have less speculators than prior.

And as BTC flows into Polkadot, Solana ( @SBF_Alameda is eyeing it with Ren), Cosmos and others, DeFi will act as a bigger sink hole for BTC.

Also, Prince of Pump isn't going anywhere. If anything, @BarrySilbert's pumpability is expanding.

Also, Prince of Pump isn't going anywhere. If anything, @BarrySilbert's pumpability is expanding.

Which begs the questions... If there's a liquidity crisis, who's selling?

To read the essay on this, you can read it here: https://jarvislabs.substack.com/p/bitcoins-current-crisis

Thank you for reading, hope you enjoyed. Be sure to subscribe to get daily insights like this delivered to your inbox for free.

for reading, hope you enjoyed. Be sure to subscribe to get daily insights like this delivered to your inbox for free.

To read the essay on this, you can read it here: https://jarvislabs.substack.com/p/bitcoins-current-crisis

Thank you

for reading, hope you enjoyed. Be sure to subscribe to get daily insights like this delivered to your inbox for free.

for reading, hope you enjoyed. Be sure to subscribe to get daily insights like this delivered to your inbox for free.

Read on Twitter

Read on Twitter