1/ #Bitcoin  FUD-busting time!

FUD-busting time!

claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin"

truth: the facts, my friends, simple don't line up. let's dive in!

FUD-busting time!

FUD-busting time! claim: bitcoin ownership is heavily concentrated.

@business published an article claiming "2% of accounts control 95% of all Bitcoin"

truth: the facts, my friends, simple don't line up. let's dive in!

2/ interrogating on-chain addresses is tricky.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

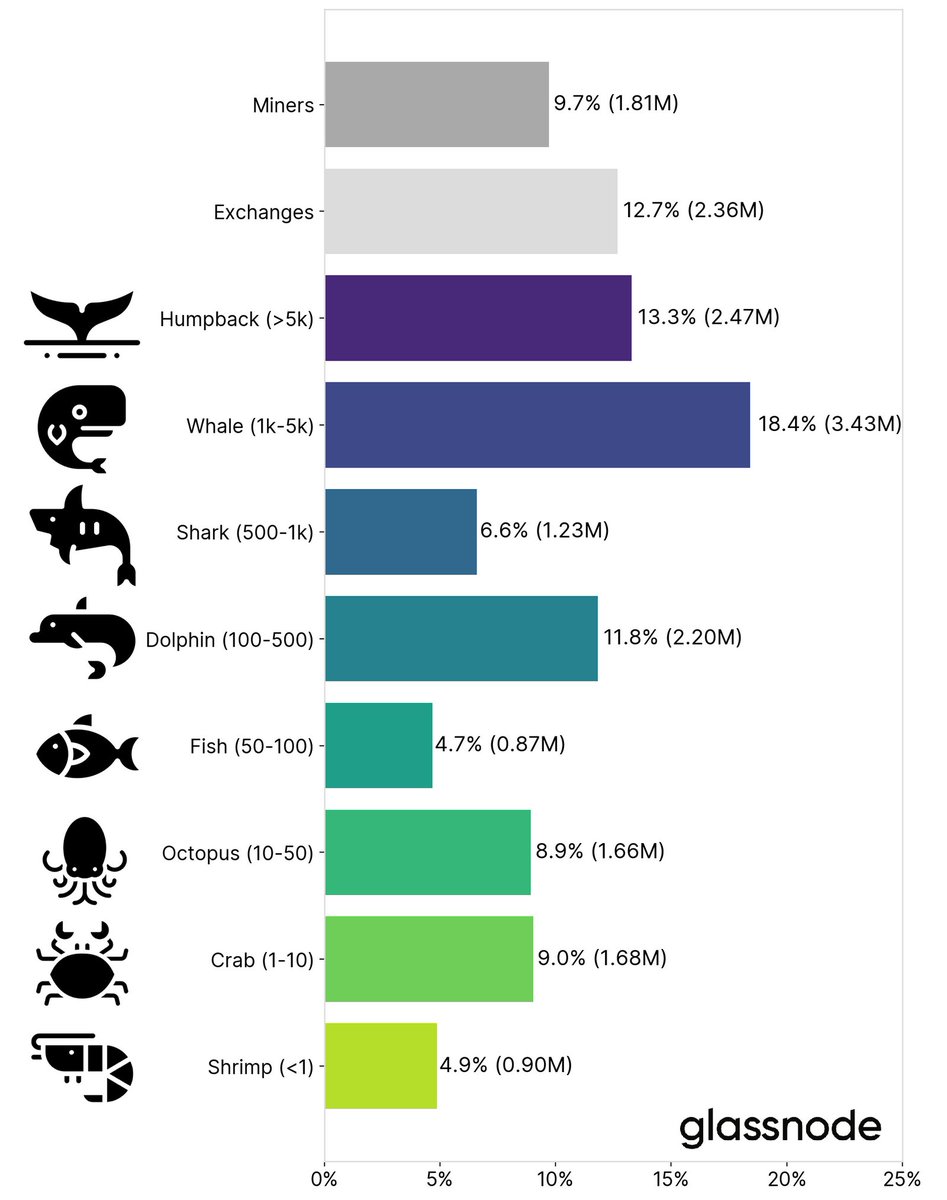

3/ the fine folks @glassnode published an excellent analysis of on-chain address balances in January

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://insights.glassnode.com/bitcoin-supply-distribution/

the ownership distribution of bitcoin among wallets is actually much more diverse than one might expect.

full piece here:

https://insights.glassnode.com/bitcoin-supply-distribution/

4/ 31% of BTC is held in addresses not identified as exchange wallets.

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

these are likely institutions, funds, custodians, and OTC desks.

our analysis at @CoinSharesCo indicates >15% of all bitcoin is held in third party custody, including @coinbase and our own @KomainuCustody

5/ in fact, between asset managers @Grayscale ($36B in BTC) and our @xbtprovider ($4B in BTC), 4% of bitcoin is locked up by fund providers and asset managers!

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs - https://coinshares.com/research/digital-asset-fund-flows

our @CoinSharesCo research team publishes an EXCELLENT weekly report on fund flows and AUMs - https://coinshares.com/research/digital-asset-fund-flows

6/ distribution of bitcoin over time has also changed a lot

as new market microstructure emerges, the way market participants manage and store their coins also changes.

with more institutions and more AUM in structured products and funds, inevitably we see more clustering

as new market microstructure emerges, the way market participants manage and store their coins also changes.

with more institutions and more AUM in structured products and funds, inevitably we see more clustering

7/ if we look at number of participants, the trend looks as we might expect. there is a very fat tail, with the majority of wallets (22M) holding less than one bitcoin.

8/ ultimately, bitcoin ownership is not as heavily concentrated as reported. this is because the large wallets holding much of the bitcoin supply represent thousands if not millions in user funds.

these types of misconceptions lead to all sorts of wild, wrong claims.

these types of misconceptions lead to all sorts of wild, wrong claims.

9/ bitcoin DOES represents equality of opportunity.

you don't need a bank.

you don't need a brokerage account.

you don't need to be an accredited investor or well connected.

anyone with a smartphone and an internet connection can buy $5 of bitcoin easily and quickly.

you don't need a bank.

you don't need a brokerage account.

you don't need to be an accredited investor or well connected.

anyone with a smartphone and an internet connection can buy $5 of bitcoin easily and quickly.

10/ let me know what other misconceptions you want to talk about! it's important that we arm ourselves with the *facts* and support our claims with empirical evidence and data.

luckily the #bitcoin ecosystem is comprised of incredibly intelligent people who do this research!

ecosystem is comprised of incredibly intelligent people who do this research!

luckily the #bitcoin

ecosystem is comprised of incredibly intelligent people who do this research!

ecosystem is comprised of incredibly intelligent people who do this research!

Read on Twitter

Read on Twitter