1/ Lifestyle changes are contributing to a startling rise in infertility today.

Up to 5% of couples facing difficulties to conceive seek in-vitro fertilization (IVF) as a last resort solution.

This is an attractive, growing industry (9.5% ’20-’27 CAGR) with favorable tailwinds

Up to 5% of couples facing difficulties to conceive seek in-vitro fertilization (IVF) as a last resort solution.

This is an attractive, growing industry (9.5% ’20-’27 CAGR) with favorable tailwinds

2/ IVF involves combining sperm + egg outside the body in a lab. After its formation, the embryo is placed in the uterus.

As one would expect, this is a delicate, complex and highly costly treatment.

With success rates as high as 80%, IVF resulted in 8+ million babies globally

As one would expect, this is a delicate, complex and highly costly treatment.

With success rates as high as 80%, IVF resulted in 8+ million babies globally

3/ Ok so IVF is a high-growth miracle of modern medicine, but is there an opportunity here for investors?

Well, there is only ONE pure-play listed IVF co. today: Vitrolife.

This Swedish SMID-cap (USD $4Bn) also happens to be the market leader and quite the wonderful company!

Well, there is only ONE pure-play listed IVF co. today: Vitrolife.

This Swedish SMID-cap (USD $4Bn) also happens to be the market leader and quite the wonderful company!

4/ Vitrolife was founded in Sweden in '94, the early years of assisted reproduction.

The founders realized the value to IVF clinics & their patients of products that deliver consistent, repeatable performance, enhancing clinic workflow efficiency and increasing IVF success rates

The founders realized the value to IVF clinics & their patients of products that deliver consistent, repeatable performance, enhancing clinic workflow efficiency and increasing IVF success rates

5/ Vitrolife sells devices & single-use consumables to IVF clinics.

Its broad portfolio features products for every step of the treatment chain, from egg retrieval to cryopreservation.

It has a growing genomics division that runs genetics tests on embryos pre-transfer

Its broad portfolio features products for every step of the treatment chain, from egg retrieval to cryopreservation.

It has a growing genomics division that runs genetics tests on embryos pre-transfer

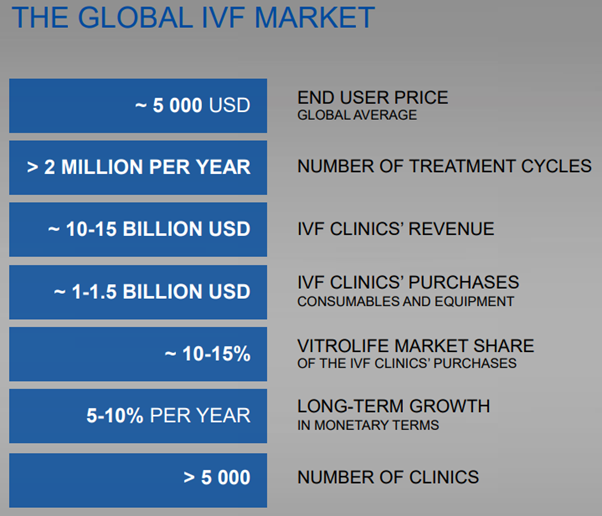

6/ Through a combination of R&D and prudent acquisitions, the company is now a global leader.

Vitrolife estimates total annual purchases by IVF clinics of single-use products + equipment is $1.0-1.5Bn. Vitrolife’s LTM sales implies a global mkt share of 10% of these purchases.

Vitrolife estimates total annual purchases by IVF clinics of single-use products + equipment is $1.0-1.5Bn. Vitrolife’s LTM sales implies a global mkt share of 10% of these purchases.

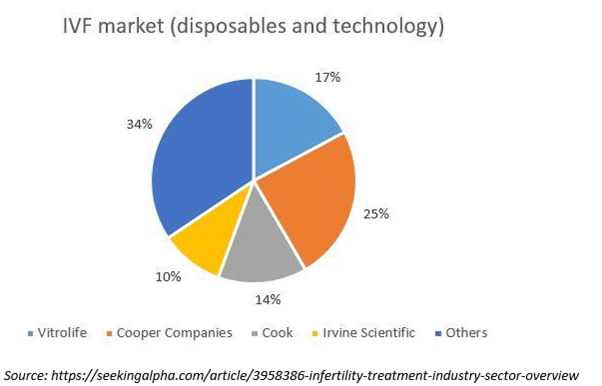

7/ If we look specifically at the mkt for reagents/media, instruments & technology, Vitrolife accounts for a whopping 36% share according to Allied Market Research.

Cooper Companies ($COOP) a non pure-play competitor, commands 25% of the mkt. All other rivals are far behind

Cooper Companies ($COOP) a non pure-play competitor, commands 25% of the mkt. All other rivals are far behind

8/ Vitrolife products are perceived as high quality and consistently receive strong customer reviews. A company-sponsored survey showed 81% of cust. gave Vitrolife a high rating (8-10). Quality products help clinics control costs, further entrenching Vitrolife in their practice

9/ Quality control is central to the Vitrolife ethos; a maniacal focus on lot consistency and product reliability w/extensive testing.

Suppliers are rigorously evaluated. Raw material stringently tested. Mfg highly controlled & quality system is regularly audited + ISO certified

Suppliers are rigorously evaluated. Raw material stringently tested. Mfg highly controlled & quality system is regularly audited + ISO certified

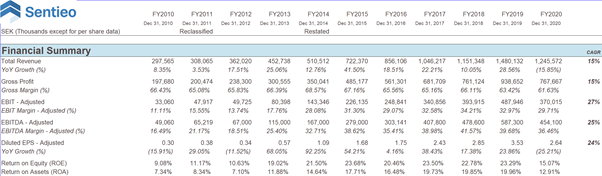

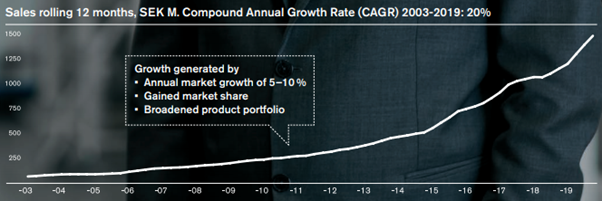

10/ Financials as you'd expect from a co w/a leading mkt position, in an industry w/entry barriers (quality/rep./regulatory), & benefiting from growth tailwinds:

10yr sales CAGR: 15% (20% pre COVID)

Gross margin: 65%

EBITDA margin: 38-40%

EPS CAGR: 24%

Tech-esque numbers right?

10yr sales CAGR: 15% (20% pre COVID)

Gross margin: 65%

EBITDA margin: 38-40%

EPS CAGR: 24%

Tech-esque numbers right?

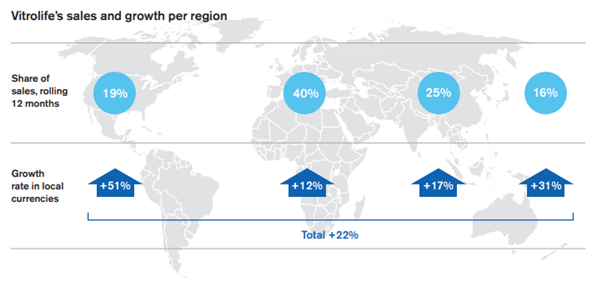

11/ Growth is generally well balanced globally as IVF gains increasing acceptance around the world.

Importantly, while mgmt forecasts industry growth of 5-10% p.a., they deliver 20% sales growth through a combo of market growth, share gains, pricing, and prudent acquisitions.

Importantly, while mgmt forecasts industry growth of 5-10% p.a., they deliver 20% sales growth through a combo of market growth, share gains, pricing, and prudent acquisitions.

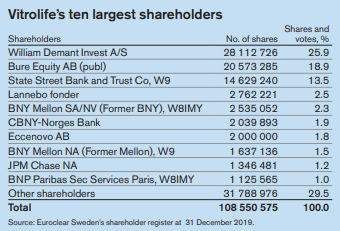

12/ I seek companies with mgmt ownership alignment but insider ownership here is low: Chairman owns 30k shares, CEO owns 50k shares.

However, ownership is highly concentrated and the top 2 shareholders (45%) are LT investors. The top 10 shareholders own 71% of the shares.

However, ownership is highly concentrated and the top 2 shareholders (45%) are LT investors. The top 10 shareholders own 71% of the shares.

13/ Demant Invest & Bure Equity are proven investors w/solid tracks. Demant is family-founded and controlled by a foundation w/a history of value creation in med devices.

Governance is good: they control an election committee that sets board chairmanship + size & remun. of board

Governance is good: they control an election committee that sets board chairmanship + size & remun. of board

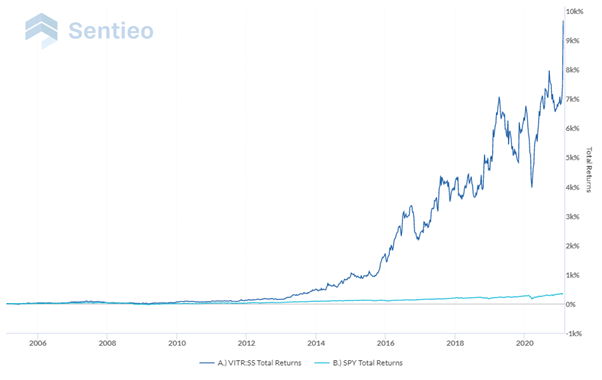

14/ Historical shareholder returns mirror the incredible financial results, delivering eye-popping results for Vitrolife shareholders.

Compounded annual returns:

2 years: 24%

3 years: 28%

5 years: 32%

10 years: 49%

15 years: 36%

Just beautiful

Compounded annual returns:

2 years: 24%

3 years: 28%

5 years: 32%

10 years: 49%

15 years: 36%

Just beautiful

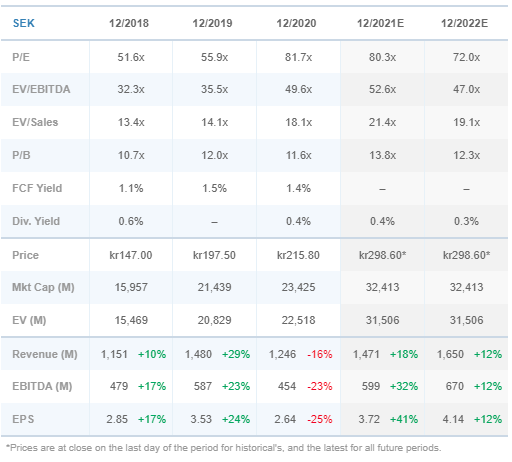

15/ Valuation: The shares trade at a fwd P/E of 81x, EV/sales 21x, and FCF yield of <1%. It’s RARELY traded cheap, however. The shares went for as low as 20x NTM P/E in 2011/2012 and was an absolute steal at that price.

Quality doesn't come cheap and this is a quality company!

Quality doesn't come cheap and this is a quality company!

16/ Disclosure: I don’t own shares in this company. It is, however, on my watchlist to buy on weakness. Vitrolife seems like fitting addition to any collection of wonderful businesses for the long term. /end

Read on Twitter

Read on Twitter