Carlotz ( $LOTZ ) has been trending for a while as it was one of the many companies to go public via the SPAC route.

Here are a few things you should be looking out going forward

A thread……

Here are a few things you should be looking out going forward

A thread……

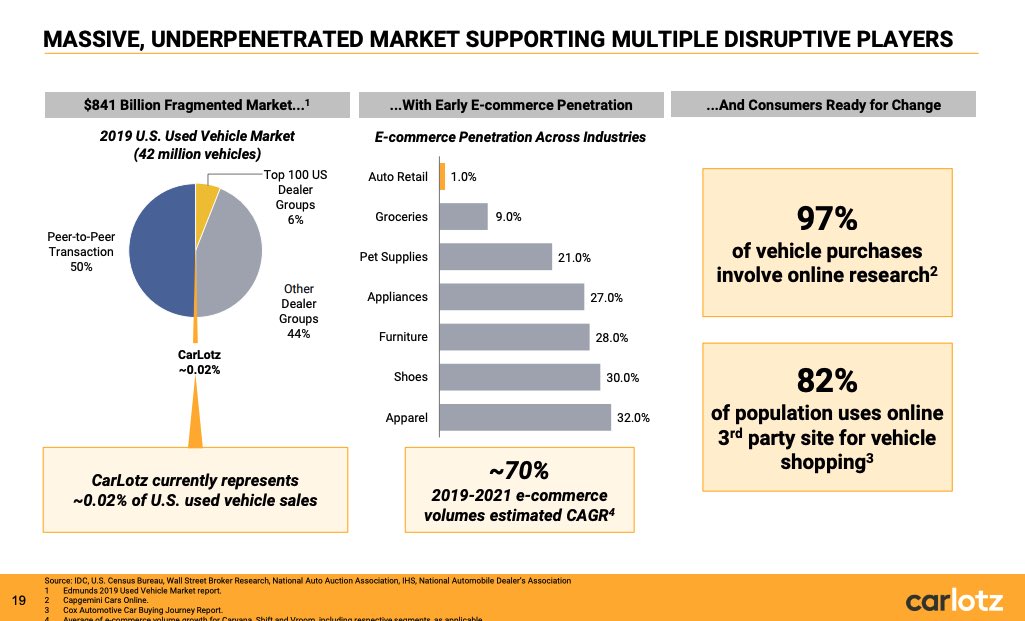

Current market outlook =

The used car market has taking off during Covid, and is not going anywhere as families relocate to new states and buy new homes that usually means = more car buying.

The used car market has taking off during Covid, and is not going anywhere as families relocate to new states and buy new homes that usually means = more car buying.

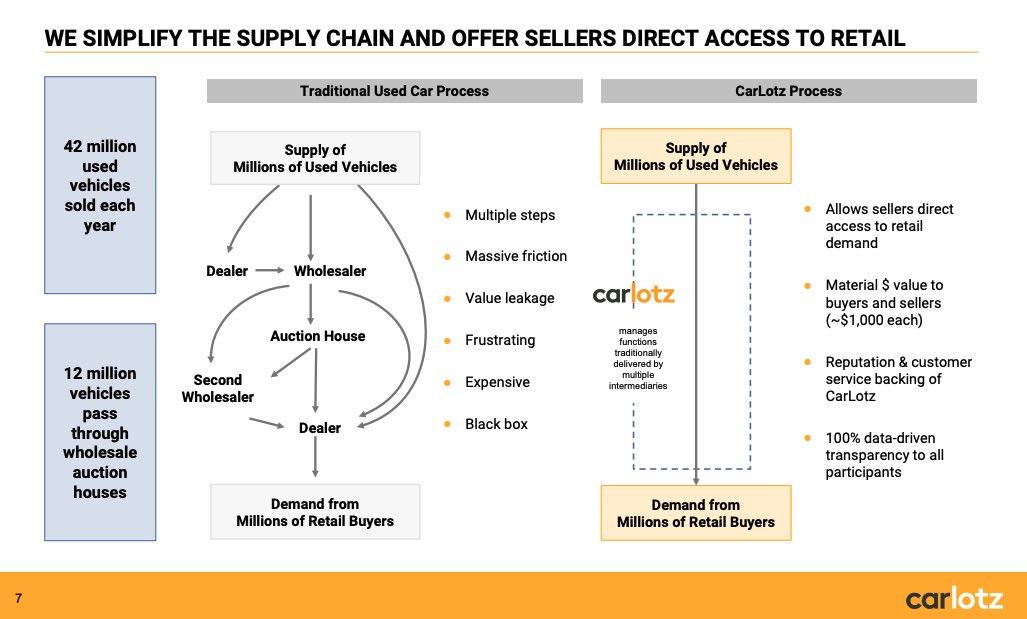

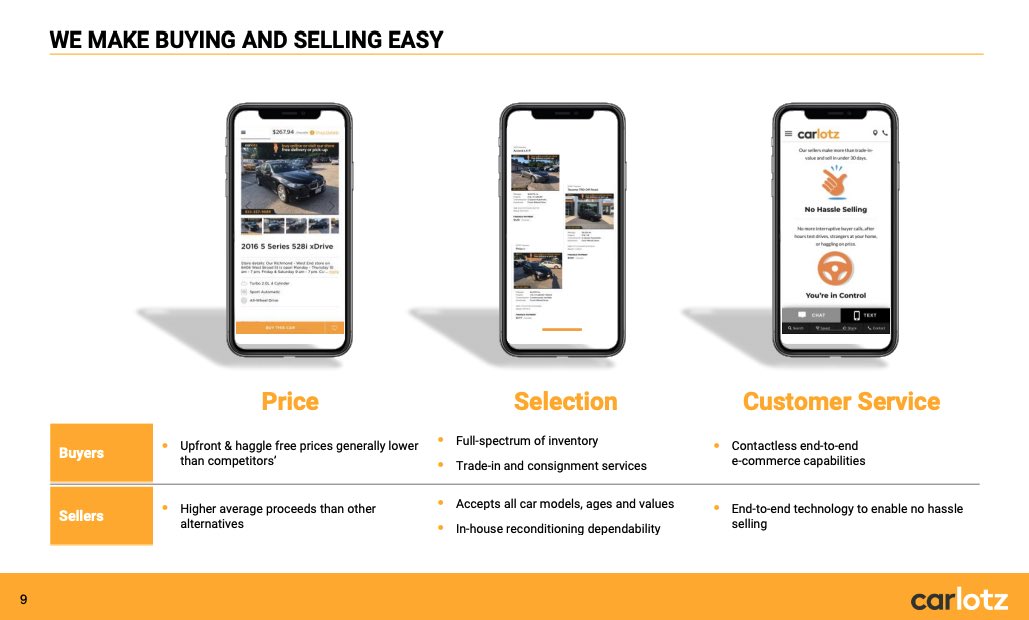

$LOTZ enables consumers and corporations to make the most money possible when selling their vehicles.

For a flat fee (paid by the sellers) $LOTZ :

prepares vehicle

markets it nationwide

manages buyer Q’s

conducts test drives

negotiates a deal on the seller's behalf

For a flat fee (paid by the sellers) $LOTZ :

prepares vehicle

markets it nationwide

manages buyer Q’s

conducts test drives

negotiates a deal on the seller's behalf

One important thing I would like to point out $LOTZ is founder led, which I tend to look for when making an investment.

I know the CEO has skin in the game ( @Michaelbor ) and Founder led companies tend to perform pretty well.

I know the CEO has skin in the game ( @Michaelbor ) and Founder led companies tend to perform pretty well.

My investment strategy consists of 2 main things:

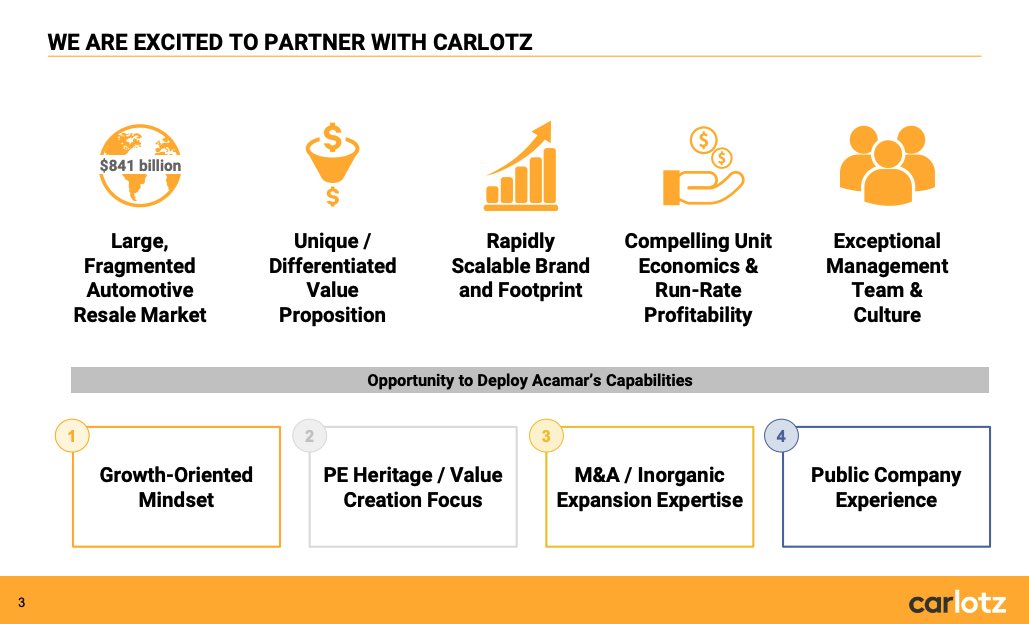

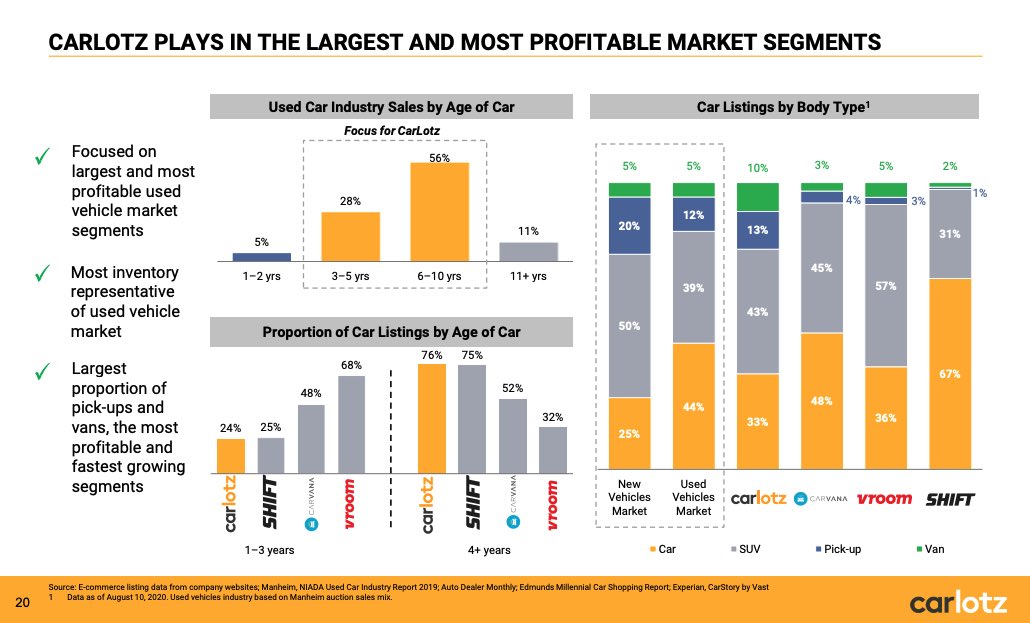

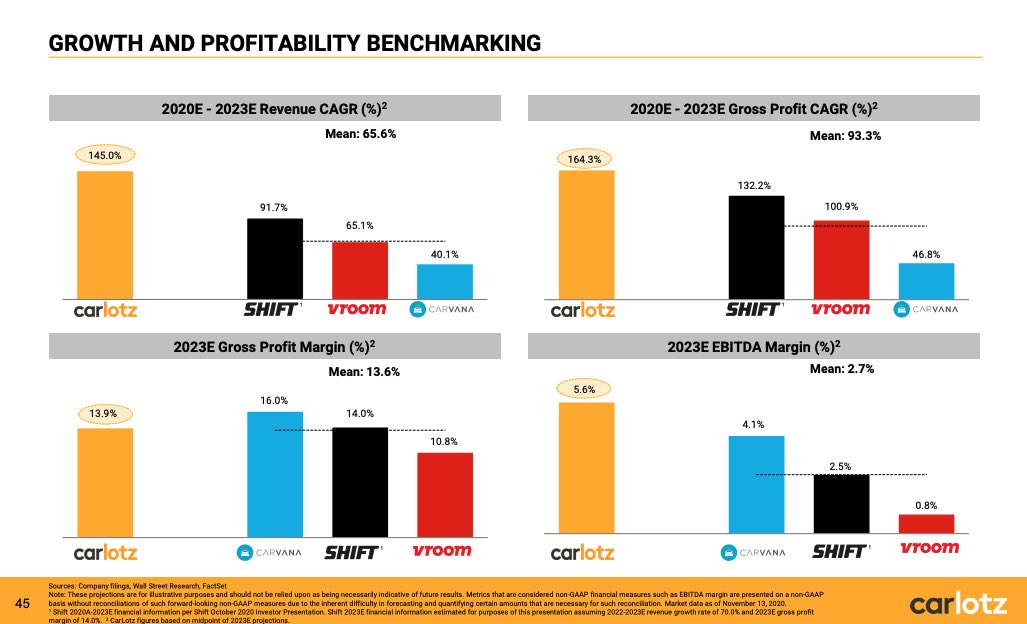

1.- Innovative/Disruptors with a high CAGR (Compound Annual Growth Rate)

2.- Big TAM (Total Addressable Market)

$LOTZ has them both with a large resale automative resale market and flexible business model

1.- Innovative/Disruptors with a high CAGR (Compound Annual Growth Rate)

2.- Big TAM (Total Addressable Market)

$LOTZ has them both with a large resale automative resale market and flexible business model

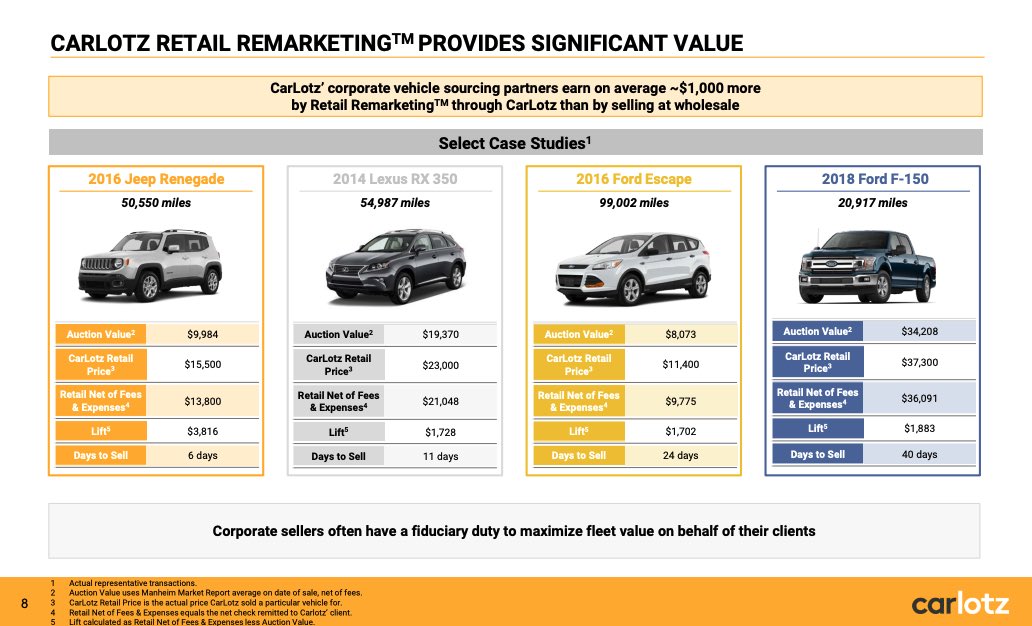

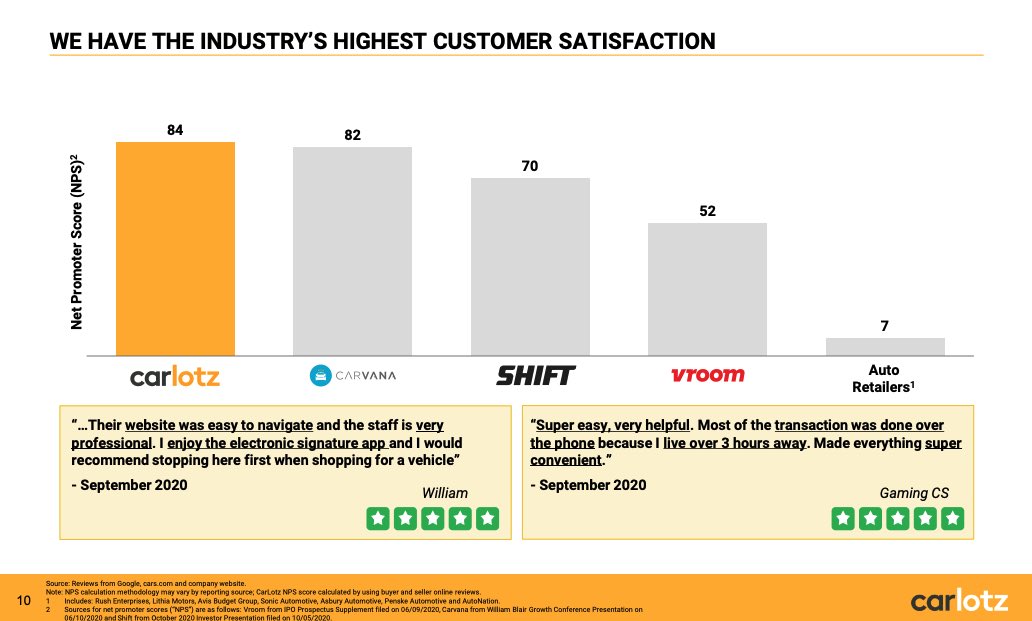

Here is a quick look at $LOTZ success providing significant value to its costumers both on the Buy and Sell side

$LOTZ

- Adds value

- Convenient

- Customer Satisfaction

$LOTZ

- Adds value

- Convenient

- Customer Satisfaction

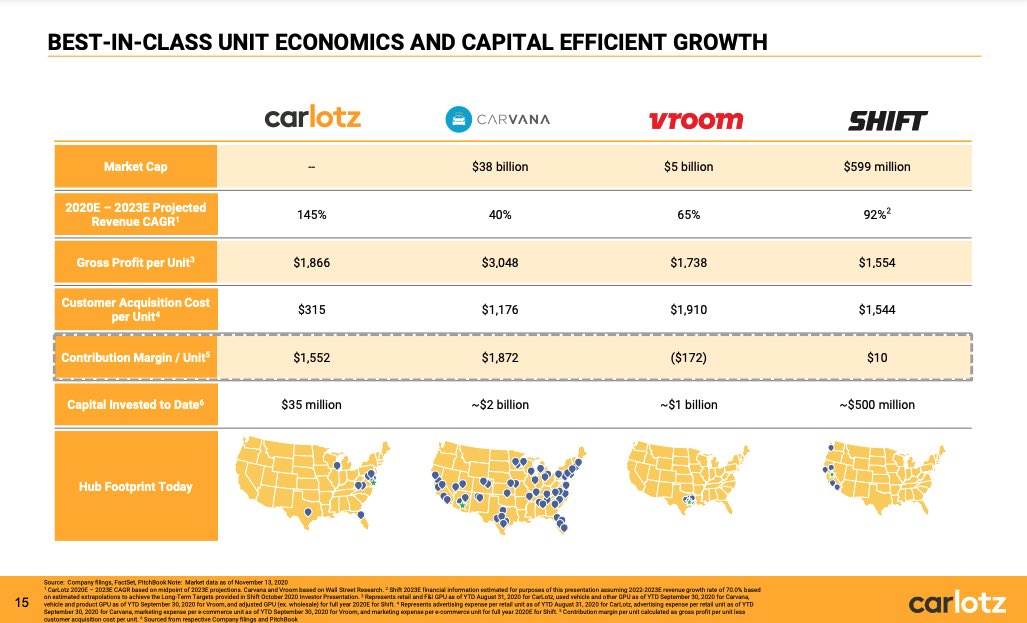

Three things:

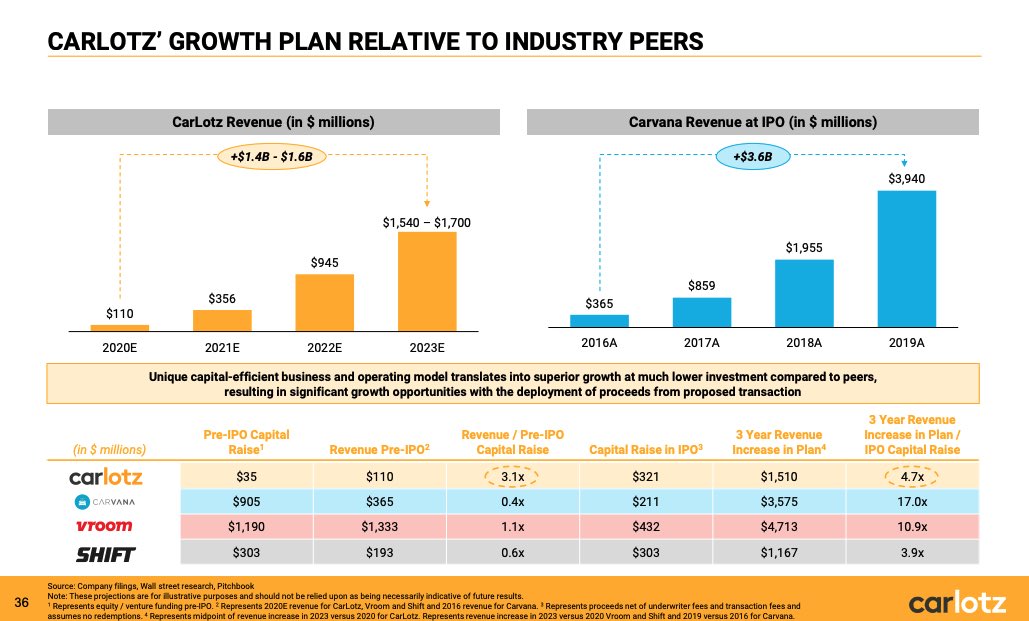

- Biig CAGR (Compound Annual Growth Rate)

- Disruptor

- Big TAM well (think $CVNA $VRM)

(think $CVNA $VRM)

- Biig CAGR (Compound Annual Growth Rate)

- Disruptor

- Big TAM well

(think $CVNA $VRM)

(think $CVNA $VRM)

Also one thing to note the used car sales is a huge market roughly 40M and the shift to a flexible buying experience is just getting started as @michaelbor mentioned in the @PGIRPod podcast ( )

)

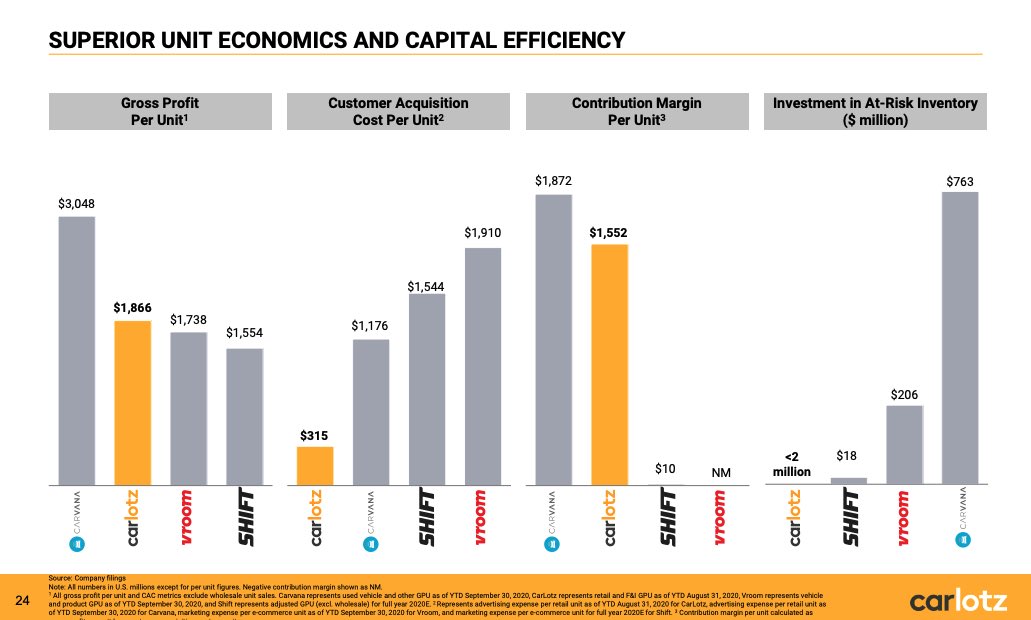

There is room for everyone, but here is a comparison of the main players.

)

) There is room for everyone, but here is a comparison of the main players.

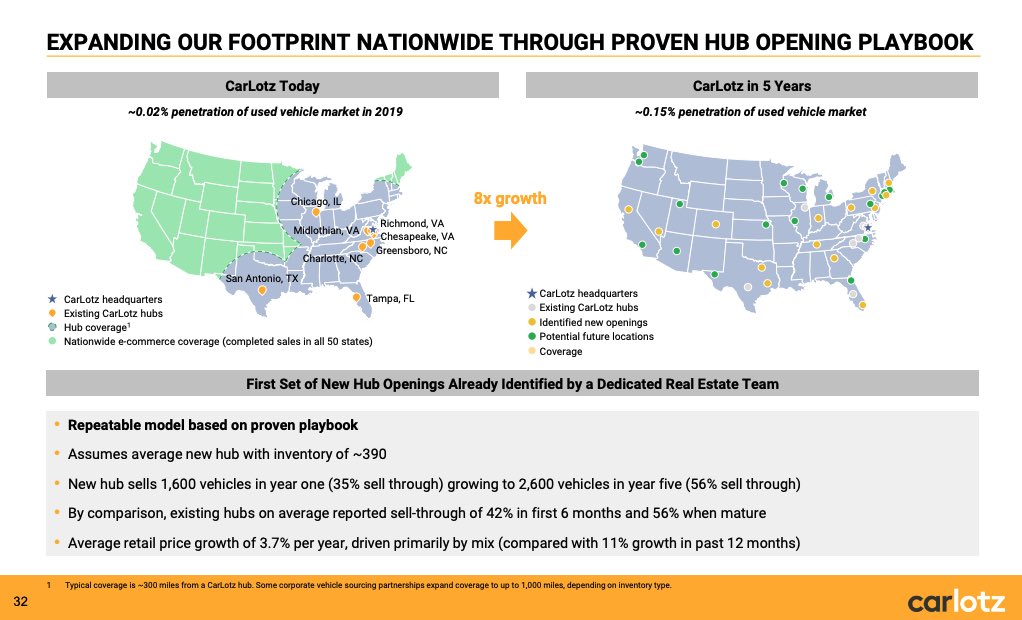

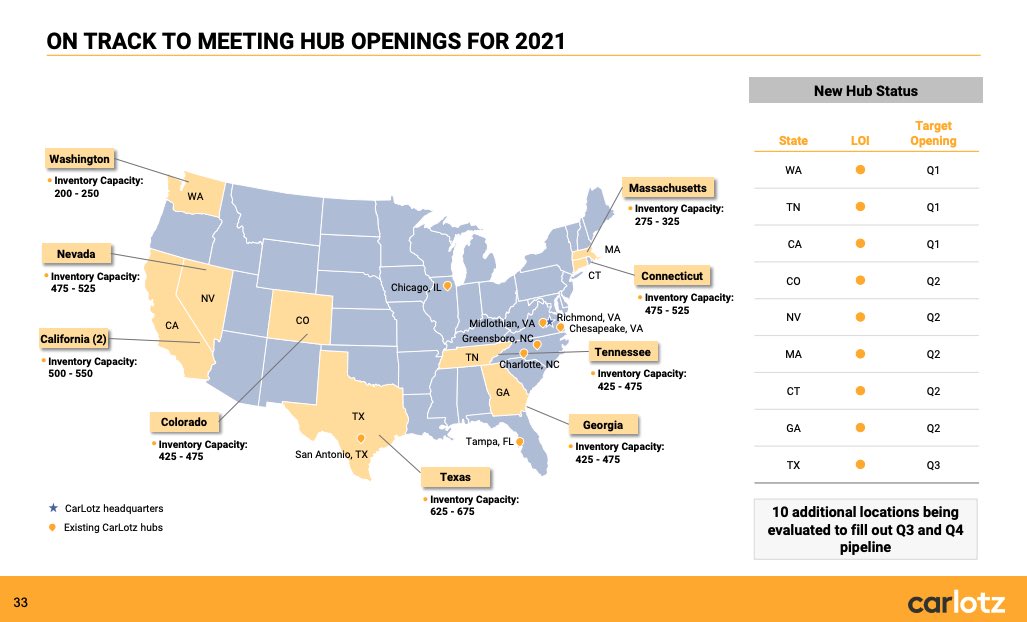

CAR $LOTZ is growing rapidly and here are their plans of where and when they are expanding, with some new hubs opening very soon.

Make sure to give @michaelbor a follow to read more on $LOTZ and if you want to hear from him directly here is an interview of him on @CNBCFastMoney in January https://twitter.com/michaelbor/status/1354464712013078535

This is not investment advice and please do your own research before taking a position in any ticker you see on Twitter or anywhere really!

Enjoyed the breakdown? please let me know & give me a follow. If there is any company in particular you would like to see reply below

Enjoyed the breakdown? please let me know & give me a follow. If there is any company in particular you would like to see reply below

You can find all the slides and research in this thread @CarLotz411 website under the investors tab

Besides doing some deep dives into different stocks and ETF’s I also post some  memes, so follow me for more https://twitter.com/pablolerdonews/status/1354794308830957571

memes, so follow me for more https://twitter.com/pablolerdonews/status/1354794308830957571

memes, so follow me for more https://twitter.com/pablolerdonews/status/1354794308830957571

memes, so follow me for more https://twitter.com/pablolerdonews/status/1354794308830957571

Read on Twitter

Read on Twitter